The investing ‘fight of the century’

Ding, Ding, Ding! As the fighters begin dancing around the ring, the tuxedoed announcer reviews their impressive records: “Richard Dennis and his so-called Turtle disciples have been prime examples of momentum investing since the 1980s. Dennis is said to have turned $400 into tens of millions, and some of the Turtles have had incredible success stories of their own. His style might be summarized by the maxim, ‘The trend is your friend.’”

“And what can we say about Larry Connors,” continues the announcer. “The challenger has distinguished himself with a ‘Buy when there is blood in the streets’ trading style, and with several books to his credit over the last 15 years, there is plenty of evidence to support his methods.”

“Let’s get ready to ruuummmbbbllleee!”

These “fighters” have championed their own unique versions of two popular types of active management approaches: price momentum and mean reversion. Yet, despite the apparent contradiction in styles, there are successful fund managers and investors who swear by both approaches. How can that be?

Is there a clear-cut winner when evaluating trend-following versus mean-reversion strategies?

Let’s define both terms. Price momentum can be viewed simply as a period of increasing prices, either on an absolute or relative basis. Absolute momentum evaluates each investment “one fighter at a time.” In contrast, relative momentum weighs how a stock or index has performed in comparison to others. In both cases, momentum can cover a variety of time frames and asset classes, including foreign exchange, bonds, commodities, stock indexes, and individual stocks.

In this article, we’ll focus on absolute mid-term price (AMTP) momentum, using only stocks. In this context, we can define momentum using the most recent 3- to 18-month (i.e., mid-term) change in stock prices. If prices are higher at the end of the period than at the beginning, there is positive momentum. Academic studies confirm that investments in strong performers over this period tend to continue to outperform the market in the following 1 to 12 months.

In contrast, mean reversion is the tendency for equities that have underperformed or outperformed to reverse course. For example, numerous publicly available strategies capitalize on the tendency for “noisy markets” to reverse direction. Noisy markets are those where price, like our fighters, tend to dance around even as they trend in an overall direction. There are several categories of mean reversion—short term and long term, absolute, and relative. This article will discuss absolute, short-term price (ASTP) mean reversion. In ASTP mean reversion, poor performing markets, sectors, or stocks tend to bounce back.

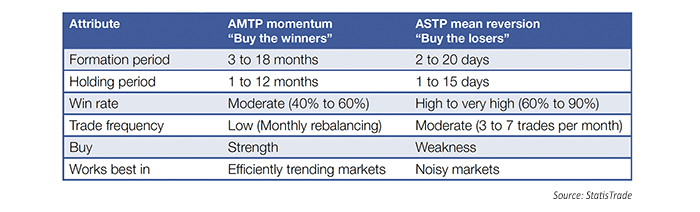

Let’s walk through the “tale of the tape” table to understand typical aspects of both strategies.

Tale of the tape

Absolute, mid-term price momentum strategies buy a selection of stocks that have performed well over a period (the “formation period”)—often the past 3 to 18 months—hold them for a time—typically 1 to 12 months—and then repeat the process. Some versions also short the weak stocks, but our focus is on long-only portfolios.

The reported win rate for momentum strategies varies; shorter formation and holding periods often result in lower win rates. But our experience evaluating client strategies shows AMTP momentum typically averages win rates from 40% to 60%.

Momentum strategies work best in markets that trend efficiently. What is an efficiently trending market? These markets get from point A to point B in a relatively straight line; the straighter the line, the more efficient the market. As you might have guessed, momentum investors in U.S. securities have reaped significant profits during the bull market of the past six years.

“Both momentum and mean-reversion strategies have rewarded savvy investors and money managers in the current bull market.”

In contrast, ASTP mean reversion takes advantage of the noise, or choppiness, apparent in many markets. These strategies buy a selection of stocks that have performed poorly over the formation period, which is typically 2 to 20 days. Because the formation period is relatively short, the market information it relays is also seen as relatively immediate. As a result, securities are held briefly, just until they start to recover, which usually takes from 1 to 15 days. Because bull markets tend to recover when they dip, mean-reversion index traders have also been handsomely rewarded during recent years.

One challenge with mid-term momentum strategies is deciding when to invest new money. Because some versions of these strategies hold positions up to 12 months, should you wait to add new money until you rebalance? Or wait for a pullback? How big of a pullback? For customers who regularly draw from their accounts, similar questions about when to exit positions need answers.

Short-term mean-reversion strategies avoid these issues. Because holding periods are often just a few days, new money can be put to work quickly without having to solve the “when to get in” puzzle. These strategies also work well for investors who take regular draws because of the short holding periods. And there is another advantage: because they trade more frequently, have a high win rate, and usually have a relatively low correlation to AMTP momentum strategies, they can also reduce account drawdowns and smooth investors’ equity curves.

Short-term mean-reversion strategies offer another potential advantage: increased compounding. Because they trade (and win) frequently, these strategies can boost performance. To make this clearer, if you take a single trade in a momentum system and the position returns 5%, there is no compounding. But if you take five mean-reversion trades in the same period, each making 1%, the net result is slightly larger than 5%. While this type of strategy isn’t right for everyone, it can provide a significant benefit to investors who are comfortable with more trades per month.

So who wins our “fight of the century”? The answer, it turns out, are savvy investors and money managers. Why? On closer inspection, these strategies aren’t fighting each other at all; they operate in different time frames and complement one another. Both strategies have rewarded investors in the current bull market with profits and reduced volatility.

Rather than seeing these strategies as competing fighters, a more accurate way to view them might be as two Olympians: a boxer and a wrestler. The competitors possess different skills and battle in somewhat different arenas, but a national Olympic team can certainly see success in both disciplines during the course of any given Olympics—with each adding to the medal count. Similarly, active asset managers might employ both strategies within an umbrella portfolio approach and be successful at fielding “winning teams” in each area that add to the overall portfolio’s success.

Momentum and mean reversion are two popular, and often complementary, trading strategies. Advisors should understand how both can be used to fight for their clients’ investment success.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.