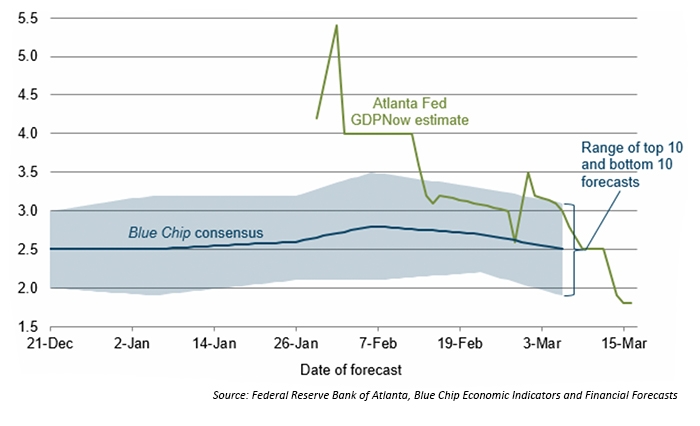

Consumer sentiment, according to the University of Michigan Consumer Sentiment Survey, is probing record levels. Barron’s wrote last week,

“The preliminary index for March jumped more than 2 points to 102.0, which is a 14-year high. Current conditions, where strength hints at ongoing gains for both consumer spending and employment, is up nearly 8 points to 122.8 and reflects growing confidence in the lower income bracket. Expectations, which is the other component of the index, are actually down 1.4 points to 90.0 and reflect income doubts among the higher bracket.”

The university’s Surveys of Consumers chief economist, Richard Curtin, noted,

“Consumers continued to adjust their expectations in reaction to new economic policies. In early March, favorable mentions of the tax reform legislation were offset by unfavorable references to the tariffs on steel and aluminum—each was spontaneously cited by one in five consumers. Importantly, near-term inflation expectations jumped to their highest level in several years, and interest rates were expected to increase by the largest proportion since 2004. These trends have prompted consumers to more favorably cite buying as well as borrowing in advance of those expected increases. While income gains are still anticipated, the March survey found that the size of the expected income increase returned to the lows recorded in the past year.”

FIGURE 1: UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT

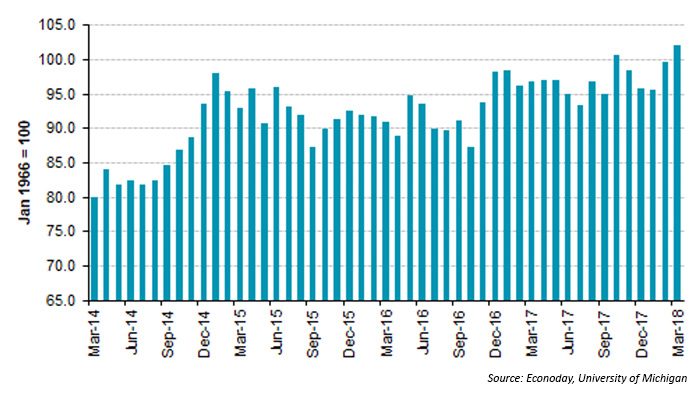

Another leading indicator, the National Federation of Independent Business (NFIB) Small Business Optimism Index, was around historically high levels for February. Bespoke Investment Group noted on the survey’s release,

“Say what you want about the pace of economic growth, but most small business owners remain downright giddy and are more confident than they have ever been in their careers. The latest evidence is the monthly sentiment survey of small businesses from the NFIB. In this month’s report, the headline index came in higher than expected, rising from 106.9 to 107.6 versus expectations for an increase to 107.1. The last time the index was higher was in September 1983.”

NFIB chief economist Bill Dunkenberg said, “Small business owners are telling us loud and clear that they’re optimistic, ready to hire, and prepared to raise wages—it’s one of the strongest readings I’ve seen in the 45-year history of the Index.”

FIGURE 2: NFIB SMALL-BUSINESS OPTIMISM (1975–2018)

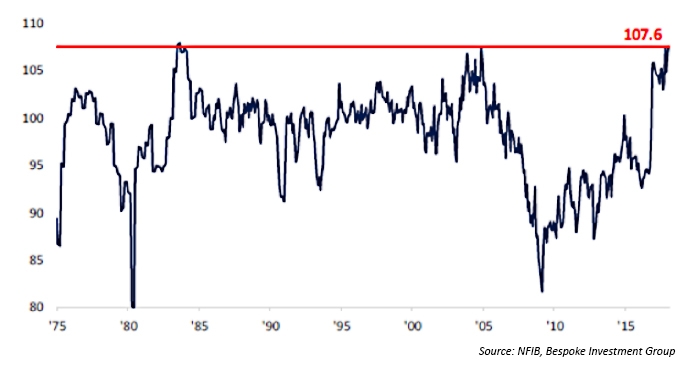

Despite these two very positive consumer and small-business sentiment readings, the Atlanta Fed has backed off considerably from earlier estimates on U.S. GDP growth for the first quarter. Bespoke Investment Group wrote,

“In terms of economic growth, expectations have really become a lot more grounded since earlier this year. A case in point is the Atlanta Fed’s GDPNow model. In early February, GDPNow had Q1 growth modeled in at over 5%, but now six weeks later growth is forecast to come in at 1.8%. The apparent slowdown in economic activity has many economists asking if the ‘Trump bump’ is fizzling out.”

FIGURE 3: EVOLUTION OF ATLANTA FED GDPNOW Q1 GDP FORECAST