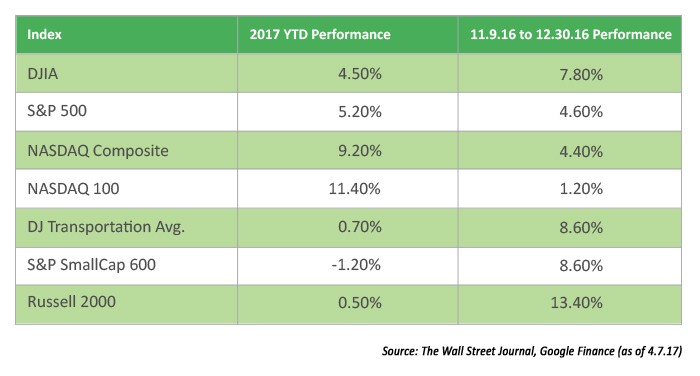

Three closely watched indexes—the S&P SmallCap 600, the Russell 2000, and Dow Jones Transportation Average (also known as the Dow Transports)—have all underperformed the Dow Jones Industrial Average, S&P, and NASDAQ throughout 2017. All three indexes are considered leading indicators for future economic growth expectations and broader market performance. Their relative softness in 2017 likely reflects a less optimistic outlook for U.S. GDP growth than seen immediately after the November U.S. elections.

The SmallCap 600 gained 15.4% from Election Day to the end of 2016, the Transports were up 8.6% during the same period, and the Russell 2000 gained 13.4%. The market has seen a significant rotation from small caps and the Dow Transports in 2017, especially into some of the larger-cap tech stocks represented in the NASDAQ 100.

The important question is what does this rotation, and the relative weakness of small caps and the Dow Transports in 2017, say about the market going forward? Or is it just normal sector rotation at work?

With the daily noise out of Washington, geopolitical unrest around the globe, and vast uncertainty over the likelihood of Trump administration “growth” policies being implemented soon (or ever), it is difficult to read much into 2017’s market action so far. However, if one believes in Dow theory, the Dow Transports are sending a not-so-positive message about the broader market.

ETF Daily News wrote recently,

“The fact that the Dow Transports are not confirming the rally in the Dow Jones Industrials should be setting your Spidey Senses tingling. It’s a warning of potential ugliness. … When either one of these indices makes intermediate highs and the other doesn’t follow suit, it’s considered a sign that markets will reverse and head lower. … The Transports are not confirming the big move higher in the industrials. … So if the real economy is slowing, maybe that’s a harbinger of a rough road ahead for stocks.”