Is artificial intelligence the future of financial planning?

Is artificial intelligence the future of financial planning?

Industries across the spectrum are now finding ways to leverage artificial intelligence to better serve their customers—the financial-planning industry is no exception.

Artificial intelligence (AI) has garnered much the same reaction in the financial-services industry that robo-advisors generated several years ago.

“Oh my gosh, it’s going to disrupt the industry!’” says Doug Fritz, CEO and founder of F2 Strategy, a technology and consulting firm based in Santa Cruz, California. However, while robo-advisors have changed the industry to a certain extent, they have not materially impacted how clients work with their financial advisors.

“AI is going down the same path. People say, ‘Robots are going to take over!’ But that’s just more noise and it distracts people from what they really should be focused on,” Fritz says.

Custodial companies and fintechs are now developing AI and machine-learning tools that advisors can use to more accurately predict when and how clients may need certain advice, freeing up advisors to do what they do best—help clients develop the right plan to meet their lifetime financial goals.

The key to using AI and machine learning, the natural-language processing part of artificial intelligence, is to have high-quality data that is readily available and trusted by the advisor and other stakeholders, Fritz says. Without a centralized source of quality data, most of these tools don’t work, he says. But that takes the integration of information from the custodian, the CRM platform, and other platforms that advisors use in their practices.

The key to using AI and machine learning, the natural-language processing part of artificial intelligence, is to have high-quality data that is readily available and trusted by the advisor and other stakeholders, Fritz says. Without a centralized source of quality data, most of these tools don’t work, he says. But that takes the integration of information from the custodian, the CRM platform, and other platforms that advisors use in their practices.

“There are some custodians that seem excited and energized to help advisors with these types of tools and capabilities,” Fritz says. “I’m impressed with Schwab and Fidelity wanting to break down walls by working to have the right type of architecture and mindset, and to some degree TD Ameritrade.”

The goal is for advisory firms to have their own set of data, emancipated from their technology and custodian partners, in which they can bring together client profile data, account holdings, price history of transactions, planning data, and compliance data, he says.

“Having this all in one place linked together would allow these firms to properly leverage the power of AI and machine-learning tools,” Fritz says.

Pershing is developing algorithms to make sense of the large amount of data across its platform for a wide range of institutions and retail-oriented clients, says Greg O’Gara, a senior research analyst for Aite Group’s Wealth Management practice. The goal is to move from a reactionary business intelligence model for advisors to a more proactive engagement model.

“Custodians are implementing business intelligence analytics for their advisor clients by looking at advisor and investor actions across the platform to determine which advisory firms are the most profitable and why,” O’Gara says. “They can then add value through practice management solutions and digital alerts to advisors who are suboptimal performers.”

The custodians are correlating different variables within RIA and other practice models, benchmarking what advisors are doing within certain asset groups, he says. They are also analyzing client demographics and geographies—a wide array of data points—trying to correlate what makes a successful advisor.

“They are then presenting that information to advisors, perhaps in the same AUM grouping, who are not achieving optimal profitability and probably not providing the most compelling client solutions,” O’Gara says.

Vendors are also integrating client information from custodians and other vendors that advisors connect through APIs (application programming interfaces), he says. For example, the Salesforce CRM platform typically holds robust client data for advisors that can enhance the client-advisor dialogue in a financial-planning conversation.

“The goal is to apply sophisticated algorithms to all of these integrated data sets, to provide advisors with suggestions on how to improve their practice,” O’Gara says. “It will also provide suggestions to advisors on what a client’s next action might be, based on client behavior.”

Currently, voice recognition technology exists in Alexa-type applications, where a client can get answers to questions such as “What is my account balance?” However, adoption is somewhat mitigated by the level of comfort with a given technology. “I don’t think we’re quite there yet,” O’Gara says.

There are also regulatory concerns. Advisor-client communications have to meet compliance standards, and firms need to get more comfortable with digital-channel adoption, though this transformation is starting to happen, he says.

“AI will ultimately help advisors move from reactive actions for their clients to predictive actions, where an advisor may be able to prevent a client from leaving,” O’Gara says. “Additionally, bringing in data aggregation tools, and looking at actions that clients are taking outside of their primary provider, will help advisors to deliver better advice.”

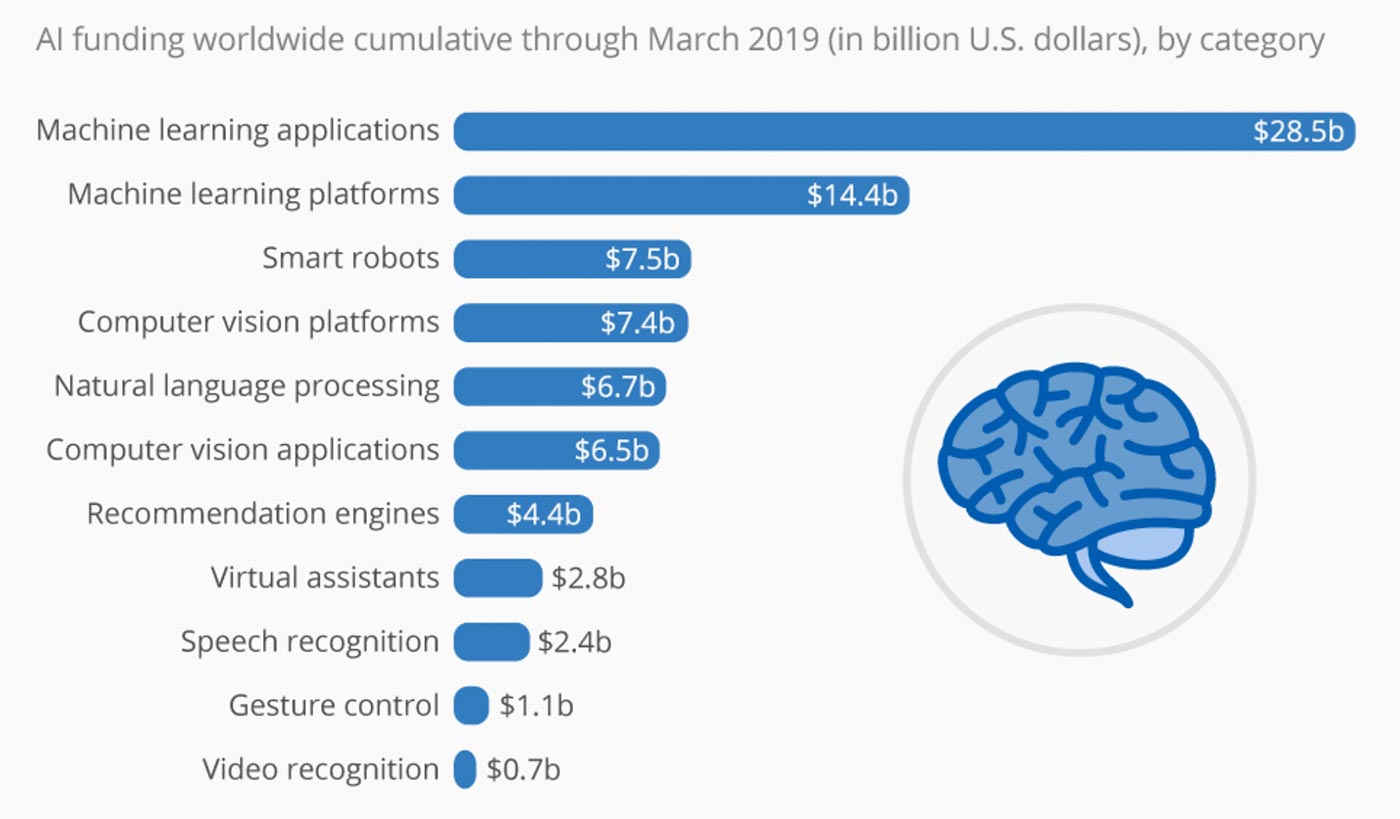

Sources: Venture Scanner, Statista estimates

Wealth Wizards offers Turo for Advisers, a white-label automated advice platform for financial planners that incorporates both machine learning and AI, says Simon Binney, business development director of the UK-based fintech. Turo has machine-learning capability to discern a planning firm’s particular advice policy and philosophy after examples of client cases are entered into the platform. The solution then uses AI to learn from past cases and makes recommendations for future advice based on algorithmic patterns and outcomes.

Turo does the “heavy lifting” of fact-based data collation, automated quotation feeds, solution mapping, and suitability report generation and leaves the advisor free to focus on customer-facing and relationship-building tasks, Binney says. “We are now able to use our tech to look at the advice our advisor clients are already giving and use this to tailor our tech so that it gives advice that’s relevant and specific to their brand,” he says.

Good advice also needs to be highly ethical and delivered by financial planners with the right qualifications and professional standards, Binney says. Wealth Wizards is mapping these standards into its technology to ensure that these key qualities “are embedded in every piece of advice that is given.”

The digitization of financial services will introduce a better, more comprehensive assessment of customer needs. It will do this holistically via “fintegration,” where multiple solution providers join together to combine solutions to better meet clients’ needs, Binney says. Solutions will need to be fast, highly competitive, able to provide advanced valuation of customers, and able to anticipate their ongoing needs.

“Imagine you’re talking to an advisor who is being prompted with questions on screen,” he says. “The AI listens to your answers and populates a fact find, together with ‘sentiment analysis’ to work out your attitude toward risk.”

AI will also be integrated into the advice itself, Binney says. Financial planners can “teach” it how to advise by giving it previous advice cases that it can analyze. “In the future, using AI, we can make financial advice cheaper, quicker, safer, and more consistent, allowing and facilitating access for more people,” he says.

Redtail Technology in Sacramento, California, now has AI capabilities on its platform to better predict and estimate client needs, create better outcomes, and “discover important connections that enable all parties to make better financial decisions,” says Brian McLaughlin, CEO.

