Separate? Separately managed? Or both?

Some advisors have an ingrained resistance to using separately managed accounts—but it doesn’t have to be an all-or-nothing proposition.

There are perhaps as many styles of investment management as there are people in the financial-services industry. Some investment advisors have difficulty relinquishing any degree of control. Consequently, they select not only every single security, bond instrument, mutual fund, or ETF on a client’s behalf, but also decide on a client-by-client basis when to purchase and sell each of the holdings. A piece of this is understandable, as many advisors entered the industry with a passion for investment theory and execution, and they believe they “know what’s best” for each of their valued clients.

Advisors who use managed funds, rather than allocating exclusively to individual issues and deciding what and when to buy and sell on their own, are perhaps slightly less controlling because they are turning over some of the operations and intellectual capacity to a third-party management team. Another approach is to offload both the selection of the securities or funds, as well as the timing as to when to buy and sell those, onto a money-management team that specializes in separately managed accounts.

I personally see a large degree of shortsightedness in advisors who retain complete control and are unaccepting of utilizing any expertise and value-add that other managers can deliver for their clientele. By the same token, I believe that having skin in the game and being a part of the decision-making processes makes one a more engaged, active participant. From where I sit, this satisfies both an intellectual drive and curiosity to stay on top of what is happening in the markets and various asset classes, as well as my desire to fulfill the specific needs of each individual client.

That said, there is no one “correct answer” to how advisors prefer to manage client accounts. First and foremost, we all bear fiduciary responsibility to act in the best interest of our clients and strive to bring proper suitability-based strategies to client accounts.

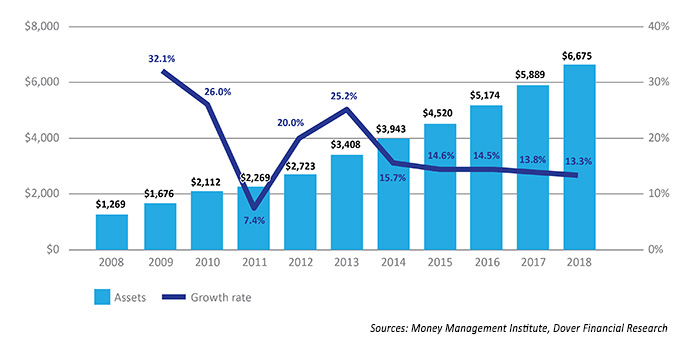

TOTAL MANAGED SOLUTIONS ADVISORY FORECAST, 2014-2018 ($BILLIONS)

Advisors who allocate exclusively to separately managed accounts have no direct accountability with respect to when an investment is bought or sold. Transferring this accountability to a third party, rather than being personally responsible for the trades, diminishes the pressure of having to monitor the fundamental and technical qualities of the market. There is a double-edged sword in terms of bearing this type of responsibility and pressure. On the one hand, arguably, our industry is one of the most stressful and time-pressured. While achieving efficiencies is a positive, especially when you are talking about client accounts that might number in the dozens or even hundreds, one could argue that taking direct responsibility for at least some trading or timing decisions makes one a better-informed and more engaged advisor.

Our business combines asset gathering as well as asset management. There are those who argue that it is nearly impossible to be effective with both of these functions. I contend that if we are strictly asset gatherers, then we run the risk of effectively becoming sales people promoting a product or commodity. I also believe that the responsibility inherent in, and activity/knowledge associated with, direct involvement in the investment-management process develops greater conviction and articulation for the value-add that enhances the asset-gathering abilities. The challenge is combining these skill sets without being spread too thin.

Using separately managed accounts allows me to better balance asset management and asset gathering in our practice.

Furthermore, the sales skills of the asset gatherer might open doors, but it is not in and of itself adequate, in my mind, to consistently close new business when the “product” is something as critical as someone’s finances. People might not be so concerned with the technical knowledge of various “salespeople” they encounter in their lives, even ones involved with big decisions such as buying a car or a new home. But they surely care about the knowledge, experience, and confidence of a surgeon who proposes to operate on them. And, they care about their money and who should be hired as their steward. As with a surgeon or an attorney, my experience has been that potential clients seek a financial advisor they can trust completely and who they believe has deep expertise.

