Concentrated stock investing ‘de-risked’

Concentrated stock investing ‘de-risked’

Stock protection funds (SPFs) provide advisors with a fresh risk-management tool in portfolio construction for clients who either own, or wish to acquire, a concentrated stock position.

Many individuals and families have accrued immense amounts of wealth by acquiring or investing in concentrated positions in publicly traded stock and holding onto them for a long time. Some received their positions through inheritance or gift. Others secured stock through a liquidity event as a result of entrepreneurial success. Still others accumulated stock over the path of their careers at public companies. Additionally, a small group of professional investors (such as Warren Buffett, Mario Gabelli, Seth Klarman, and Joel Greenblatt) have successfully embraced an active, fundamental research-driven, long-term, buy-and-hold, stock-picking strategy (“concentrated stock investing” or “CSI” herein). There is considerable empirical evidence found in academic studies and literature that support concentrated stock investing’s potential for outperformance.

The potential for higher returns, however, comes with a high level of company-specific risk. It is this risk exposure that has left many advisors reluctant to employ a CSI strategy at any level on their clients’ behalf, favoring instead a mix of passive and active strategies that provide exposure to a more diversified asset base.

Fortunately, recent innovations in single-stock risk management have made it possible to meaningfully reduce the idiosyncratic risk related to CSI in a low-cost manner, making CSI a potentially attractive and prudent investment solution for investors wishing to allocate a percentage of their portfolio to individual stocks that may deliver an above-market rate of return.

Enter stock protection funds

Stock protection funds (SPFs) are a recent development. They can help investors who would like to safeguard unrealized gains on highly appreciated stock positions they currently hold (see CFA Institute’s “Take 15” video), but they can also be used to protect new concentrated stock investments that investors make. SPFs allow investors to retain the upside potential gains of a stock, while “mutualizing” its downside risk in a cost-effective and tax-efficient manner.

SPFs marry the principles of modern portfolio theory with risk pooling and insurance. MPT reveals that over time there will be substantial dispersion in individual stock performance. Risk pooling makes it possible to cost-effectively spread similar financial risk evenly among participants in a self-funded plan designed to protect against catastrophic loss. By integrating these concepts, SPFs deliver downside protection analogous to that of at-the-money or slightly out-of-the-money European-style put options, for a fraction of the cost.

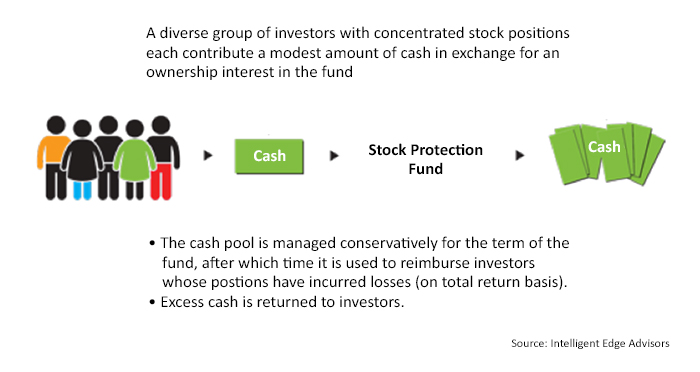

SPFs work like this. Investors, each with a stock in a different industry and each looking to protect the same notional value of stock, contribute a modest amount of cash (not shares, which they can continue to own) into a fund that terminates in five years. The cash is invested in U.S. Treasurys that mature in five years, and upon termination, the cash is used to reimburse those of the investors whose stocks have lost value on a total return basis.

Losses are reimbursed using a “reverse waterfall” methodology until the cash pool is exhausted. If the cash pool exceeds the aggregate value of all losses (approximately a 70% probability, based on extensive backtesting), all losses are eliminated, and the excess cash is returned to investors, beginning with those whose stocks did not sustain a loss (i.e., those who have not yet received any distribution). If the aggregate value of all losses exceeds the value of the cash pool (approximately a 30% probability, based on extensive backtesting), large losses are substantially reduced.

