Bucket investing with risk-managed portfolios

Bucket investing with risk-managed portfolios

The “bucket” approach to asset allocation by wealth advisors has deservedly grown in popularity for retirement planning. It can be enhanced through the use of actively managed investment strategies.

Empirical evidence has shown that investors are indeed far from rational. In a classic study by DALBAR, the average equity mutual fund investor made a return of 5.02%, while the S&P 500 made 9.22% over the same 20-year period. The 4.20% return differential could not be explained by financial theory and was famously dubbed “the behavior gap.” Investors lost over 60% of the returns available to them through poor market timing that was driven by emotional decision-making.

It can be argued that the most important job for an investment advisor or financial planner is simply to protect investors from themselves. Creating an asset-allocation approach that can keep them invested and avoid selling risky investments at the wrong time is a difficult challenge. The “bucket” approach to investing has emerged as a popular asset-allocation methodology in the financial-planning and advisory community because it is specifically designed to account for actual investor behavior. Furthermore, it is highly compatible with the traditional financial-planning objectives that require matching assets to meet future liabilities.

The essence of the bucket approach is to divide a client’s portfolio assets into several pools, or “buckets,” each with different planned goals, needs, or time horizons, and then design a separate asset-allocation policy for each “bucket.” For different investors, an individualized bucketing approach also reflects financial planners’ and advisors’ emphasis on tailored solutions for their fee-paying clients.

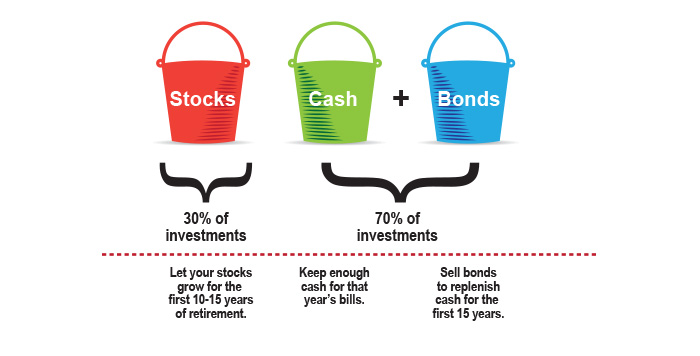

The 3-bucket strategy

Income for life

Asset allocation using the bucket approach utilizes discrete “buckets” assigned to asset type, such as bonds for income and capital preservation, or equities/stocks for capital appreciation. The simplest implementation of bucket investing would use only two buckets: bonds or cash to meet short-term expenses, and stocks for long-term growth.

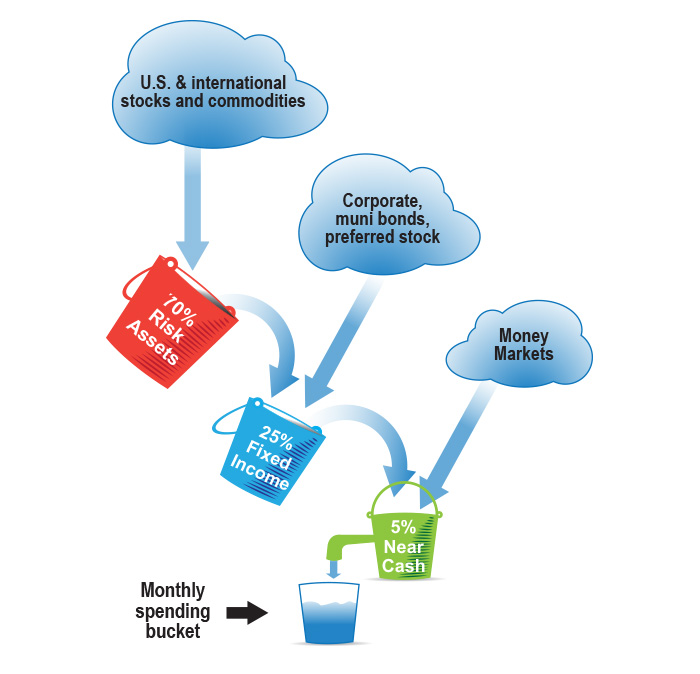

Waterfall bucket approach to retirement income

There are also more complicated “bucketing” strategies that use three to six buckets. Intermediate “buffer buckets” can have more refined planning time horizons designed for growth or spending goals and thus be targeted at layered return objectives. From an investment management standpoint, a more complex bucket approach could use different portfolios for each bucket, and these portfolios could be formed using either assets or strategies (or both) with either a passive or active management overlay.

