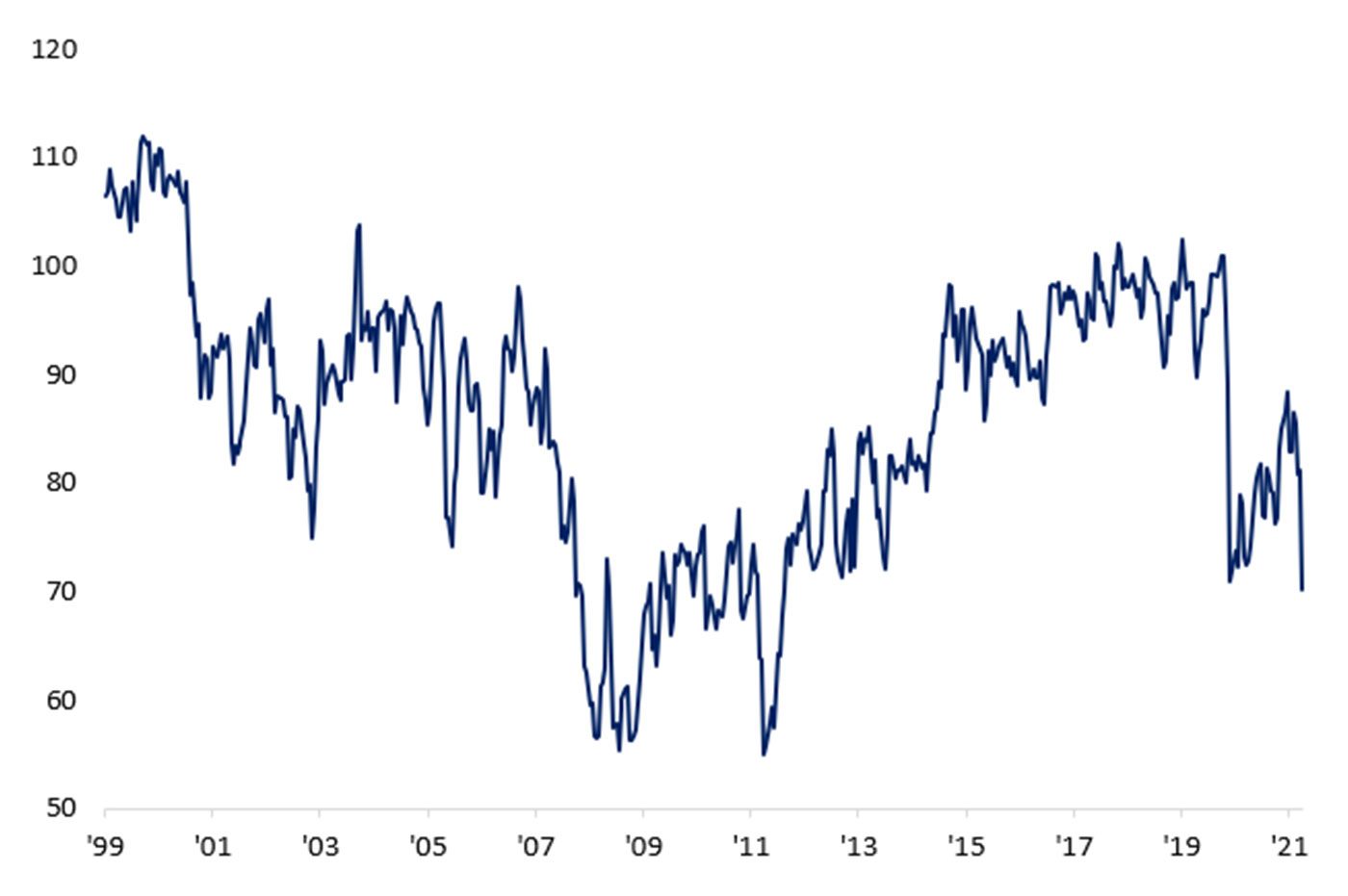

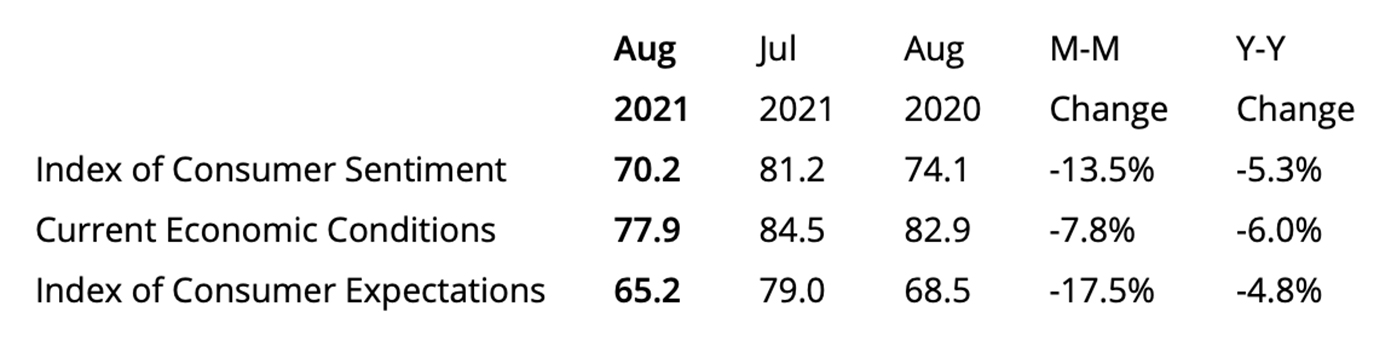

The University of Michigan’s survey of consumer sentiment fell hard in the preliminary August report, coming in at 70.2 versus a final July reading of 81.2.

According to MarketWatch, economists polled by The Wall Street Journal had expected an August reading of 81.3.

MarketWatch also noted that it was “the lowest sentiment reading since December 2011, below any level in the beginning of the pandemic last year.”

Sources: University of Michigan, Bespoke Investment Group

Richard Curtin, chief economist of the University of Michigan’s Surveys of Consumers, provided the following commentary on the preliminary August report:

“Consumers reported a stunning loss of confidence in the first half of August. The Consumer Sentiment Index fell by 13.5% from July, to a level that was just below the April 2020 low of 71.8. Over the past half century, the Sentiment Index has only recorded larger losses in six other surveys, all connected to sudden negative changes in the economy: the only larger declines in the Sentiment Index occurred during the economy’s shutdown in April 2020 (-19.4%) and at the depths of the Great Recession in October 2008 (-18.1%).

“The losses in early August were widespread across income, age, and education subgroups and observed across all regions. Moreover, the losses covered all aspects of the economy, from personal finances to prospects for the economy, including inflation and unemployment.

“There is little doubt that the pandemic’s resurgence due to the Delta variant has been met with a mixture of reason and emotion. Consumers have correctly reasoned that the economy’s performance will be diminished over the next several months, but the extraordinary surge in negative economic assessments also reflects an emotional response, mainly from dashed hopes that the pandemic would soon end.

“In the months ahead, it is likely that consumers will again voice more reasonable expectations, and with control of the Delta variant, shift toward outright optimism. Consumers’ reaction to Delta’s modestly higher precautionary measures indicates the difficulty of producing optimal policy responses.”

Source: University of Michigan

Bespoke Investment Group noted about the survey results,

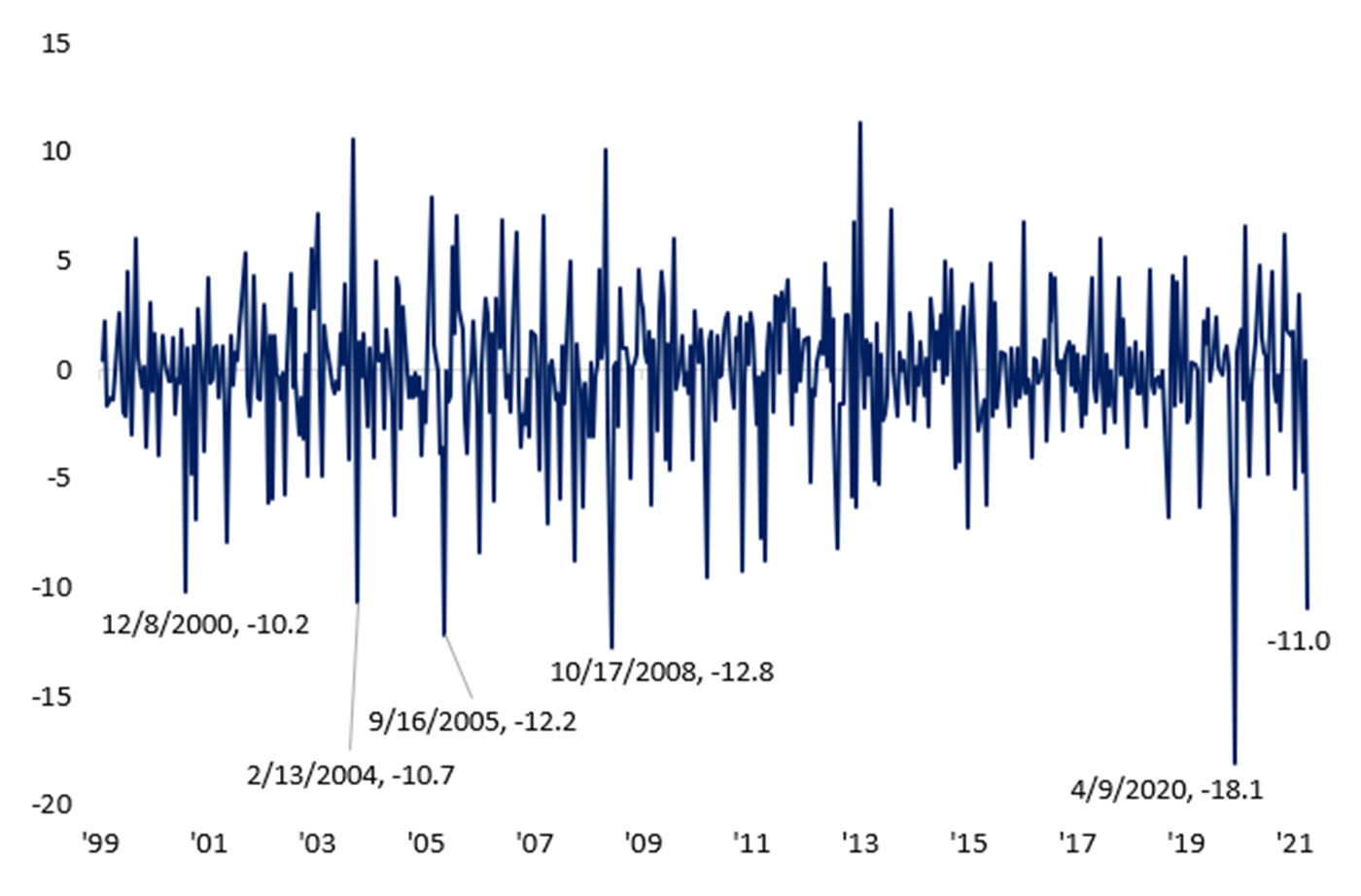

“The 11 point drop from 81.2 at the end of July to 70.2 today was the largest decline between two reports (either the preliminary and the prior final report or the final report and the preliminary reading) since the preliminary reading in April of 2020. The April 2020 reading was the largest drop on record at 18.1 points. Before that, October 2008 was the next largest and last double digit decline.”

