Holding investor hands as the market churns

Holding investor hands as the market churns

An advisor-client discussion can reassure investors during market storms. Explaining the value of dynamically risk-managed strategies that mitigate volatility can be an important part of that discussion.

The Beatles sang of it in their first American hit. And nearly 60 years later, on May 3, Lady Gaga released a new single with the same subject matter for the movie “Top Gun: Maverick.”

Hand-holding. We learned to do it innocently as children. Then as teens, it took on a different meaning. Throughout adulthood and into senior life, it still remains meaningful.

Holding another’s hand can provide assurance, assistance, and comfort. Says Toni Coleman, LCSW, a psychotherapist and relationship coach in the Washington, D.C., area, “Research shows that touch, like holding hands, releases oxytocin, a neurotransmitter that gives you that feel-good buzz.”

Barron’s presaged my comments in a story back in January, saying, “With markets plunging in recent sessions and volatility spiking, many financial advisors may find themselves in hand-holding mode as clients fret about their portfolios and the potential for further downdrafts.”

The markets of late have certainly provided ample reasons to need a strong dose of oxytocin. After seven straight weeks of stock market declines through May 20, the S&P 500 flirting with bear market territory, and one of the worst historical starts to a year for equities (and arguably the worst ever for bond market performance), many investors can definitely use “that feel-good buzz” that a talk with their trusted financial advisor can give them during such times.

I strongly advise doing so.

How advisors ‘hold clients’ hands’ through tough times

If you surf around the web and review many advisors’ websites, however, you’ll often see one prominent value proposition: “We’ll help you manage your investment behavior.”

For most advisory services using such a value proposition, they really mean, “We’ll hold your hand when the bear market comes.” Their primary purpose is to support a “buy-and-hope” mode of investing by working to keep their clients invested and to avoid the common investor mistake of selling out at or near market bottoms.

In analyzing this type of hand-holding, a recent article tells us that there are at least seven different ways we can hold each other’s hands. I think numbers four (the firm but non-interlaced grip) and six (one hand gently resting on top) may be applicable here.

In hand-holding technique number four, the article says, “the hand-holder may be tightening their grip in a protective way to offer comfort or reassurance if the other is anxious. …”

I think this is the primary grip used in advisor-investor hand-holding. The advisor is trying to comfort the investor and assure them that they are doing the right thing in waiting out a market decline.

However, if the decline lasts long enough, the hand-holding may change character. With hand-holding technique number six, the article says it doesn’t necessarily mean that you are “doomed,” but you do need to pay attention: “When you put your hand on top of someone else’s and let it rest for a minute while you speak, it may mean that you’re delivering bad news.”

Can we alleviate the need for investor hand-holding?

The significant declines (the 50% to 75% variety) experienced not once, but twice, in the first decade of this century meant different things to different investors. Some were young and had time to start over again. Others were older and saw their dreams of an early retirement substantially delayed or abandoned. Some retired investors were forced to return to the workforce or materially reduce their standard of living.

When I started Flexible Plan Investments in 1981, I did so with the belief that I could create a different type of asset-management service. My market timing would be so accurate that it would alleviate the need for investor hand-holding.

In the ensuing 40-plus years that we have been in business, I learned that no market-timing approach is so consistently precise in its timing that counseling isn’t still needed. As we moved into using trend-following strategies, in search of wealth-preservation methods for different asset classes, we had to settle for trades “close to” bottoms and tops instead of being precisely at them.

Since trend following works in most but not all market environments, I sought other types of strategies. Finally, I realized that only by using multiple types of strategies in a single portfolio could I get close to my goal.

But, alas, perfection is elusive, or more accurately, impossible.

I have to admit to failure. I have not been able to eliminate the need for anxious clients to seek counsel and, yes, hand-holding. Hopefully, our approach has reduced the need.

The value of dynamic risk management in volatile times

When global politics, inflation, economic downturns, bad policies, and Federal Reserve tightening cause markets to become as volatile as they are today, it’s not surprising that investors look for hand-holding. Even financial advisors that work with us need to spend some hand-holding time with their clients. Part of that time is used to explain the value of an asset manager, like Flexible Plan Investments, that employs dynamic risk management.

First, and most importantly, investors use us so that they don’t have to make their own investment decisions. They don’t have to try to understand the conflicting messages of the markets. They don’t have to worry about being right or wrong. We take all the actions for them.

