The problem with pie charts

Relying on 30-year-old asset-allocation models makes little sense in today’s investment environment.

“Tactical,” “strategic,” “active,” “passive”: These are all somewhat nebulous terms that financial advisors use expecting the general investing population to appreciate their significance. How can an investor possibly ascertain which approach is best when there is so much long-standing debate among investment professionals?

Like any good debate, this topic can be influenced by personal, deep-rooted biases. If one believes that rules-based and/or mathematical formulas will not outperform the market, and if one has developed and marketed a business plan in accordance with this belief, then those biases will frame his or her arguments.

But there is another side to the story.

“Lies, damned lies, and statistics” is an adage popularized by Mark Twain. The gist is that all of us can creatively set parameters for a statistical analysis to support a position. This creative licensure is ever prevalent in the world of investing. By way of example, passive investors who seek to replicate an index can boast that their returns in the last five-to-seven years have outpaced the performance of many active managers. However, if the period were modified to include 2008 performance results, different conclusions could be reached.

The framework for this discussion is whether allocating “strategically” to a classic pie-chart model—which is by definition somewhat “passive”—is better than investing through a more “tactical” and “active” methodology.

An aging asset-allocation model

The approach that has dominated the investment world for at least a generation is a diversified asset-allocation model based on variations of the pie chart. Based on the answers to basic risk-tolerance questions, investable dollars are allocated in defined percentages typically into only two general asset classes—stocks and bonds—and then further segregated into subcategories of these two asset classes. For equities, this usually means classifying the stock universe along broad parameters such as large and small caps, U.S. and foreign, growth and value, and so on.

When these models were originally introduced, the world looked and acted very differently. For one thing, the world pre-Internet was much less connected. Moreover, emerging markets were far more distinct from the developed world. There was much less cross-border trade between continents, and this resulted in greater negative correlation between markets and pieces of the “pie” on the asset-allocation model.

A passive asset-allocation model can work quite well in a bull market. Investor ignorance can be blissful. However, when markets recede or mean-revert, especially in an Internet-linked world, asset classes that were negatively correlated can become positively correlated, and the diversification of the pie-chart allocator actually becomes “diworsification.”

Multiple issues with passive allocation

While “life” is a noun, “live” is a verb. Life is active and it evolves. Technological advancements evidence this evolution. Yet, today’s pie-chart allocator doesn’t look much different from the model used before the Internet’s mass adaptation and the leaps in computing technologies.

“When these models were originally introduced, the world looked and acted very differently.”

For investors with a time horizon of decades before liquidity is needed, the pie-chart approach might work just fine. However, this is an unlikely scenario. The current economic and geopolitical environments need to be taken into consideration when determining when and how to invest. By definition, a static pie chart ignores current conditions.

It may be considered “strategic,” but it is fairly passive. Even if an investor’s time horizon is lengthy before needing liquidity, most investors significantly underperform benchmarks because the pain from loss is too powerful of an emotion to rationally contain. The power of negative compounding is greater than the magic of positive compounding, making it unrealistic that most investors will remain committed to the percentages in the pie chart, even if the need to do so is intellectually understood.

Economics is part science and part psychology. It is impacted by human behavior and sentiment. Positive market momentum can raise the values of both good and bad stocks. And, negative momentum can lead to overreactions, fear, and panic, which distort markets. If markets were always efficient and rational, they would not experience booms and busts. Determining market percentages and rebalancing back to those predefined percentages regardless of market behavior seems counterproductive and irrational.

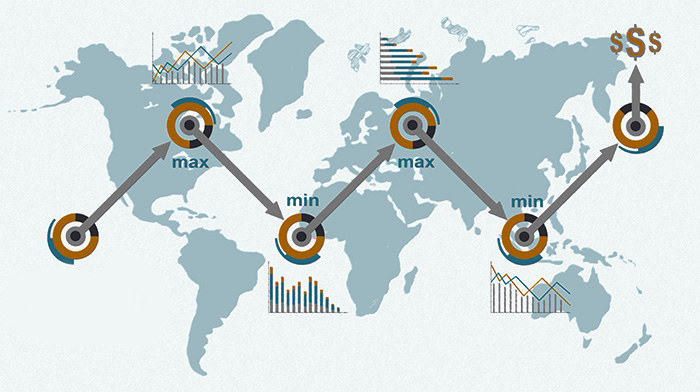

Another issue with static models is that they ignore the continuum of market cycles. During economic contractions, it makes sense to tactically allocate to more defensive sectors, to cash, or even to an inverse position on the markets.

As the economy demonstrates signs of early-stage and then late-stage recovery, certain sectors should be favored and rotated. The tactical use of leveraged strategies might be appropriate during strong bull market trends.

Furthermore, the market has allowed the bond component of the pie-chart models to remain relatively static over the last 30 years because interest rates have consistently declined from the high rates prevalent in the early 1980s. Now that the market is operating in an environment of historically low interest rates, irrespective of whether they are real or contrived, it is inevitable that the trend will reverse. A rising-interest-rate environment after such extended low levels may wreak havoc on models that have rarely confronted such a phenomenon.

Active management offers an evolutionary strategic approach

Duplicating benchmarks is fine in strong markets, but simple math dictates that minimizing losses during steep corrections is far more important. Compounding can work its magic best when it does not have to overcome periods of severe portfolio drawdown, which inevitably occur over market cycles.

Allocating with an eye to current market conditions requires one to invest tactically, on an active basis, utilizing multiple asset classes. The harnessing and sophisticated use of computing power is now at the fingertips of active managers—for creation of models, for strategy backtesting, and for algorithm-based indicators and tactical trading systems. Active management helps eliminate the bias of emotion-based investing decisions, encouraging investors to stay the course when appropriate and move out of harm’s way when needed. Active management plays offense and defense.

While taking responsibility for actually navigating markets might be intimidating, it is hard to argue with the logic of active management. Which makes more sense: loading a client into a prefabricated, static investment model or utilizing the most sophisticated active strategies attuned to the current market environment? The choice seems simple to me.

Editor’s note: This article first published in Proactive Advisor Magazine on June 19, 2014, Volume 2, Issue 11.

![]() See Related Article: They’ve got it backward!

See Related Article: They’ve got it backward!

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in the Baltimore, Maryland, area. www.gannpartnership.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The opinions expressed in this material do not necessarily reflect the views of LPL Financial. Securities offered through LPL Financial, Member FINRA/SIPC.