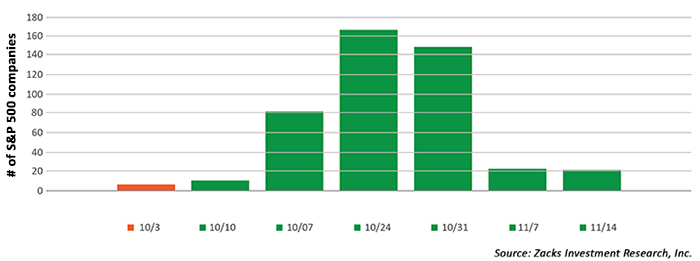

As can be seen in Figure 1, the bulk of Q3 reporting will cluster around the middle and end of October.

What are some of the key highlights for the upcoming earnings season?

1. The market expects to see the sixth consecutive quarter of earnings declines.

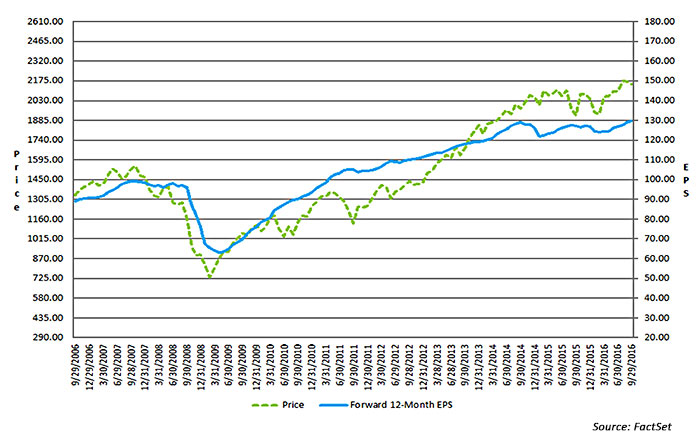

Said The Wall Street Journal recently, “That slump would be the longest since FactSet began tracking the data in 2008. The third quarter was supposed to be when earnings growth returned to U.S. companies. The prolonged contraction has raised questions about how far stocks can rise without corresponding strengthening in corporate earnings.” Figure 2 tracks the S&P 500’s 10-year price trend versus forward-looking EPS growth for companies represented in the index.

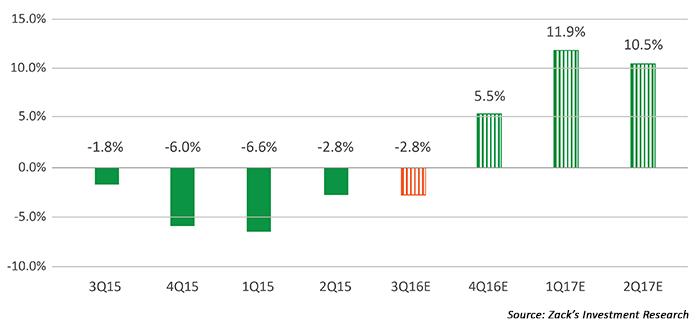

2. The Q3 earnings decline versus the same period in 2015 looks to be in a projected range from -2.1% (FactSet) to -2.8% (Zacks Investment Research).

The Wall Street Journal’s estimates are in the middle of the range at -2.3%. According to FactSet, 80 S&P 500 companies have issued negative EPS guidance for Q3 2016, and 34 S&P 500 companies have issued positive EPS guidance. While the Zacks Investment Research estimate for Q3 is at the lower end of the range, they do see potential for a significant earnings rebound for Q4 2016 and into 2017 (Figure 2).

3. There are at least two points of good news in the Q3 earnings outlook: (1) Downward revisions to earnings estimates have been lower than normally seen. (2) When the Energy sector is excluded, total S&P 500 earnings are projected to be slightly positive year-over-year (+0.3%).

Says FactSet, “In terms of EPS estimate revisions for companies in the S&P 500, analysts have made smaller cuts than average to earnings estimates for Q3 2016. On a per-share basis, estimated earnings for the third quarter have fallen by 2.9% since June 30. This percentage decline is smaller than the trailing 5-year average (-4.3%) and trailing 10-year average (-5.6%) for a quarter. At the sector level, the Energy sector has recorded the largest cuts to earnings estimates to date for the quarter.”

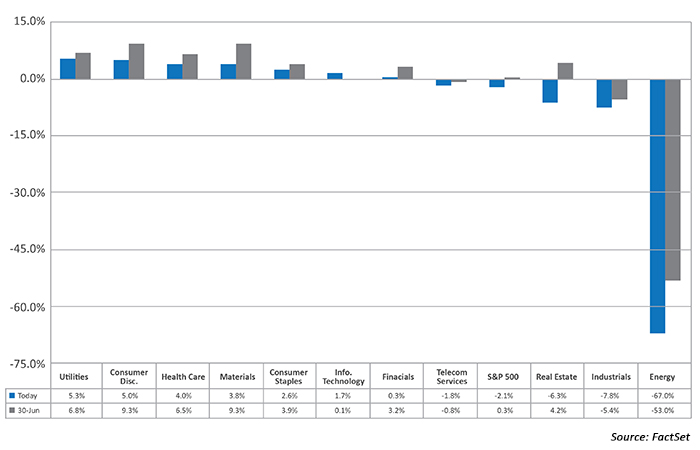

4. Estimates call for the Utilities sector to be near the top of the sectors showing the greatest year-over-year earnings growth in Q3 and the Energy sector to continue to be a large drag on the overall S&P 500 results.

Says FactSet, “Seven sectors are predicted to report year-over-year earnings growth, led by the Utilities, Consumer Discretionary, Health Care, and Materials sectors. Four sectors are projected to report a year-over-year decline in earnings, led by the Energy and Industrials sectors.”

5. Importantly, in somewhat of a reversal of recent trends, the estimated revenue growth rate for Q3 2016 is 2.6% for companies in the S&P 500 Index.

FactSet says, “If the index reports growth in sales for the quarter, it will mark the first time the index has seen year-over-year growth in sales since Q4 2014 (2.0%).”