Pathways to growth: Capital Group’s 2022 advisor benchmark study

Pathways to growth: Capital Group’s 2022 advisor benchmark study

Capital Group’s study finds that the highest-growth advisory practices are characterized by three key factors: focused client-acquisition strategies, offering a broad array of value-added services, and leveraging business-management best practices across their firms.

Editor’s note: Proactive Advisor Magazine would like to thank Capital Group for permission to republish the article “Pathways to Growth: Capital Group’s 2022 Advisor Benchmark Study.” The article appears in edited form. Please visit Capital Group’s PracticeLab to download the original white paper and to access many other advisor resources.

What does a successful advisory practice look like today?

For one thing, it’s growing. During a year that brought unprecedented challenges, the average advisor firm has not only survived but thrived. Strong market returns helped to lift the revenue growth of the average advisor we surveyed by 11% in 2021. But an elite segment of practices did even better, growing by an average of more than 26% over the same period—an increase of 138%. So what are these advisors doing that’s different?

In Capital Group’s second-annual advisor benchmarking study, we set out to confirm our initial findings about what the highest-growth advisors do differently, and which behaviors and skills prompted their exceptional growth.

A comprehensive multiyear study with a clear purpose: Understanding what drives growth

In 2020 and 2021, we anonymously surveyed over 2,300 financial professionals who together provided a representative view of the U.S. advisor landscape. Participants ranged from seasoned veterans to those at the outset of their careers, and from registered investment advisors (RIAs) to advisors at regional firms to corner-office wire-house teams. Some practices were modest, while others had books of business that numbered in the billions of dollars.

We analyzed results based on dozens of factors, including things like model-portfolio usage, assets-under-management (AUM) growth, retirement-plan assets, technology adoption, and practice-management behaviors. We were also intentional about including responses from advisors who have a specialty focus, such as having a large number of high-net-worth clients, or an emphasis on providing advisor-sold retirement plans. The resulting framework places practices in segments, from low to high growth, and identifies behaviors and skills associated with each. Focusing on the traits of the highest-growth segments can help advisors chart their own pathways to growth.

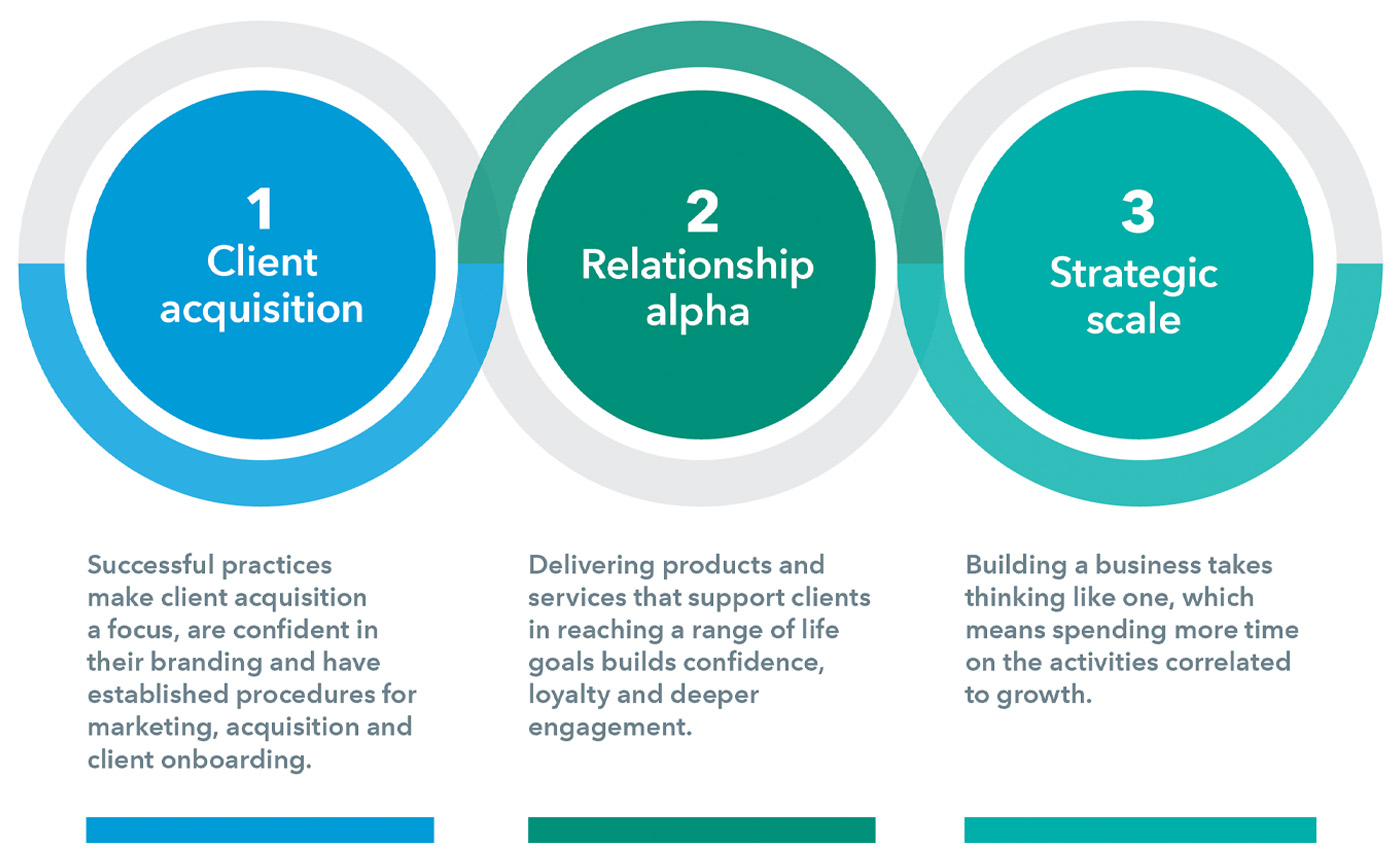

Three factors behind highest-growth practices

While there’s no single path to success, our study continues to show that three factors were behind the highest-growth practices. Understanding the factors, what moves them, and how they relate to one another can help advisors rebalance their time and energy toward growth-related behaviors that will enable them to forge their own pathways to growth.

