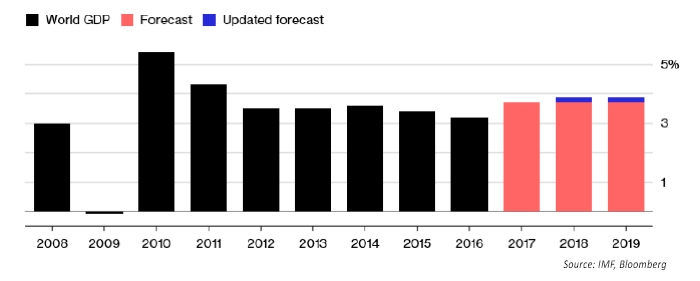

The International Monetary Fund (IMF) recently raised global growth forecasts for most nations around the world, further reinforcing the theme of “synchronized global growth.”

Reuters reported,

“Pointing to growth in the United States and China, the IMF forecast a global growth rate of 3.9 percent for both 2018 and 2019, a 0.2 percentage point increase from its last update in October.

“The U.S. economy has been showing steady but underwhelming annual growth since the last recession in 2007-2009. The IMF now expects it to expand by 2.7 percent in 2018, much higher than the 2.3 percent the fund forecast in October. U.S. growth was projected to slow to 2.5 percent in 2019.”

Bloomberg notes, however, that the IMF “warned policymakers to be on guard for the next recession even as it predicted global growth will accelerate to the fastest pace in seven years as U.S. tax cuts spur businesses to invest.”

IMF Managing Director Christine Lagarde told reporters in Davos last week that the strengthening recovery is the “perfect opportunity now for world leaders to repair their roof,” adding “growth in our view needs to be more inclusive.”

FIGURE 1: STRONGER MOMENTUM FOR GLOBAL GROWTH

The IMF, in the January 2018 update to its “World Economic Outlook,” cites several risk factors to the revised global growth forecast, calling the risks “broadly balanced in the near term, but skewed to the downside over the medium term.”

These risk factors include the following:

- “Rich asset valuations and very compressed term premiums that raise the possibility of a financial market correction, which could dampen growth and confidence.”

- “A faster-than-expected increase in advanced economy core inflation and interest rates as demand accelerates. … One notable threat to growth is a tightening of global financing terms from their current easy settings, either in the near term or later.”

- “If global sentiment remains strong and inflation muted, then financial conditions could remain loose into the medium term, leading to a buildup of financial vulnerabilities in advanced and emerging market economies alike.”

- “Inward-looking policies, geopolitical tensions, and political uncertainty in some countries also pose downside risks. … An increase in trade barriers and regulatory realignments would weigh on global investment and reduce production efficiency, exerting a drag on potential growth. …”

- “Political uncertainty also gives rise to reform implementation risks or the possibility of reoriented policy agendas, including in the context of upcoming elections in several countries (such as Brazil, Colombia, Italy, and Mexico).”

- “Recent extreme weather developments—hurricanes in the Atlantic, drought in sub-Saharan Africa and Australia—point to the risk of recurrent, potent climate events that impose devastating humanitarian costs and economic losses on the affected regions.”

- “The response of U.S. investment to tax policy changes could be more modest than envisaged in the baseline, with attendant repercussions on the strength of external demand for the main U.S. trading partners. … In light of the increased fiscal deficit, which will require fiscal adjustment down the road, and the temporary nature of some provisions, growth is expected to be lower than in previous forecasts for a few years from 2022 onward, offsetting some of the earlier growth gains.”

***

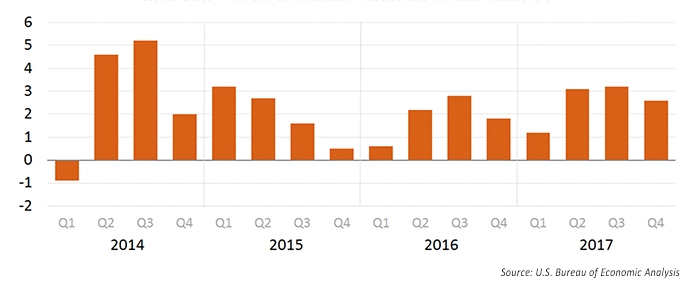

Last Friday (1/26), the Bureau of Economic Analysis released its “advance estimate” of fourth-quarter U.S. GDP growth, with the headline number coming it at 2.6%. This was slightly below consensus of 2.9% and below the growth rate of the second and third quarters, but well above Q4 2016 (2.1%), indicating a continued trend higher.

FIGURE 2: REAL GDP—PERCENT CHANGE FROM PRECEDING QUARTER

Barron’s wrote that the headline number “doesn’t do justice to fourth-quarter GDP where consumer spending rose a very strong 3.8 percent that reflects a 14.2 percent burst in durable spending. Residential investment, which is another consumer-related component, rose at a very impressive 11.6 percent annualized rate.”