As it stands today, the “short volatility” trade has been watered down to a great extent.

Perhaps in an effort to get ahead of the regulators, most of the exchange-traded products (ETPs) that deal with short volatility have made adjustments so that their products are no longer as volatile as they had previously been.

While there are several short-volatility ETPs in existence, only three have the trading volume to be viable: SVXY (the ProShares short-volatility exchange-traded fund, or ETF), VMIN (the REX VOLMAXX short-volatility exchange-traded note, or ETN), and ZIV (the Credit Suisse intermediate-term “brother” of the now-defunct XIV1). These all have reasonable liquidity now that XIV is gone. There are a few others that we will discuss later in this article.

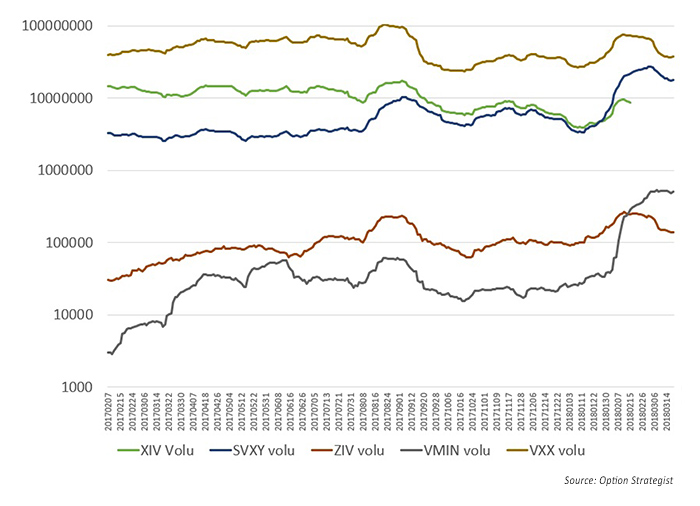

Figure 1 shows the 20-day average volume of five volatility ETPs, charted on a lognormal scale. The five are the four short-volatility ETPs noted above and the major long-volatility ETN, Barclay’s VXX, which was the first volatility ETN listed back in late January 2009. It was necessary to use lognormal because VXX volume is so dominant that the least active ones would be dwarfed on a linearly scaled chart. The chart covers the time period from January 2017 to March 2018. In January 2017, from highest volume to lowest, the lines on the graph are VXX, XIV (no longer trading), SVXY, ZIV, and VMIN.

FIGURE 1: VOLATILITY ETP TRADING VOLUME

20-day average of volume of VXX, XIV, ZIV, SVXY, and VMIN (log scale)

There was a surge in trading volume of all of these ETPs in August 2017, during a very small market correction. The recent stock market decline, which began in late January 2018 has increased volume in SVXY and VMIN past those peaks of last August, as they have picked up some of the volume that had previously been trading XIV. ZIV volume is tapering off after a brief post-XIV surge. VXX remains the most active, but ironically it was more active last summer than it is now. I say “ironically” because VXX is arguably a better long-volatility product now than it was then, because the $VIX futures are trading with small premiums or discounts, and the term structure of the $VIX futures is relatively flat; both of these factors are beneficial to the price of VXX.

In addition to VXX, there are a lot of long-volatility ETPs. VIXY (ProShares VIX short-term Volatility ETF) is one that is rather liquid. Two of the more prominent leveraged volatility products are UVXY (the Credit Suisse ultra-long-volatility ETF) and TVIX (the double-speed, long-volatility ETN, issued by VelocityShares).

The “short volatility” trade made a lot of money from January 2009 through January 2018—particularly in 2017, when the market marched steadily upward as volatility languished. For a full recounting of the trade and its sudden demise in February 2018, please refer to our article “XIV—the scapegoat of the market’s decline,” published in our newsletter of February 16, 2018, and also found at Seeking Alpha.

For a while, the “short volatility” trade was taking the primary blame for the market’s sudden collapse, even though the market was already declining rapidly before the short-volatility ETPs imploded (in fact, that’s why they imploded; if the market hadn’t already been declining—causing volatility to explode—there wouldn’t have been a problem in the first place). There were, of course, other reasons why the stock market collapsed and still hasn’t recovered. Witness the fact that almost every other sector (bonds, gold, currencies) has struggled as well. The “short volatility” trade certainly didn’t affect them. Regardless, there was a hue and cry from uninformed but vocal critics in the media, and apparently there was some concern among the underwriters of the short-volatility products that perhaps they were too volatile for the “average investor”—or at least that might be a legal argument brought against them.

This seems to me to be a ridiculous argument. The main problem was that a few investors had not bothered to read the prospectuses or did not believe them. The prospectuses clearly spelled out the dangers if the underlying $VIX futures were to explode by more than 100% in a day—something that is certainly possible in a crashing stock market. These people would not have been protected even if the products had been less volatile.

In summary, the “short volatility” trade will once again be viable, but only after the term structure of the $VIX futures begins to slope steeply upward once again. However, it is going to be far less profitable to play it with this current array of products. The only thing that hasn’t changed is VXX. Since VXX has options, perhaps the best approach to shorting volatility is to buy puts or put spreads on VXX. We have been using VXX puts to implement the “Big (Volatility) Short” strategy for several years.

1. Credit Suisse made the decision to terminate XIV after the debacle that occurred when it lost nearly all of its value in a single day, on February 5, 2018. It was within their rights to do so, even though it wasn’t actually necessary since the ETN still had a net asset value above 0.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is a condensed version of an article that first appeared in the Option Strategist Newsletter on March 23, 2018, available by subscription at http://www.optionstrategist.com/. The original article provides further detail on the recent adjustments that have been made to several volatility financial products.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com