Dynamic risk management is right for investor portfolios

Dynamic risk management is right for investor portfolios

Dynamic risk management—like most investment solutions—may not always be perfect. But it is responsive, ever changing, and puts more defensive tools in a manager’s toolbox to combat the black swans lurking on the financial landscape.

Since I began investing in the late 1960s, I have always been in the active investing camp. When I started Flexible Plan Investments, Ltd., in 1981, the only investment services we offered were active management (and that is still true today). I thought an investment manager should be “flexible” rather than locked into a rigid buy-and-hold approach.

Active management, or “dynamic risk management” as I now view it, is necessarily tactical. It looks for the right market to be in and realizes that every market is not right all of the time. Dynamic risk management, as Flexible Plan applies it, is responsive to market forces. We don’t try to predict where the market is going. Rather, we respond to the directional clues the market itself provides.

In 1988, I met with a small group of colleagues to create the industry trade association now known as NAAIM, the National Association of Active Investment Managers. Formed in 1989, it soon became apparent that the reason each of us had chosen to be active rather than passive, buy-and-hold managers was different from the common impression.

At that time, if you had asked most members of the press and the majority of those in the financial industry what the goal of active managers or “market timers” was, they would have universally said that it was to “beat the market.” By that, they meant outperforming the market indexes, such as the Dow and S&P 500, every quarter or every year, purely on a return basis.

But as I listened to my colleagues, they were saying the same thing I had long been preaching; they were in it to protect their investment dollars. Active management was not part of the go-go investment philosophy of the 1970s or the tech bubble of the 1990s—it was being undertaken to seek protection from the major market crashes that ravaged investor portfolios every three to seven years.

We did not believe the only weapon against these financial disasters was asset allocation or simple asset-class diversification. We had been in the business too long to believe that this weapon alone could protect our clients’ assets. In every firm’s case, active management was viewed as an essential weapon against these downturns. NAAIM’s first president, John Sosnowy, would often say, “If you see a train bearing down on you, the best defense is to get off the tracks.”

One of NAAIM’s first projects was completed by three of us. We wrote a paper that was published by the prestigious Journal of Portfolio Management demonstrating for the first time that active management firms outperformed the indexes on a risk-adjusted return basis. In other words, they earned more than would be statistically expected for the risk they were taking. The research was later replicated and validated in a different time period by a group of academic researchers.

So, we were active managers for defensive purposes! Why? Because when you minimize your losses in a market correction, you can have more money working for you when the market recovers. Over a full market cycle, you can end up with more money, yet you will have taken less risk.

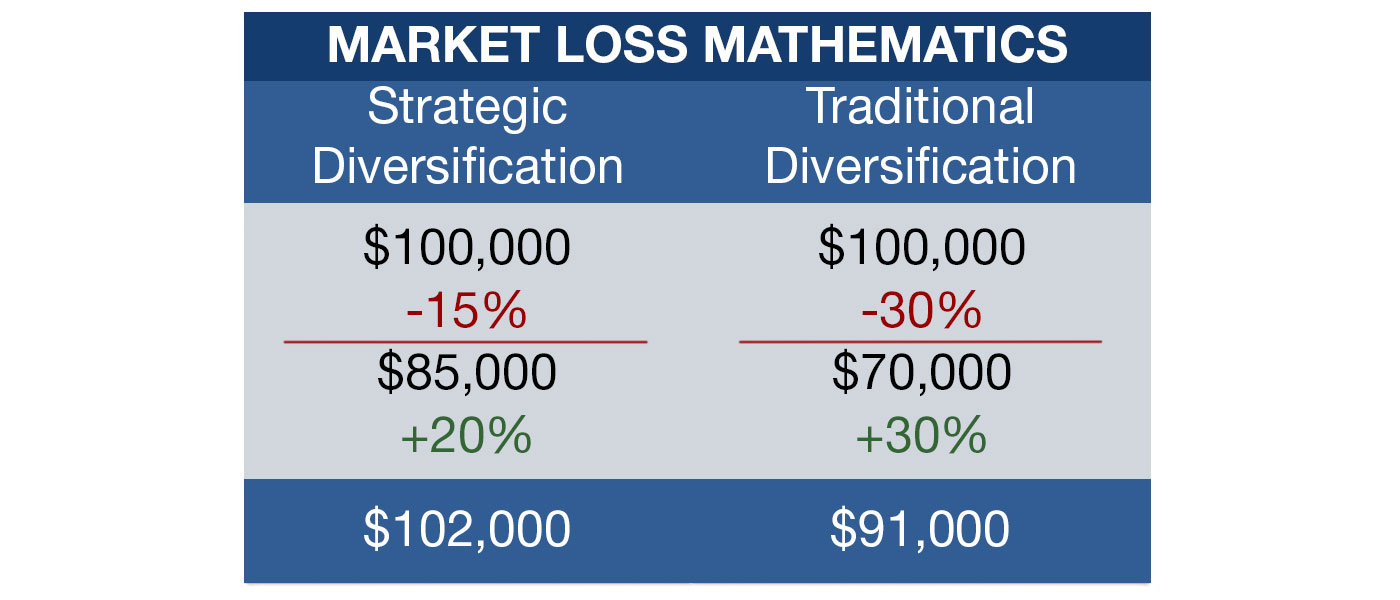

Simple arithmetic demonstrates that it’s more important to be protected from losses on the downside than to try to squeeze out every ounce of upside potential. Let’s examine two hypothetical accounts.

One account is actively managed and the other is made up of a traditional, passive, buy-and-hold allocation model. In the traditional account, the market and the investor lose 30% in one of the bear markets that we have experienced every four to five years over the last century. Then, over the next few years, as often happens, the market gains 30% back.

Source: Flexible Plan Investments

The investor is back to breakeven, right? No. His or her investment is now 9% lower because the 30% gain was earned on the smaller portfolio balance that remained after the loss.

Comparatively, the active, tactical investor avoids half the market losses but gains only two-thirds of the market rally. Who has done better? The active investor has a 2% overall gain versus the passive investor’s 9% loss.

The active investor has 12.1% more at the end of the market’s ups and downs compared to the passive investor. Year after year, cycle after cycle, losses really add up.

Since most active managers are in some way trend followers, they fall victim to a couple of common problems. First, as trend followers, they have to wait for the trend to change. For the trend to change, time must pass.

As a result, they always leave some money on the table when markets are topping out and are late to the game when markets finally start to recover. They seek to make money for their investors by missing most of the downturns and gaining some of the upturns.

Second, sometimes the markets are in neither an uptrend nor a downtrend. They get locked in a sideways waiting pattern while investor forces are marshaling for a new bullish charge or a bearish retreat.

These times are analogous to encountering a curvy stretch of highway. For such driving, Detroit automakers equipped our cars with two pedals: a brake and an accelerator. While a buy-and-hold investor must keep his or her foot on the gas throughout the twists and turns and either win the race to the other side or end up in a ditch, the active manager uses both pedals judiciously to try to make it to the destination as fast as possible while staying in one piece.

Active management can outperform when the market is not trending either upward or downward and investors are trying to get their bearings, but it can also underperform if the ups and downs are just noisy instead of trendy.

When I see a client terminating after such a period, I have to wonder, did they expect a defensive, active manager to keep his foot on the gas and their investments fully deployed during such turmoil? Or, if their investments underperformed for only a quarter or two and they quit, did they invest based on that short of a track record? If not, why did they give up with no more information than that?

You can’t just compare your portfolio’s performance to a market benchmark such as the S&P 500. The S&P 500 is just an unmanaged collection of stocks that tend to decline in market corrections much more than investors can afford to endure. Trying to track it will only cause you to take more risk than you can bear.

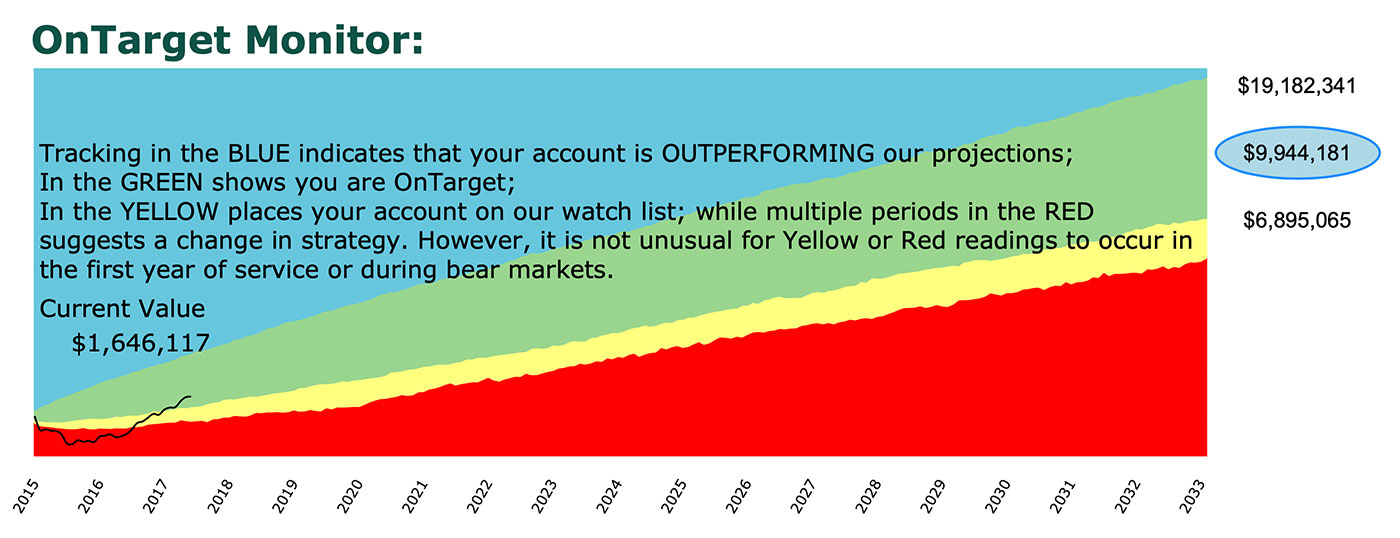

To solve the problem, many years ago we developed a methodology for monitoring strategy performance within the context of probabilities. We developed a way to tell when a strategy was performing in line with our research and when it was broken.

Our OnTarget Investing process passes on the benefits of that methodology to our clients. Our OnTarget Monitor tells them whether their portfolio is behaving in line with our research or diverging. It shows the performance of actual client portfolios on a color-coded map of what their investment performance is expected to look like over time.

Source: Flexible Plan Investments

As long as their portfolio, represented by the black line on the chart, is tracking through the green or the blue background, it is performing as expected. If it is in the yellow, they might want to talk to their financial advisor about a change, or at least complete a new suitability questionnaire. If it is in the red, a change is in order.

Dynamic risk management may not be perfect, but it is the best answer we have in managing investment dollars. It’s responsive, ever changing, and puts more defensive tools in a manager’s toolbox to combat the black swans lurking on the financial landscape. At Flexible Plan Investments, we combine it with diversification of strategies and OnTarget Investment monitoring to keep our clients’ portfolios on track to meeting their financial goals.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com