The battle for investment assets: The active versus passive debate

The battle for investment assets: The active versus passive debate

Insights on the advancement of active investment management from the 2017 Market Technician Association’s 44th Annual Symposium.

I recently had the privilege of attending the Market Technicians Association’s (MTA) 44th Annual Symposium, held in early April. The theme of this year’s symposium was “Technical Analysis: Integral to Successful Active Management.”

Why a privilege?

Because some of the best minds in the investment management industry gathered in one spot for two days to share their specific areas of expertise, insights on technical analysis and its practical applications, and many different viewpoints related to investment philosophy.

Regarding the symposium’s banner theme of incorporating the latest technical analysis techniques within effective active management, there were several angles of attack. Not the least of these was the opportunity to learn from and cultivate relationships with industry leaders and value generators from around the world.

Some of the key topics discussed at the symposium included the following:

- Application of technical analysis—How to incorporate new tools with discipline and objectivity to remove subjective bias from the investment process across asset classes.

- Implementing macro strategy—Developing a top-down investment strategy that factors in the global economic landscape and implements best practices in tactical asset allocation.

- Fusing multiple disciplines—Combining classical technical analysis with emerging quantitative methods for improved momentum, mean-reversion, and volatility-based trading strategies (and more).

- Analysis of behavioral psychology trends—How behavioral psychology and its decision-making frameworks can inform and help track performance at key investment decision points.

- Embracing new technology—Understanding the latest trends in “big data”: collection, analysis, visualization, and utilization.

- Adding value for clients—The application of technical analysis as a means of risk management and alpha generation in the context of portfolio management.

What is the mission of the MTA?

The MTA is a long-standing, highly respected not-for-profit member association of more than 4,500 investment professionals in 85 countries.

As the home of the Chartered Market Technician (CMT) Program, the MTA focuses on (1) continual enhancement and maintenance of the highest professional standards for technical analysis, (2) sponsoring educational events and forums around the world, and, (3) maintaining and promoting thought leadership on the theory, practice, and application of technical analysis.

How do they define technical analysis? According to the MTA, “Technical analysis provides a framework for informing investment management decisions by applying a supply and demand methodology to market prices. Technical analysts employ a disciplined, systematic approach that seeks to minimize the impact of behavioral biases and emotion from the investment practice. A tool that complements other investment disciplines, many institutional analysts, strategists, and portfolio managers fuse technical research with other analytical approaches, such as quantitative, fundamental, and macro-economic methods.”

One of the MTA’s foremost imperatives is adding value for its members as they address the current market environment and the attitudes, behaviors, and objectives of their clients and constituencies. At this moment, the “active versus passive” debate is a topic of great interest to virtually all MTA members.

The investment backdrop of the 2000s

Technology, global competition, more activist central banks, sluggish growth in major economies, unprecedented low interest rates, and an ever-challenging sociopolitical and macroeconomic picture form the backdrop for today’s investment professionals. Equally daunting is the conundrum faced by asset managers related to contradictory “trends” seen since the turn of this century.

The 2000s have witnessed two of the fiercest and fastest-moving bear markets since the Great Depression. With professional and retail investors both having relatively fresh (and painful) memories of these events, a desire for risk management for investment portfolios would seem to be a given.

However, human nature being what it is, one of the longest-running bull markets in the post–World War II era has given rise to an unexpectedly high level of complacency. How else can we explain the continual barrage of news coverage on the growing popularity of passive “indexing” among many investors? Can that be attributed to the strong viewpoints expressed by Warren Buffett and Jack Bogle? To the PR machines of large institutions with a vested interest in those products? To the sentiments of some best-selling personal finance authors? Or simply to the behavioral finance concepts of recency bias (the tendency for investors to extrapolate recent results into the future) and herding (the propensity to act in the same way as the majority of other investors)?

The buzz around index investing is, of course, not “fake news.” Over the very long history of the markets, it has proven difficult for advocates of active investing to make a strong case for consistently outperforming “the market” on a pure mathematical return basis (risk-adjusted returns are another matter). The very big caveat to this is that most investors do not have 60-, 80-, or 100-year time frames as they contemplate their investment portfolio, their retirement income needs, and an investment strategy that meets their personal financial objectives. The sequence of returns is a very real issue for investors, especially those nearing or in retirement.