Sources: University of Michigan, Bespoke Investment Group

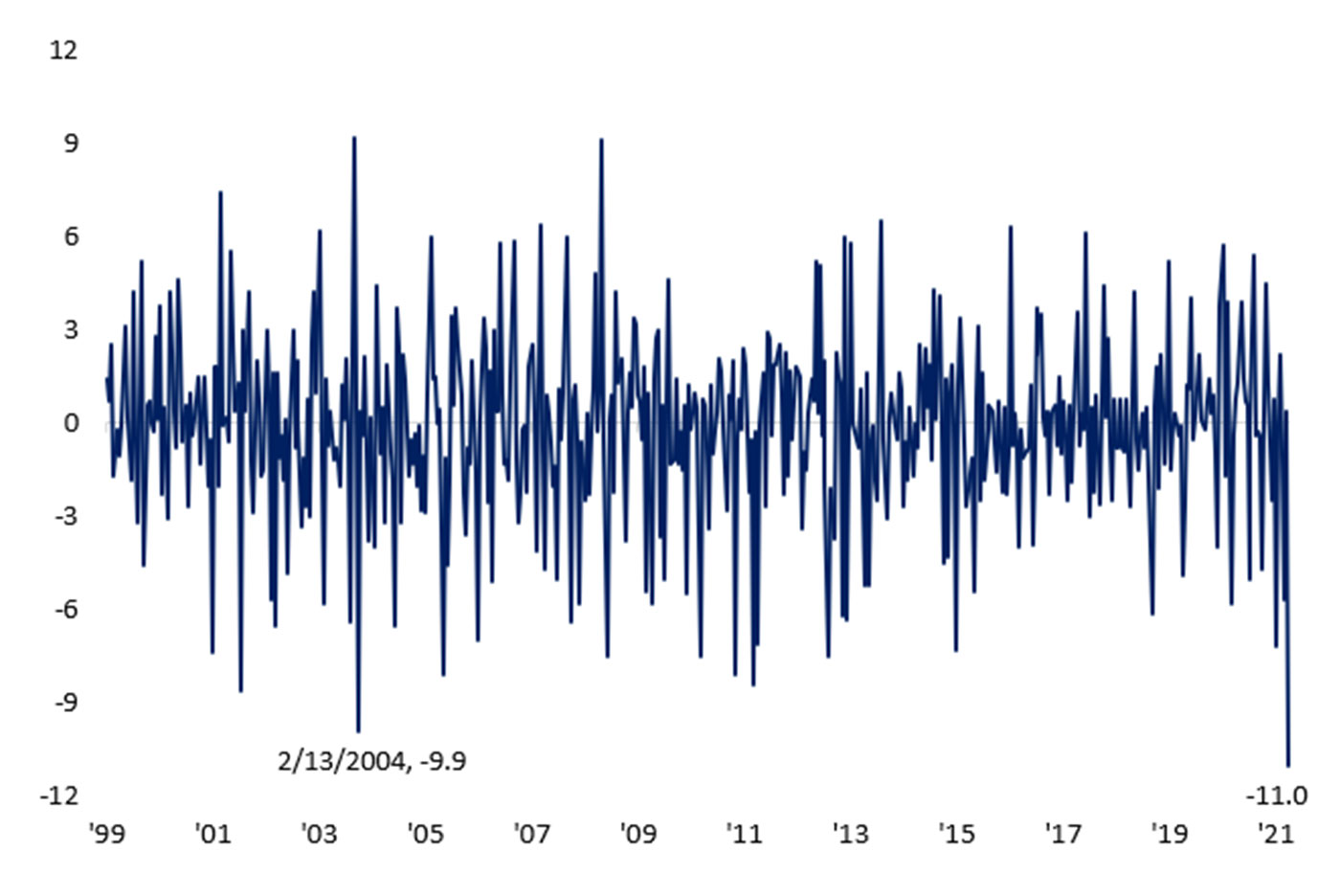

Bespoke also reported, “Not only was the release dramatically worse than the last update, but it was a huge miss relative to expectations. … Today’s release came in 11 points below expectations. The only other month going back to at least 1999 that even comes close was a 9.9 point miss in the preliminary reading in February 2004.”

Sources: University of Michigan, Bespoke Investment Group