Why advisors should target the 403(b) market

Why advisors should target the 403(b) market

By educating employees in tax-exempt plans about the self-directed brokerage account option, advisors have the opportunity to deliver sophisticated, risk-managed, active strategies within nonprofit retirement plans.

While 403(b) plans—as well as 401(a) plans and 457 deferred-compensation plans—historically offered more limited investment choices than 401(k) plans, they’ve recently begun offering a broader array of investment options. Moreover, if the plan sponsor allows participants to have a self-directed brokerage account (SDBA), participants can choose investments based on the recommendation of their own personal wealth advisor.

This can be a bonanza for advisors in the active management space, experts say. “The self-directed brokerage account option is a huge opportunity,” says one prominent investment manager. “There’s over $7 trillion in assets from 401(k)s and 403(b)s that you can manage now that maybe you didn’t know you could manage before.”

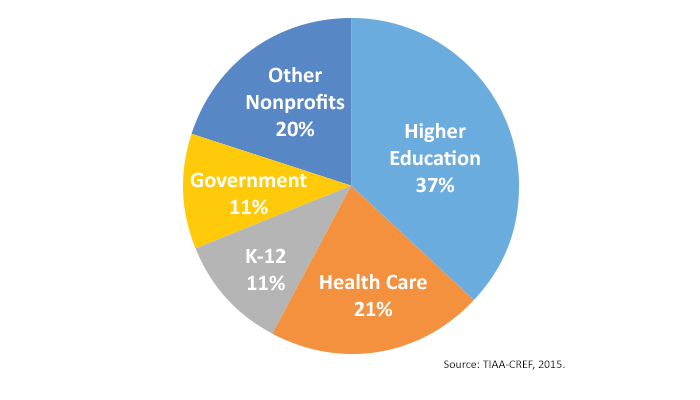

According to a 2015 TIAA-CREF white paper, 403(b) plan assets are expected to grow to $1.8 trillion by 2018. Almost half of these assets are found in the educational market, with health care the next largest sector.

FIGURE 1: 403(B) RETIREMENT PLAN ASSETS BY SECTOR

Educating company employees about self-directed brokerage accounts

Reign Benefits Consulting in Overland Park, Kansas, specializes in working with clients who have access to an SDBA option within their employer-sponsored plan—whether it be a 401(k), 403(b), 401(a), or 457 plan. “Our experience tells us that these individuals are usually not aware that they have more investment options within their plans in addition to the core fund lineup offered by the employer and the plan sponsor,” says Bart Spachek, founder and director of Reign Benefits Consulting. “Once we educate them on this SDBA option, we further educate them on access to actively managed strategies within this option.”

Self-directed brokerage accounts within these plans are becoming more popular, and much of that “has to do with fiduciary responsibility,” he says. To carry out that fiduciary responsibility, the plan provider, the investment company, and the employers offering these plans have to approve what mutual funds are available to employees, Spachek says. But when plan participants choose the SDBA option and manage on their own, all of the fiduciary responsibility is transferred to the plan participant. If they want assistance via third-party money managers, then the advisor takes fiduciary responsibility.

John Fitch, Reign Benefits’ director of advanced planning, says that more employers are choosing to provide the SDBA option after a number of lawsuits were filed regarding employer-sponsored retirement plans. In these claims, the plaintiffs alleged that the companies weren’t taking a consistent look at the core mutual fund lineup, or they were using proprietary funds that unduly benefited the plan provider.

“It appeared that they weren’t taking fiduciary responsibility—they were more interested in utilizing an approach of ‘what is in our best interests may not be in the employee’s best interest,’” Fitch says. “The Department of Labor is now taking a greater look at fiduciary responsibility.”

The team at Reign Benefits first educates workers that the SDBA option within their plan exists, “because it’s the part of the plan that no one has typically ever talked about before,” Spachek says.

Educating employees in these plans about active management

The second step is educating employees that they can use active management within this type of account, Fitch says. The first task of an advisor is to determine the risk profile of a client—to find out where he or she falls along the spectrum between conservative and aggressive. Advisors can then put together a strategic approach for clients that fits the kind of risk-return equation they are hoping to achieve, with actively managed strategies potentially playing a major role.

The second step is educating employees that they can use active management within this type of account, Fitch says. The first task of an advisor is to determine the risk profile of a client—to find out where he or she falls along the spectrum between conservative and aggressive. Advisors can then put together a strategic approach for clients that fits the kind of risk-return equation they are hoping to achieve, with actively managed strategies potentially playing a major role.

“We also go a step further in many situations,” Fitch says. “For instance, if a hospital offers a 457 plan, we educate plan participants that if the hospital has potential financial or solvency issues, that 457 could be at risk to the participant in the sense that the hospital could ‘recapture’ the contributions and use them for the benefit of the hospital. Does the participant want to put a lot of their money into this type of plan, or should they utilize a taxable account?”

Likewise, a growing concern for teachers and other employees in school districts today is a potential pension crisis, he says. The team at Reign Benefits educates such workers about underfunded pensions and whether should they be contributing more to retirement through other investment options, as opposed to relying solely on a pension.

“In addition, many teachers tend to be more conservative with their investments, and many assume all active management is an aggressive strategy,” Fitch says. “We further educate them on the various risk profiles of strategies, and a conservative approach can certainly be used. Again, with all of our clients, including teachers, it is an educational process, and then they let us know what is important to them.”

The team also educates clients on the difference between the buy-and-hold approach versus active management through a defined investment process, identifying market trends and adjusting the funds held within the SDBA in 403(b) plans based on given economic and market conditions, Spachek says. “There are some pretty stark differences, and clients typically appreciate learning about those differences,” he says.

