Investing in a ‘news-rich’ environment

Investing in a ‘news-rich’ environment

Rules-based investment management—and a holistic portfolio approach—can help advisors guide clients through market “noise” and volatile investment environments.

Like many other investors, I am always interested in what drives the equity and fixed-income markets on a daily basis.

Some days, it is a total mystery—even though the financial press and investment community never have a shortage of opinions on specific reasons.

Other times, it is crystal clear.

Such was the case in late August. In the words of one observer,

“As our omnipotent central planners descended upon Jackson Hole, Wyoming, this week, markets gyrated between exuberance and despair. After Fed Chair Powell spoke Friday morning, the threat of aggressive, Volcker-esque rate hikes tipped markets into … despair.”

Any number of factors can influence markets each day, week, month, or year, falling under the broad—and often differing—umbrellas of fundamental or technical analysis.

The major categories can include, but are not limited to, broad macroeconomic trends, fiscal and monetary policy, corporate earnings, specific economic data, company news, legislative or administration actions, elections, geopolitical risk, seasonality, sentiment of various market participants, and technical indicators. These technical indicators may include supply and demand, overbought/underbought conditions, trend following versus mean reversion, and technical “levels” of support and resistance.

This is far from an exhaustive list.

The impact of news on investment decision-making

While I am not an investment expert, as a communications specialist, I find the impact of “news” on investment decision-making and investor behavior a meaningful and rich topic.

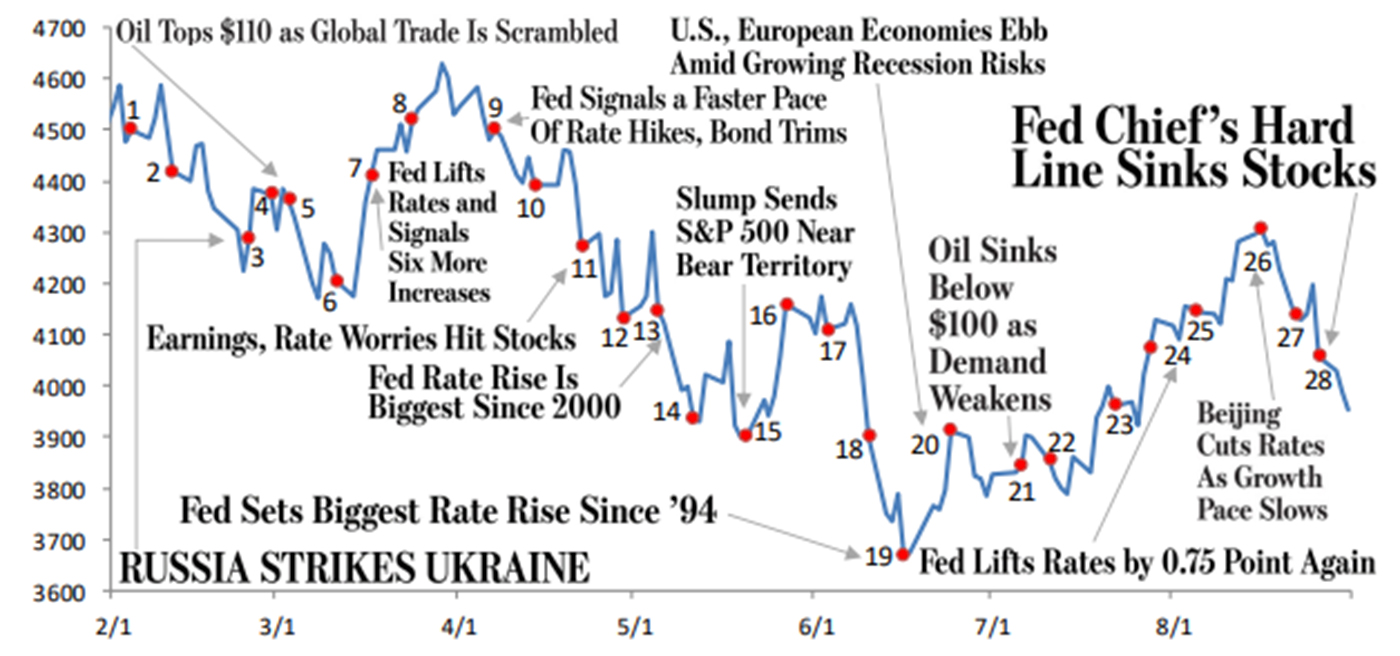

We have had no shortage of important news this year, with major headlines about the war in Ukraine, inflation and energy prices, U.S. midterm elections, political and economic developments in China, Biden administration initiatives, GDP and other economic trends, and Fed rate announcements—which is perhaps the most important news from a market perspective.

