Walter Todd, president and CIO at Greenwood Capital, told Bloomberg in a recent interview regarding the Q2 2022 earnings season,

“Everybody is so happy that earnings were not as bad as we feared that they’ve forgotten the fact that they are actually going down. … Revisions are actually headed lower … not to a great degree but they are going down. … When you pull out energy then it really looks worse; earnings are actually down on a quarter-over-quarter basis.”

FactSet’s analysis of energy’s Q2 performance

Data and analytics firm FactSet recently provided the following metrics for the Q2 2022 earnings season, with a focus on energy:

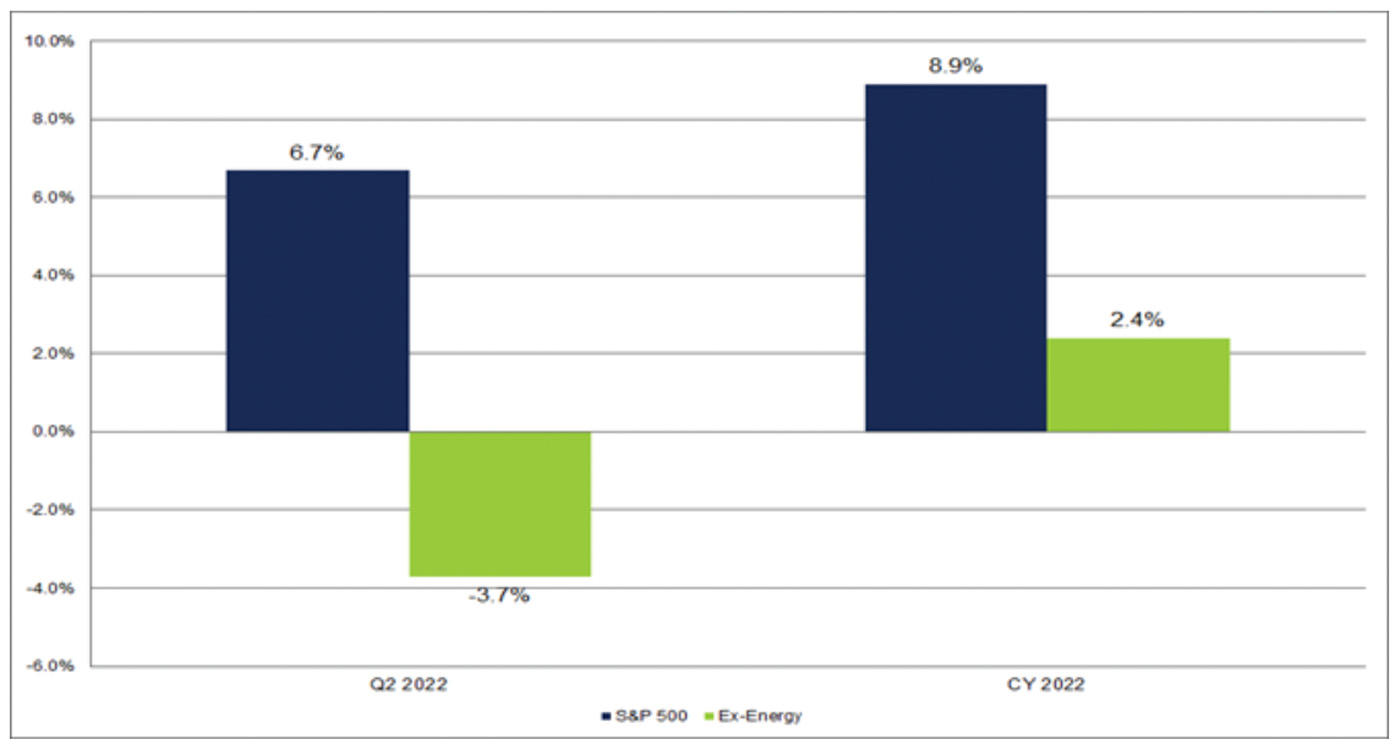

“For Q2 2022, the blended earnings growth rate for the S&P 500 is 6.7%. At the sector level, six sectors are reporting year-over-year growth in earnings for the quarter. However, the Energy sector is reporting the highest earnings growth of all 11 sectors at 299%.

“The Energy sector is also the largest contributor to earnings growth for the S&P 500 for Q2 2022. The sector is reporting an aggregate year-over-year increase in earnings of $47.7 billion, while the S&P 500 overall is reporting an aggregate year-over-year increase in earnings of $31.1 billion. In fact, if the Energy sector is excluded, the S&P 500 would be reporting a year-over-year decline in earnings of 3.7% rather than a year-over-year increase in earnings of 6.7%.”

FIGURE 1: S&P 500 EARNINGS GROWTH—EX-ENERGY

Source: FactSet

FactSet notes that Exxon Mobil and Chevron have led the energy sector in earnings growth:

“Exxon Mobil reported EPS of $4.14 for Q2 2022, compared to EPS of $1.10 for Q2 2021. Chevron reported actual EPS of $5.82 for Q2 2022, compared to EPS of $1.71 for Q2 2021. Combined, these two companies account for about $20.9 billion (44%) of the $47.7 billion year-over-year increase in earnings for the Energy sector.

“The Energy sector is also expected to be the largest contributor to earnings growth for the S&P 500 for all of CY 2022. If this sector is excluded, the estimated earnings growth rate for the index for CY 2022 falls to 2.4% from 8.9%.”

Impact of lower oil prices on the energy sector

FactSet observes, “Higher year-over-year oil prices contributed to the year-over-year improvement in earnings for this sector in the second quarter, as the average price of oil in Q2 2022 ($108.52) was 64% above the average price in Q2 2021 ($66.17).”

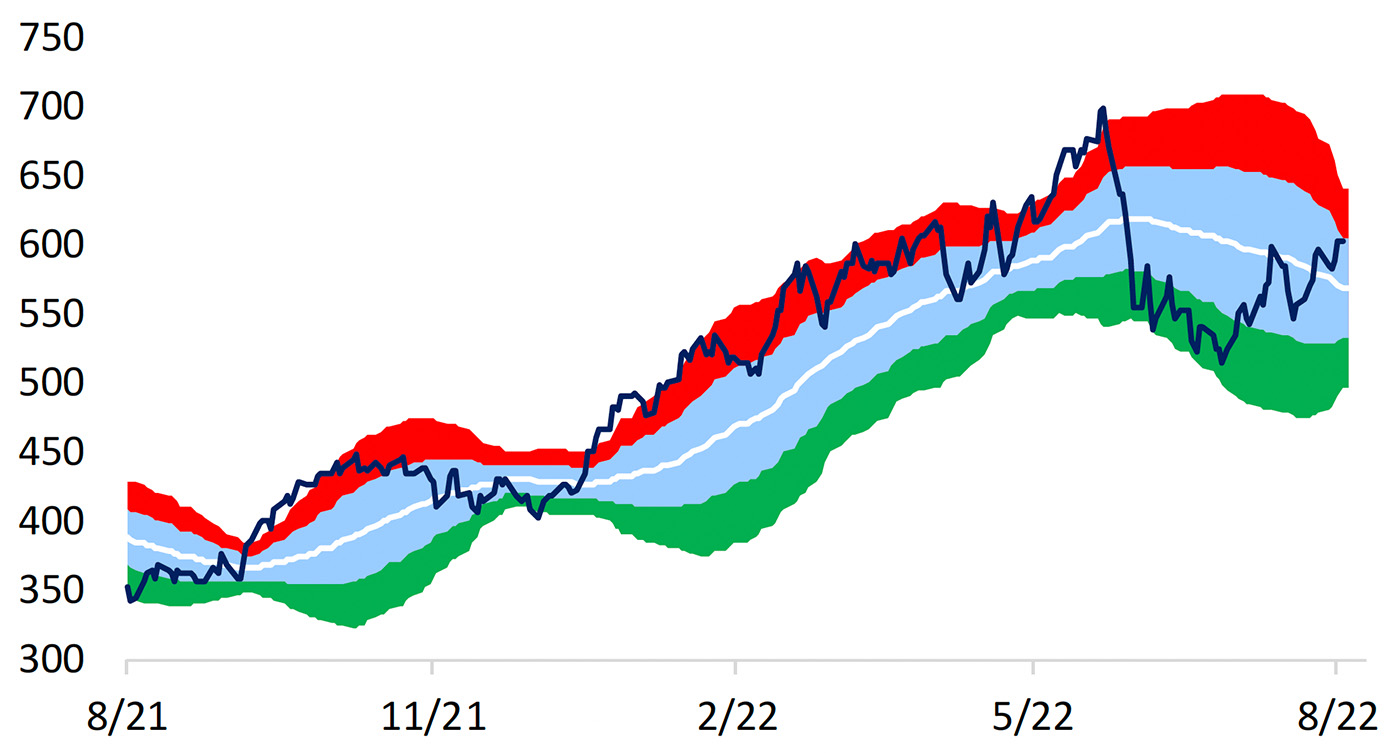

The question is whether further price declines in oil will derail energy stocks, which are off midyear highs but now back in an uptrend.

FIGURE 2: ENERGY SECTOR ETF PRICE TREND

Source: Bespoke Investment Group

Over the weekend, Barron’s presented arguments for why energy stocks can hold up even if oil prices fall further:

“Everything starts with the price of oil, and risks abound. Macquarie Group strategist Vikas Dwivedi notes that a combination of lower consumer demand, continued access to Russian oil despite the war, and the possibility of more production out of Saudi Arabia and the U.S., among other factors, could cause oil to fall below $70 over the next few months.

“But OPEC might be more constrained in production than expected, says Mark Haefele, chief investment officer at UBS Global Wealth Management, while Chinese demand could recover over the rest of the year as rate cuts by the People’s Bank of China begin to boost the economy. At the same time, high coal and natural-gas prices could keep demand for oil strong. ‘We continue to see a tight oil market and retain our positive price outlook,’ he writes.

“Either way, energy stocks should hold up OK. A big part of that is earnings. It’s no coincidence that the sector’s rally coincided with reporting season. Energy stock profits rose nearly 300% during the second quarter, according to Refinitiv, nearly 10 times faster than the next sector, industrials, which grew earnings at a 32% clip. Energy stocks have increased earnings by 400% from 2019, says DataTrek Research’s Nick Colas. ‘Their earnings power is far better than prepandemic, and we believe that can continue,’ he writes.”

New this week: