In investing, as in life, it’s all relative

In investing, as in life, it’s all relative

In creating a portfolio, it is important to reflect varying frames of reference. This can be achieved by using diversified asset classes in multiple risk-managed strategies that focus on different time periods.

A couple of years ago, I was at physical therapy for a back ailment. They had me begin on the treadmill. Trudging along, time seemed to drag. Reaching the end of the exercise interval seemed like a distant goal. As I looked around the room in abject boredom, I noticed a group of therapists chatting away with another client. They were animated. The level of chatter increased. They were so engaged!

When the bell rang, indicating that my drudgery had finished, one of the therapists came running over. She exclaimed, “Oh, that was fast. It seems like you just started!”

This experience reminded me of Albert Einstein’s explanation of his theory of relativity: “When you are courting a nice girl an hour seems like a second. When you sit on a red-hot cinder a second seems like an hour. That’s relativity.”

Einstein’s special theory of relativity posits that time slows down depending on your frame of reference. He recounted how time to a person on a moving train moves slower than time for a loved one waiting at the station. Today, countless movies have been based on how aging slows for those on a moving spacecraft relative to those left behind on Earth.

Everything is relative. Recognizing that a person’s frame of reference affects their experiences can help investors understand what’s happening in the financial markets.

For example, when one asks how the stock market is doing, the answer depends on the time period referenced.

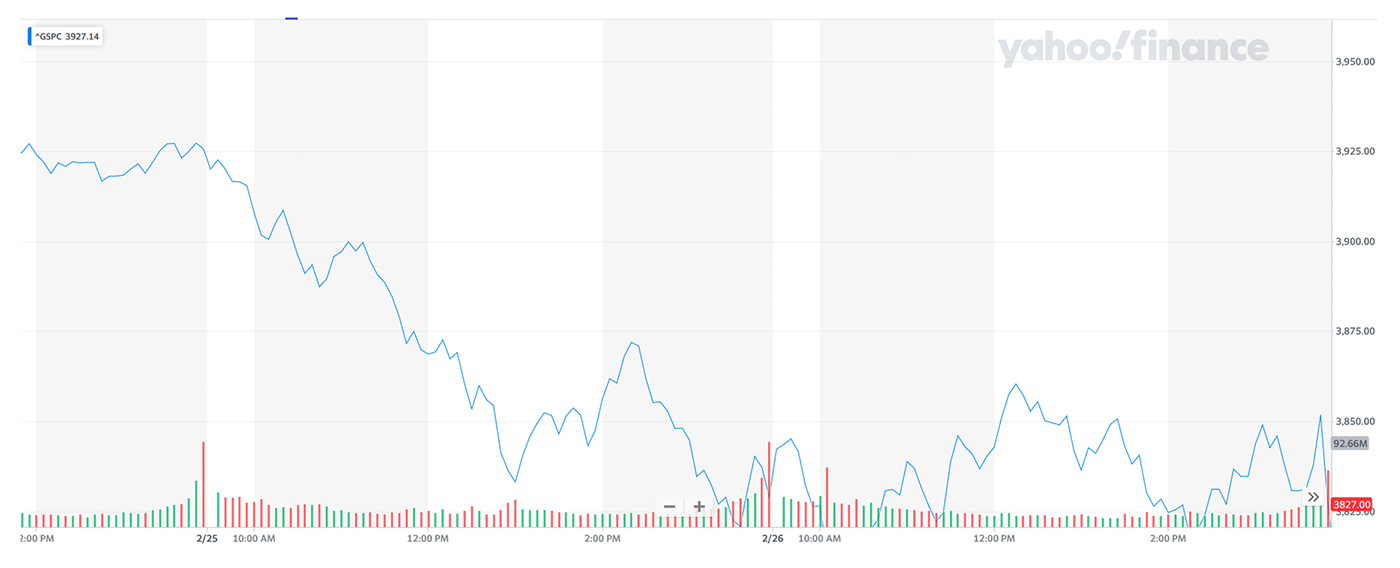

A short-term view of the S&P 500 can look this bleak:

Source: Yahoo Finance

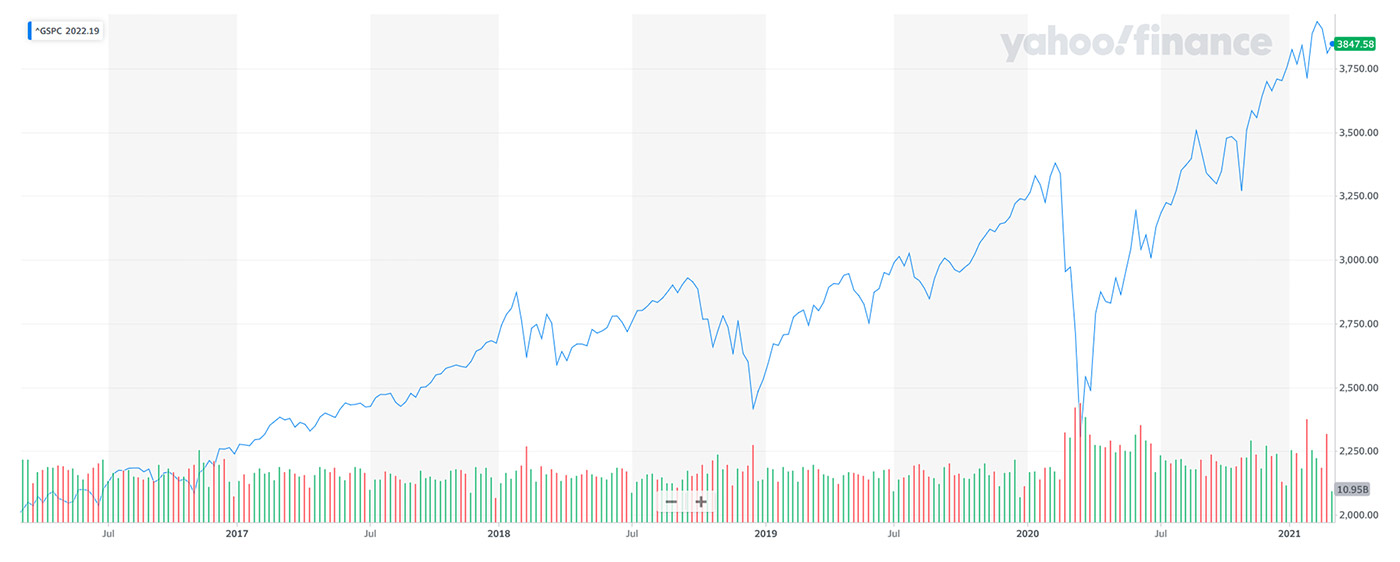

While a longer-term view can convey a different message:

Source: Yahoo Finance

In building strategies, we try to take this into account by measuring what the market is doing over multiple time periods. We do this to obtain a different perspective by changing our frame of reference. In the long run, we believe that this makes a strategy more robust in dealing with the future.

Another method is to create investment strategies designed to perform in different time periods. One strategy may be created to capture short-term moves in stock prices, while another may focus on an intermediate-term period.

In creating a portfolio, it is just as important to reflect multiple frames of reference. We can do this by using multiple investment strategies that each focus on different time periods.

Of course, this is what we do when we use different assets to diversify a portfolio. Diversifying by strategies can accomplish the same thing but with the bonus of adding dynamic risk management to the picture.

When you look at the markets over a longer time, it is also clear that a longer frame of reference reinforces the view that different assets should be included within a core portfolio. In creating such a portfolio, it is important to have assets that have (1) positive returns over the long run and (2) a life of their own. In other words, they don’t always move in sync with one another.

Our All-Terrain, Fusion, and Multi-Strategy Core strategy offerings were formulated around these concepts. Performance is monitored and evaluated over multiple time periods within each. And each uses three asset classes (stocks, bonds, and gold) in the manner necessary to meet our two prerequisites for a core portfolio.

Of course, this is all consistent with a portfolio that is constructed using modern portfolio theory. The difference is that each of these core portfolios also includes dynamic risk-management tools designed to help defend against the ravages of super bear markets (markets that lose 20% or more).

Diversification certainly helps when the market goes through a correction, a sideways market, or a baby bear market (markets that decline less than 20%). But to avoid the worst of a major bear market decline, dynamic risk-management tools like hedging and moving to the safety of defensive holdings are essential.

Evaluating the success of the resulting portfolio requires an understanding of relativity as well. Strategies should be evaluated not alone but rather relative to the performance of the other strategies in the portfolio.

When big events happen in the market, if all of the strategies in a portfolio move in the same direction, the portfolio is not diversified. You may not think this is a problem when the strategies are all moving up together; however, if this is what is happening in a client’s portfolio, I can almost assure you, you will also see them all fall together at some point in the future.

Similarly, portfolios should be evaluated from different points of reference. Make sure to evaluate the portfolio as a whole, not just on a strategy-by-strategy basis. And make it truly relative by asking, “How is it performing relative to the risk being taken?”

Performance shouldn’t be judged in a vacuum or compared to an equity benchmark that is not relevant to the risk your clients are willing to take. Rather, it should be gauged by comparing it to like investments that are unmanaged (a 60/40 fund portfolio, for instance, if a client has a balanced suitability profile) and also to a customized benchmark based on your clients’ initial goals, using a methodology such as that found in our firm’s OnTarget Investment Monitor.

Similarly, portfolios should not be evaluated over a single fixed period. Instead of looking at the results over a single bad week or a short, choppy period, take a step back and see if the portfolio did what you expected it to do during positive periods.

If it participated reasonably (relative to like investments) during these periods and mitigated some of the losses in bad periods, it probably should not be abandoned. This is so even if all of the strategies in the portfolio did not perform equally well.

***

Investment performance, like most experiences in life, is relative. The key to successful investing is being able to answer the question “Relative to what?” Hopefully, this discussion gives us all the same necessary frame of reference to answer that question.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com