During 2022 so far, we have done just what we were employed to do. While the stock market fell, inflation soared, bonds exhibited volatility as significant as stocks, and the ultimate alternative—cyber coins—crashed, we had our investors in the defensive position appropriate for each strategy.

Our tactical (timing) strategies were all defensively positioned, mostly in money markets, short-term bonds, gold, or inverse funds. Equity strategies that are not tactical were moved to value and other defensive assets.

Still, on any given day, we can appear out of position. We’ve had so many days when the market is up 1% to 3%, only to be followed by negative returns of equal magnitude the next day. Many conflicting news stories are being digested by financial markets day by day and even hour by hour. And there is always a random element caused by the emotion that is a big part of human behavior.

I often write about the difference between baby bear markets and the grizzly bear varieties. The former are short and shallow declines of up to 25%, while the latter are long and drawn out with losses in the range of 50% to 75%. Suitability profiles and asset-class diversification can usually handle the baby bears. On the other hand, the grizzly bears require multiple dynamic strategies employing tactical decision-making.

Believe it or not—despite all the bad news and market volatility—we still are in the baby bear stage.

Strategies, like markets, go through transition periods. Periods as volatile and hostile as those of late hold the potential for the current baby bear to turn into a grizzly bear fairly quickly. Or the markets could settle down. We could work our way out of the present baby bear market. How do we know how we are doing when we are in such a phase?

It can be difficult because trend-following and tactical strategies can do a bit worse than the market indexes in a baby bear market. It can take a movement into grizzly bear territory to justify their approach.

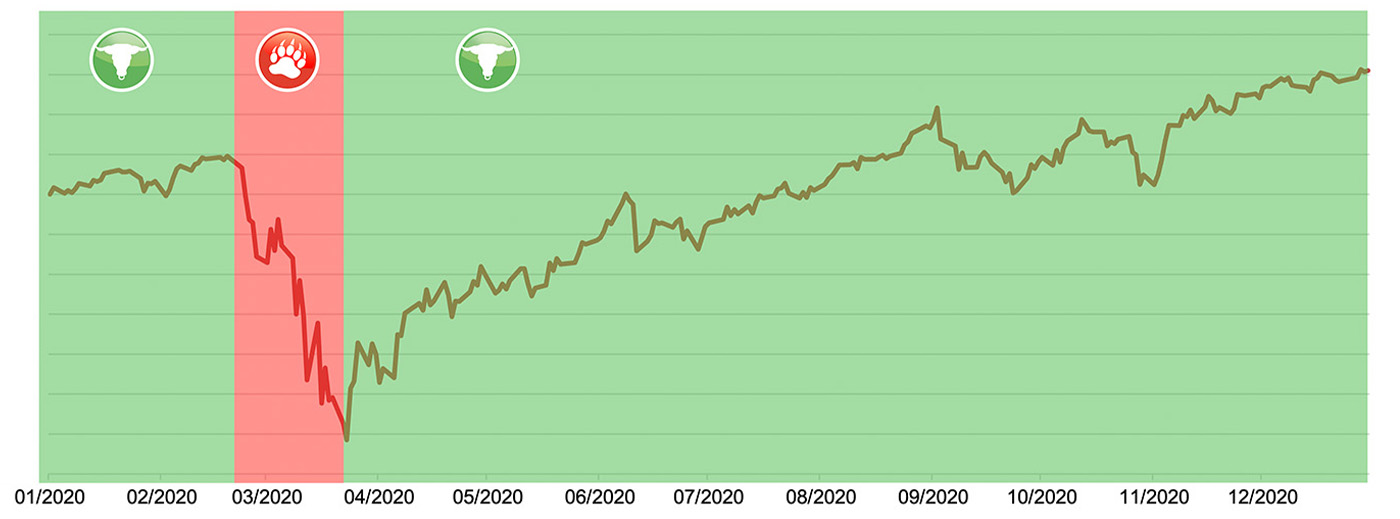

In another article, I pointed out how 2020 was a near-perfect market environment for experiencing how this works. The 2020 bear market had two significant downturns: the baby bear phase and the grizzly bear phase. The first phase was a transition period. Being in a baby bear period, many of our strategies fared about as badly as the indexes. But in the grizzly bear phase, these strategies did much better than the indexes.

S&P 500 COMPLETES ‘FULL MARKET CYCLE’ IN 2020

Source: Flexible Plan Investments Research

The same seems to be happening this time around. Although we have had two distinct down legs in 2022, the overall decline does not yet qualify as anything more than a baby bear market. Yet, many of our firm’s strategies are doing even better than the indexes in 2022. And in the two present bear market plunges, the strategies are once again doing better in what may turn out to be the grizzly bear decline than they did in the earlier baby bear phase. Strategies take time to transition, but they do adjust.

