Early results for the third-quarter earnings season have been generally positive, according to data from FactSet. Last week they issued the following broad metrics covering Q3 earnings through October 19, 2018, in their earnings season update and Earnings Insight report:

- Overview: “For Q3 2018 (with 17% of the companies in the S&P 500 reporting actual results [for the quarter]), more companies are beating estimates than average, but the magnitude of the beats is smaller. In terms of earnings, more companies are reporting actual EPS above estimates (80%) compared to the five-year average. In aggregate, companies are reporting earnings that are 3.9% above the estimates, which is below the five-year average. In terms of sales, more companies (64%) are reporting actual sales beating estimates compared to the five-year average. In aggregate, companies are reporting sales that are 0.5% above estimates, which is below the five-year average.”

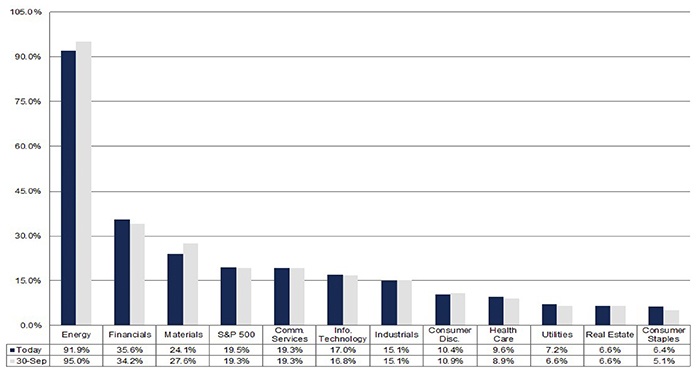

- “Earnings Growth: For Q3 2018, the blended earnings growth rate for the S&P 500 is 19.5%. If 19.5% is the actual growth rate for the quarter, it will tie the mark for the third highest earnings growth since Q1 2011 (also 19.5%).

- “Earnings Revisions: On September 30, the estimated earnings growth rate for Q3 2018 was 19.3%. Five sectors have higher growth rates today, due to positive EPS surprises and upward revisions to EPS estimates.

- “Earnings Guidance: For Q4 2018, nine S&P 500 companies have issued negative EPS guidance and four S&P 500 companies have issued positive EPS guidance.

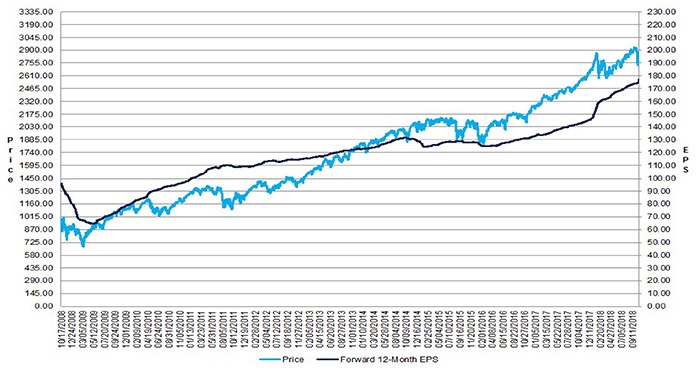

- “Valuation: The forward 12-month price-earnings (P/E) ratio for the S&P 500 is 15.9. This P/E ratio is below the five-year average (16.3) but above the 10-year average (14.5).”

FIGURE 1: S&P 500 EPS TREND VS. PRICE TREND (10 YEARS)

Source: FactSet

In terms of specific sectors, FactSet notes that all 12 sectors (up from 11 due to the recent redefinition of sectors) are expected to report year-over-year growth in earnings. Eight sectors are projected to report double-digit earnings growth for the quarter, led by the Energy, Financials, and Materials sectors.

FIGURE 2: S&P 500 PROJECTED Q3 EARNINGS GROWTH BY SECTOR

Source: FactSet

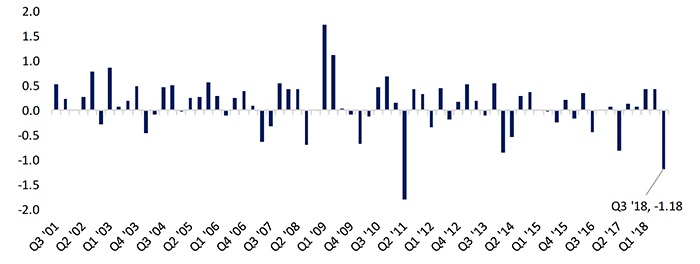

The recent market weakness and volatility has had a significant impact on companies who have reported either Q3 earnings or sales results that have missed estimates or a forward outlook in their earnings report that was lower than expectations.

Bespoke Investment Group says, “The overall earnings reaction is also tracking the worst since Q2 of 2011.” As can be seen in Figure 3, the average stock this earnings season is down 1.18% from the close before earnings have been reported to the close after earnings. Bespoke also notes, “Companies are having a more difficult time meeting sales expectations.”

FIGURE 3: EARNINGS SEASON 1-DAY REACTION (AVERAGE % GAIN/LOSS)

Source: Bespoke Investment Group

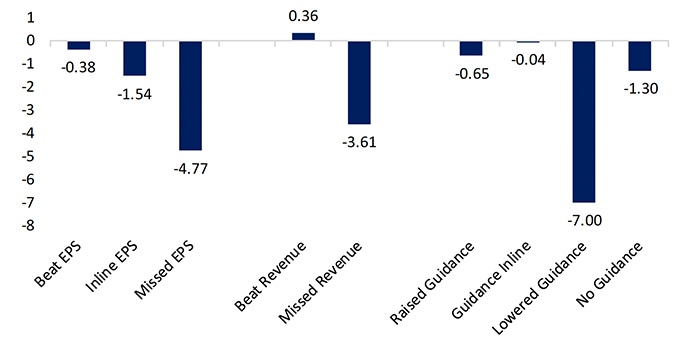

Figure 4 shows what factors have influenced those declines the most, with those stocks having “lowered guidance” suffering the deepest losses, down 7% on average.

FIGURE 4: GUIDANCE + REVENUE GUIDE REACTION TO EARNINGS (% GAIN/LOSS)

Source: Bespoke Investment Group

These results, however, must be taken within the context of an earnings season that still has a long way to go (the Q3 earnings season runs from the beginning of September through the end of November). This week will be one of the heaviest for S&P 500 companies’ earnings reports, including several of the large technology names.

While Q3 2018 may still be a very strong reporting period, the market is likely looking well past results for the previous quarter (as seen in the emphasis in Figure 4 on forward guidance). The market is closely following how and if major global companies express concerns over geopolitical issues (tariffs and “trade wars”) and how those factors may impact future earnings results.

MarketWatch reported on Monday, October 22,

“Eric Wiegand, senior portfolio manager at U.S. Bank Wealth Management, told MarketWatch that ‘we have seen the narrative begin to shift,’ to a more cautious one, citing fears over slowing global growth and whether U.S. companies can maintain their recent strong earnings growth in the quarters to come.

“‘Investors are anxious for more information,’ he said, adding that while he believes the current backdrop is supportive of stocks, it will all come down to earnings. ‘With so many bellwether names across so many industries reporting this week, things should get interesting.’”