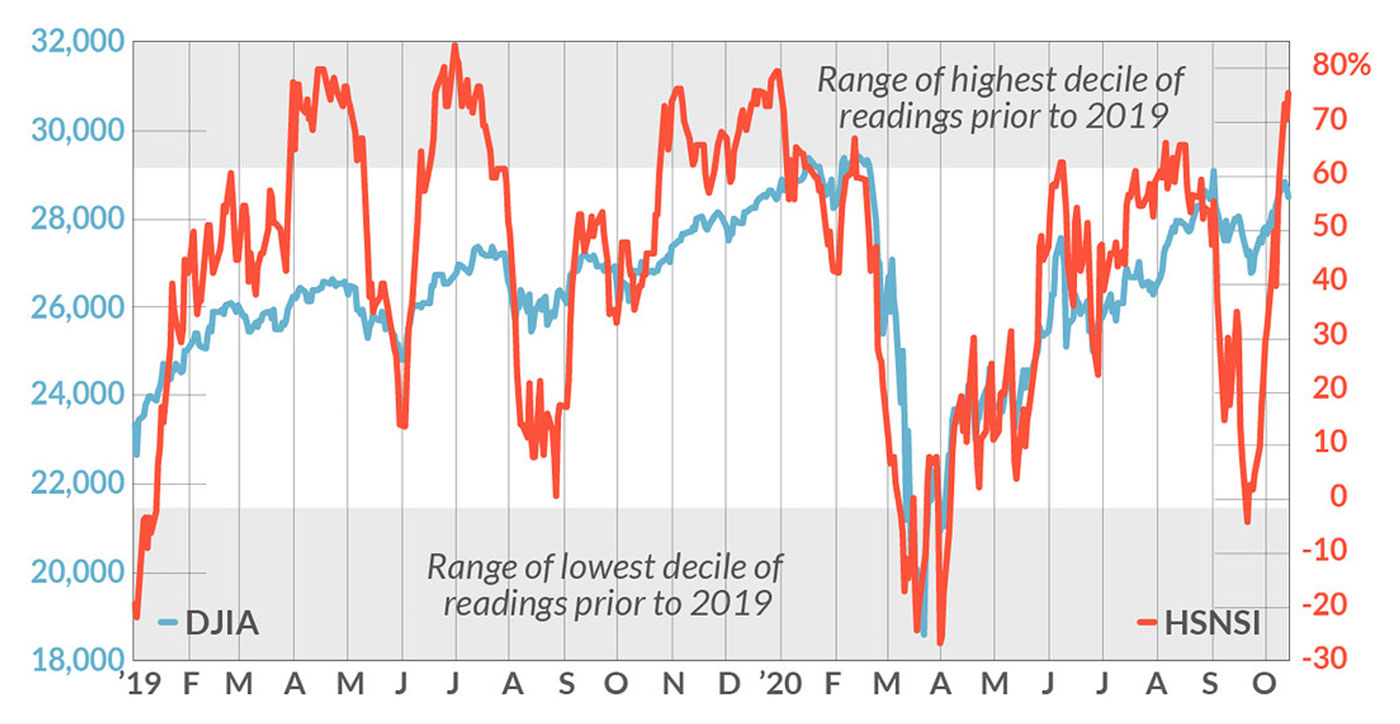

An article by analyst Mark Hulbert at MarketWatch last week said that market timers are “more bullish than at almost any other time since such data began being collected in 2000.”

According to Hulbert, this contrarian signal has usually led to struggles for the stock market “in the wake of bullishness this extreme.”

He adds,

“To put the timers’ current exuberance in perspective, consider the Hulbert Stock Newsletter Sentiment Index (HSNSI), which reflects their average recommended equity exposure. Since 2000, 99% of the HSNSI’s daily readings have been lower than where it stands today. … The extent and duration of market weakness in coming days depends, according to contrarian analysis, on how quickly the market timers retreat to the bearish camp.”

