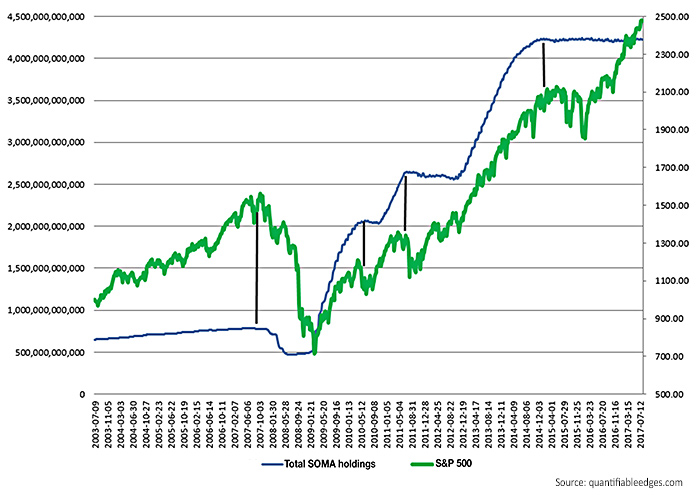

The following chart shows the total holdings of the Fed’s SOMA alongside the S&P 500. At Quantifiable Edges, we have tracked Fed purchases for several years, and it is clear the stock market has consistently reacted positively when the Fed buys securities in the open market and increases the size of its account. When the SOMA account has declined, the market has struggled. The obvious takeaway is “don’t fight the Fed.” As far as intermediate-term indicators go, this has been as good as anything over the last 14 years.

FIGURE 1: TOTAL FED SOMA HOLDINGS VS. SPX

When the QE3 purchase program ended in late October 2014, the market initially struggled. But while the Fed stopped making new quantitative easing (QE) purchases, it has continued to reinvest maturities. In other words, when a bond they owned has matured, they have reinvested the cash they receive into a new bond purchase. This has kept the size of the SOMA inflated and fairly steady. And this reinvestment has helped support the rally over the last few years. In fact, the liquidity these reinvestments provide has seemed to directly impact stock market movement—even over shorter time frames.

Since the beginning of 2015, the SPX has risen 66% of the time and gained a total of 14.04% during the 44 weeks in which SOMA expanded at least 0.01%. During the 91 other weeks, when SOMA either shrank or was basically flat, SPX has only risen 51% of the time and has gained a total of just 6.12%. That’s less than half the gains in over twice the time. At Quantifiable Edges, we find this information very noteworthy. We also anticipate the flows based on the maturity schedules to see when the SOMA is likely to expand or shrink.

The upcoming change in policy that we may see implemented as soon as October or November could have a profound (and negative) impact on stock prices. As has been the case over the last 14 years, it will be important for investors to closely monitor Fed policy. Changes are coming. Understanding the impact of these changes, and being able to monitor market behavior in this evolving environment, will allow investors a much better chance to survive and thrive.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com