Inflation, the Ukraine conflict, weakening consumer sentiment, the Fed’s anticipated rate-tightening cycle, faltering U.S. growth expectations, and the market’s continued poor performance have overshadowed what is turning out to be a decent Q1 earnings season.

Here are some key highlights of the Q1 earnings season from FactSet’s weekly update:

-

As of May 6, 87% of S&P 500 companies have reported on Q1 earnings.

-

“79% of S&P 500 companies have reported a positive EPS surprise and 74% of S&P 500 companies have reported a positive revenue surprise.”

-

The estimated “blended earnings growth rate for the S&P 500 is 9.1%” for Q1. “Nine of the eleven sectors are reporting year-over-year earnings growth. …”

-

The estimated overall revenue growth rate for Q1 is 13.3%. “If 13.3% is the actual growth rate for the quarter, it will mark the fifth-straight quarter of year-over-year revenue growth above 10% for the index. All eleven sectors are reporting year-over-year growth in revenues. …”

-

Positive surprises and earnings revisions have led to the almost doubling of the overall estimated earnings growth rate since March 31. “Ten sectors have higher earnings growth rates today (compared to March 31).”

-

“For Q2 2022, 50 S&P 500 companies have issued negative EPS guidance and 22 S&P 500 companies have issued positive EPS guidance.”

