Apple Inc. (AAPL) reported earnings after the bell on October 27, and CEO Tim Cook called the financial results for its fiscal 2015 “Apple’s most successful year ever, with revenue growing 28% to nearly $234 billion.”

The company posted fiscal Q4 revenue of $51.5 billion and quarterly net profit of $11.1 billion, crushing the year-ago quarterly figures of $42.1 billion in revenue and net profit of $8.5 billion. According to the earnings release, earnings-per-share growth was 38%, and Apple “returned $17 billion to our investors during the quarter through share repurchases and dividends, completing over $143 billion of our $200 billion capital return program.”

Wall Street took a generally favorable view of the report, sending AAPL shares up 4.1% the following day, and Apple shares briefly traded above $120 over the next few days. The stock suffered along with the overall market and tech sector during the volatility of August-October, and market watchers are speculating it may be poised to make another attempt at firmly breaking through the $130 level that provided a ceiling on four occasions in 2015.

Barron’s last weekend quoted a research note from equity analysts at Drexel Hamilton that took a very optimistic view of the stock’s future prospects:

“In our view, Apple remains one of the most undervalued technology stocks in the world (at just nine times our calendar-2016 EPS estimate, ex-cash) and is positioned better than ever to capitalize on the growth of the mobile Internet. Our 12-month price target of $200 is based on 17 times our 2016 EPS estimate.”

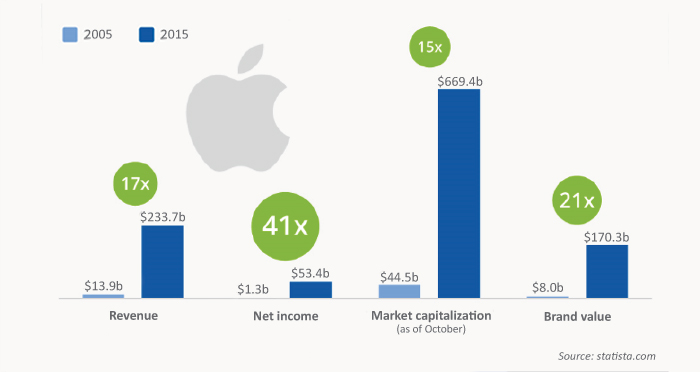

Based on Apple’s continued amazing growth of core products and continual innovation, this projected share price appreciation of over 60% may not be so radical. Research firm Statista says Apple’s net profit of $53.4 billion was “more than any other company in corporate history had made in a single year.” The previous record of $45.2 billion was set by ExxonMobil in 2008.

They further stated, “Apple’s growth over the past decade, largely fueled by the blockbuster success of the iPhone, has been truly remarkable. As our chart illustrates, the company’s profits have increased more than 40-fold since 2005, helping Apple to become the biggest brand and the most valuable company on the planet.”

WHAT A DIFFERENCE 10 YEARS MAKES

Apple’s revenue, net income, market capitalization, and brand value in 2005 and 2015