Real-life example

StockShield, LLC, the firm that developed and patented this strategy, operated a protection fund from June 1, 2006, to June 1, 2011. The fund was composed of 20 investors, each protecting a different stock in a different industry, but all protecting the same notional amount of stock. The investors’ upfront cash contribution was 10% (2% per annum for five years) of the value of the stock being protected.

After five years, eight of the 20 stocks had incurred a loss: 37%, 32%, 24%, 18%, 13%, 8%, 5%, and 1%.

There was more than enough cash in the cash pool to cover all losses, so all losses were fully reimbursed (i.e., the maximum stock loss = 0%), and the remaining cash was returned to the investors.

Result: Each investor received the equivalent of a five-year at-the-money put option protection on their stock, and the amortized cost of that protection was 1.38% per annum pretax (about 1% after tax). During this same period (i.e., throughout the Financial Crisis), it would have been cost-prohibitive, if not impossible, for these investors to roll put options to achieve at-the-money protection.

Source: Intelligent Edge Advisors

Tax considerations

An SPF is tax-efficient in that it doesn’t cause a constructive sale, the straddle rules don’t apply, dividends received remain qualified for long-term capital-gain treatment, and the distribution upon termination of an SPF will result in either long-term capital gain or currently deductible capital loss.

Additionally, because the straddle rules don’t apply, if an investor participates in an SPF within the first year of stock ownership, his or her holding period in the stock does not need to be reset to zero for the purpose of determining whether gain or loss on the stock will qualify for long-term capital-gain treatment (i.e., aging the holding period of the protected shares from short-term to long-term is possible). Likewise, an investor does not have a suspended holding period for purposes of determining whether a dividend received on his stock is qualified dividend income (i.e., dividends that qualify for taxation at the long-term capital-gain rate are not disqualified and taxed at the ordinary rate).

Other considerations

For company insiders, the use of an SPF does not cause a reportable event (however, they can voluntarily disclose, if they’d like to). In addition, company insiders and employees can use an SPF to shield both stock and stock-linked compensation (assuming company policy allows), including company shares held within a defined contribution plan.

The shares needn’t be pledged, are not encumbered in any way, and can be held in custody wherever the investor desires. Therefore, the investor can sell, gift, donate, borrow against, or otherwise dispose of his company shares at any time. If desired, investors can borrow against their stock to fund their investment into an SPF, so as to not disturb their current asset allocation.

SPFs are easy to understand, transparent, and entail no counterparty credit risk.

Stock Protection Funds

It’s important to note that continuing to own some of one’s shares as a long-term, core holding is just one of many goals an investor with a concentrated position might have. There are a number of strategies investors can turn to in order to satisfy their various objectives. For instance, exchange funds can help investors who wish to diversify out of some of their position in a tax-advantaged manner, put options and collars can be used to protect stock positions in a tactical (short-term) manner, prepaid variable forwards can be used to hedge and monetize (i.e., generate cash from) stock positions, and charitable remainder trusts can be used by those who are charitably inclined. SPFs are just one strategy that investors with highly appreciated stock positions should consider.

The increased risk of CSI can be muted with SPFs

SPFs naturally appeal to investors with existing single-stock concentrations who cannot —or do not wish to—dispose of all of their shares because SPFs enable them to significantly reduce their downside risk, in an affordable manner, without giving up their stocks’ upside potential.

On the flip side, advisors to clients who do not currently have wealth concentrated in a single publicly traded stock can leverage this risk-management tool in order to make strategic single-stock investments on their clients’ behalf, enabling them to benefit from any future appreciation in those stocks, while substantially reducing their exposure to the stocks’ idiosyncratic risk factors.

Employing SPFs in conjunction with CSI de-risks CSI, not unlike a “married put” strategy (i.e., long stock, long put on the same stock), but it is substantially less expensive and more tax-efficient (as previously described).

As such, this new investment strategy—CSI + SPF—could be an attractive solution for the portion of an investors’ portfolio advisors would like to allocate to assets that have the potential to generate an above-market rate of return.