There is a middle ground to my intellectual debate. In the financial-services arena, I market myself as the clients’ financial quarterback. I have to continuously sift through research, solicitations, and a vetting/due-diligence process to narrow the universe of programs and managers to achieve the appropriate portfolio for each client. To be most effective, we have to participate in all aspects of the business. We have to “get our hands dirty,” so to speak. I compare this need to get our hands dirty to what it takes to be an effective surgeon or litigator.

A surgeon or litigator can learn a lot from their rigorous education and from observing leaders in their respective fields in action. They can reiterate the facts of cases and why a particular skill or technique was utilized. However, the best surgeons and litigators one day have to go beyond observation. They have to move from being informed and educated to rolling up their sleeves and doing.

The way I have resolved the juxtaposition between these two extremes—(a) being the sole planner/strategist/trader of client accounts (the asset manager) and (b) solely allocating to separately managed accounts as an asset gatherer—is to combine both.

I generally allocate to separately managed accounts that are actively managed. These sophisticated active managers have skill sets and proprietary methodologies well beyond my capabilities and that complement other components of our clients’ portfolios. They actively trade as their models or systems deem appropriate, which can be quite challenging for an advisor with a decent size book of business, as well as costly in the absolute and in terms of time management. Finally, they add a valuable risk-management component to portfolios, which has become an ever-increasing consideration for my management of client assets.

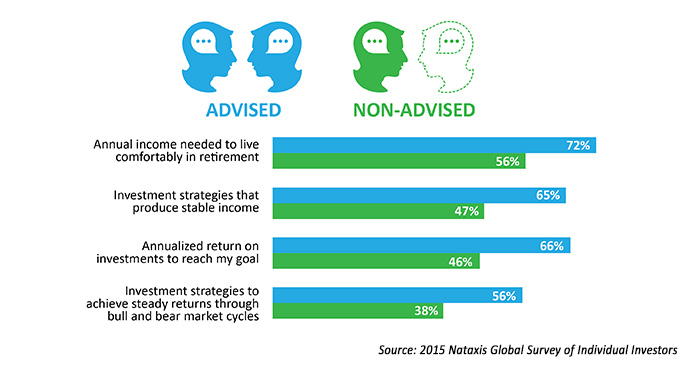

INVESTORS WITH ADVISORS REPORT HIGHER LEVELS OF KNOWLEDGE ON INVESTMENT GOALS

As the quarterback, I integrate third-party managers as part of my team. They deliver a level of intellectual capacity and active trading strategies that I do not possess and could not obtain simply by adding more funds into a client’s portfolio. The key is to also apply rigor in the initial assessment of their capabilities and then to monitor on an appropriate time frame how they are executing against their strategic imperatives.

By retaining day-to-day management for a portion of a client’s portfolio, in conjunction with allocating a portion to separately managed accounts, I feel that I am adding a greater degree of diversification, uniqueness, and expertise than I could provide as a lone asset manager. And, because I retain control of the management of some of the portfolio, I remain entrenched in the dynamics of the market. In addition, for smaller accounts that are difficult to actively manage, but important to develop or maintain as a client relationship, separate account management provides a level of sophistication for the client and a desired scalability for the advisor.

An investment management approach need not be black or white. There are many shades of gray. Incorporating separately managed accounts as part of my overall approach allows me to better balance the asset-management and asset-gathering functions of our advisory practice.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The opinions expressed in this material do not necessarily reflect the views of LPL Financial or Proactive Advisor Magazine. Securities offered through LPL Financial, member FINRA/SIPC. In an asset-based fee relationship, clients pay an annual fee based on the level of assets for the advice and services provided by their financial advisor as a part of the advisory relationship. By deciding to pay a fee for these services rather than commissions, clients should be made aware that the fee may be higher than the cost of a commission alternative during periods of lower trading activity.

This article first published in Proactive Advisor Magazine on October 22, 2015, Volume 8, Issue 4.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com