How financial advisors talk about risk management

How financial advisors talk about risk management

Risk management becomes especially important during the latter phases of a lengthy equity bull market cycle. Financial advisors can help clients avoid the pitfalls of complacency and recency bias through education and the management of their investment expectations.

When all is said and done, however, there are usually four major objectives that clients are most interested in:

- Growing and protecting their wealth.

- Making sure their health-care needs will be covered for their lifetime.

- Establishing a successful road map to and through retirement.

- Ensuring that their legacy objectives are fulfilled.

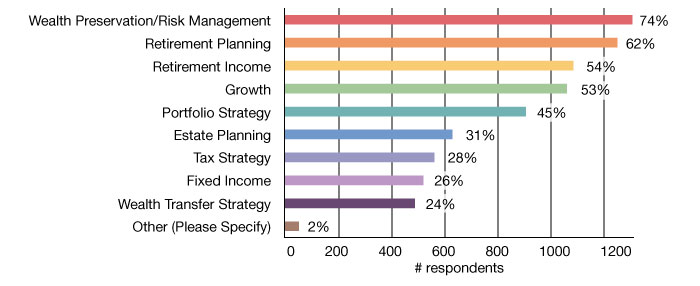

In a March 2017 survey conducted by The IMS Wealth Management Monitor, financial advisors identified their ranking of investment and retirement-planning priorities for clients as shown in Figure 1.

Source: IMS Wealth Management Monitor, March 2017, thinkadvisor.com

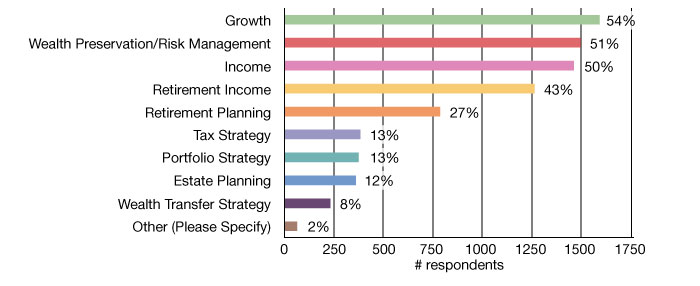

Source: IMS Wealth Management Monitor, March 2017, thinkadvisor.com

As experienced professionals who have witnessed the potentially devastating effects of steep market corrections and prolonged bear markets, the financial advisors interviewed by Proactive Advisor Magazine almost universally cite education around risk-management issues as a key element of their financial and investment-planning process. They address with clients issues such as systematic or cyclical-market risk, sequence-of-returns risk, longevity risk, retirement-date risk, and important behavioral finance concepts such as recency bias (which can lead to complacency and overconfidence).

Risk management becomes especially important during the latter phases of a lengthy equity bull market cycle. A recent blog post at a prominent third-party active investment manager’s website expressed it this way:

- “Economic growth remains healthy, but late-cycle pressures have recently been on the rise, including tighter labor markets, continued Federal Reserve rate hikes, and a flattening yield curve.

- “Corporate tax cuts have boosted US markets and partially offset these late-cycle pressures, but their effects are likely to fade as monetary policy grows tighter.

- “Overall, the global expansion continues, but there’s growing evidence of slowing momentum in both developed and emerging economies.”

“Therefore, as we evaluate third-party managers, I am very focused on how their strategies performed during down market years. For example, how long did it take their strategies to recover from the bear market of 2007 to 2009? I explain to clients that the compounding of returns can work strongly in their favor over time if they are able to mitigate risk in those very volatile market downturns. This type of education is an important component of our overall planning process and the value we can bring to clients.”

“Related to the complexity idea, we have also seen the nature of the markets evolve over the last two decades, going from the relative calm of the great bull market of the 1990s to a highly volatile environment for large parts of this century. When you combine that with unusually low interest rates since the credit crisis, many of the old concepts of traditional portfolio management and approaches to investment allocations have needed to be revisited. Risk management, in my opinion, has taken on a new prominence in helping to build a client’s retirement and investment plan.”

“Most new clients that I see assume that if they have a traditionally diversified portfolio they will be OK. It is amazing to me how quickly people forget what happened during the credit crisis. We learned then that a well-diversified portfolio with a default mix of equity and fixed income across various asset classes could not weather the storm well. From 2007 to 2009 it essentially did not matter how diversified a portfolio was. During the extreme volatility of that period, everything was so closely correlated that most asset classes went down hard. The solution for this, I believe, is portfolio construction for clients that employs active, risk-managed strategies. These strategies come in many forms, but most have an objective to mitigate the degree of drawdowns to a client portfolio during stressed market conditions.”

“I tell clients that it does little good to earn 30% in their portfolio one year if the next year they are going to lose 20%. The math might seem good on an averaged basis, but that is not the way the real math works out. Again, this is all part of our educational process. I am more interested in smoothing out returns and volatility over long periods and avoiding damaging drawdowns as much as possible. That is where the risk-management tools of our managers’ strategies play such an important role. We are not aiming for the highest returns, but for competitive returns, with the goal of maintaining them over time to help clients achieve their retirement-funding goals.”

“I work with a few outside professional money managers who use rules-based strategies that are designed to adapt to changing market conditions. One objective of these strategies is to smooth out some of the volatility of the markets while also achieving competitive returns. I believe the old model of using a passive investing approach may have worked decently up until the late 1990s, but it has not since then. What happens if a client is planning on retiring in 10 years and a massive drop in the market occurs eight years from now? Their account could be 40% to 50% lower if they are using a passive approach—that is really no way to face retirement after working a lifetime to accumulate assets.

“We are more interested in setting up a goals-based investment approach that will attempt to deliver the returns over a long time frame for a client that will help them meet their financial needs. Conceptually, that sort of managed-money approach will not attempt to outperform the market in very good market years, but neither should it see the major drawdowns that have occurred throughout history. I work hard to select professional money managers who can deliver risk-managed investment strategies.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.