Evaluating active management is a multi-faceted exercise

When helping clients develop expectations for long-term investment performance, benchmarks should be a tool, not the ultimate gauge of success.

Most studies of “active managers” focus on the active mutual-fund manager who selects individual stocks for the portfolio rather than following an index approach. But that is just one aspect of the active space. Active management also includes portfolio managers who are actively allocating among asset classes, and adjusting levels of market exposure, in response to market conditions. While the active mutual-fund manager is typically judged successful or not based on a benchmark index, the “active allocator”—for lack of a better term—typically determines the success of the management approach based on a number of objectives.

Most studies of “active managers” focus on the active mutual-fund manager who selects individual stocks for the portfolio rather than following an index approach. But that is just one aspect of the active space. Active management also includes portfolio managers who are actively allocating among asset classes, and adjusting levels of market exposure, in response to market conditions. While the active mutual-fund manager is typically judged successful or not based on a benchmark index, the “active allocator”—for lack of a better term—typically determines the success of the management approach based on a number of objectives.

What makes sense in evaluating active management and its role in client portfolios? Let’s start by looking at the characteristics of a good investment approach.

A long-term approach to investing. There are many ways to make money in the financial markets from long-term passive investing to futures and commodities trading, value and growth investing, sector rotation, speculation, income investing, and more. Every investment approach will go through good times and tough times—times when gains are realized easily and other times when losses seem to come more readily and gains are hard won. Successful investors are inevitably those who understand their investment approach and have the fortitude to stay with it for the long run.

Risk management. Great investors are individuals who understand the need to control risk. Warren Buffett maintains, “Rule number 1 is never lose money. Rule number 2 is never forget rule number 1.” There will always be another opportunity to make money as long as one’s principal has not been lost by taking on too much risk.

When it comes to managing assets for others, managing risk is even more important because losses are the biggest reason people fail to take a long-term approach. Real people rarely buy and hold for the long run. In severe market downturns, as years of savings disappear relatively quickly with no end in sight, the natural inclination is to run for safety. Once burned, individual investors are reluctant to return to the market, missing opportunities to recover their losses.

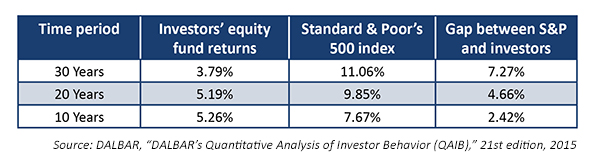

Behavioral finance has no shortage of studies explaining why, from loss aversion to the “gambler’s fallacy” (the belief that recent events will change the randomness of probabilities). DALBAR’s QAIB studies, Mercer Consulting investor return studies, and others have demonstrated for years that investors underperform the funds in which they are invested by selling low and buying high.

EXHIBIT 1: TYPICAL INVESTORS UNDERPERFORM THEIR FUNDS’ BENCHMARKS

Active management can provide a safety net that can make it much easier for investors to take a long-term approach to investing, with investment managers having a wide array of risk-mitigating strategies and tactics in their toolbox.

Achieving consistent returns that help investors stay committed for the long term is more challenging than ever in today’s low-interest-rate environment.

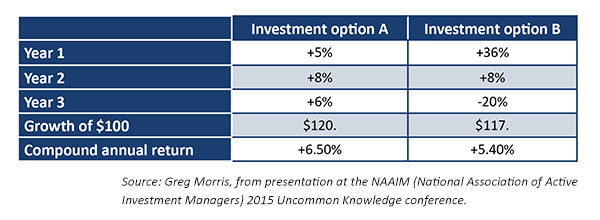

Consistent returns. Outperforming the major stock indexes over a realistic time period, that is, the 10 to 30 years more typical of the average investor’s (especially retirees) time frame, can be surprisingly achievable when risk is managed well. How? Maintain consistent, single-digit returns. (Yes, there will be some years that are outliers).

Big gains in the market can be seductive. But when they are accompanied by big losses (which is typical of a full market cycle), lower-risk, lower-return investment approaches can outperform. Too many investors rely on the arguments promoting “average” annual market returns that are in the high single digits. But these average returns are, in fact, based on 50 to 75 years of market history, a time frame that is meaningless to most investors. (And they do not take into consideration the sequence-of-returns issue facing many investors, nor the tremendous variance from the mean that can occur in any given year.)

Well-known investment manager and author Greg Morris offers a simple illustrative example on how the mathematics of “slow and steady” can win the race versus the roller-coaster nature of passive portfolios following benchmarks such as the S&P 500. Which portfolio would you, or your clients, be more comfortable owning?

EXHIBIT 2: SIMPLE MATH BEHIND SMOOTHER RETURNS VS. “AVERAGE RETURNS”

Historically, many investors (especially retirees) have been able to maintain the buying power of their retirement dollars in the relative safety of government-bond-heavy portfolios, guarding against market volatility. There have even been periods when this approach resulted in better returns than equity indexes over relatively long periods of time. For example, for the 30 years preceding 2011, returns on Treasurys outpaced stocks. Treasurys easily outperformed the major U.S. equity indexes during the 10-year period from 2000 to 2010 and the 20-year period from 1966 to 1986.

![]() See Related Article: 10 reasons investors need active management in retirement

See Related Article: 10 reasons investors need active management in retirement

This option ended abruptly in 2008 with the manipulation of interest rates by the Federal Reserve to spur economic growth. This fall marks the eighth anniversary of the longest and most accommodating spell of monetary policy in the history of the United States, with the federal funds rate at 0.5% and returns on short-term government bonds below 1%. For the foreseeable future, low aggregate bond returns are expected to continue. For most retirees, government-bond-heavy portfolios seem destined to fail to generate adequate returns to fund necessary future income streams.

The need for higher returns has driven many investors to riskier investments. If and when the Fed finally takes serious rate-hiking actions, that risk will accelerate. Says a recent article from Seeking Alpha, “The increased chance of a Fed rate hike creates downside risk at the long end of the yield curves (i.e., Treasury bonds 20+ year) and for corporate bonds. Perhaps most at risk are high-yield bonds with the double whammy of rate rises and on valuations where investor thirst for income has led to yields being potentially over-bid.”

Role of active management. Because active management has the ability to respond to market conditions, it can take advantage of whatever investment class offers the best opportunity in the current market environment. An active manager can be more aggressively positioned in market upturns and leverage the return on the portfolio during those periods. In declining markets, the manager moves to the safety of lower-risk assets, limiting losses. Because no active management approach can perfectly “time” the market, active strategies tend to lag changes in market direction, participating in part of the downturn and missing part of the upturn. But, by providing more consistent returns over time, the strategies have the potential to outperform over the long run.

Good portfolio management is more than beating a benchmark. It is also using knowledge and good judgment to limit risk in the portfolio—to assure that investors don’t lose their principal and to preserve their financial security. Passive investing sees the world in the rear view mirror. There is no guarantee that the past will repeat. Blind optimism that the market will always recover in time makes no sense to the active manager. Bad things happen to good people. The manager’s job is to protect the client as well as invest profitably. Goals-based investing seeks realistic, achievable returns that, when compounded over time, help the investor reach his or her objectives.

![]() See Related Article: Why goals-based investing makes sense

See Related Article: Why goals-based investing makes sense

Beating a benchmark over a limited period of time is not the ultimate gauge of success for a manager or an investment approach. If active management gives the investor a reason to stay invested for the long term, it succeeds. If it keeps the investor from buying high and selling low, it succeeds. If it contributes to a lower stress level for the investor, it succeeds. And, if it produces consistent growth over the long run, it succeeds.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com