Bespoke Investment Group usually issues a visual review of major news headlines in the context of the S&P 500’s performance at the end of each month. August’s recap is an example of what investors have contended with over the past seven months.

S&P 500: FEBRUARY 2022–AUGUST 2022

Source: Bespoke Investment Group

Investopedia notes the following on government news releases (but this applies to any major news story):

“In the short term, these news releases can cause large price swings as traders and investors buy and sell in response to the information. Increased action around these announcements can create short-term trends, while longer-term trends may develop as investors fully grasp and absorb what the impact of the information means for the markets.”

This statement makes two underlying points that bear further discussion:

- “Large price swings” based on news is a phenomenon that has only been enhanced in recent years by quantum improvements in artificial intelligence and sophisticated news-based trading programs employed by large institutions and hedge funds. The average investor has little chance of “competing” on a short-term basis in this environment.

One of our recent articles, “How behavioral finance is delivering alpha,” delves into some of the many ways “data mining” based on behavioral analysis is now impacting the investment industry. The author writes, in part,

“One way to think of professional investing is as a zero-sum game among well-informed investors. If I win, then someone who is as smart and heavily resourced as I am must lose. …

“But there is another way to think about investing. As is often said in professional sports, ‘Take what the defense gives you.’ Rather than going after the best defender on the other side, pick on the weakest link—which isn’t as emotionally satisfying but a successful approach nonetheless. The starting point is the recognition that many diverse groups are driving equity prices. I refer to these as emotional crowds, because new information may provide the trigger but the resulting price is a response to collective emotional decisions.”

2. Developing “longer-term trends” can often be counterintuitive to the immediate face-value impact of any specific piece of news. How often have you seen a “Fed announcement day” trend reverse within 48 hours? Likewise, haven’t you often wondered who decides when “bad news is good news” (and vice versa)? Again, an individual self-directed investor is often left in the dust.

A behavioral finance expert and Wall Street veteran addressed many of these issues in the article “How much attention should you really pay to the news?”

He points out several of the behavioral impacts for both market professionals and individual investors in processing the latest news:

“The fact is that our brains already employ a host of shortcuts to deal with all of the information we are currently exposed to. We use availability bias to give more weight to the most recent information. We use representative bias to overweight anecdotal information. And we use herding to overweight what others are doing. All of these are ways in which the brain arbitrarily reduces the available information to something that can easily support a decision. None of these heuristics make the decision more valid or accurate.”

“It is certainly important for financial professionals—if not all investors—to stay well informed on the latest political, business, economic, and market developments. But it is equally important to recognize that short-term, news-driven investment decisions are generally not a wise course of action—especially for individual investors who may lean toward overreaction.”

Jay Mooreland, MS, CFP, is an expert in behavioral finance and coaching financial advisors. In his book, “The Emotional Investor: How Biases Influence Our Investment Decisions…And What You Can Do About It,” he writes,

“Many investors spend the majority of their time considering factors that are beyond their control. We constantly wonder what the market is going to do, what sectors will outperform, where interest rates are heading, and what policy changes government may make.

“Yet we spend very little time thinking about issues over which we have complete control—things like our investment process and plan. …

Advisors that ‘get’ the behavioral aspect of investing are much more valuable than those who don’t. … And you know what the biggest factor is in the added value? Behavioral coaching.”

The approach of rules-based investment management

We have often written about third-party managers who specialize in quantified, active investment management, with a focus on strategic diversification.

These managers are undoubtedly attuned to market-driving news and data. But, in the words of one manager, “There will always be a bullish, bearish, and neutral way to interpret the news that the financial markets are faced with every day. Which one is correct? Who can say?”

The manager goes on to say that though his firm may have opinions on, say, the economy or the impact of an election, those opinions do not affect its investment decision-making. He continues,

“Instead, we are focused on the data, rule sets, and results that help guide us to being invested on the correct side (long, inverse, cash) of all markets, … viewing the news of the day, week, or month objectively and agnostically. We are not concerned with ‘being right in our view.’ We are concerned with being on the right side of the trend of each of the markets (stock, bond, alternative) in which we participate.”

I think it is reassuring for financial advisors and their investor clients that whether markets are facing a “news-rich” and volatile scenario—or a relatively benign period—they can employ a holistic portfolio approach and strategies that can be responsive to virtually any market environment.

In his book, Mr. Mooreland refers to a quote from Wall Street Journal columnist and author Jason Zweig (influenced by Benjamin Graham) that I think sums things up well: “Investing intelligently is about controlling the controllable.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.