An intentional approach to acquisition

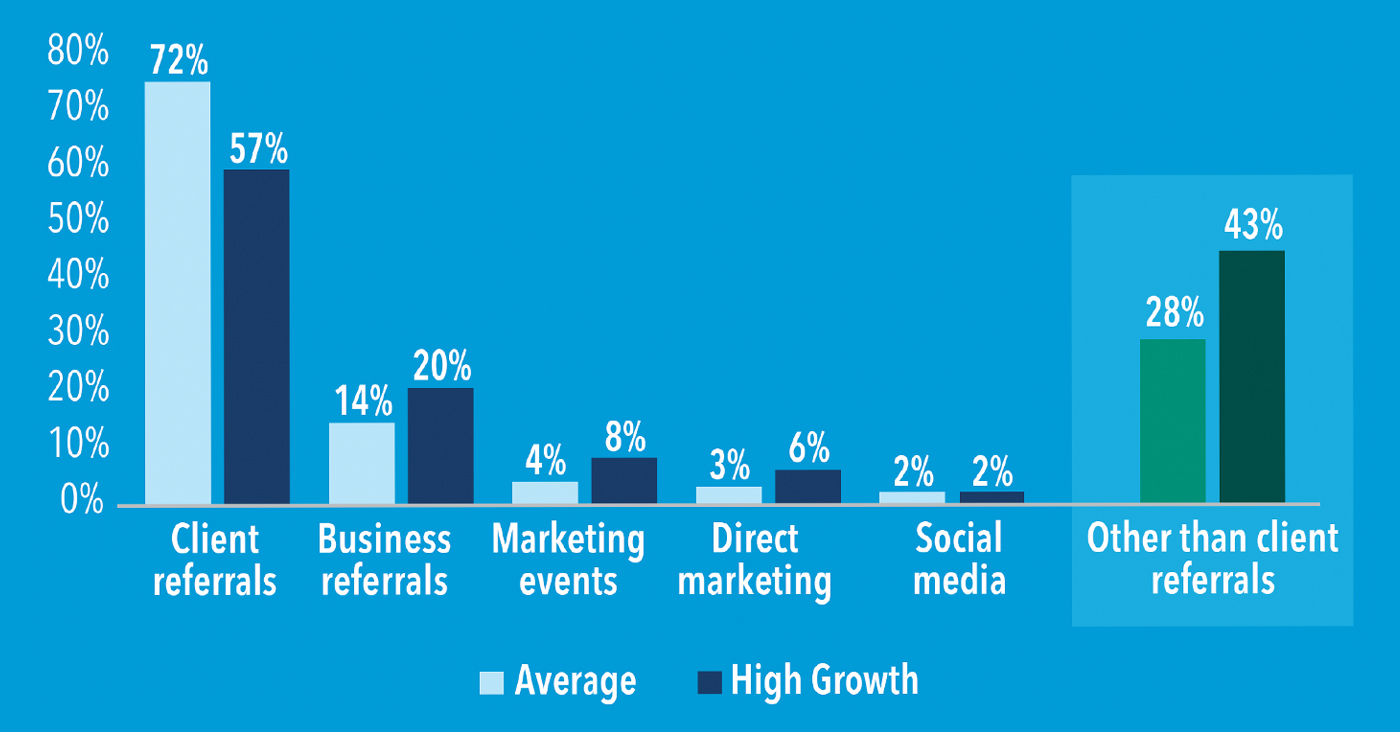

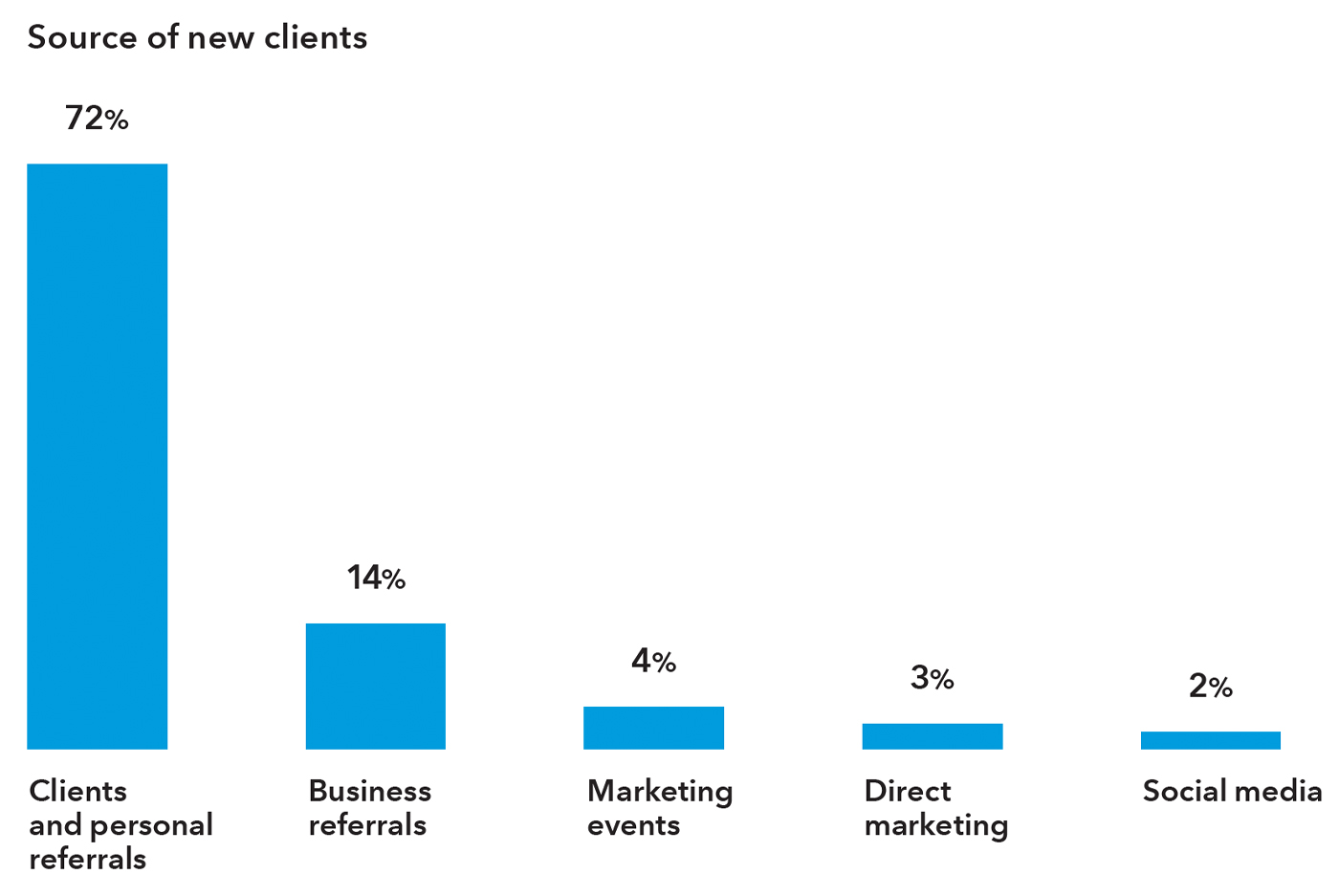

Clients are the lifeblood of every practice, and new clients are key drivers of AUM and revenue growth. So it would seem natural to have an intentional strategy for acquiring them. But our study confirmed that the average practice remains reliant on a single source for 86% of their new clients: referrals from current clients and business partners. By contrast, marketing-based client-acquisition strategies, including events, direct marketing, and social media outreach, accounted for only 9% of new clients on average.

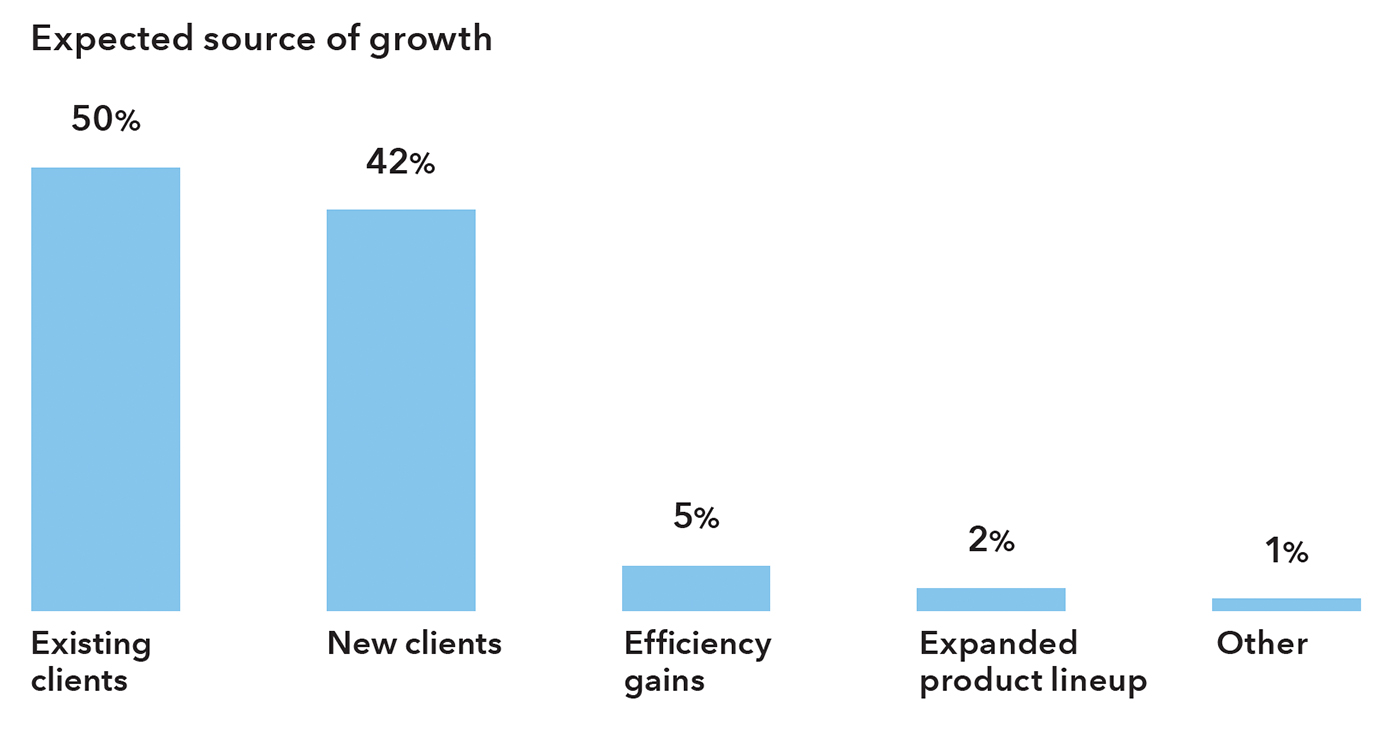

Despite very limited acquisition-oriented marketing activity, advisors continue to recognize its importance. When asked to predict sources of future practice growth, 42% of respondents cited new clients as a primary driver.

The low level of marketing activity and high dependence on referrals suggest a lack of intentionality when it comes to an expected driver of business growth. Yet this is one of the areas in which a deliberate strategy clearly matters, as more than half of advisors in the two highest-growth segments have client acquisition as an established business goal. And, during a year of uncertainty, our study showed practices that kept a consistent focus on client acquisition and continued to use marketing-based strategies gained a greater share of new clients through those efforts while also achieving higher-than-average growth.

