A ‘living in the moment’ guide to investing

A ‘living in the moment’ guide to investing

While active portfolio management draws upon history for the basis of each strategy, it is continually focused on what is happening now.

Recently I was speaking to a friend about some of the more memorable celebrations in our lives. I had to put on that list the year that our family visited New York City’s Times Square to witness firsthand the famous ball drop and the overwhelming crowd scene.

But in thinking about it, what impresses me the most about New Year’s Eve is not the partying; it’s the hour-by-hour progression of the celebration, starting at the international date line somewhere east of New Zealand. As midnight is reached around the world, the crowds roar and the fireworks explode. An hour later it repeats—Auckland, Sydney, Tokyo, Bombay, Moscow, Berlin, Paris, London, New York, Los Angeles, and, finally, Honolulu.

For the 10-second countdown to midnight, and maybe a few seconds more, the people in each time zone are truly living in the moment.

Why’s that important? Since the beginning of recorded history, living in the moment has been valued. In Buddhism it’s said that “being mindful of the present is the key to happiness.” And according to Matthew 6:34, Christ said, “So do not worry about tomorrow; for tomorrow will care for itself.”

The Romans had their “carpe diem,” as they taught their young to “seize the day.” Our own Henry David Thoreau counseled, “Live in the present, launch yourself on every wave, find eternity in each moment.” His contemporary historian and author, Alice Morse Earle, wrote, “The clock is running. Make the most of today. Time waits for no man. Yesterday is history. Tomorrow is a mystery. Today is a gift. That’s why it is called The Present.”

Recent studies have confirmed that we are happiest not when our mind is wandering, contemplating the past or future, but rather when it is focused on the moment.

Matthew Killingsworth, a Robert Wood Johnson Foundation scholar, Harvard graduate, and Ph.D. in psychology, created a project to measure and quantify the causes of happiness in real time using a smartphone app (www.trackyourhappiness.org). He has written, “We developed a smartphone technology to sample people’s ongoing thoughts, feelings, and actions and found that people are thinking about what is not happening almost as often as they are thinking about what is, and found that doing so typically makes them unhappy.”

I must say that while I agree with all of this, I’ve lived my life very differently. I’ve tried to balance my life with a healthy regard for the lessons of the past, have always planned for the future, and tried to make the most of the opportunities of the present. Yet, as I watched midnight occur across the globe this year, I realized that one of my lifelong passions was indeed governed by the philosophy of living in the moment.

Active management is all about living in the moment. While it also draws upon history for the basis of each active strategy, it is continually focused on what is happening now. Active management strategies cannot see into the future; they can only seek to realize what the present provides. They are based on the probability of favorable outcomes and seek each day to profit from them.

Buy-and-hold investing does not have much relationship to the here and now. You buy and wait. You invest and hope. Rather than seeking to profit from what’s happening in the present, buy-and-hold investing considers the present—the moment—irrelevant.

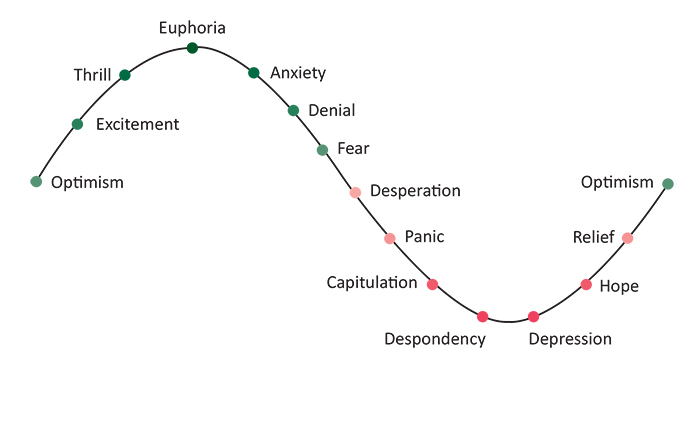

Yet, we know from experience that even if active strategies do not return more to investors over a given period, what happens each day is relevant to even the buy-and-hold investor. Every financial market goes through peaks and valleys. Investors get euphoric, and they also get despondent.

The cycle of market emotions

When stock prices fall day after day, when the percentage of the daily decline moves from decimals to single and then to double digits, even the most ardent of buy-and-hold investors has had second thoughts. Many have abandoned the approach, and their investments, at the very worst time—near the bottom. They begin to live in the moment, and it becomes very relevant.

When the market puts in a fast 5%-10% decline after several months of bullish action, it’s easy to understand the fear. Fear comes from our past, but it can influence our actions in the present and our plans for the future. It clouds our judgment.

But we can use the power of computers to test active strategies in advance. And we can use them to track and carry out high-probability trades in the present. Fear does not enter the picture or cloud their view of the present.

History shows that when the market is in a strong uptrend, it does not pay to try to time the short-term trends. It is a time when taking some short-term pain can be profitable in the intermediate term. Just as we saw periodically in 2014, corrections will come and go, but there is no evidence that the bull market is over as yet. The primary trend remains positive, and most indicators are still pointing to higher prices in the intermediate term.

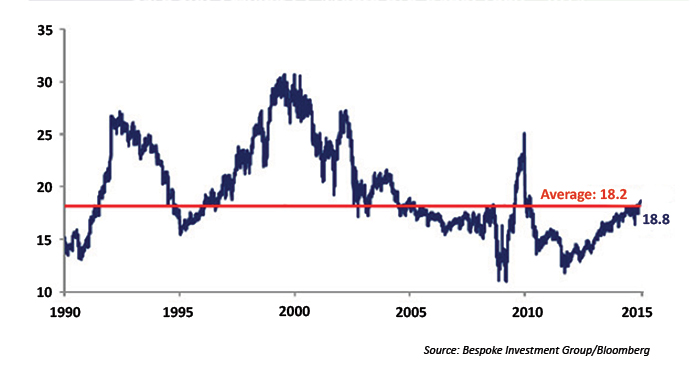

While stocks are not undervalued, it is noteworthy that price-earnings (P/E) ratios (the generally accepted measure of valuation) are about the same today as they were a year ago, even though the S&P 500 grew by over 10% in 2014. Why? Because earnings have been growing at similar double-digit rates, keeping P/E multiples in check. As the chart indicates, the S&P 500’s trailing 12-month P/E ratio is only slightly higher than the average for the last 24 years.

S&P trailing 12-month P/E ratio: 1990-2015 (YTD)

Living in the present may promote happiness, but it does not guarantee it in the short term. Responsiveness is an advantage that active management has over the buy-and-hold approach in most markets, but when a bull market is identified, it usually pays to give the primary trend the benefit of the doubt until proven otherwise.

Investors using active strategies for the first time have got to shrug off the buy-and-hold mindset. I know you have seen your buy-and-hold investments in the past rise to new heights and then be dashed when a major bear market arrives on the scene. And in the past you have had to simply hold and hope for a recovery.

But as active investors know, each strategy has high-probability trading parameters that can move your investments to safety when the historically tested sell parameters are met, rather than when fear is at a maximum. It’s all about living in the present and not fearing the actions of the past or worrying about the future.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com