Buy and fold

The only investment approach investors should consider is one they will actually follow.

Millions of Americans follow what has become traditional advice to “buy and hold.” This approach might be best summarized by John Bogle, founder of The Vanguard Group: “Get out of the casino, own corporate America, and hold it forever.”

The basic idea of buy and hold is that you can’t time the market. Investing is a zero-sum game, so if you try to time the market, the only party that wins is the one collecting the commissions (the casino dealer/croupier in Bogle’s analogy).

The most commonly cited evidence about investor inability to time the market is the DALBAR Quantitative Study of Investor Behavior (QSIB). The key statistic from the 2014 QSIB was quite remarkable, though not a surprise to advisors who have witnessed investor behavior firsthand:

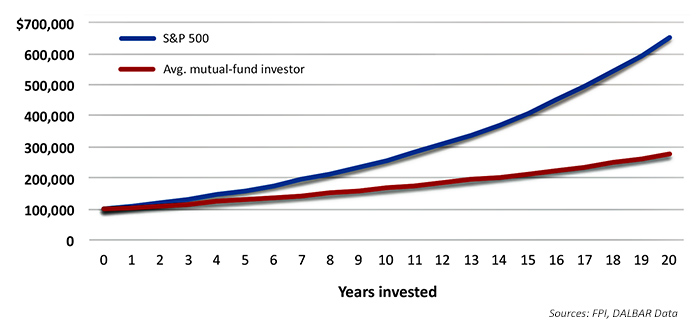

The 20-year annualized S&P return was 9.85%, while the 20-year annualized return for the average equity mutual fund investor was only 5.19%—a gap of 4.66 percentage points.

The buy-and-holders cite this as evidence that misguided attempts at timing the market (buying those funds high and selling them low) is the main explanation for poor returns. In theory, it is difficult, maybe even impossible, to argue with buy and hold. The problem comes when we all wake up and realize investors/clients do not live in a theoretical world and they do not retire on theoretical money.

To summarize, the buy-and-holders believe that large-scale underperformance comes from investors not using buy and hold. I have a slightly different hypothesis: Investors “buy in” to buy and hold when the case looks the best—market tops—and they “fold” (give up) on buy and hold when it looks worst—market bottoms.

What if a client found out that their current portfolio was 300% riskier than he or she was prepared to tolerate? At our firm, we see it every day when analyzing the holdings of a new client or prospect. Besides questions of knowledge, experience, time horizon, liquidity needs, and so on, the most important risk-tolerance question we ask is this: “You are investing $XXX dollars with us today. What is the lowest balance you could handle before you would fire us or go to cash?”

Clients often answer that a 15% decline in portfolio value would be a tipping point, but the answers can fall anywhere from 0% to 50%. This is not unexpected, given our relatively large sample of clients with unique goals, experience, sophistication, and life situations.

When we show an equity investor with a theoretical maximum loss tolerance of 15% that the maximum drawdown of the S&P 500 is well over 50%, and can exceed 20% on a fairly regular cyclical basis, they’re often shocked. No wonder they have difficulty being disciplined investors—they were never mentally prepared to withstand a 50% loss. They aren’t trying to “time” the markets, per se, when they sell at the bottom—they’re panicking! They’re throwing in the towel on the entire idea of buy and hold.

If you know ahead of time that you will panic when the market enters bear territory, why would you commit to a strategy that historically has lost twice your tolerance (or more) every five to seven years?

Mr. Bogle is, of course, 100% aware of the past. In a recent CNBC interview, he said an investor should be prepared for two 50% drawdowns in the next ten years. Many people mistook this for a “call” or prediction. It wasn’t. It was Mr. Bogle stating historic fact, that markets go up and markets go down, and if you are going to buy and hold, you should fully expect the future to at least resemble the past.

To reiterate, I believe when investors buy at the top, they are “buying” buy and hold as a concept or strategy. Conversely, when investors sell at the bottom, they are throwing in the towel on an idea they were never emotionally prepared to follow in the first place.

When investors buy and hold, they often don’t consider things like drawdown, or they don’t anticipate how they may respond during a bear market and premeditate their actions. Most important, their expectations do not match historical results.

How do you reduce that drawdown to something in line with a level of risk they can actually handle? In my experience there are only two ways to do it:

- True diversification.

- Dynamic management.

For the sake of brevity, we define true diversification across three levels:

- Multiple assets. (For example, don’t hold just one company, hold many. This is what many people think of when discussing “traditional” diversification.)

- Multiple asset classes. (For example, equities, fixed income, commodities, currencies, private equity, and real estate.)

- Multiple strategies. (Ideally, managers or strategies with varying approaches/strategies.)

I can just hear the media’s generalization now, “Managers?! 80% of managers fail to outperform the market!” (Before we get too far, if anyone ever tells you they know how to buy at the exact bottom and sell at the exact top, politely excuse yourself, grab your wallet, and run.) But, back to the “80% of managers” adage—I have several responses to that notion.

First, I’ve never found a reputable study that proves that point the way it is commonly understood.

Second, I have found studies that say 80% of active mutual funds underperform their benchmarks, but here’s the problem: Mutual funds are not active (by our definition). Many have an investment mandate that requires them to stay fully invested and not deviate from their stated asset classes and allocations. (How active is a manager when they have to stay invested in one asset class or sector, and stay fully invested, regardless of conditions? When you are required to stay invested in a single asset class, can only diversify within that single class, but yet charge a higher fee than a passive benchmark that does the exact same thing, underperformance is the only logical outcome.)

The final piece to the response is the most important. Our clients are not looking to outperform the market. Rather, they are seeking to outperform on a risk-adjusted basis.

For example, consider two portfolios: Portfolio A has a compound annual return of 8% over the past 10 years, with a maximum loss of 15%. Portfolio B has a compound annual return of 10%, with a maximum loss of 55%. Which one is “better?” (“Better” is a very subjective term, as each person’s situation is unique, but for discussion purposes, I’ll use the word.)

Buy-and-holders would say the second. Annual performance that is 2% greater is enormous over ten years. “Brace yourself to deal with the 55% drawdown and stay patient,” they say.

Our clients would select the first. Getting an 8% return in a portfolio strategy you can handle long term is much more effective than “buying” portfolio B at the top and “folding” on portfolio B at the bottom (which, instead of those 10% returns, might lead to flat performance or even a loss).

If your clients are fine with sustaining a 50% loss every four to seven years to guarantee they never fall far short of long-term “market performance,” they should feel free to go for a buy-and-hold strategy. (This is not tongue-in-cheek at all.) If they are more focused on minimizing expenses and achieving raw returns rather than risk-adjusted returns, then it might be just fine for them over a very long period of time (assuming that the sequence of returns will not be an issue).

However, if they are anything like the hundreds of clients we’ve worked with over the years, the buy-and-hold strategy may include risk parameters far outside their tolerance. It remains my humble opinion that advisors should discourage clients from buying into a strategy they won’t be able to maintain for the long haul. Buy and hold, unfortunately, too often turns into buy and fold.

Tony Hellenbrand, RICP, is a partner at Fox River Capital, a registered investment advisor in the state of Wisconsin. For more information and full disclosures, please visit FoxRiverCapital.com.