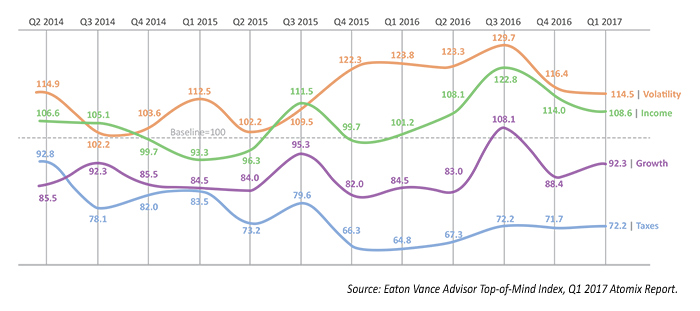

And, of course, professional and retail investors alike do have a strong stated interest in risk management for their portfolios. Survey after survey reinforces the concerns investors of all stripes (and their advisors) have regarding portfolio volatility, avoiding steep losses in any given year, and seeing their assets grow over time. According to the Eaton Vance Advisor Top-Of-Mind Index, updated through Q1 2017, while advisors’ volatility concerns have abated somewhat since the U.S. elections, “volatility remained top of mind for the sixth-straight quarter.”

FIGURE 1: TOP FINANCIAL ADVISOR CONCERNS (Q1 2017)

What is top of mind with you among these four choices?

These valid investor concerns about risk and volatility are often challenged by the two most prevalent arguments currently being made for a passive indexing strategy: (1) lower relative fees and (2) investments that “never underperform their benchmark.” Of course, active investment managers counter with the logical thought: “Who would want to mimic benchmarks that can demonstrate the potential to lose over 50% of their value?”

Two other interesting and contradictory trends provide another retail investor context for the active/passive debate:

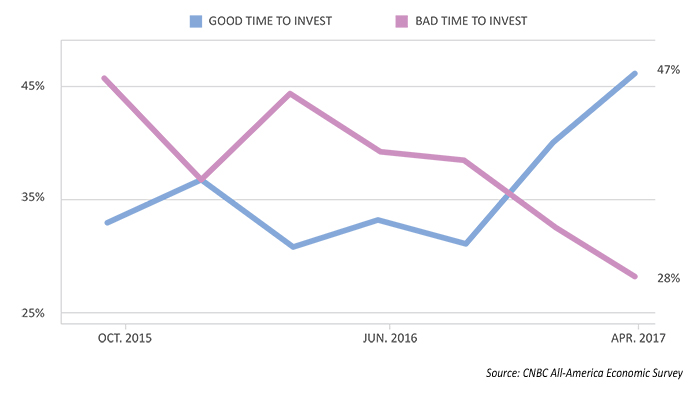

- According to a very recent CNBC poll (CNBC All-America Survey), stock market optimism is at a 10-year high. In reviewing the data on April 12, CNBC’s senior economic reporter, Steve Liesman, said, to paraphrase, “Mom and pop investors are very bullish on the stock market [the most since before the credit crisis], though that has no strong correlation to potential further sustained gains in the market. … However, their attitudes are not necessarily any better or worse as a market predictor than the attitudes of professional investors.”

FIGURE 2: RETAIL INVESTOR SENTIMENT

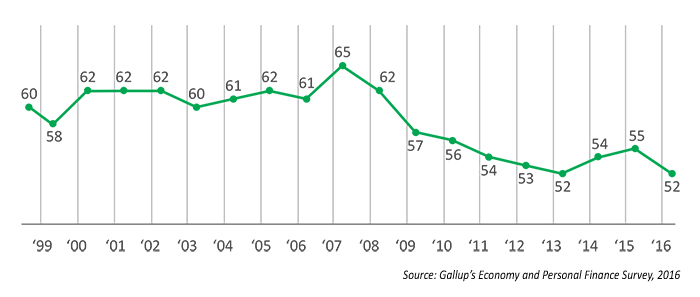

2. But while retail investors might be expressing optimism about both the market and future economic growth prospects under the Trump administration, it will be interesting to see if trends reverse this year in Gallup tracking data that has shown declining levels of stock ownership since the credit crisis.