The solution uses machine learning as a launching point to build additional value by clarifying financial planners’ workflows so they can make better decisions, McLaughlin says.

“This is a starting point of AI for financial planners,” he says. “It will continue to evolve, but we need to provide a baseline to get people comfortable with the computer learning on their data.”

Redtail’s solution can help financial planners have better conversations by analyzing the histories of their emails, text messages, advisor notes, and other threads of communication they have had with clients and prospects, McLaughlin says.

“Say a client has mentioned their child will be going to a certain college, but the advisor may have forgotten or overlooked that,” he says. “Our solution presents statements like these as well as sentiments in a more focused way, so the planner can respond more quickly and have more effective goal-based planning conversations with the client.”

Redtail is also interested in looking at how AI affects the integration of planning tools, synchronizing relationships with goal-based and cash-based solutions. “To me, the really interesting evolution of how we use AI is not so much for automated client account maintenance, but for automated goal-based planning,” McLaughlin says. “That will be really cool down the road.”

Robert Kirk, founder and CEO of artificial intelligence-driven forecasting firm InterGen Data Inc. in Dallas, has deployed the first stage of the fintech’s machine-learning platform. His firm’s proprietary algorithms will enable advisor firms “to predict when your customers’ most important life events might occur, what they will be, and how much of a financial impact that they could represent.”

Robert Kirk, founder and CEO of artificial intelligence-driven forecasting firm InterGen Data Inc. in Dallas, has deployed the first stage of the fintech’s machine-learning platform. His firm’s proprietary algorithms will enable advisor firms “to predict when your customers’ most important life events might occur, what they will be, and how much of a financial impact that they could represent.”

The solution can correlate historical data from government sources such as the Centers for Disease Control and the Bureau of Labor Statistics, as well as private data sources like Realtor.com and Bloomberg. Then, based on specific demographic, geographic, employment, and other information, the solution can predict when people are likely to get married or divorced, buy a home, have children and pay for their college, as well as whether they’re more or less likely to get a critical illness such as cancer, among other things.

“We then forecast the costs of all of that, add in inflationary estimates and then present that to the user in a simple-to-read ‘cash flow forecasted model,’” Kirk says. “Now, we’re beginning on stage two of our machine-learning platform—analyzing actual client results versus our predicted likely costs and refining the accuracy of our predictive models.”

There are “only five to six companies in the world currently doing true AI—everyone else is doing machine learning to find groupings or associations,” he says.

“True AI, to me, means that a computer would act like a human,” Kirk says. “If a robot was dropped into the Himalayas, would it be able to understand the context of what is going on, react like a human, and figure out what to do next to achieve a goal?”

In terms of financial planning, true AI would be if a computer were able to take a phone call from a client and understand not only how they are and where they are in their financial journey, but also figure out how to relate to them emotionally and then figure out what the client needs to do next, he says.

“With true AI, computers would be able to act like a human, but today they simply can’t do that,” Kirk says. “In the future, I see the industry becoming AI-driven but advisor-assisted, as in a ‘concierge’—this is very distinct from being advisor-led.”

Most advisors and most broker-dealers want to increase their business by bringing wealth management to the masses, but that entails having advisors who can handle 500 to 1,000 clients, he says. The only way to do that efficiently is by employing AI tools to learn and understand client needs and objectives. The advisor would still play the primary role, in coordination with third-party managers, in guiding clients in the determination of suitable investment products and strategies.

For advisors working with ultra-high-net-worth clients who have complicated investments and estate plans, it could be AI-driven but advisor-led, Kirk says.

“Advisors would still have to understand associations, things like multiple geographies. A U.S. client could own a home in Switzerland and have dual citizenships, or could have companies in multiple jurisdictions,” he says. “As such, their planning needs are vastly more complex than the mass affluent.”

For the mass affluent, Kirk sees the AI-driven-but-advisor-assisted model occurring in three to five years. Computers are able to learn at an exponential rate, says Kirk. As more data becomes available, they will be able to almost instantly process and accurately correlate products and services with individuals’ potential risks, life stages, risk profiles, aspirational goals, life events, and financial plans.

The new models coming onto the scene will also benefit from another development. Firms are currently conducting psychoanalytical studies—using natural-language processing and building personas—to understand how people react both logically and emotionally to life events, and why they do certain things that can impact their financial plans, he says.

“As this occurs, advisors who can integrate the results from those studies with machine-learning tools within their client’s financial journey will have a tremendous upper hand on their competition,” Kirk says. “AI will have an enormous impact on how customers understand themselves and how firms help them achieve financial success.”

***

Says a recent white paper by software and business intelligence firm AnswerRocket, “AI is full of potential for the business person who wants to spend their time thinking strategically and acting on critical insights.” As more companies launch solutions that can leverage the power of machine learning and AI, advisors will have far more available in their toolkits than they ever imagined—helping their clients efficiently develop living and evolving financial plans.