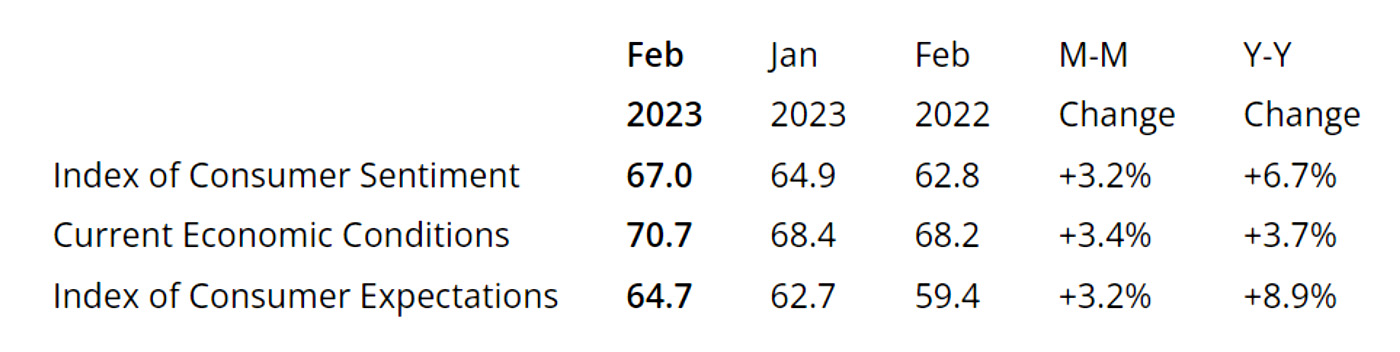

The University of Michigan’s final February reading of consumer sentiment showed a small month-to-month uptick for the third month in a row, but it is still well below its historical average.

FIGURE 1: CONSUMER SENTIMENT RECOVERING FROM 2022 LOWS

Sources: University of Michigan, Trading Economics

TABLE 1: FINAL UNIVERSITY OF MICHIGAN SURVEY RESULTS FOR

FEB. 2023

Source: University of Michigan

Surveys of Consumers director Joanne Hsu reported on the latest findings:

“Consumer sentiment confirmed the preliminary February reading, rising a modest 3% above January. After lifting for the third consecutive month, sentiment is now 17 index points above the all-time low from June 2022 but remains almost 20 points below its historical average. Consumers with larger stock holdings exhibited particularly large increases in sentiment. Overall, February’s reading was supported by a 12% improvement in the short-run economic outlook, while all other index components were essentially unchanged.

“Year-ahead inflation expectations rebounded to 4.1% this month, from 3.9% in January and 4.4% in December. Consumers continued to exhibit considerable uncertainty over short-run inflation, and thus their expectations may be unstable in the months to come. Long-run inflation expectations remained at 2.9% for the third straight month and stayed within the narrow 2.9-3.1% range for 18 of the last 19 months.”

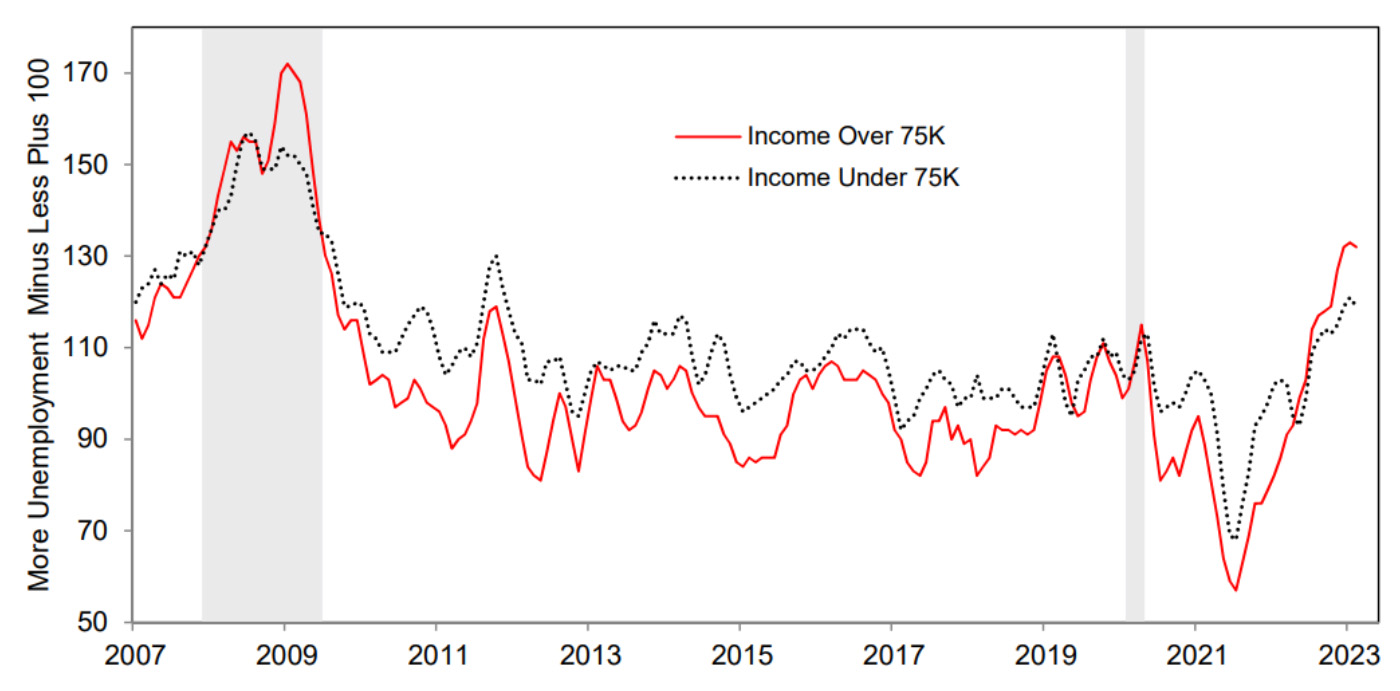

Unemployment expectations

The expected future outlook for the labor market is one area of the consumer sentiment picture that is headed in the wrong direction, according to the University of Michigan’s survey.