The firm does not manage the investments within these accounts by having full discretionary authority, but instead uses third-party investment managers in order to use strategies that can read and react to market conditions, Spachek says. “There are many advisors who don’t have access to this type of actively managed portfolio approach, and we will occasionally receive referrals from them, in addition to referrals from clients,” he says.

Finding the right employer-sponsored plans to target

Johnathon T. Davis, a financial advisor at JT Davis Asset Management, LLC, in Lexington, Kentucky, says that he’s successful in this space because he targets the plans themselves, and not specific workers within the plans.

Johnathon T. Davis, a financial advisor at JT Davis Asset Management, LLC, in Lexington, Kentucky, says that he’s successful in this space because he targets the plans themselves, and not specific workers within the plans.

“When I got back into advising eight years ago, 96 of my first 100 clients all worked at the same place,” Davis says. “I didn’t know them personally beforehand, but I knew what they had as a plan and how, after assessing their objectives and financial situation, I could likely satisfy their investment needs. Importantly, I also knew that their employer allowed for automatic fee deduction, which meant I wouldn’t have to continually bother them to get paid, or justify every month why they are writing a check. I could just advise them objectively. It put the client and our firm on the same side of the table.”

The primary differences between the 403(b) plans of different employers lie not so much in the structure of the plans themselves, but rather the committee or internal administration’s interpretation of the rules of engagement, he says.

“Be cognizant if you are dealing with an entity that is very controlling,” Davis says. “Follow their rules to the letter if you want to continue to work with their people. It can actually serve as a positive barrier to entry if you can gain trust as they are pushing others out.”

He recommends that advisors focus their prospecting on two or three large plans and learn the peculiarities of each plan. Most of the major RIAs keep informal lists of plans that are friendly to advisors who adhere to the active management philosophy.

“The self-directed brokerage account option is a huge opportunity,” says one prominent investment manager.

“Go where they allow in-service management and automatic fee deduction and talk to those people,” Davis says. “Make friends. Become an advocate. Get referrals. A good advisor should close eight out of 10 people he or she sits down with for in-service active management. They wanted to see you for a reason. Do not chase lukewarm people. There is very little competition in this business right now. Most people want someone else to manage their plan.”

Joseph Petry, a financial advisor at CPR Investments LLC and Ausdal Financial Partners in Latham, New York, says that he works with state employees who have opted for the self-directed brokerage account within 457 deferred-compensation plans, as well as educators with 403(b) plans. As a former educator, most of his business comes from word of mouth and referrals.

Petry, whose firm often uses the strategies of third-party managers, says that tactical management is becoming much more popular and something people in these types of plans are increasingly asking about. As they get more educated about tactical active management, more employers are changing their plan documents to allow it to happen.

“Tactical management is not just buying and holding. You can have a particular strategy be fairly aggressively positioned in the stock market on Monday, but if a negative jobs report comes out Friday that could impact the market, they could move over time to a lower exposure level or even to cash,” he says. “So tactically managing these portfolios lets clients be in the stock market sometimes, but not always in the stock market.”

“Tactical management is not just buying and holding. You can have a particular strategy be fairly aggressively positioned in the stock market on Monday, but if a negative jobs report comes out Friday that could impact the market, they could move over time to a lower exposure level or even to cash,” he says. “So tactically managing these portfolios lets clients be in the stock market sometimes, but not always in the stock market.”

Education is the key, and Petry reminds his clients that the market “does not always go straight up.” “Everyone’s goal is to make money and not lose it,” he says. “Clients say, ‘I want to make 10%, never lose, and have little to no risk.’ Me too! But, of course, all investments carry some level of risk. The key is how that risk is potentially mitigated through actively managed strategies.”

Petry also lets his clients know that they can add leverage and short strategies to their portfolios, if those are strategies appropriate to their investment plan. “Clients are shocked to learn that some strategies actually were positive in 2008. I once met with a potential client who had a sizable amount of money in a 457 plan and was 100% in cash, proud that he never lost a penny in 2008,” he says. “I showed him what his account might have been had he gotten back in the market over the past several years. He was very interested, and when we conducted a thorough review of his goals, risk profile, and investment objectives, he saw the benefits of having an account where actively managed strategies could be employed.”

The benefits of delivering actively managed strategies for 403(b)s

In broad terms, targeting 403(b)s and other types of nonprofit retirement plans can allow an advisor to do the following:

- Provide additional retirement investment options for current clients.

- Gain a prospecting opportunity for new clients in targeted nonprofit sectors.

- Pursue a unique business and revenue growth opportunity.

The employers that offer these types of plans typically have large workforces, which can serve as an additional network of referrals for advisors.

In addition, by helping clients use the SDBA option that is already a part of their 403(b) plans, advisors can provide them with an actively risk-managed separate account within their current plan. There is no need to recommend a rollover or in-service distribution, and advisors do not have to wait until clients retire.

Actively managed strategies are designed to respond to changing market conditions to help preserve capital growth, assist clients in avoiding the temptation to buy high and sell low, and smooth out the volatility of the market while still providing performance. Active managers can employ a wide selection of asset classes and have both income and growth strategies available. This can be a welcome investment framework for many clients, especially those over the age of 50 who are concerned with capital preservation as they begin considering their financial and income needs in retirement.

The opinions expressed in this article are those of the author and the interviewed advisors and do not necessarily represent the views of Proactive Advisor Magazine or organizations associated with the author or advisors. These opinions are presented for educational purposes only.