-

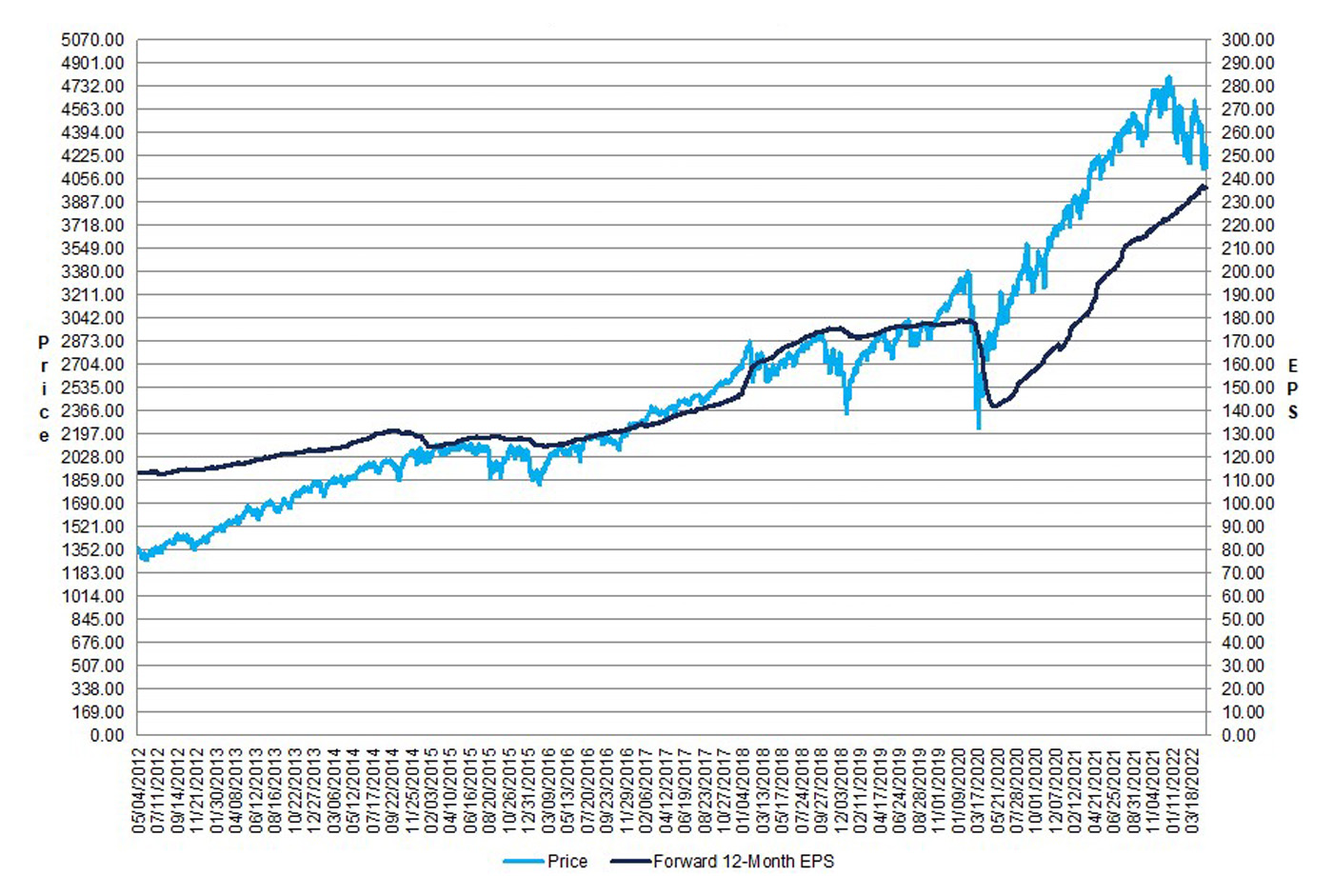

“The forward 12-month P/E ratio for the S&P 500 is 17.6. This P/E ratio is below the 5-year average (18.6) but above the 10-year average (16.9).”

FIGURE 1: S&P 500 CHANGE IN FORWARD 12-MONTH EPS VS. CHANGE IN PRICE—10 YEARS

Source: FactSet

FactSet summarizes the Q1 earnings season to date as follows:

“At this point in time, the percentage of S&P 500 companies beating EPS estimates is above the 5-year average, but the magnitude of these positive surprises is below the 5-year average. As a result, the index is reporting higher earnings for the first quarter today relative to the end of last week and relative to the end of the quarter. However, the index is also reporting single-digit earnings growth for the first time since Q4 2020. The lower earnings growth rate for Q1 2022 relative to recent quarters can be attributed to both a difficult comparison to unusually high earnings growth in Q1 2021 and continuing macroeconomic headwinds.”

Sector earnings performance

As has been the case in recent quarters, the Energy (+267.1%) sector has led all other sectors in estimated earnings growth for Q1 2022, followed by the Materials (+41.3%) and Industrials (+32.6%) sectors. Financials (-19.7%) and Consumer Discretionary (-33.9%) have been major drags on the overall S&P 500 Q1 earnings growth average.

FIGURE 2: S&P 500 ESTIMATED EARNINGS GROWTH BY SECTOR (Q1 2022)

Source: FactSet

Earnings and sales ‘beat rates’ a bright spot amid bearish sentiment

Bespoke Investment Group noted last Friday (May 6),

“With headlines like ‘Nowhere Near Bottom’ shown at the top of the Drudge Report today, the pain in financial markets has clearly made its way from Wall Street to Main Street. Sentiment levels remain at some of their most bearish readings of the last 50 years.

“Probably the most bullish indicator we can find right now is just how bearish everyone is. It’s usually when no one can find anything positive on the horizon that bottoms are made. Historically, when investor sentiment has been this bearish, forward returns going out one month to one year have been very positive. …”