FIGURE 1: MOST NEW CLIENTS COME FROM REFERRALS, VERY FEW FROM MARKETING

FIGURE 2: DESPITE LIMITED MARKETING ACTIVITY, ADVISORS ARE PROSPECTING NEW CLIENTS TO DRIVE GROWTH

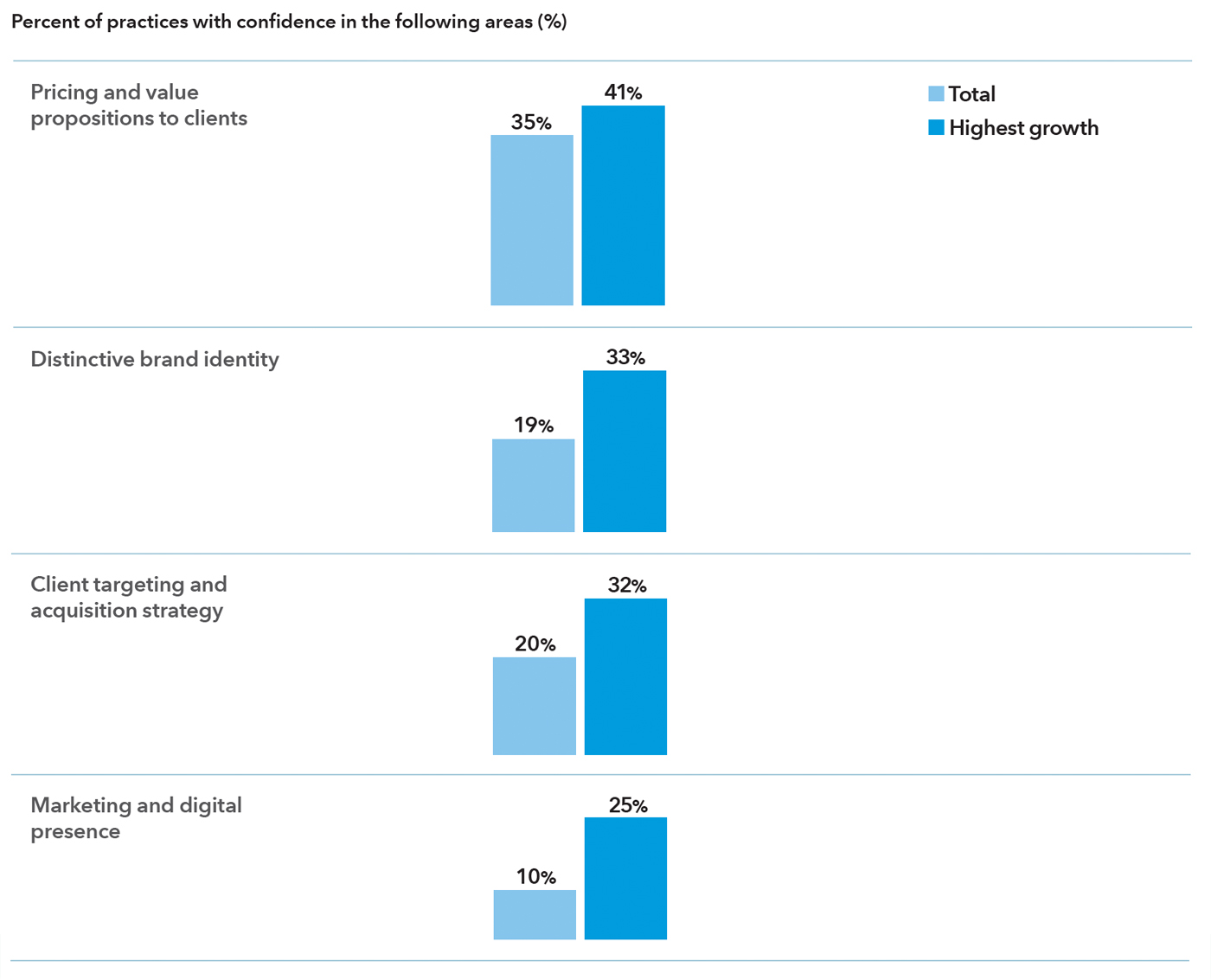

The highest-growth segment has higher confidence in their marketing capability

The average advisor’s low level of marketing-related activity becomes less surprising given our finding that only 10% consider themselves to be experts in marketing or digital presence. By contrast, 25% of the highest-growth practices regard themselves as experts in this area. Perhaps predictably, the highest-growth group rates itself as having a higher level of confidence across a broad range of areas surveyed—from goals-based financial planning to business planning and goal setting. But in our survey, the gaps in self-assessment were most pronounced in the areas of marketing and digital practices, distinctive brand identity, and client targeting and acquisition strategy. Importantly, marketing is not an innate skill but a learned one, which means a focus on skill building is a key consideration for those seeking higher growth.

FIGURE 3: HIGHEST-GROWTH PRACTICES HAVE GREATER CONFIDENCE IN THEIR MARKETING SKILLS

Developing your client acquisition capability

Of course, every advisor knows that new business is important. But our study reveals that what distinguishes high-growth practices is the spectrum of behaviors and competencies associated with their client-acquisition strategies.

Here are a few specific behaviors associated with highest-growth practices:

-

Setting acquisition goals. While the average advisor relies on existing clients for business growth, advisors in the highest-growth segment look to new clients as a growth strategy. The highest-growth practices are 22% more likely to be focused on client acquisition.

-

Referral-driven segmentation. Most respondents in our survey reported that most new clients come from referrals—72% from existing clients and 14% from business referrals. Within the highest-growth segment, advisors rely less on referrals for business growth. But these respondents say they incorporate “potential for referrals” into their client-segmentation strategy 47% of the time versus 40% for all those surveyed.

-

An optimized marketing mix. Among the highest-growth practices, advisors increased their digital expertise by 20% compared to the previous year. Advisors in these practices are twice as likely to do marketing through direct mail, email, or text messaging, and are more likely to have gained new clients through these channels.

-

Client onboarding process. Onboarding standard operating procedures (SOPs) were common among advisors, with 62% of the high-growth group using them. Additionally, a greater proportion of the fastest-growing advisors indicate an expertise in client service agreements, suggesting that information gathering during client onboarding is crucial.

AN ALWAYS-ON APPROACH TO MARKETING

One area where stark differences in behavior can be observed is marketing. Despite the pandemic, the highest-growth advisors spent five times more on marketing than others we surveyed. This strategy of maintaining consistent marketing efforts helped them achieve above-average growth in a challenging year.

In general, this high-growth segment is far less dependent on referrals for new business and 81% more likely to get new business through marketing events, direct marketing, or social media. These advisors were also 142% more likely to have defined and measurable goals for marketing return on investment (ROI).

The high-growth segment also stood out for their use of digital marketing techniques. While the average advisor surveyed was more likely to use marketing dollars for local events, local ads, or direct mail campaigns, high-growth advisors were more likely to use marketing-specific emails or webinars.

Marketing strategies of the highest-growth advisors:

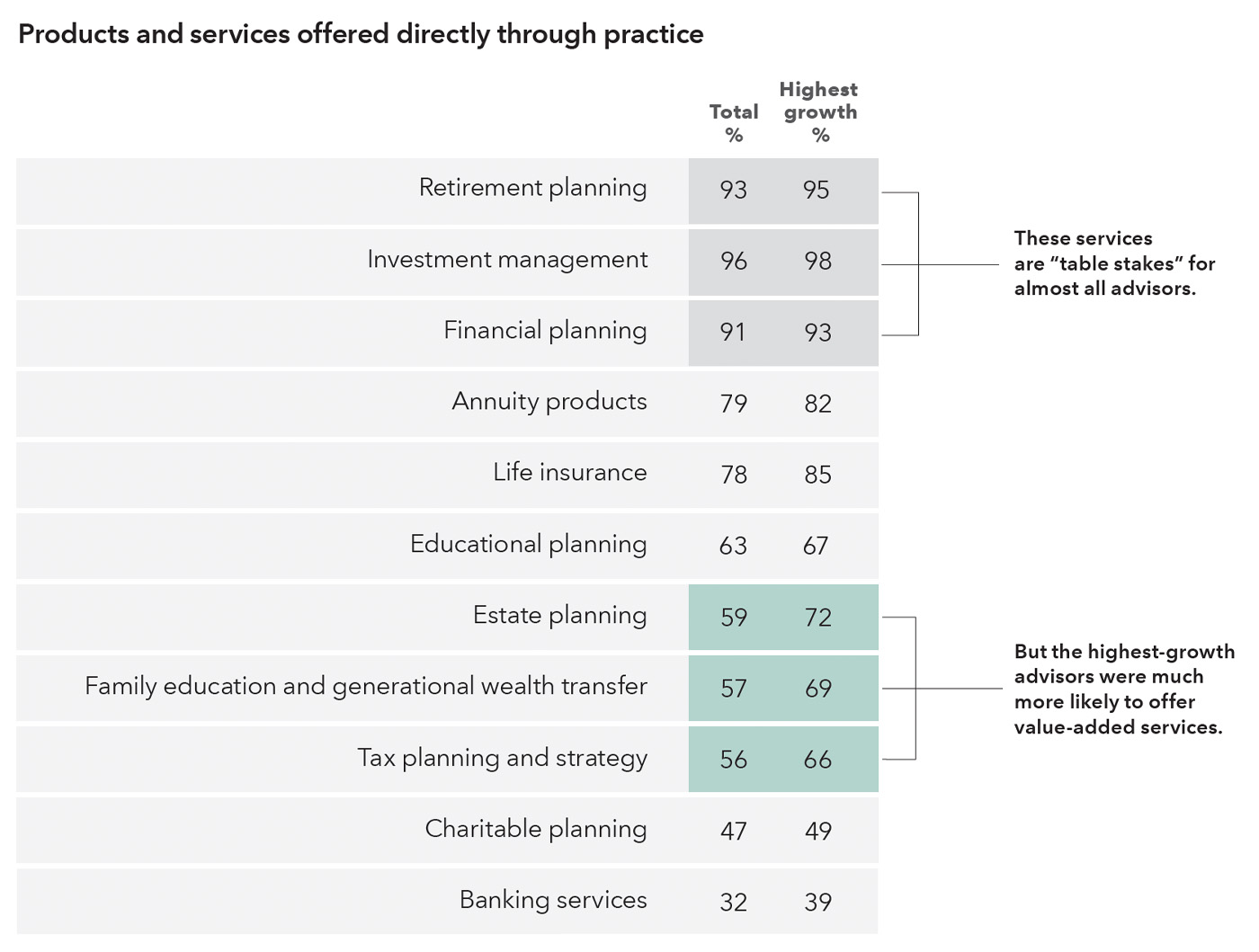

Broaden professional services to deepen engagement

Our original study found that certain products and services are “table stakes” offerings for all practices. These include retirement and financial planning and investment management. The highest-growth segment continues to distinguish itself by offering more “value-added” services at significantly higher rates. These include areas like tax planning and strategy, estate and educational planning, as well as guidance on generational wealth transfers. Year over year, high-growth advisors increased tax-planning offerings in particular by 11%. Engagement in this area may pave the way toward multigenerational relationships, which continue to be correlated to the highest-growth practices.

Our latest results also found that high-growth practices were more attentive to the client relationship in 2021. They reported 63% more client interactions compared to the average advisor.

For the highest-growth group, one service offered at a significantly higher rate than average is retirement-plan consulting and management for businesses. The highest-growth practices continue to have a significantly higher-than-average share of their AUM in retirement plans.

TABLE 1: HIGHEST-GROWTH PRACTICES OFFER MORE SERVICES TO ALL CLIENTS

Enhanced client service and retirement-plan business

Beyond merely offering more services, the highest-growth practices delivered those services in a differentiated way. This segment provided customized product and service offerings, investment policy statements, and full written financial plans at higher-than-average rates. These practices provide transparency and a high level of client service while freeing up advisors to focus on activities more correlated with growth.

Highest-growth practices also have a higher level of their AUM in retirement-plan assets. In addition to delivering on an important need for business clients, having a higher percentage of retirement-plan assets made advisors in our study twice as likely to be growing AUM. Retirement-plan assets were also linked to more referrals.

FIGURE 4: HOW HIGHEST-GROWTH PRACTICES DELIVER RELATIONSHIP ALPHA

DELIVERING RELATIONSHIP ALPHA

Client engagement and loyalty are as important to a practice’s health as ever before, but it seems to be the quality of that engagement that drives growth. The following steps help growth-seeking advisors provide a differentiated client experience:

- Set client satisfaction goals. Goal setting is an important practice-management skill of its own, but higher-growth advisors were more likely to set goals for client satisfaction and client retention. During a challenging year, this meant paying more attention to client needs. The highest-growth advisors had 63% more interactions with their clients, and they increased their focus on offering tax-planning services.

- Consider retirement-plan business to diversify and create sticky assets. Having a higher percentage of retirement-plan assets made advisors in our study twice as likely to be growing AUM. This makes sense as adding retirement plans to your practice has always been viewed as a clear growth driver. But beyond providing a reliable source of flows, high levels of retirement-plan assets were also linked to higher-net-worth referrals. Having retirement-plan capabilities—particularly when paired with standardizing your approach to client service—also provides an opportunity to efficiently scale your practice.

- Look beyond investment management. The fastest-growing advisors in our study spent 13% less time on investment management than the average advisor. Instead, they were more likely to offer services focused on supporting specific financial goals, such as educational planning, estate planning, and tax planning and strategy. And while segmentation is important to growth and efficiency, these types of services were offered to all clients, regardless of segment. These areas of service contributed to an increase in consumer loyalty, retention, and referrals.

- Multigenerational engagement. While a large proportion of high-net-worth clients might seem to be a marker of highest-growth practices, this isn’t necessarily the case. Our study found that better indicators of above-average growth are practices that create multigenerational engagement and wealth-transfer plans. Not surprisingly, they have a higher proportion of multigenerational households and are twice as likely to achieve high growth.

- Simple, transparent client communication and access. Beyond service offerings, there were behaviors tied to growth that seem to take into account clients’ specific needs, concerns, motivations, or foundational habit building. Providing written investor policy statements or financial-plan documents to instill confidence and clarity, or using account-aggregation platforms, signal transparency and make it easier for clients to access information. Together with a tiered approach to service, they also help deliver a high level of client service while freeing up advisors to focus on activities more correlated with growth.

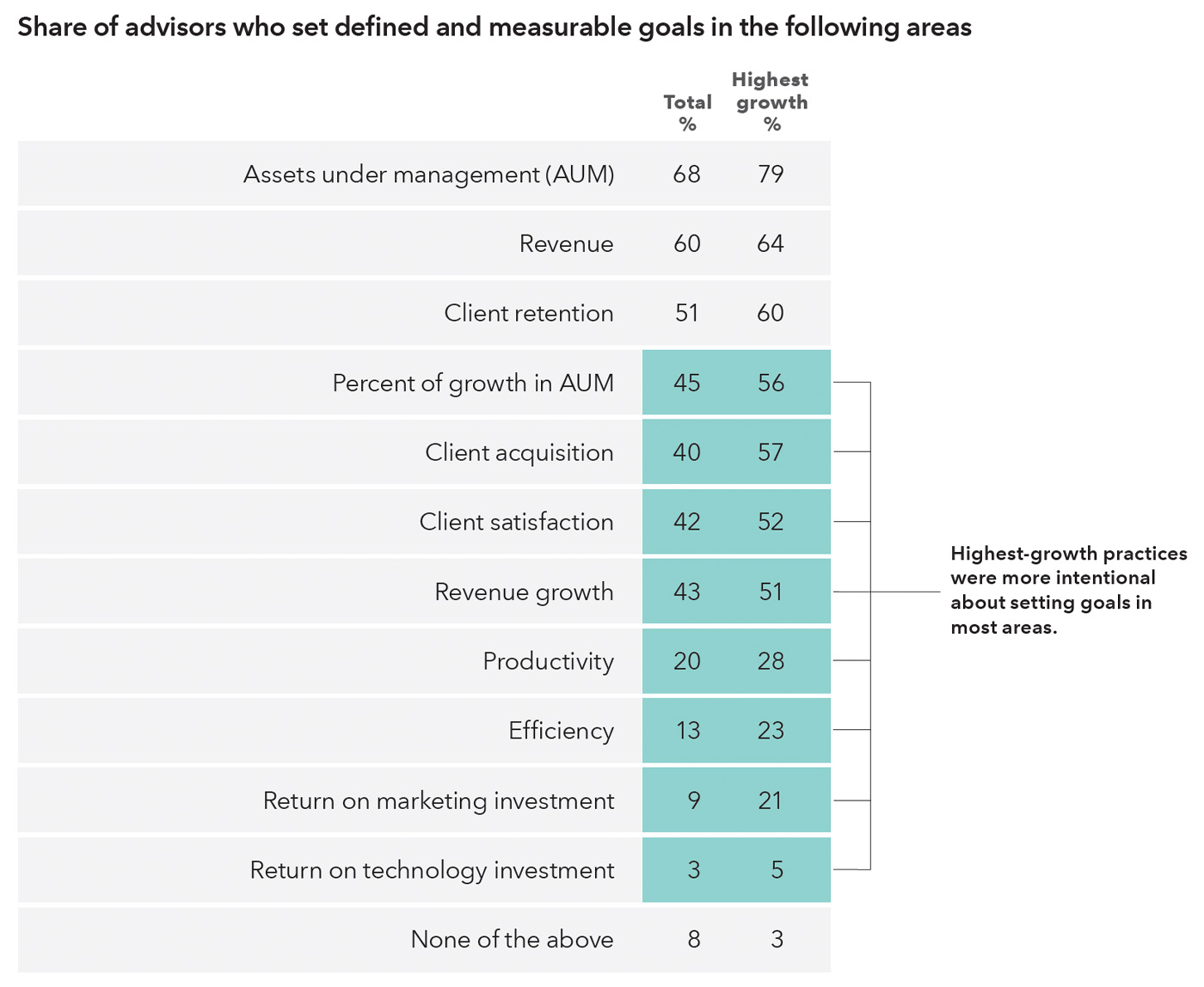

Running your practice like an enterprise

While it may come as no surprise that advisors are dedicating 80% of their time to client and investment management, our findings continue to indicate that allocating more time to business management leads to higher growth. Employing select disciplines often found in more corporate enterprises—flexibly and in accordance with your style and preferences—was associated with highest-growth practices.

For example, whereas the broader universe of advisors focused on revenue, the highest-growth segment was also focused on revenue growth, arguably a more sophisticated practice-health measure.

In addition, advisors in the highest-growth segment continue to be more intentional about goal setting in areas like efficiency, productivity, client satisfaction, and AUM growth. The highest-growth group also allocated nearly 50% more time to team management but 11% less time to client book management. And while all advisors—including the highest-growth segment—reported using SOPs less consistently in the past year than they had previously, standardization continues to be a best practice for efficiency.

