Risky business

How can advisors build a more meaningful investor behavioral profile?

The long-lasting effects of the Great Recession

It is hardly news that many investors remain permanently scarred by the credit crisis of 2007 to 2009. Many research studies since have detailed the long-lasting psychological impact of the largest market declines since the Great Depression. The Federal Reserve’s 2013 Survey of Consumer Finance found that “only 48.8% of Americans held stock either directly or indirectly in 2012.” According to CNBC, that was the lowest level since 1995.

It is hardly news that many investors remain permanently scarred by the credit crisis of 2007 to 2009. Many research studies since have detailed the long-lasting psychological impact of the largest market declines since the Great Depression. The Federal Reserve’s 2013 Survey of Consumer Finance found that “only 48.8% of Americans held stock either directly or indirectly in 2012.” According to CNBC, that was the lowest level since 1995.

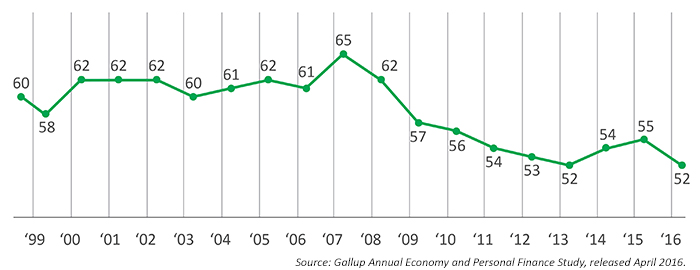

A more recent 2016 study by Gallup shows similar findings, with slightly more than half of Americans (52%) saying they currently have money in the stock market, “matching the lowest ownership rate in Gallup’s 19-year trend.”

Understanding clients’ behavioral biases and employing active risk management can help overcome negative attitudes toward investing.

FIGURE 1: PERCENTAGE OF U.S. ADULTS INVESTED IN THE STOCK MARKET

Do you, personally or jointly with a spouse, have any money invested in the stock market right now—either in an individual stock, a stock mutual fund, or in a self-directed 401(k) or IRA?

While equity markets have rebounded to make new high after new high in the years since the recession, a large cohort of Americans has been effectively sitting on the equity sidelines. They are now suffering from the doubly painful effects of not only having memorialized permanent losses to their net worth, but also mentally calculating “what might have been” had they pursued some other course of investing behavior.

Some investors in this category may be having the exact opposite reaction, refusing to pay any attention to the stock market as it still represents a far too recent and troubling reminder of the losses suffered. Findings from a 2014 Wells Fargo/Gallup Investor survey, though a bit dated, are revealing and likely have not changed much over the past three years. While 64% of respondents did know that the broad stock market went up in 2013, only 7% knew the average increase was anywhere close to the 30% range.

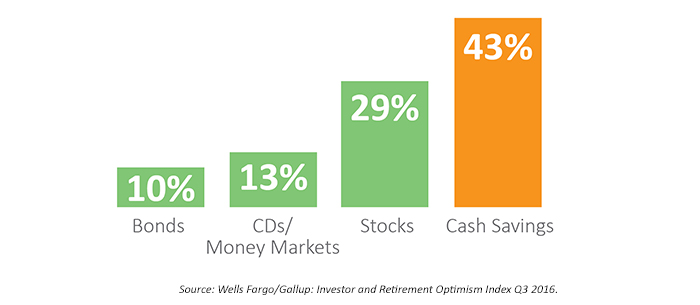

These attitudes are highlighted by a recent 2016 Wells Fargo/Gallup survey finding: “43% of investors say they have moved their money to cash or cash equivalent savings over the past year—far more than those moving money to stocks or bonds.” Some members of this large group may be suffering from the phenomena of “anchoring bias,” meaning they are “anchored” to a negative frame of reference for investing. This bias, not to mention the trauma of losing significant amounts of money, has left them with a lower tolerance for riskier assets.

FIGURE 2: MOVEMENT OF INVESTABLE ASSETS (AUG. 2015–AUG. 2016)

The up-and-down nature of the markets over the past year, and uncertainty over the U.S. elections, has contributed to a heightened concern about volatility and risk. Despite respondents in the Gallup tracking becoming more optimistic about the stock market’s upside prospects since 2007–2009 (recently hitting the highest level of market optimism since 2007), they continue to fear a variety of threats to their portfolios.

Says Gallup,

“Investors are clear about their aversion to risk, with 59% saying they are only willing to take on ‘a little risk’ (44%) or ‘no risk at all’ (15%). About 40% say they are willing to take on ‘a lot of risk’ (5%) or a ‘fair amount’ (35%) of risk.”

According to Victor Ricciardi, a finance professor at Goucher College and co-author of “Investor Behavior: the Psychology of Finance Planning and Investing,” the pain of emotional and financial loss can have a long-term effect on an investor’s willingness to get back into the stock market.