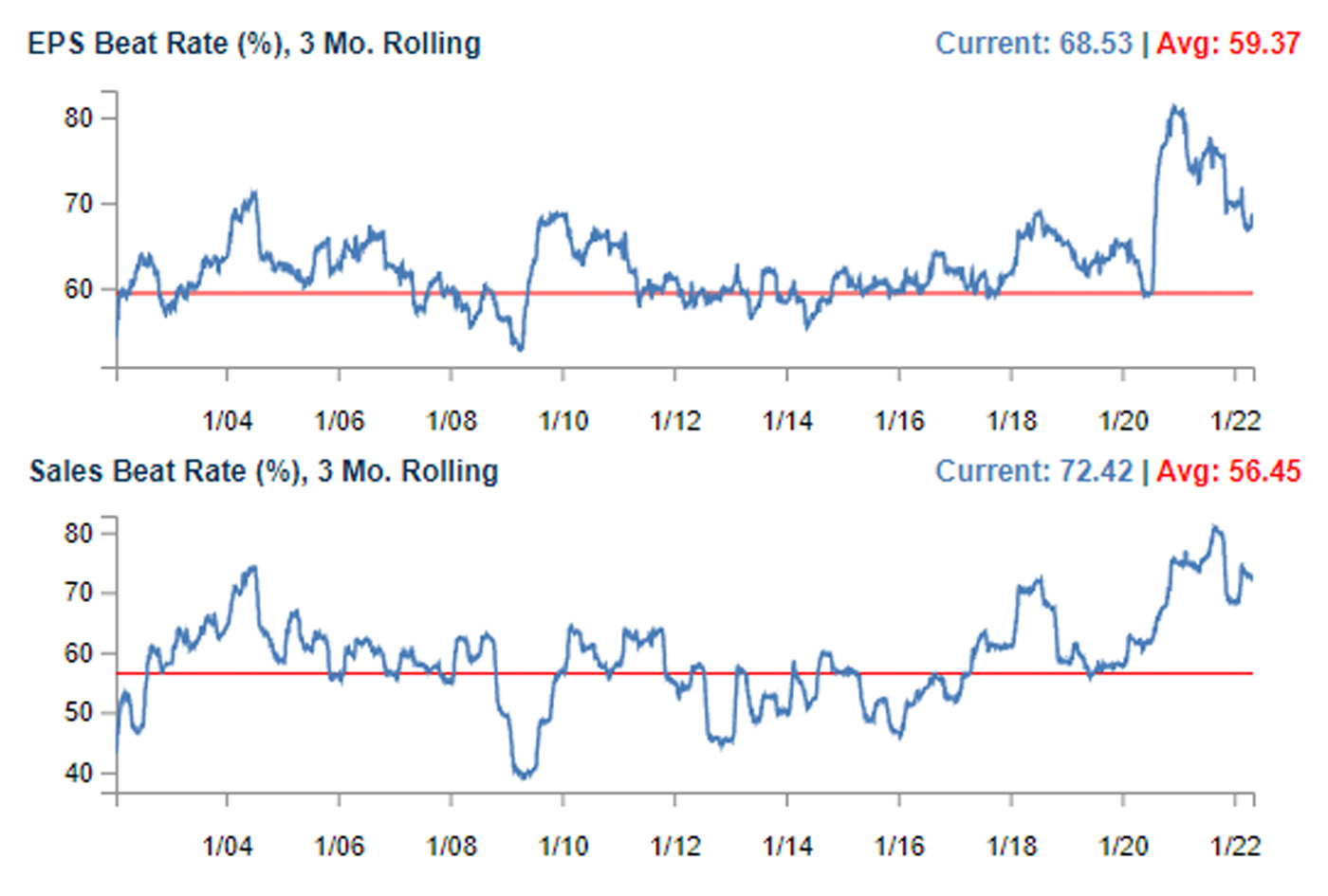

“The market is stumbling its way through another earnings season with a decline of more than 6.5% at the moment, but we’ve actually been surprised that companies have still managed to top analyst expectations at well-above-average rates. We’re tracking 70%+ beat rates for both EPS and revenues for the Q2 reporting period, and more companies are raising guidance than lowering guidance.”

Figure 3 provides a look at rolling averages for “beat rates” on earnings and revenues going back about 20 years.

FIGURE 3: ROLLING AVERAGES FOR ‘BEAT RATES’ ON EARNINGS AND REVENUES

Source: Bespoke Investment Group

New this week: