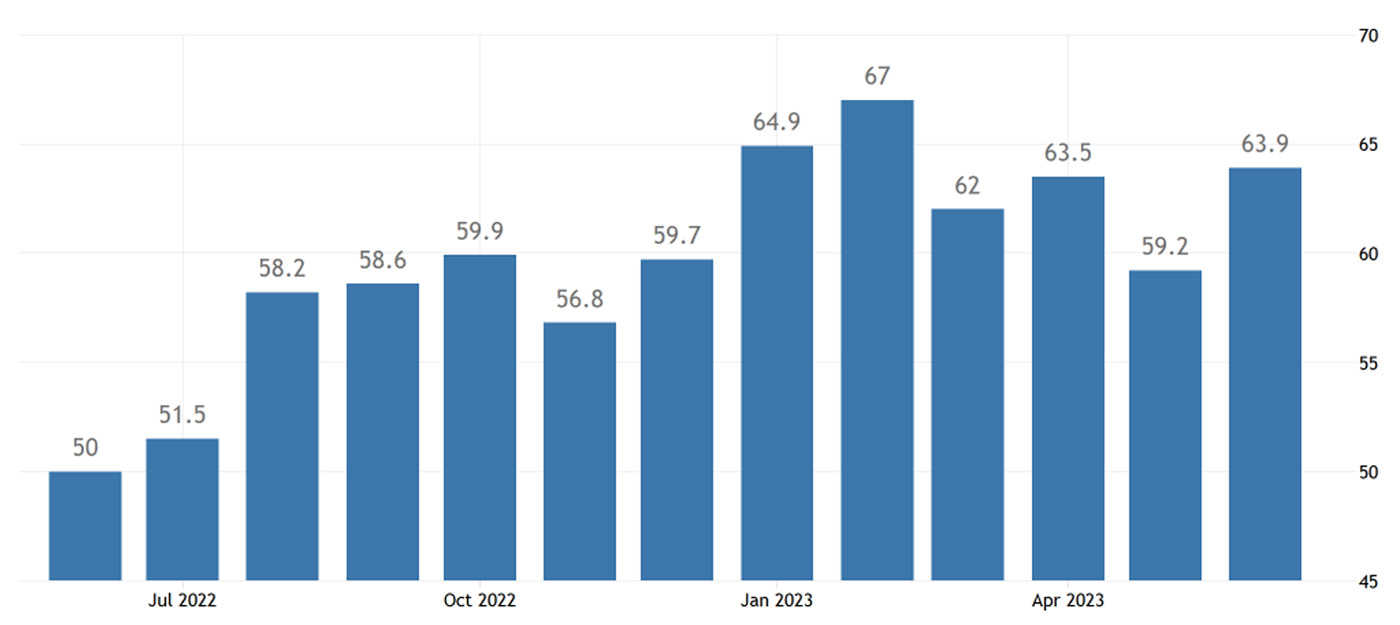

Last week, the University of Michigan reported that its Consumer Sentiment Index had increased to a four-month high.

The June 2023 preliminary report for the Consumer Sentiment Index came in at 63.9, up 4.7 points (7.9%) from May’s final reading.

FIGURE 1: UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX—JUNE 2023 PRELIMINARY

Sources: University of Michigan, Trading Economics

Surveys of Consumers Director Joanne Hsu noted,

“Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook over the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then. As it stands, though, sentiment remains low by historical standards as income expectations softened. A majority of consumers still expect difficult times in the economy over the next year.

“Year-ahead inflation expectations receded for the second consecutive month, falling to 3.3% in June from 4.2% in May. The current reading is the lowest since March 2021. In contrast, long-run inflation expectations were little changed from May at 3.0%, again staying within the narrow 2.9-3.1% range for 22 of the last 23 months. Long-run inflation expectations remained elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

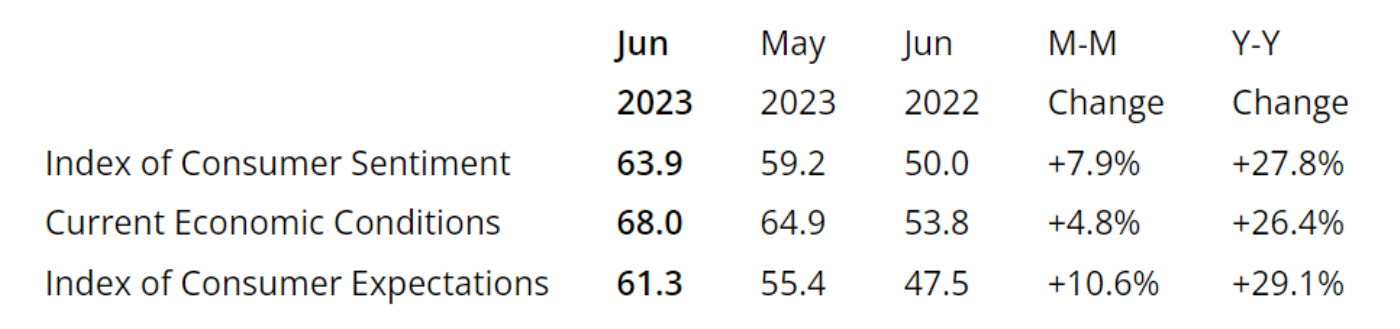

TABLE 1: PRELIMINARY RESULTS FOR JUNE 2023—CONSUMER SENTIMENT

Source: University of Michigan Surveys of Consumers

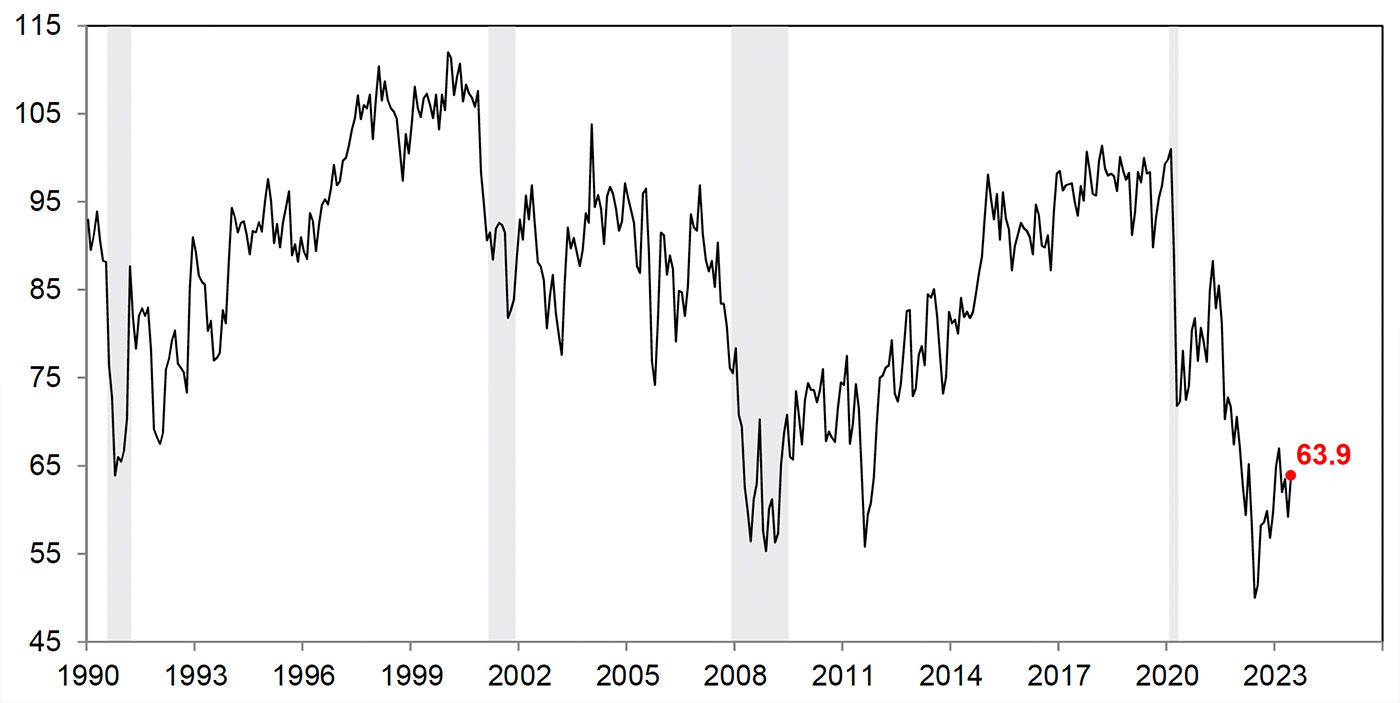

As noted by Ms. Hsu, despite the recent uptick in the Consumer Sentiment Index, the overall level remains depressed when viewed in the context of the past 30-plus years.

FIGURE 2: HISTORICAL PERSPECTIVE ON CONSUMER SENTIMENT INDEX

Source: University of Michigan Surveys of Consumers

Wage growth, consumer spending, and recession outlook

On the positive side, Charlie Bilello at Creative Planning reports that “U.S. wages outpaced inflation on a YoY basis in May by 0.2%, ending the ignominious streak of 25 consecutive months of negative real wage growth.”

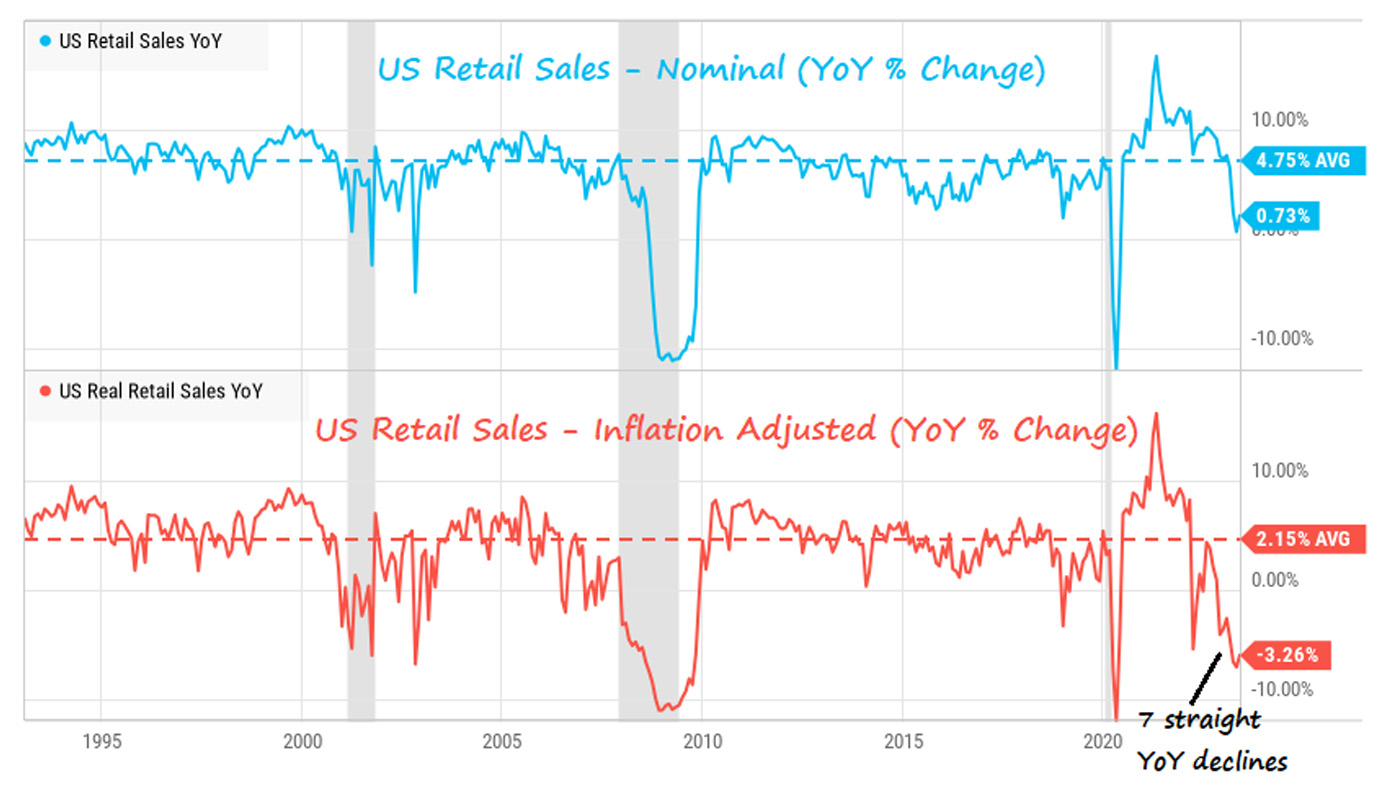

However, he also points to the weakness in consumer spending, noting, “While tighter monetary policy may be helping to curb inflation, it is also curbing demand. After adjusting for inflation, U.S. retail sales fell 3.3% over the last year, the 7th consecutive YoY decline. That’s the longest down streak since 2009. Nominal sales increased 0.7% YoY vs. a historical average of 4.8%.”

FIGURE 3: U.S. RETAIL SALES—NOMINAL AND INFLATION-ADJUSTED

Source: Creative Planning

The question remains: Will the U.S. fall into recession in 2023 in the face of what Bilello calls the “tightest monetary policy since 2007”?

David Folkerts-Landau, Deutsche Bank chief economist, recently wrote that a recession toward the end of 2023 will be hard to avoid:

“The U.S. is heading for its first genuine policy-led boom-bust cycle in at least four decades. The inflation we see was induced largely by expansive fiscal and monetary policy, and the aggressive rate hikes needed to tame that have now materialized. Avoiding a hard landing would be historically unprecedented.”

In its Spring 2023 edition of “Crucial Conversations,” Guggenheim Investments also sees a high likelihood of a 2023 recession:

“… While we are just a few years from the last recession, our focus has again turned to forecasting recession timing, given slowing economic activity, fiscal tightening, and a Federal Reserve intent on slowing demand.

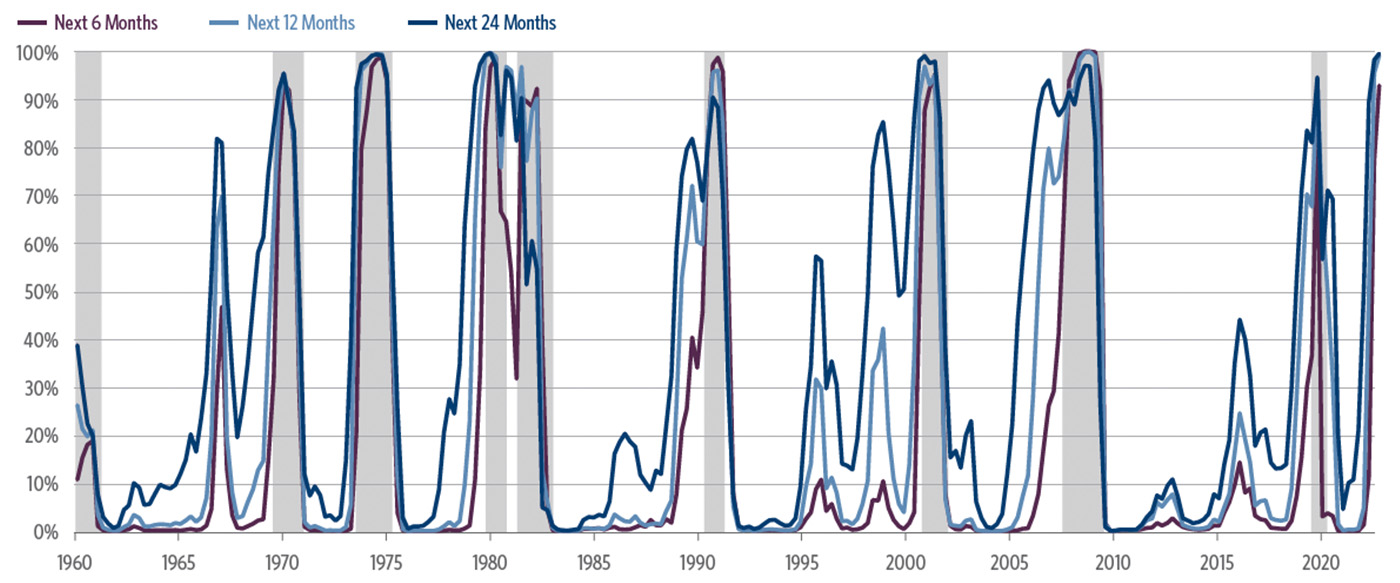

“Guggenheim has developed several tools to guide this effort. Our Recession Probability Model predicts the probability of a recession over six-, 12-, and 24-month horizons. As of the first quarter, the model points to very high risk of recession in the next several months, with leading indicators of economic activity falling at a pace seen in the runup to prior recessions. Other warning signs include the lagged impact of aggressive Fed tightening, a deeply inverted yield curve, and an unsustainably tight labor market. …”

FIGURE 4: GUGGENHEIM—RECESSION PROBABILITY MODEL

Note: Hypothetical illustration. The Recession Probability Model was established in 2017 with no prior history of forecasting recessions. Its future accuracy cannot be guaranteed. Actual results may vary significantly from the results shown. This illustration is not representative of any Guggenheim Investments product. Shaded areas represent periods of recession. Guggenheim’s Recession Probability Model attempts to predict the probability of a recession over six-, 12-, and 24-month horizons. Guggenheim developed the model using the unemployment gap, the stance of monetary policy, the yield curve, and The Conference Board Leading Economic Index (LEI), as well as the share of cyclical sectors of the economy (durable goods consumption, housing, and business investment in equipment and intellectual property) as a percent of GDP.

Source: Guggenheim Investments, Haver Analytics. Data as of 3/31/2023.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

New this week: