Soft landing, hard landing, or ‘no landing’ for economy?

In recent comments, Jerome Powell continues to cite moderate strength in the overall U.S. economy, while pointing to the impact of slow progress in further reducing the rate of inflation.

According to CNBC,

“Federal Reserve Chair Jerome Powell said Tuesday that the U.S. economy, while otherwise strong, has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon. …

“‘More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,’ the Fed chief said during a panel talk.”

The Fed’s Beige Book, released last week, said the U.S. economy has “expanded slightly” since late February, Bloomberg reported. However, “firms reported greater difficulty in passing on higher costs.”

Many analysts question whether the U.S. will face some form of recession—either mild or severe—which typically follows aggressive rate hikes by the Federal Reserve.

Strategist Stephanie Pomboy at Macro Mavens is among those who firmly believe that a significant recession will occur, says Business Insider:

“‘We are not going to avert a hard landing,’ Pomboy said in a recent interview with Rosenberg Research. ‘I think that this notion that the Fed could raise rates in record speed and magnitude on an economy, toting record leverage without economic or financial incident, is laughable.’

“While some commentators have rolled back their recession calls, US consumers already look to be suffering from a downturn, Pomboy said. Retail sales have ‘gone nowhere for two years’ and are already in recession territory when adjusted for inflation, she noted.

“The consumer recession could soon be followed by a nosedive in corporate earnings, given that the full impact of Fed’s rate hikes has yet to play out in the economy. That will hit firms with higher borrowing costs at a time when profits already look poised to weaken, Pomboy said.”

(Editors’ note: The advance estimate for Q1 2024 GDP was released by the Bureau of Economic Analysis on April 25, following publication of this article. Q1 increased at a 1.6% annualized pace, well below the 2.4% consensus forecast. Additionally, reports CNBC, “The personal consumption expenditures price index, a key inflation variable for the Federal Reserve, rose at a 3.4% annualized pace for the quarter, its biggest gain in a year.”)

Is a ‘no landing’ scenario a possibility?

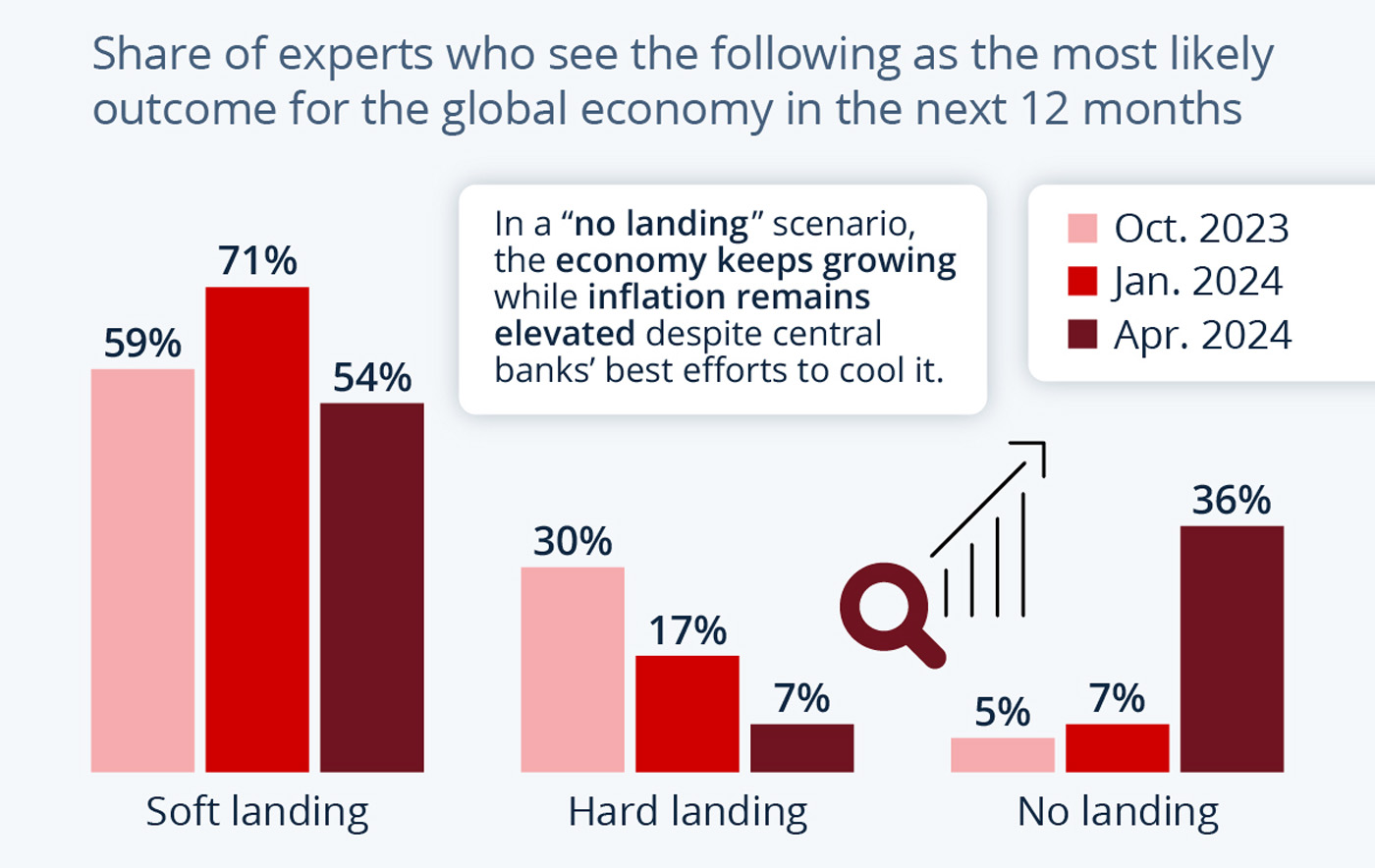

Data analyst firm Statista recently provided the following interesting analysis of market opinion on the range of potential economic outcomes:

“After there’s been a lot of talk about a so-called soft landing, i.e. successfully bringing down inflation towards its target without plunging the economy into recession, the U.S. economy’s continued strength along with some hotter-than-expected inflation readings has given rise to a new buzzword, the ‘no landing’ scenario.

“As opposed to a soft landing explained above and a hard landing, which describes bringing down inflation at the cost of a sharp drop-off in economic activity and a significant rise of unemployment, a ‘no landing’ scenario describes an outcome where robust economic growth coincides with a failure to bring down inflation despite the Fed’s or any other central bank’s efforts to cool it.

“According to Bank of America’s Global Fund Manager Survey, which gauges the sentiment of approximately 300 institutional, mutual and hedge fund managers around the world on a monthly basis, such an outcome for the global economy is now considered significantly more likely when looking at the next 12 months than it was at the beginning of the year.

“In April, 36 percent of respondents saw a ‘no landing’ as the most likely scenario for the next 12 months versus just 7 percent in January. At the same time, the dreaded ‘hard landing’ is no longer considered a likely outcome for the vast majority of fund managers amid strong economic readings in the United States and internationally, which have eased recession fears but also dashed hopes of imminent rate cuts from central banks across the globe.”

STUBBORN INFLATION FUELS FEAR OF ‘NO LANDING’ SCENARIO

Note: Based on monthly surveys of roughly 300 institutional, mutual, and hedge fund managers around the world.

Sources: Statista, Bank of America Global Fund Manager Survey

RECENT POSTS

SUGGESTED ARTICLES