Gallup’s 2016 survey report said, “Slightly more than half of Americans (52%) say they currently have money in the stock market, matching the lowest ownership rate in Gallup’s 19-year trend. … Though the Dow Jones industrial average has made great gains since bottoming out in 2009, Americans’ stock ownership has yet to recover to the level reported prior to the recession. … Although Americans in all income groups are less likely to have stock investments now than before the Great Recession, middle-class Americans have been the most likely to flee the market.”

FIGURE 3: PERCENTAGE OF U.S. ADULTS INVESTED IN THE STOCK MARKET

Do you, personally or jointly with a spouse, have money invested in the stock market now—either in an individual stock, a stock mutual fund, or a self-directed 401(k) or IRA?

Clearly, with American investors conflicted over feelings of bullishness on the economy and market while still deeply scarred by the Great Recession’s significant losses, the topics of risk management, proactive portfolio management, and the application of non-emotional and sophisticated analytical tools for investing should be of great interest to all investors.

So, why does the “active versus passive” debate rage on, and how should professionals be addressing it?

Investment professionals seek new tactics to gain an edge in the battle for investor assets

Almost by definition, the various constituencies represented within the MTA have their own belief systems, which generally are diametrically opposed to a purely passive (and, hence, non-risk-managed) investing approach. The CMT designation is, notably, “awarded to those who demonstrate mastery of a core body of knowledge of investment risk in portfolio management settings.”

Here is how the MTA framed the issue of “active versus passive” for its membership and symposium attendees:

“The symposium brings together top-performing investment professionals presenting an arsenal of insights intended to provide today’s active managers with the tools they need to outperform in a world increasingly dominated by low-fee, passively managed portfolios.

“New low-cost passive investing alternatives have pushed active managers towards greater efficiency and higher performance standards. Still, one notable fact often overlooked among today’s headlines is that, despite record amounts of money flowing to passive investing in 2016, approximately 60 percent of all institutional money in the U.S. stock market is still actively managed, according to Morningstar. Now more than ever, portfolio managers and analysts need industry-leading insights and tools which differentiate their practice and improve performance.

“The MTA conference for 2017 will be a tremendous resource for portfolio managers, registered investment advisers, asset allocators, strategists, traders and analysts. The symposium will explore how technical analysis is often the missing component in any actively managed investment process. Attendees will study the ETF ecosystem, market volatility variation, cross-asset correlations, data visualization methods, decision theory, machine learning algorithms, and examine the forces of Price vs. Valuation. The 44th Annual MTA Symposium will uncover practical examples of how technical analysis adds value to the portfolio management process in the context of both risk management and identifying investment opportunities.”

There is no single ‘right answer’

While many might wish that there was one silver-bullet answer to building the absolutely ideal investment process and strategic framework, the MTA symposium reinforced the exact opposite idea: There are many effective approaches to incorporating technical analysis principles and new technologies into effective, active, risk-managed strategies. Clearly, well-diversified combinations of strategies, asset classes, and different managers is an increasingly favored investment approach.

Understanding the latest trends in behavioral science, finance, and economics was a key theme that struck home with many attendees. As one sage presenter remarked, “What is technical analysis, after all, than the analysis of humans acting in the markets? Points of resistance and support, to give one simple example, are nothing more than the reflection of traders’ and investors’ prior actions regarding price.”

Sticking with this behavioral theme as it pertains to the “active versus passive” debate, there are usually few absolutes when it comes to human behavior or investment strategy. I think many strategists, portfolio managers, and financial advisors might well agree with the sentiment expressed recently by the Wells Fargo Investment Institute (as reported by MarketWatch)—no matter how far one leans intellectually toward one side or the other:

“We believe the active/passive debate does not yield a clear-cut winner. In our view, both strategies can be utilized together to help maximize expense reduction without fully eliminating the investment opportunities offered by active managers. … Active managers may outperform their passive peers in the latter part of a recovery, where we believe this recovery may be.”

Editor’s note: Many thanks to the management team of the Market Technicians Association for the permission to quote from their symposium materials.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.