How we can help make hand-holding conversations more valuable

One of the significant added-value benefits we offer to financial advisors is the ability to review this type of information with their clients using the many tools we offer.

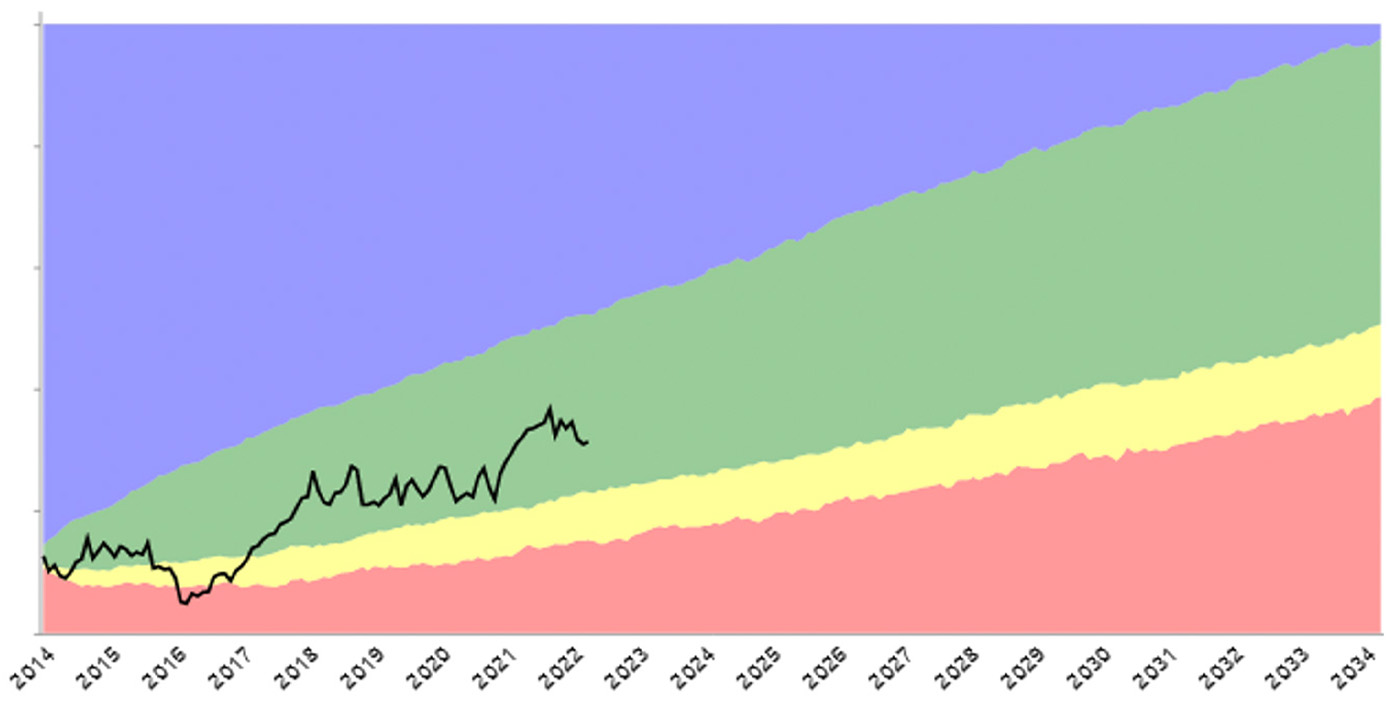

Our OnTarget Benchmark Monitor is one of those tools. It shows advisors and their clients how each client portfolio is doing against third-party Lipper benchmarks derived from actual mutual fund performance. The benchmarks are customized for each client in the same proportional percentage as the strategies in their portfolio.

ONTARGET BENCHMARK MONITOR

Source: Flexible Plan Investments Research

Despite the early warning from Barron’s that advisors will hold their clients’ hands when they want to discuss the current market volatility and its effects on their portfolios, many advisors won’t have to resort to that for most clients.

Still, an advisor-client discussion is never a bad idea, and it can generate the comfort and assurance some investors may need to weather the current financial market storms. Understanding each client’s behavioral and emotional profile around market risk is part of what defines truly successful advisors.

And, when appropriate, they may want to reach out to select clients with a version of the Beatles’ famous words, “We want to hold your haaaand.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com