Why smart clients do dumb things

Highly intelligent people are often susceptible to making poor investing decisions—behavioral research offers some clues why

Keith E. Stanovich, professor emeritus of applied psychology and human development at the University of Toronto and author of seven books about cognition, maintains that being smart can actually be a drawback when it comes to making rational decisions. In a study published in the Journal of Personality and Social Psychology, Stanovich found smart people tended to make more mistakes than those of average intellect on logic problems because smart people were more likely to take shortcuts or make assumptions.1

Behind some of these shortcuts was overconfidence and underrating the importance of effort and practice. When many things come easily, people may become so reliant on feeling smart that they fail to develop skills that require effort and practice. When overconfidence is combined with greed, pride, stress, and even laziness, poor decisions proliferate.

Making logic-based decisions requires deliberate effort and the luxury of time. Over the course of evolution, stopping to think about a problem wasn’t always the best survival tactic. Human brains became very good at learning patterns and automating decisions to operate more efficiently. Emotional brain circuits have proven to make faster decisions and often jump into play before one pauses to think in a rational manner.

“The first thing you have to know is yourself. A man who knows himself can step outside himself and watch his own reactions like an observer.”

–Adam Smith, “The Money Game”

Automatic responses encourage leaps to conclusions before evaluating evidence. While faster decisions may be a good survival tactic when one is under attack, in situations that require rational thought, they can be a definite drawback.

The study of behavioral finance has come up with a number of reasons why people make irrational financial decisions, especially when it comes to their investments. The one common characteristic of these reasons is typically “the shortcut.” Rather than taking the time to thoroughly evaluate situations and opportunities, mental shortcuts are used.

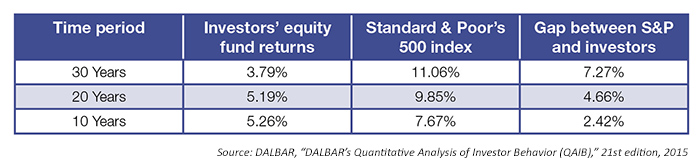

Says one prominent academic study, “A number of behavioral biases in aggregate influence the investment decisions. … Under the influence of some such biases or combination of the same, individual investors often make irrational investment decisions. And therefore, individual investors, in aggregate, earn poor long-run returns.”2 (See Exhibit 1 for DALBAR’s analysis of long-term investor underperformance.)

Here are some of the most common biases:

- Loss aversion gives priority to avoiding the pain that results from losing money, even if it means failing to make money.

- Anchoring focuses on one piece of information—often the first piece of information offered—as the basis of a financial decision. A vivid anecdote has more influence than statistics.

- Familiarity bias is rule-of-thumb decision-making—basing decisions on prior experiences or similarities.

- The gambler’s fallacy (or Monte Carlo fallacy) is the belief that past patterns somehow influence future results. The investor bets it all on black because black is due.

- Herd behavior occurs when the belief that everyone else is doing it, so it must be right takes over.

Can people learn to overcome these biases? Professor Daniel Kahneman, of Princeton University, is not very encouraging on that front. He proposes that we actually have two systems for thinking. The deliberate, logical part of our mind is capable of analyzing a problem and coming up with a rational answer. But using this part of our mind is slow and requires a great deal of energy and focus. When asked a difficult problem while walking, most people have to stop to be able to focus on the problem.

The second way of thinking is fast, intuitive, and automatic. And, explains Kahneman, it is so powerful, it is actually responsible for most of the things that you say, do, think, and believe. It is a hidden auto-pilot and the source of the cognitive biases that form the basis of behavioral finance/behavioral economics.3

Kahneman’s study of loss aversion—how people respond differently to losses and gains—was the basis of the work that won him the Nobel Memorial Prize in Economic Sciences. The deep-seated nature of cognitive biases, according to Kahneman, makes them hard to change. The assumption that one’s clients will make rational decisions quite often runs counter to reality.

The challenge becomes designing an environment that prevents or minimizes likely mistakes and encourages the conscious effort of the “thinking” circuits our brains require to resolve complex and conflicting information.

Encourage clients to automate savings and investing contributions

Remove one aspect of the conscious decision by working with clients to set up automatic payroll deductions, 401(k) contributions, and regular contributions to their nonqualified-money investment plan (even if that money is initially parked in liquid accounts). Don’t give the intuitive mind an opportunity to second-guess each decision.

Continually reinforce and educate

Ultimately, your role is to make sound recommendations, not impose decision-making. But within this framework, clients deserve your best efforts to educate on the rationale behind those recommendations. A recent Financial Times article strongly supported this point, “This can be done by increasing the number of education-focused meetings advisors have with clients and by making more educational webinars and studies available to investors. This way, even when less-sophisticated investors leave their advisor’s office, they leave with a much better understanding of their overall portfolio.”

Establish investment goals and a plan to reach those goals

This requires engaging the logical part of the mind; taking the time to walk through scenarios, to look at alternatives, and to establish a means of gauging the success of the investment plan. Without a goal and a plan to reach that goal, investing becomes centered too often on the daily volatility of the market and emotional responses take over.

Provide feedback on the progress toward goals

Market analysis and insight into factors influencing the markets, while interesting, turn the investor’s focus back to the uncertainty and emotional rollercoaster of investing and encourage second-guessing. Client communications need to focus on the plan and its specific success—not its comparison to largely irrelevant market benchmarks. And if it is not performing within the boundaries of expected progress, what will the advisor do to improve the potential of success?

Consider the role of outsourced investment management for some portion of client assets

Whether a client is in the accumulation or distribution phase of their life, outsourced investment management that has a strong risk-management component merits consideration. Actively managed holistic portfolio strategies are specifically designed to accommodate investors all along the risk-profile spectrum. And, through their reliance on quantitative decision-making models, these strategies preemptively help remove bias and emotion from the investment equation.

When working with intelligent clients—individuals who are at the top of their professions—it is easy to credit them with knowledge outside their fields and a greater understanding of investing than they might really have. “Smart people” can make bad decisions, often much more quickly than people of average intelligence. Having a process in place for all clients that systematically walks through investment recommendations, policy, and plans—and assures that the thinking mind has had a chance to become engaged—is not only good client relations, but also the right thing to do.

- Keith E. Stanovich, “Rational and Irrational Thought: The Thinking That IQ Tests Miss,” Scientific American, January 1, 2015.

- Ravindra Jain, Prachi Jain, and Cherry Jain, “Behavioral Biases in the Decision Making of Individual Investors,” IUP Journal of Management Research, July 2015.

- Daniel Kahneman, “Thinking, Fast and Slow,” New York: Farrar, Straus, and Giroux, 2011.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com