At the close last Friday, the equity markets finished what many analysts are calling “the worst 10-day start to a year—ever!”

That seems a little hard to believe, as the Dow Industrials (DJIA) and S&P 500 (SPX) were both “only” down about 8% for calendar year 2016—although the NASDAQ Composite (COMP) lagged the other major indexes with a 10% loss. However, several markets have already entered bear market territory, with the Russell 2000 22% lower than June 2015 highs and the EURO STOXX 50 Index down 23% from April’s peak (both as of 1/16/16).

While investors are wondering when the selling streak will slow down, Fed-watchers are speculating that the pace of 2016 rate hikes may be lower than the FOMC is currently telegraphing. With oil still in a tailspin, recent U.S. economic data showing weak spots, and China’s problems looming large (despite the recent announcement of a liquidity infusion), fear of recession has gained prominence in the discussion of more bearish analysts.

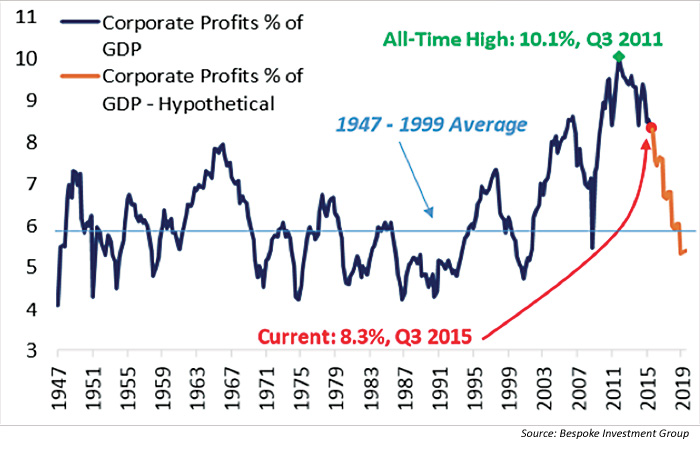

CORPORATE PROFITS AS % OF GDP SINCE WW2

The Q4 2015 earnings season so far has done little to offer real encouragement. MarketWatch wrote on Monday of this week, “The prospect of four straight quarters of earnings declines is staring investors in the face on top of the worst multiweek selloff for stocks in years. … Total earnings for the S&P 500 in the fourth quarter are expected to decline from the previous year, even factoring that Wall Street’s forecasts have been lowered. … Plus, current-quarter earnings estimates have taken a notable downturn in the past week. First-quarter 2016 earnings for the S&P 500 are expected to decline from the year-ago period by 0.6%, compared with estimated growth of 0.9% at the beginning of the quarter, according to FactSet data.”

Bespoke Investment Group is not predicting recession, but cites concerns over the rapid drop in corporate profits. They say, “Corporate profits were actually down 8.2% year-over-year in nominal terms through Q3 of 2015—that’s the worst print since 2008.”

The Wall Street Journal was a little more upbeat in its analysis over the weekend, summarized by the statement, “Worries about slowing global growth have plagued stocks for months, but many analysts have maintained that the U.S. economy is relatively healthy and that recent declines in the stock market should stabilize.”

Bespoke notes (see chart) that although corporate profit growth is slowing down significantly, the increases in company margin ratios over the past several years will still help maintain a relatively healthy profit outlook from a historical perspective: “Assuming nominal GDP growth of 3% per year going forward (four quarter average year-over-year change is 3.6%, so we feel this is fair), and profit shrink of 8.2%, corporate profits will still be above their 1947–1999 average until 2019!”