Big names such as Macy’s, Nordstrom, and J.C. Penney, and specialty retailers such as Urban Outfitters, took huge post-earnings hits. The earnings parade for retailers was far more positive this week, with Walmart, Home Depot, and TJX all reporting robust sales numbers on Tuesday. However, the outlook for Q4 does not look promising, says MarketWatch: “Out of the 17 companies in the sector that have provided a fourth-quarter earnings outlook, no company has forecast one that is above FactSet’s consensus estimate”.

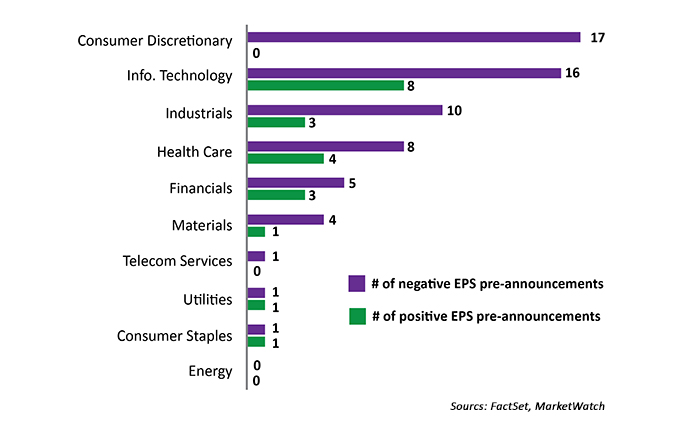

NUMBER OF COMPANIES WITH POSITIVE & NEGATIVE GUIDANCE

The continuing overall weakness in 2015 consumer spending has been a theme frustrating many economists and analysts. The significant drop in oil prices and resulting decreases in home energy costs and gasoline prices at the pump prompted expectations that those savings would flow to retail spending. Lack of significant wage growth and uncertainty over the economy are the two most frequently cited counterbalancing factors.

Whatever the cause and effect, Barron’s reported that overall retail spending disappointed again last week, with the headline October number rising just 0.1% when growth of 0.4% was expected. For the year, the Dow Jones industry subsector of Clothing & Accessories is down 21.3% through the end of last week, and Consumer Electronics is off 19.6%. One bright spot is the Toys category, up 38% and catching energy from the Star Wars and Peanuts movie franchises. Star Wars toys and merchandising are especially hot and should pick up more steam with the December 18 movie release of “Star Wars: Episode VII—The Force Awakens.”

On an extremely sad note, our thoughts and prayers go out to the victims and families affected by the tragic terror attacks in France. From a business perspective, the combination of heightened global security, reduced travel, and the strengthening U.S. dollar will not benefit U.S.-based retailers this Christmas season. This may noticeably impact the holiday foreign tourist trade for New York City and other major U.S. metro areas. Unfortunately, France and other European nations will be facing their own tourism issues for some time.