“Friday’s job report was supposed to give key figures to investors, to more properly assess chances of a rate hike in September. Instead, numbers added even more uncertainty: 150K new payrolls in August were below average consensus (190k), well below bullish stances (220–230) but definitely not bad enough to completely remove the hypothesis of a move in September.”

While the U.S. employment situation looks to still be on a fairly positive track, the Fed’s rate hike decision remains tricky given slowing growth in the U.S. and abroad. FXStreet remarked:

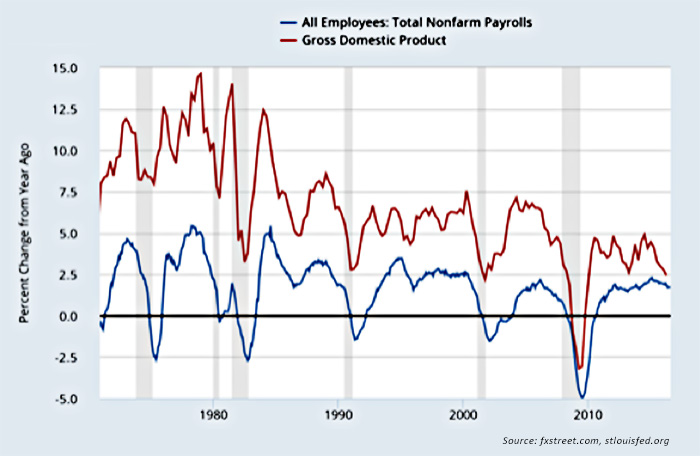

“…since the U.S. economy is growing at the slowest pace since almost three years [ago] (Actual: 1.2%, Forecasted: 1.8%), it is highly probable that [the] job market will lose track accordingly, receding albeit marginally from its status [as] a fully employed economy. In addition, recent leading economic data in the U.S were modest to weak, [and] the IMF revised down economic growth estimates. … In such an uncertain global scenario, all relevant central banks are engaging in additional rounds of monetary stimulus (Australia, Canada, United Kingdom, Japan, New Zealand, ECB and Japan), and the remaining are ready to intervene, if necessary.”

FIGURE 1: U.S. TOTAL EMPLOYMENT VS. GDP GROWTH RATE

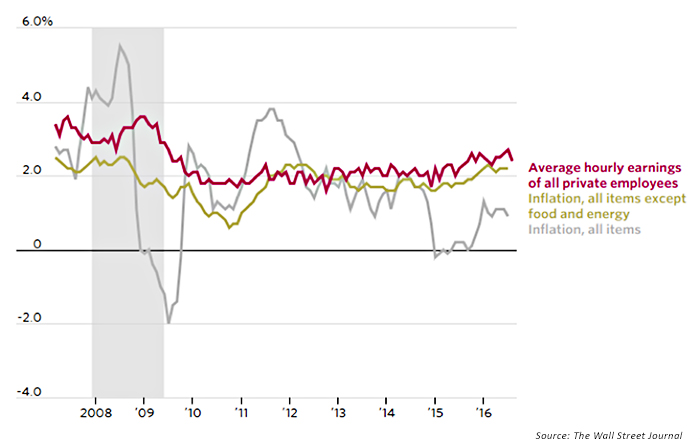

The Wall Street Journal notes that, “Key to the rate debate inside the Fed will be an assessment of how much slack remains in the labor market.” They point out that while incremental additions to the U.S. workforce may naturally be harder to come by with an unemployment rate below 5%, the pace of growth in worker wages remains slow: “Average hourly earnings for private-sector workers rose 0.1% last month and 2.4% from a year earlier in August—a slowdown from July’s 2.7% annual gain, which was the best in seven years. The slower growth in part reflects strong August hiring in low-wage fields.”

FIGURE 2: EARNINGS STEADILY, ALBEIT NARROWLY, OUTPACE INFLATION

Change from a year earlier

Fed Chair Janet Yellen, in her remarks on August 26 at the Jackson Hole symposium sponsored by the Federal Reserve Bank of Kansas City, left the door open for a Fed rate hike in any of the upcoming 2016 FOMC meetings:

“Looking ahead, the FOMC expects moderate growth in real gross domestic product (GDP), additional strengthening in the labor market, and inflation rising to 2 percent over the next few years. Based on this economic outlook, the FOMC continues to anticipate that gradual increases in the federal funds rate will be appropriate over time to achieve and sustain employment and inflation near our statutory objectives. Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.”