There are many reasons why a distinct bucketing strategy design might be appropriate for different investors, such as different tax brackets and/or opportunities to shelter income from taxation, or different planning objectives. For example, some investors have relatively short-term objectives, while others may have longer-term goals such as saving for college tuition payments, retirement spending, or estate planning.

In addition, part of the reason the bucket approach has gained popularity in the investment advisory and planning community is the anecdotal evidence from peers that it improves client communication and retention. Behavioral finance proponents attribute this success mainly to the fact that most investors have a “mental accounting” bias. “Mental accounting” describes a person’s tendency to categorize and evaluate economic outcomes by grouping their assets into a number of non-fungible (non-interchangeable) “mental accounts.”

A time-horizon-based “bucketing” approach for wealth management was designed to address psychologically both the safety of near-term liquidity need and the goal of long-term growth of wealth. In practice, a floor level of assets designated as a short-term “spending bucket” is often kept as cash or in short-term securities that have little or no investment risk. Further, from a portfolio management perspective, planning “buckets” of capital under the framework of “goals-based investing” does institute beneficial risk discipline into the investment process.

The ‘bucket approach’ and active management

One of the key failures of static asset-allocation approaches is that all of them fail to follow trends in both returns and risk. As we have seen, bear markets have been devastating to all forms of static allocation—especially if they happen at the wrong time. This is true regardless of whether one employs a constantly rebalanced approach (nearly impossible to implement) or the bucket approach.

The key difference between these two methods is that when buying and holding traditional asset classes, the bucket approach is most affected by bear markets that occur toward the end of the investor’s time horizon, while the constantly rebalanced approach (with systematic withdrawal) is most impacted by bear markets that occur at the beginning.

From a practical perspective, since both of these methods were designed for retirement planning, the bucket approach has more psychological appeal. In theory, people that have just retired are most sensitive to their nest egg and may make rash decisions if they encounter a bear market early on. It is harder for them to be concerned about what may happen if they run out of money at some point in the very distant future. Human nature is to focus on the shorter term.

However, the cost of running out of money can be severe—this can mean having no financial options at a point when the client is unlikely to be able to return to work. The bucket approach is more sensitive to this outcome, especially when employing a traditional buy-and-hold approach. Yet bucketing cannot bail you out of a sequence of poor returns.

Active management—in contrast to traditional buy-and-hold investing, which penalizes the bucket approach for “bad luck” in the later years—may provide an excellent solution. It focuses on responding to trends in return and volatility by shifting asset allocation throughout the holding period. Most active management approaches that are trend-following will outperform buy-and-hold in an extended bear market. As a trade-off, they may trail on the upside in bull markets. However, in aggregate, they produce the smoother return profile that is ideal for financial planning since it typically is not as sensitive to “bad luck.”

By using active management with the bucket approach, it is possible to produce a nearly ideal scenario that is designed to keep investors invested for the long term while protecting them from events in the future that may devastate their portfolios.

Editor’s note: This article presents an excerpt from a Flexible Plan Investments, Ltd., white paper by authors David Varadi, Jerry Wagner, and Dr. George Yang. The white paper in its entirety can be downloaded at http://goto.flexibleplan.com/download/whitepaper-bucket-investing.pdf

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Since 1981, Flexible Plan Investments (FPI) has been dedicated to preserving and growing wealth through dynamic risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine FPI’s many risk-managed strategies within a single account. FPI’s fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. FPI also offers advisors the OnTarget Investing tool to help set realistic, custom benchmarks for clients and regularly measure progress. flexibleplan.com