A different kind of bear

A different kind of bear

Anticipating annual volatility and returns is always difficult. For long-term investors, the most likely way to succeed is to invest based on managing risk and probabilities, driving emotion and speculation out of the equation.

The last couple of market years have been very unusual.

2020 was one of the most volatile markets in recent history, but the S&P 500 Index finished with a positive return roughly double its annual average. 2022 was just the opposite. While there was little evidence of investor panic typical of bear markets, stocks significantly declined in value with the S&P 500 finishing the year down 19.4%.

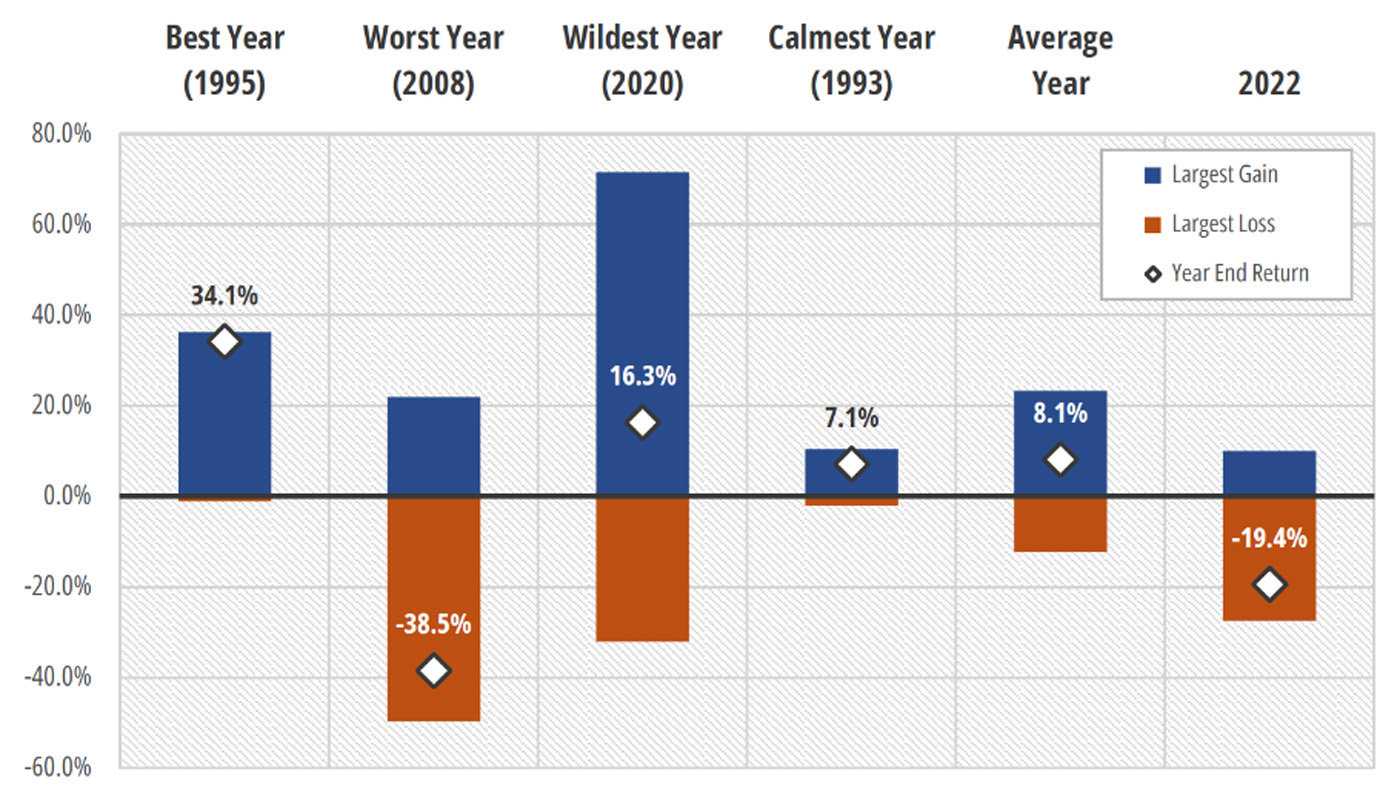

Figure 1 shows ranges of volatility, as measured by the maximum high to low intra-year index return (S&P 500) and maximum low to high return ranges, along with the year-end annual return for the last 61 years. The chart highlights the best and worst years for returns, the wildest (largest range) and the calmest (smallest range) years for volatility, and the average year over this period. Data for 2022 is located at the far right.