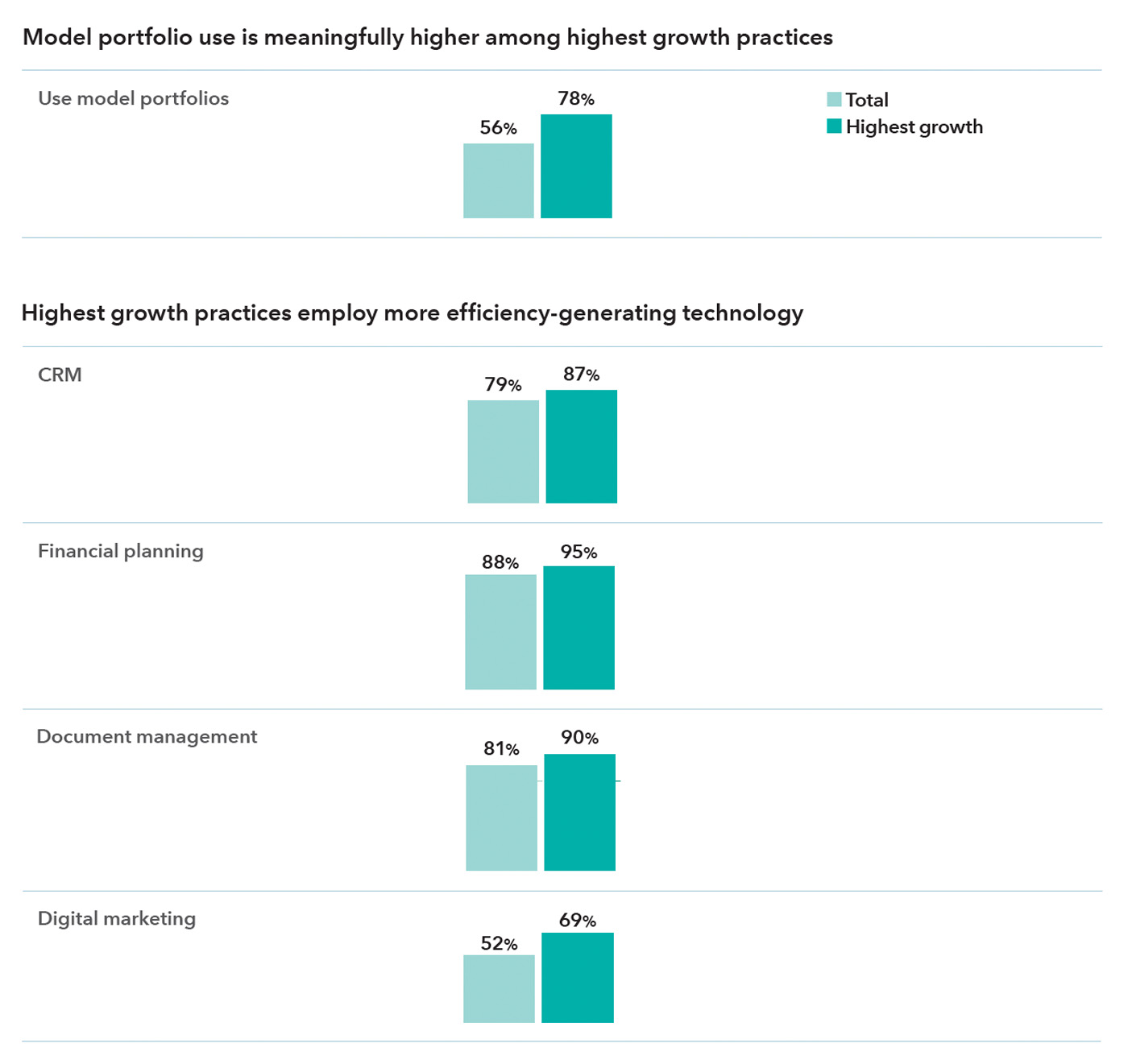

One additional source of efficiency for the fastest-growing segment was the use of select productivity-enhancing technologies, including portfolio rebalancing software and customer relationship management (CRM) systems. In addition, higher-than-average use of model portfolios remained a marker of highest-growth practices.

TABLE 2: HIGHEST-GROWTH PRACTICES ACTIVELY PURSUE EFFICIENCY AND PRODUCTIVITY

Greater use of model portfolios and select technologies are associated with highest-growth practices

More advisors in the highest-growth segment seek efficiencies through the use of tools that enable them to allocate more of their time to high-value activities. For one, they use model portfolios at higher-than-average rates. In addition, they use tools like portfolio management software, trading/rebalancing software, CRM platforms, and document management software more than advisors as a whole.

FIGURE 5: USE OF MODEL PORTFOLIOS AND EFFICIENCY-GENERATING TECHNOLOGY

BUILDING STRATEGIC SCALE

One of the clearest findings in our study was that the highest-growth advisors spent considerably more time on practice-management-related activities—behaviors associated with strategic scale, focused on efficient and productive business practices that can free up time for higher value activities. Advisors seeking to accelerate their growth would do well to consider the following:

- Set clear and measurable business goals. High-growth advisors were 42% more likely to do business planning, and to set and regularly measure goals, including client-acquisition goals, client-retention goals, AUM goals, and efficiency goals.

- Seek efficiency through models and technology. Advisors in the highest-growth segment were 40% more likely to use model portfolios and spent less time monitoring the markets. They also used technology tools, such as portfolio management software, trading/rebalancing software, and CRM and document management software, at higher rates than advisors as a whole. The efficiencies these technologies create enable advisors to allocate more time to services such as estate and charitable planning, or advice on generational wealth transfer, which our study suggests contributed to higher growth.

- Implement standard operating procedures (SOPs). All advisors in our survey, including the highest growth, were less consistent in using SOPs in 2021 compared to 2020. Still, the fastest-growing advisors were more likely to have SOPs in place in their practices. Having established processes for prospecting, onboarding, and service can make advisors more confident in client targeting and acquisition, as well as client service and satisfaction. And clear and consistent instructions for a practice’s standard of care can help make daily activities more efficient and deliver a seamless client service experience.

- Take a team approach. Team management tends to go hand in hand with increased productivity, and business-focused advisors were 50% more likely to feel confident about their team management, compensation, and recruiting. The high-growth segments spend comparatively more of their time on team management and far less time on client book management than the average advisor. Diversity when hiring may have an impact, as well. Female advisors in our study were much more likely to grow their expertise in the past year.

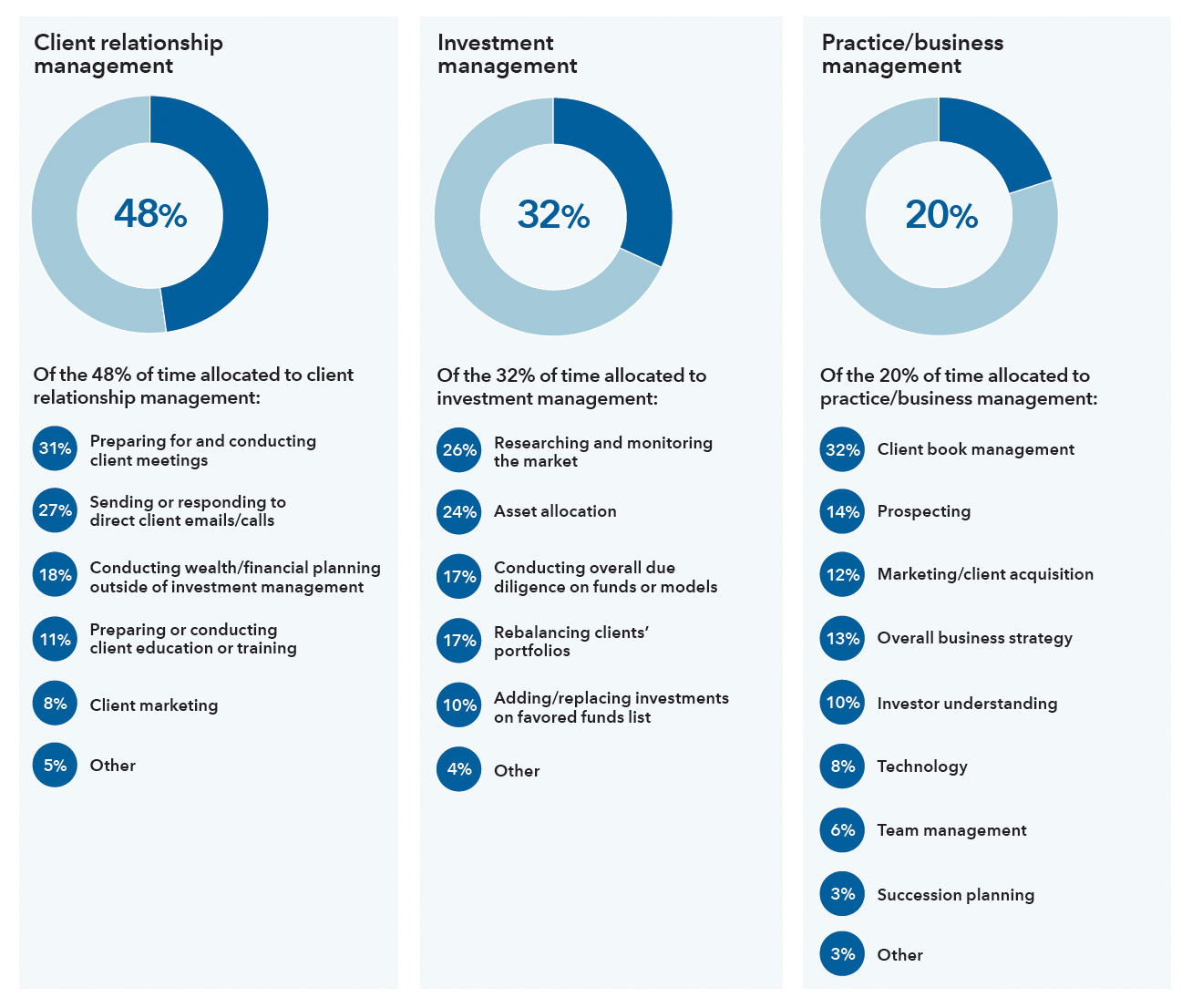

How advisors spend their time

The study showed that advisors are generally allocating their time in the following order: client management, investment management, and practice/business management.

On average, advisors are dedicating 80% of their time to activities like preparing for client meetings and rebalancing portfolios. This remains unchanged from the previous year. There are still certain behaviors that differ meaningfully based on the advisors’ growth profiles. It’s notable, however, that gaps are narrowing as advisors are increasingly adopting these practice-management behaviors across the board. For example, we found that the highest-growth group spends 10% more time on practice management and 10% more time on team management. This high-growth group also spends 7% less time on client book management but allocates 38% more time to prospecting.

FIGURE 6: PERCENTAGE OF TIME SPENT IN THE FOLLOWING AREAS

Note: Figures may not add up to 100 due to rounding.

For advisors seeking growth, our study found that just 30 minutes a week shifted away from certain lower-impact client-management tasks to higher-impact activities (like team management or strategic marketing) helped AUM grow by 3%.

FIVE STEPS ON YOUR PATHWAY TO GROWTH

At the highest level, average and high-growth advisors allocate their time similarly. But within the broad categories of client management, investment management, and practice management, significant differences emerge.

The following five steps can help advisors reallocate their time toward activities correlated to the highest-growth practices:

- Establish goals for client acquisition and prospecting: When it comes to client acquisition, being purposeful matters. Advisors with expertise in key marketing disciplines like branding and prospecting, as well as those with higher levels of marketing activity, grew faster.

- Expand your product and service offering: Financial planning and investment management are standard offerings for nearly all practices. Highest-growth advisors provide a broader range of services in value-added areas such as tax, estate, and education planning, and generational wealth transfer. In building these skills, advisors can broaden their professional networks and create connections with multiple generations of the same family, which is correlated to higher growth.

- Standardize your practices related to client service: Establishing clear processes helps foster a higher-functioning team and a better client experience. For example, onboarding SOPs were common among highest-growth practices, with over 62% using them. Additionally, a greater proportion of the fastest-growing advisors indicate an expertise in client service agreements, suggesting that information gathering during client onboarding is crucial.

- Spend less time monitoring the market and build scale and efficiency through model portfolios: Highest-growth advisors follow the advice often given to clients: Focus on what you can control. That means 9% less time researching the market. And although most practices spend comparable time on asset allocation, fewer in the high-growth segment spend time rebalancing client portfolios. The 40% higher use of models among high growers may explain why.

- Spend more time optimizing your team performance: A productive, efficient team sits at the center of many of the high-value activities uncovered in our study. Highest-growth advisors spend 47% more time on team management, while spending 11% less time on client book management.

***

Capital Group, partnering with behavior and analytics firm Escalent, conducted a multiyear advisor benchmarking study among a representative total of over 2,300 advisors. The study established a benchmark for behaviors and assessed the relationship between those behaviors and success. Online studies were conducted in July and August of 2020, and repeated in May and June of 2021, and Capital Group was not revealed as the sponsor. The data in this report represents the findings from the 2021 study. Respondents represented the range and diversity of U.S. financial advisors, and at minimum had to be 18 years old or older, personally own a book of business as an individual or on a team, and have AUM in 2021 of at least $5 million. Decision tree analysis and a time efficiency model were conducted to understand success linkages.

American Funds Distributors Inc., member FINRA. All Capital Group trademarks mentioned are owned by The Capital Group Companies Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies. © 2022 Capital Group. All rights reserved.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Since 1931, Capital Group, home of American Funds, has been singularly focused on delivering superior results for long-term investors using high-conviction portfolios, rigorous research, and individual accountability. Today, Capital Group manages more than $1.7 trillion in equity and fixed-income assets for millions of individual and institutional investors. PracticeLab is Capital Group’s digital destination for financial professionals, with insights and actionable ideas to help build their businesses and serve their clients.