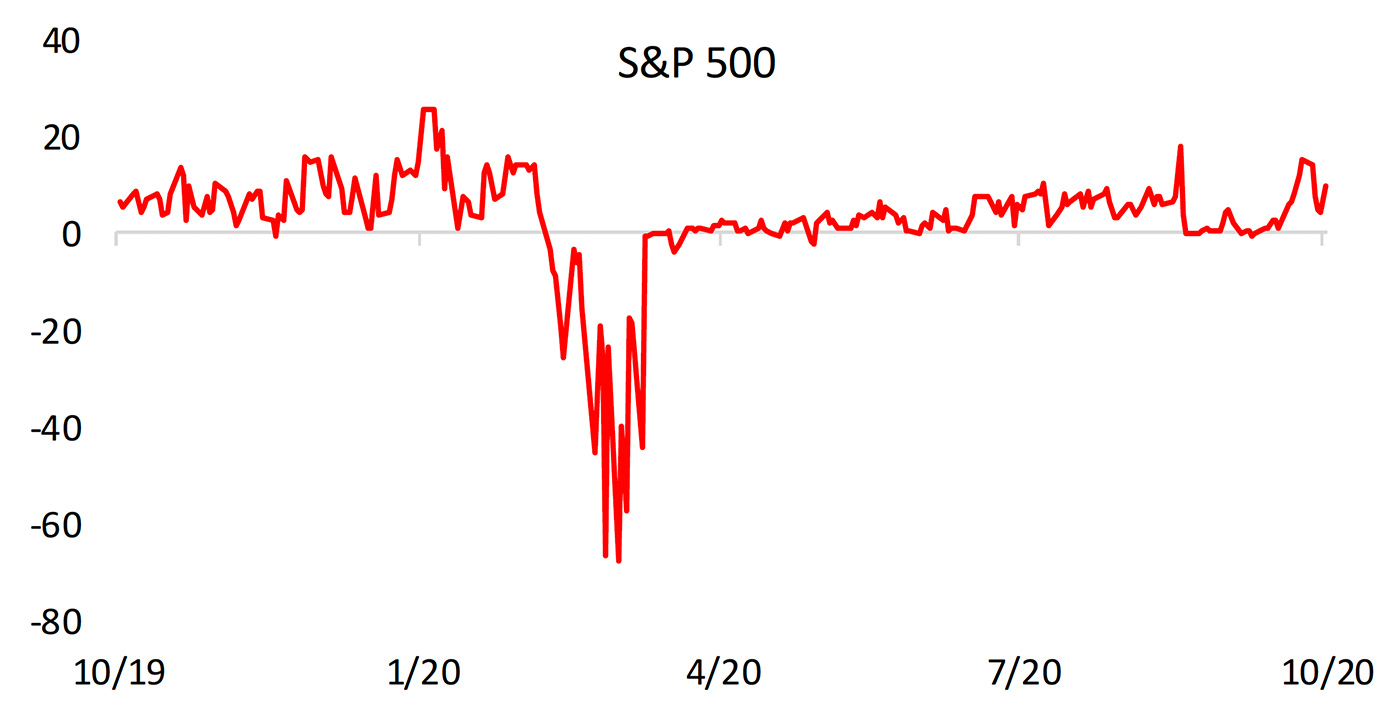

FIGURE 1: AVERAGE MARKET EXPOSURE RECOMMENDATIONS AMONG

SHORT-TERM MARKET TIMERS

Note: As measured by the Hulbert Stock Newsletter Sentiment Index (HSNSI)

Sources: MarketWatch, HulbertRatings.com

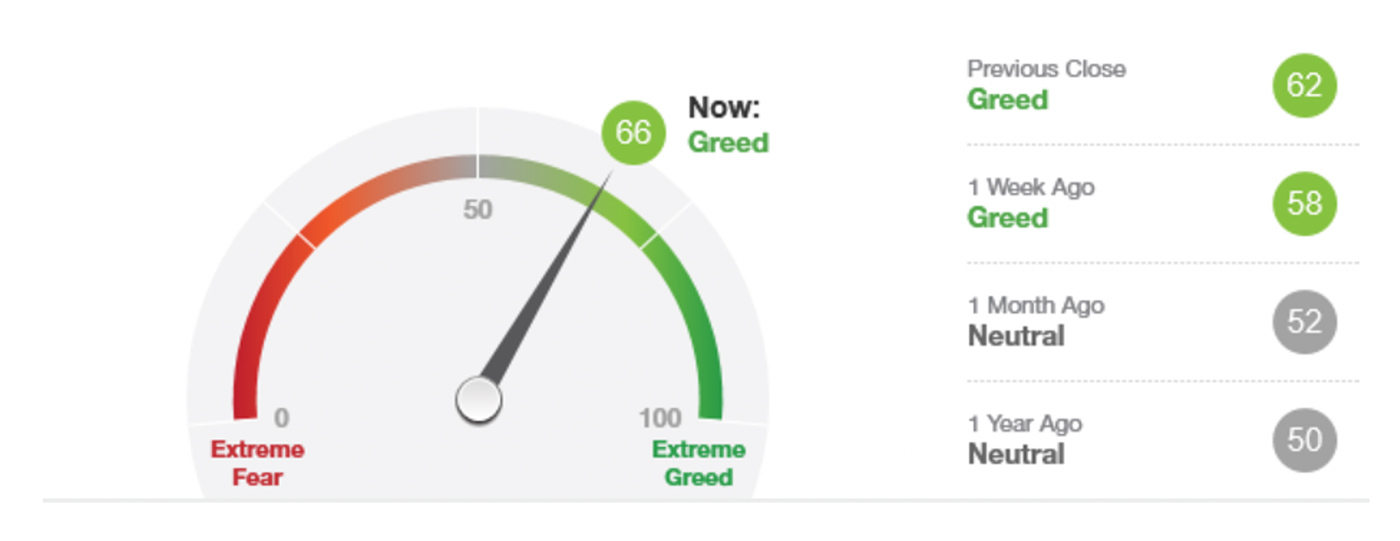

Another measure of market sentiment, the “Fear & Greed Index” from CNN Business, shows that while its index has moved up to a moderate “Greed” reading, it is still not at extremes. This measure is based on seven quantitative factors: put and call options, junk bond demand, market momentum, safe-haven demand, stock price breadth, market volatility, and stock market strength (52-week highs versus lows).

Source: CNN Business, data as of 10/19/2020

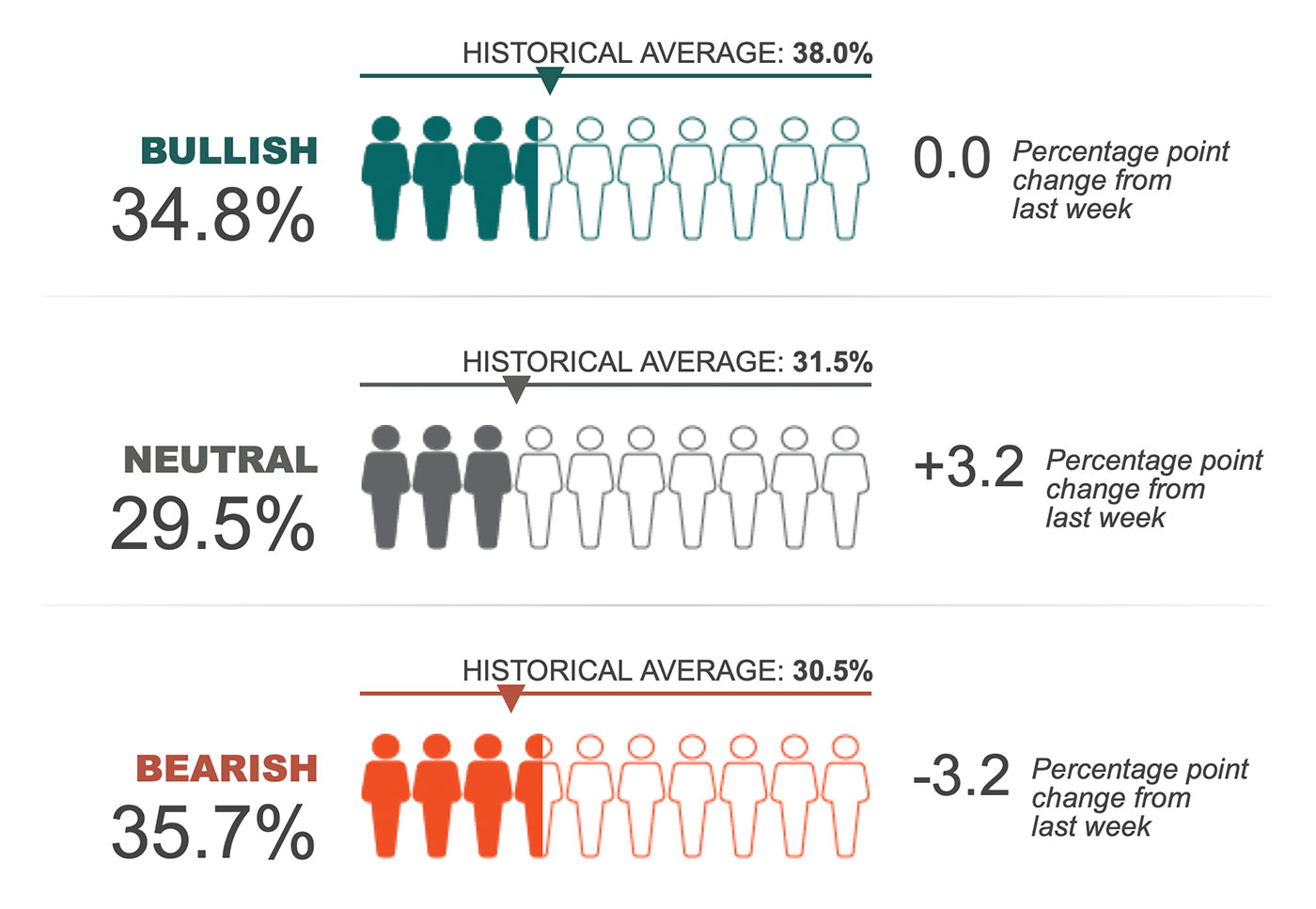

Sentiment results among individual investors are quite different, according to the American Association of Individual Investors (AAII).

While “investors describing their short-term outlook as ‘bearish’ is at an eight-month low,” bullish sentiment remains below its historical average of 38.0% and bearish sentiment “is above its historical average of 30.5% for the 34th consecutive week.”

AAII reports,

“Optimism continues to be below average while pessimism continues to be above average. This differential reflects ongoing concerns about the coronavirus pandemic, the economy, and the upcoming election. Other factors influencing AAII members’ sentiment include valuations and interest rates.”

Source: AAII, data as of 10/14/2020

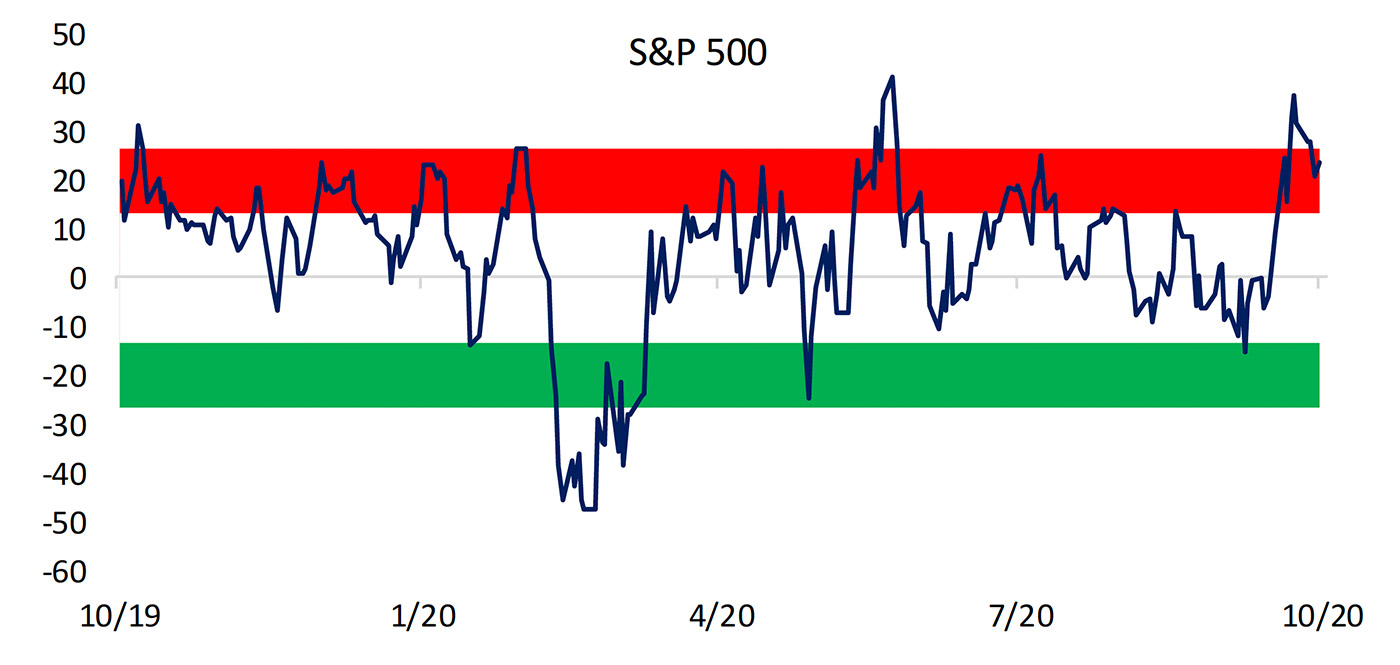

Bespoke Investment Group closely follows overbought/oversold conditions. At the end of last week, they noted,

Source: Bespoke Investment Group

Despite the short-term overbought conditions, Bespoke reports, “We like to see the list of new 52-week highs expanding and that’s starting to happen for sectors like Consumer Discretionary, Industrials, Materials, and the broader S&P 500.”

Source: Bespoke Investment Group

Despite some of these indicators suggesting the potential for a short-term pullback, Tony Dwyer of Canaccord Genuity has maintained a largely bullish outlook, saying in a client note recently,

“The market has rallied back from the September swoon, we are rapidly approaching a very uncertain election, a fiscal package agreement appears unlikely until after the election, the Covid-19 second wave fear is upon us, and we are just in the beginning of the Q3/20 EPS reporting season. Frankly, we have dealt with most of these issues since the early summer and yet the NYSE Cumulative Advance/Decline Line has consistently made new record highs. … [The Fed’s backstop] suggests periods like the ‘September swoon’ should be used to add exposure.”