Advisors might keep the bulk of a client’s investable assets allocated to various active and/or passive strategies that provide exposure to a more diversified universe of assets, but employ CSI + SPF with a modest portion of the client’s investable assets to gain exposure to all of a stock’s upside potential without bearing all of its downside price risk.

Retirement planning considerations

The long-established rule of thumb for retirees—that equities should represent a portion of one’s portfolio equal to 100%-less-one’s-age—no longer seems to resonate with retirees and their advisors. Retirees must rely on Social Security, dividends, pensions, and portfolio withdrawals to satisfy current income needs. In today’s low interest-rate environment, and with the advantages of modern, sophisticated risk-management strategies, more advisors and their clients are looking for portfolio growth via managed fixed-income and equity strategies that will fuel future withdrawals. In fact, after retirement, it’s worth noting that many wealthy investors plan to maintain or increase their equity exposure to pursue long-term growth of assets.

With traditional fixed-income strategies delivering low historical returns, many retirees and soon-to-be retirees feel an even greater need to seek higher returns to mitigate longevity risk and support a retirement that may last decades. Many wealthy retirees are also investing more aggressively to build a legacy for future generations. That said, executives, employees, and retirees with highly appreciated company stock positions that they believe will outperform the market might wish to consider retaining a portion of their company stock as a core, long-term holding, but while protecting their unrealized gains via an SPF.

Summary

Stock protection funds add a fresh and desirable facet to the wealth-planning and portfolio-construction process for investors who either own, or wish to acquire, a concentrated stock position. Due to its affordability, SPFs can be married to new concentrated stock investments that investors make, as well as highly appreciated stock positions that investors currently own, thereby substantially mitigating the downside risk associated with their positions. When the idiosyncratic risks associated with concentrated stock investing are diminished by SPFs, CSI + SPF can be an attractive option within an investor’s portfolio of long-term, wealth-building strategies.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Elizabeth Ostrander is managing director and director of business development at Intelligent Edge Advisors, an investment banking and capital markets firm that works with financial advisors to plan, structure, and execute liquidity events for their clients who own commercial real estate, privately-owned businesses, and/or highly appreciated positions in a single publicly traded stock. Ms. Ostrander has authored or co-authored several scholarly articles on various issues surrounding concentrated wealth. She has a degree from Boston College and is a CFA charter holder. http://www.intelligent-edge.com/

Elizabeth Ostrander is managing director and director of business development at Intelligent Edge Advisors, an investment banking and capital markets firm that works with financial advisors to plan, structure, and execute liquidity events for their clients who own commercial real estate, privately-owned businesses, and/or highly appreciated positions in a single publicly traded stock. Ms. Ostrander has authored or co-authored several scholarly articles on various issues surrounding concentrated wealth. She has a degree from Boston College and is a CFA charter holder. http://www.intelligent-edge.com/

Co-author

Thomas Boczar is CEO of Intelligent Edge Advisors and is an expert in the discipline of single-stock risk management, authoring more than 50 published articles on issues related to concentrated wealth and the taxation of financial instruments, products, and transactions. Mr. Boczar holds an LL.M. (taxation) from NYU School of Law, and a J.D., an MBA, and a master’s in professional accounting from the University of Miami. He also holds an advanced professional certificate in estate planning from NYU School of Law and earned the CFA Institute’s CFA designation and IMCA’s CPWA designation. He is admitted to the bar in New York and Connecticut. http://www.intelligent-edge.com/

Thomas Boczar is CEO of Intelligent Edge Advisors and is an expert in the discipline of single-stock risk management, authoring more than 50 published articles on issues related to concentrated wealth and the taxation of financial instruments, products, and transactions. Mr. Boczar holds an LL.M. (taxation) from NYU School of Law, and a J.D., an MBA, and a master’s in professional accounting from the University of Miami. He also holds an advanced professional certificate in estate planning from NYU School of Law and earned the CFA Institute’s CFA designation and IMCA’s CPWA designation. He is admitted to the bar in New York and Connecticut. http://www.intelligent-edge.com/