Does your investing suffer from a lack of dimensionality?

Does your investing suffer from a lack of dimensionality?

The question comes up frequently: “What is active management?”

Many confuse the phrase “active management” with the simple act of running a mutual fund populated with stock picks within the strict guidelines of a prospectus, as opposed to running an index fund, where the manager simply buys and holds the shares making up a particular stock or bond index. While there may be other definitions that have equal merit, I would look at the question in a different way, with active management being a means to adding multiple dimensions to one’s investing to better reach one’s goals.

We are often told to “be a buy-and-hold investor.” Yet, while the phrase “buy-and-hold” is two words linked together by a connector, that single conjunction “and” does not give the phrase dimensionality.

“Buy and hold,” in its purest form, has zero dimensionality—you buy. “Holding” is not a word of action. Following this approach is passive investing in its purest form.

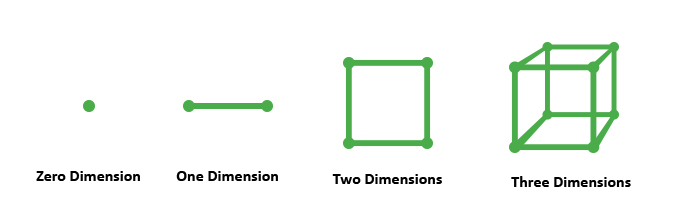

Graphically, zero dimensionality is a dot. It has no length, width, or height—it’s only a dot, just like the period at the end of this sentence. Like the period, it can appear at any place on a page—high or low. Like the return from a buy-and-hold investment, it just is. It’s the return of the underlying index, and that’s all there is. When the S&P is up, like it was in 2013, for example, the dot is higher. When it’s down 55%, like it was in 2007-2008, that’s all she wrote—you get what you see.

Dimensions

Most investors are one-dimensional investors. They buy and … they sell. Both verbs denote activity—buying and selling. That makes most investors active investors.

While passive investors often focus only on the state of the investment itself without dimension (i.e., the factors about the investment that caused them to buy in the first place), active investors view investing in at least a one-dimensional state. No longer just a “dot,” a one-dimensional line consists of at least two dots. They focus on both buy and sell factors.

Still, they differ further. Some buy and then sell after a long time, while others buy and then, within a fairly short time, they sell. One-dimensional investing, then, is like a line. And that line can be long or short.

To graduate to two-dimensional investing, as one would in drawing, where length and height are combined to form a square, one must add another component and look at direction.

A two-dimensional investor, then, considers market direction, or the prevailing direction of prices of the individual securities, in making his or her buy and sell decisions. The market environment can actually alter the length of time that one holds the investment, whether you buy or sell at all, or even whether you reverse the process and sell short to benefit from a current or impending downturn.

Dynamic, risk-managed investing adds a whole new dimension: risk management. Dynamic, risk-managed investing is like a cube. It’s three-dimensional. It has width, length, and height.

Dynamic, risk-managed investing is many steps beyond the simple act of buying and selling. A lot more is going on.

Basic, or one-dimensional active managers have factors that influence when to buy—just like the buy-and-hold investor—but add in a process for determining when to sell. Both the buy and the sell factors are quantitative (or solely numbers-based)—no emotion, no subjectivity, just disciplined, mathematical investing.

Intermediate-level, or two-dimensional active managers add in the directional dimension—price momentum, the potential downside, the price movement of one investment as it relates to another—all coming together to determine the position to take in an investment. Strategies can be employed that are based on following the trend, doing the opposite (mean reversion) or simply following price patterns that have historical persistency in terms of follow-through.

Dynamic, risk-managed investors add in yet another dimension—the risk-management dimension. Its three-dimensional practitioners incorporate advanced investment ingredients: the active reallocation of the position size in any investments to as small as zero, hedging, the use or avoidance of leverage, shifts to cash and bonds determined by volatility, tactical timing measures, and stop-loss signals.

These add a whole new element of dimensionality. The result is a complete investment strategy, a strategy based on dynamic, risk-managed investing that considers not just getting invested, or just buying and selling, or even determining whether the market is moving up or down. Instead, it considers all of these elements plus the tools to actively preserve the investment in case bad luck or a bad strategy results in unintended losses.

Finally, think of each of those dynamic, risk-managed investing three-dimensional cubes, these separate dynamic, risk-managed strategies, as bricks. Combine them and you have the safety of a home. Bringing together actively managed strategies in a single portfolio is designed to deliver a strategically diversified, dynamic, risk-managed portfolio, which, like your home, is intended to weather the fourth dimension—time.

Only active management, not passive holding of investments, is multi-dimensional.

Investors need the solid combination of all of the bricks to form a home, to weather the storms that roar through the financial environment over a full financial cycle—the times when the markets are up and the times when they are down.

Only active management, not passive holding of investments, is multi-dimensional. And today, active management is available through a growing number of money managers and the advisory firms who employ their services.

So whether an investor’s portfolio resembles a studio apartment, a modest three-bedroom home, or a far more spacious property, technological innovations can now provide the same active management advantages previously available only to high-net-worth clients and institutional investors.

Investors have to ask themselves, “What’s better: standing on a dot on the sidewalk out in front of my future home or moving into the multi-dimensional space inside?” The choice is up to you.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com