The market trend is your friend, but you can’t just blindly jump aboard one. You never know when the next correction will occur and take you out in the process. Therefore, you’re much better off waiting for some sort of pullback or shakeout to occur before you look to enter. Let’s explore one of my favorite patterns—the “Trend Knockout” (TKO)—using the QQQ ETF as an example.

After a strong trend is identified, you simply wait for a wide-range bar (WRB) against the trend. This helps to shake out the Johnny-come-latelies—those who bought late in the trend. These fickle players are often quick to exit at the first signs of adversity. And, if you are already long, their selling will likely take you out with them. Therefore, you’re better off waiting for some sort of “knockout” move to occur. The market Trend Knockout move also attracts eager shorts. I’m not sure why, but shorts tend to try to pick tops and often “confuse the issue with facts.” In other words, they often have many reasons why a market doesn’t deserve its high valuations. It might not, but as I often say, unless you’re Bill Clinton, what is, is.

Should the trend resume, those who are late to the game must buy back in or be willing to let the market take off without them. Also, the shorts will be forced out. Metaphorically, the market has sucked them in and spit them out. The predicament of these players can help to propel your position higher.

Let’s break it down:

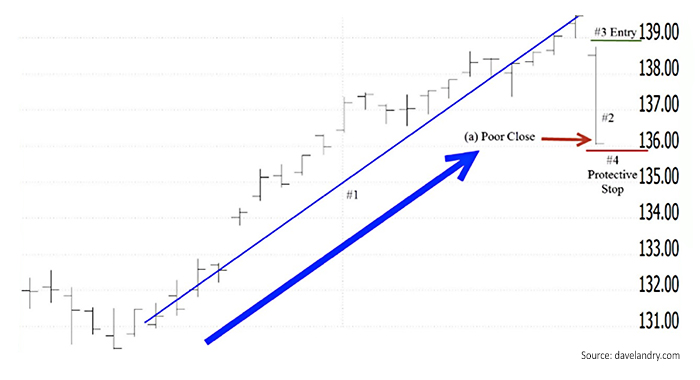

1. The market should be in a very strong trend. Ideally, the trend should also be persistent and accelerating. Persistent means that it tends to go up day after day after day. Mathematically, this is equivalent to linear regression. However, I just prefer drawing a line through as many bars as possible.

2. The market should then have a sharp sell-off relative to its volatility. This sell-off should be significant enough to have likely knocked out some existing players and possibly attracted some eager shorts. In other words, we are looking for a WRB down (for buy-side setups).

3. Look to enter above the high of the WRB (the WRB bar is noted in Figure 1 as #2) if—and only if—the trend begins to resume. In other words, wait for an entry. Should the market rally all the way back to the trigger point, it suggests that it has dismissed the sell-off and the longer-term trend is resuming.

4. Once a long trade is triggered, place a stop below the low of the WRB (#2), plus some additional room based on the volatility of the underlying instrument. In some cases, if the market closes poorly (i.e., near the low of the bar) and the WRB is fairly extreme on a relative basis, then the instrument can be traded in more of a “textbook” type of fashion—the entry can go just above the high of the knockout bar, and the stop can be placed just below the low of the knockout bar.

Looking to the QQQ, notice in Figure 1 the WRB on the far right (this occurred on May 17, 2017). The market had a classic strong and persistent uptrend, indicated by the blue line and #1. It then sold off hard with a WRB (#2 at the far right of the chart). It also closed near its low of the bar (a), creating a textbook-type setup. In a case like this, the entry will be placed above the high (#3) of the knockout bar, and, once triggered, a stop will be placed below the low of the knockout bar (#4).

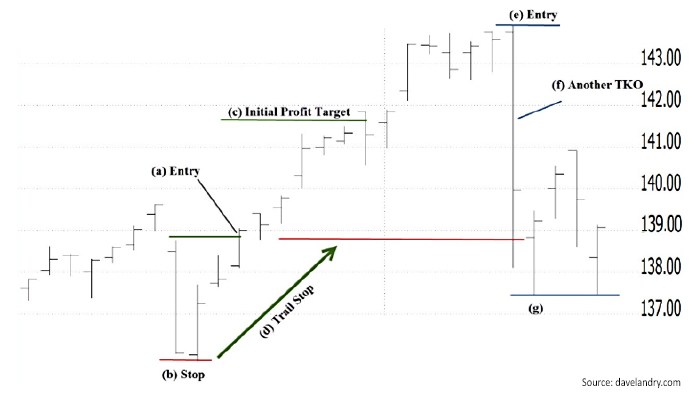

Using my hybrid form of money management, the initial profit target is the risk (entry – stop) plus the entry. Once the initial profit target has been hit, partial profits (half) are taken, and the stop on the remainder of the position is moved to breakeven. Barring overnight gaps, the worse you can now do is break even on the remainder of the trade for a profitable trade overall. If you are not stopped out, the stop is then trailed somewhat loosely on the remainder of the position in an attempt to capture a longer-term gain. The idea is to make the transition from a short-term swing-type trade to a longer-term trend following. Metaphorically, this allows you to “have your cake and eat it too”—trading for short-term gains while still allowing for the potential of a home run.

FIGURE 1: A STRONG TRENDING MARKET WITH A WIDE-RANGE BAR (QQQ)

Let’s continue with the QQQ example moving forward, this time with Figure 2. The QQQ triggered an entry (a). Therefore, a protective stop was placed below the low (b). The market then rallied to the initial profit target where profits (half) were taken (c). The stop on the remainder of the position was then subsequently moved to breakeven (d) in an attempt to ride out a longer-term trend on the remainder. The market subsequently sold off back below the previous entry to stop out at a scratch on the remainder of the position. What’s interesting is that this WRB down sets up a new TKO (e).

Sometimes a market Trend Knockout is more than just a knockout. A market top and a subsequent downtrend can start with a WRB down. The great thing is that the TKO often won’t trigger when this is the case. No capital is put into harm’s way.

If the market hits new highs, triggering this TKO (e), then it would suggest that it has once again shrugged off a correction. However, if it doesn’t trigger, then it’s possible that this is the start of something bigger. Keep an eye on the recent lows (g)—both here and in the NASDAQ—to see if this is just a Trend Knockout or if the trend has been knocked out.

FIGURE 2: IDENTIFYING REPEAT SETUPS FOR A TKO TRADE (QQQ)

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com