Going beyond planning basics

No matter the prospective client’s net worth, an advisor must obviously begin with a full understanding of the individual’s or couple’s financial state of health, current objectives, retirement goals, and hopes for the future. But assuming the advisor applies his or her usual expertise to gaining that full financial picture for planning purposes, what about the specific issue of addressing an ongoing fear of the markets? While a variety of financial asset class or product “buckets” are available to advisors, equities still usually represent the asset class of choice for growth and protection against what is likely to be some future uptick in inflation.

A full and thorough discussion of risk is the fundamental starting point. Establishing meaningful risk profiles can help advisors begin to understand investor behavior and help clients understand their own behavior—so that individuals have a fighting chance to get off the bench and invest again. Time-tested questionnaires or tools evaluate risk perception and risk tolerance—the maximum amount of risky investments an investor would be comfortable with in their portfolio. But traditional versions of these instruments don’t always contain the right questions to elicit enough information to help an advisor make a thorough evaluation—nor are they powerful enough alone to effect a change to now ingrained psychological behaviors.

A competent risk tolerance questionnaire identifies specific demographic information and other important objective questions related to identifying suitable investment strategies, such as level of investable assets, time horizons, the expected frequency of contributions and withdrawals, broad return objectives, and tolerance for risk. There have been significant advances in questionnaire techniques over the past decade. Sophisticated software algorithms are used in several methodologies to provide a less “biased” view of a client’s risk tolerance.

However, there is still some likelihood that questionnaires of all types may fall short when trying to ascertain an investor’s more nuanced perception of risk. Advisors who must counsel clients with fears surrounding the markets might delve into more behavioral questions, such as the following:

- What is your history with investing?

- What is your family’s history with investing?

- Do you feel confident about investing? (Why or why not?)

- Do you get emotional about investing? (Too high and/or too low)

- Do you worry about investing? Do you enjoy investing?

- How often do you check your portfolio’s value?

- Are you knowledgeable about investing? Why? How? Sources of information?

- How do you react to financial news about the markets? What were your emotions and behavior during the 2008 financial crisis?

It may be equally important to probe an investor’s family situation growing up and current life situation.

For example, you could ask the following: Did their parents fight about money? Was there any stress in their family related to financial issues? When and how did they become financially independent? Did they lose their parents at an early age? What is the financial situation of their children? Are there any special circumstances surrounding anyone in their immediate family, such as health issues or physical or intellectual special needs? What is their role and financial responsibility for their parents’ or other relatives’ elder care? How do they view their current job stability and salary expectations?

These answers will also inform their behavioral risk tolerance.

Client risk profiles may vary over time and by purpose

Louis Harvey, president of DALBAR, Inc., a prominent national financial-services market-research firm, agrees with Professor Ricciardi that many investor risk profiles often fall short when informing investor behavior. Traditional profiles assume an individual has one level of risk tolerance, which is not always the case. Factors change over time, and risk profiles have to be periodically reassessed.

DALBAR goes so far as to suggest different risk assessments might be assigned to different “buckets” of client assets or those assets earmarked for different “purposes,” i.e., imperatives such as funding retirement income, purchasing a first or second home, saving for college educations, assisting in elder care, starting a new business, making charitable contributions, or creating a transferrable legacy. Said Mr. Harvey in 2013 comments via CNBC, “We found that when there is a mismatch (between strategy and risk tolerance); you have reactions that lose people money.”

There are many types of risk. Systemic risk covers broad external factors: how changes in Fed policy might affect the current market outlook or the possible adverse impact of geopolitical risk abroad. Then there’s investment risk: what factors might be affecting a specific company or large sector of companies. There’s also sequential risk: how an individual investor is affected by changes in their portfolio’s investment value at a specific point in their overall time horizon. While all of these are important considerations, it is really the latter that advisors must carefully evaluate for each client.

For those clients still very nervous about investing, reducing the fear of that portfolio-destroying sequential risk is critical. Gaining a deep understanding of an investor’s behavioral profile and biases is a major part of the equation—employing investment strategies with a strong risk management component and nonemotional defensive capabilities can be equally important.

Investments really fall into two broad categories, says DALBAR’s Harvey: capital appreciation and capital preservation. “It’s the capital preservation side where we see a key role for the active manager,” he explains. “In other words, providing the tools that prevent the investor from being out of the market (or in) at the wrong time. If you’re invested in an index and the index goes down, nothing is going to change (with a buy-and-hold investing strategy). If you look at market conditions and the prudent action is to stand on the sidelines, passive management doesn’t allow you to do that—active management does.”

This article first published in Proactive Advisor Magazine on October 23, 2014, in Volume 4, Issue 5. Several statistics were updated to reflect the most current data and minor editorial revisions were incorporated. The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Kellye Whitney is founder and chief creative officer at Kellye Media & Associates. She was previously associate editorial director at Human Capital Media. She has specific expertise in human resources, diversity practices, and workforce learning and development programs. Her work has received several distinguished media awards.

Kellye Whitney is founder and chief creative officer at Kellye Media & Associates. She was previously associate editorial director at Human Capital Media. She has specific expertise in human resources, diversity practices, and workforce learning and development programs. Her work has received several distinguished media awards.