FIGURE 1: S&P 500 INDEX MAXIMUM RETURN RANGE AND CALENDAR YEAR RETURNS (1962–2022)

Sources: Dow Jones Indices LLC, AthenaInvest

With a range of 103.7%, 2020 was the wildest year. However, the year ended with a return of 16.3%. 2022 had a nearly average range of 37.5% but the fourth-worst return since 1962, trailing only 2008, 1974, and 2002. All three of those years occurred during bear markets and featured highly elevated volatility.

So last year’s negative return, accompanied by an average return range, distinguished 2022 as a different kind of bear.

Don’t fall for the trading game

The market decline of 2022 has turned into a stock surge during the first half of 2023, accompanied by the usual short-term volatility. Understandably, these conditions have left investors wondering what to do now. Many are tempted to take profits, pull out of the market, and wait on the sidelines.

Investment decisions by self-directed investors based on emotional short-term timing, including moving a portfolio to cash, are generally speculative in nature. However, for long-term investors whose goal is growth, adhering to a carefully constructed investment plan is usually the right course of action. While the desired results may not occur during any given day, month, or quarter, sticking with a plan dramatically improves the likelihood of a successful long-term outcome.

FIGURE 2: FREQUENCY OF POSITIVE STOCK MARKET RETURNS OVER DIFFERENT PERIODS (1927–2020)

Note: The frequency of positive returns includes reinvestment of dividends and is compounded by geometrically linking monthly returns.

Source: Fama-French Market Return Series, Jan. 1, 1927–Dec. 31, 2020

This is particularly the case for the stock allocation within a managed portfolio. Figure 2 highlights the percentage of time that stock market returns are positive for a range of rolling investment periods from 1927 through 2020. As you can see, the longer the holding period, the more likely it is to be positive. No holding periods longer than 15 years result in a negative stock market return. So emotional short-term trading in and out of stocks can significantly harm portfolio performance.

Trying to react and profit from short-term conditions are the hallmarks of traders and speculators. Getting in and out of the market often leads to significant underperformance for self-directed investors because it requires impeccable timing on both exit and reentry decisions. It also requires the emotional fortitude to sell when everything seems fine and buy when the markets are in turmoil. These behaviors are not only at odds with our nature, but they are also at odds with what it takes to be a successful investor, namely patience and discipline. Sticking with a carefully developed risk-management approach can help avoid these costly errors.

While professionally managed strategies may certainly adjust market exposure based on market conditions or choose to over- or underweight certain sectors at any given time, these moves are usually dictated by preexisting tactical “rules,” not spur-of-the-moment reactions.

Anticipating annual volatility and returns, as we saw earlier, is always difficult and even more challenging given recent extreme conditions. For long-term investors, the most likely way to succeed is to invest based on probabilities, while driving emotion and speculation out of the equation. True investors think in terms of years and decades, not days or months. Simply following an investment plan and overall portfolio strategy through all kinds of market conditions and full market cycles often delivers the best results.

Needs-based planning and a disciplined investment process are valuable tools to achieve long-term success. By separating long-term investments from short-term liquidity needs, investors can feel confident their needs will be met while giving growth-oriented investments the longer time periods necessary to reach their goals. As recent years have proven, wild markets don’t always lead to bad investment outcomes, nor do calm markets always lead to good investment outcomes.

What is going on from a behavioral perspective?

- The illusion of control leads us to overestimate our abilities to determine when to exit and enter markets. We also underestimate the true randomness and impact of world and market events. We have strong emotional urges to jump in or out or to stay on the sidelines.

- Salience bias: We tend to focus on things that are emotionally striking even though more mundane events may have a greater impact. With the ongoing fanfare surrounding the Federal Reserve and changes in interest rates, we may be missing other more important factors that haven’t yet caught our attention.

- Recency bias: We place more importance on recent events than historical events. In this case, the most recent large equity decline that occurred in 2020 quickly rebounded, so we may have concluded that 2022 would follow a similar pattern.

What can financial advisors do when working with their clients?

- Use needs-based planning to separate short- and long-term investments. This can insulate an investor’s emotions from short-term market events, while allowing long-term investments the time they need to mature.

- Build a strategy-diverse portfolio that can be resilient in a variety of market conditions and is designed for the long run. Have a disciplined, data-driven, and rules-based investment process to drive out emotional decisions.

- Use your experience through many different market environments to provide a valuable perspective and coaching that can help an investor stick to the plan and stay focused on long-term goals. Provide access to a variety of investment solutions that can be customized to client needs. Consider working in concert with third-party investment managers who can develop disciplined, risk-managed portfolio approaches.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. The information provided here is for general informational purposes only and should not be considered an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.