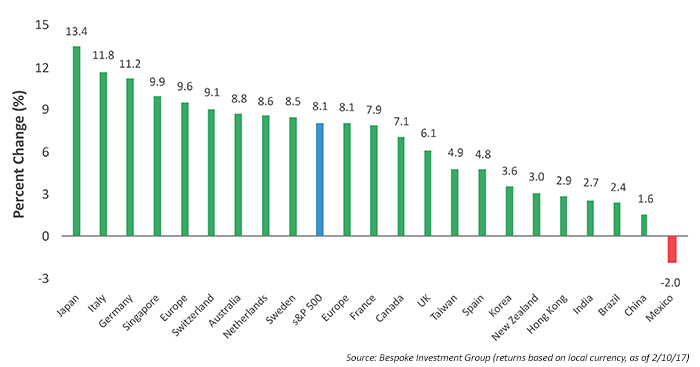

While most of the financial media attention has been on the unstoppable “Trump rally” in the U.S., European companies have been staging an impressive earnings turnaround in recent months, leading to equally healthy market gains.

In the U.S., the most recent leg higher for markets over the past two weeks has come on the back of President Trump’s statements regarding financial regulatory reform, his tax-cut intentions (still to take final form), promised infrastructure spending, and stronger-than-expected corporate earnings. Reuters now projects that Q4 2016 earnings for S&P 500 companies will increase by 8.3%, “the best performance since the third quarter of 2014,” and will handily exceed estimates going into the earnings season.

The Wall Street Journal reported over the weekend that major European companies are also on track to exceed earnings estimates. They said on February 10:

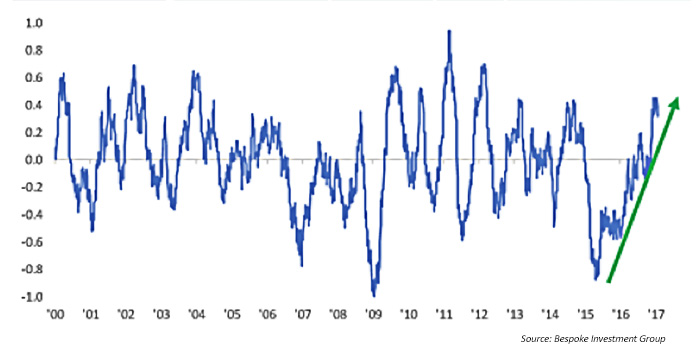

“European companies are posting their first rise in earnings in four years, giving local stocks a boost and promising further gains for markets. … Among companies that have reported results at firms in the blue-chip Euro Stoxx index, about half so far, earnings are up 5.1%. … That is the first annual rise since 2012 and the strongest in five years.”