Wage earners at different income levels continue to see higher unemployment levels coming over the next 12 months.

FIGURE 2: EXPECTED CHANGE IN UNEMPLOYMENT DURING THE NEXT YEAR (THREE-MONTH MOVING AVERAGES)

Source: University of Michigan

It is not surprising that relatively higher-income consumers are somewhat more pessimistic about employment prospects, given recent headlines surrounding current and potential layoffs in the financial-services and technology sectors.

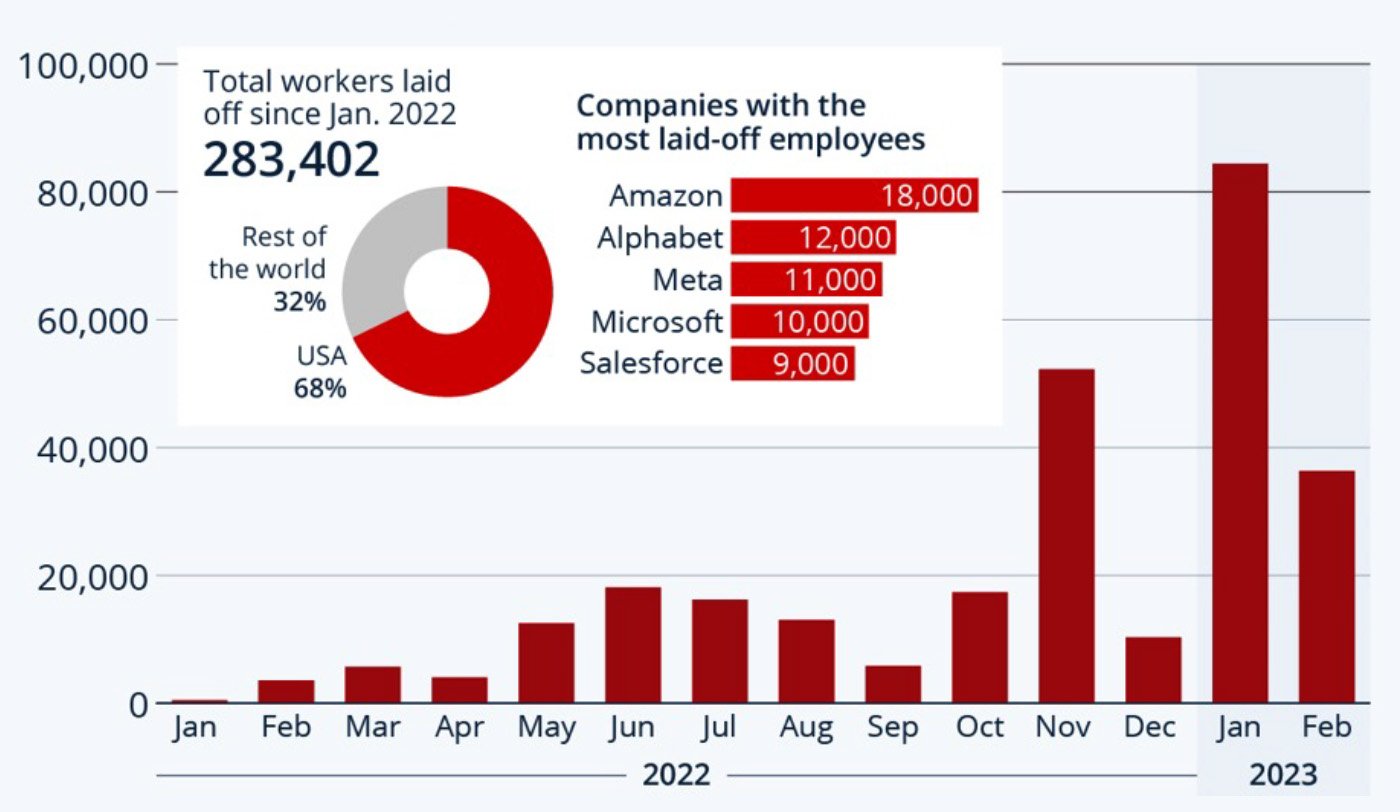

Data analytics provider Statista wrote recently,

“Many tech stocks have been in a tailspin for the better parts of the last 12 months, which was one factor in the reduction of the workforces of numerous companies and startups in the tech sector after the pandemic years of growth. Even tech bulwarks like Amazon, Meta and Twitter carried out mass layoffs, with Jeff Bezos’ company topping the global ranking for corporations with the most laid-off employees with 18,000 layoffs. On January 19, Microsoft announced it would reduce its workforce by about ten thousand. A day later, Google parent Alphabet announced it would cut 12,000 jobs. As our chart shows, the winter months have been especially layoff-heavy at tech companies and startups. …

“Since the beginning of the year, more than 120,000 employees have been laid off at tech-related companies, which is around 75 percent of the tech and startup workforce let go in all of 2022.”

FIGURE 3: WORLDWIDE LAYOFFS IN THE TECH/START-UP SECTOR SINCE JAN. 2022

Source: Statista

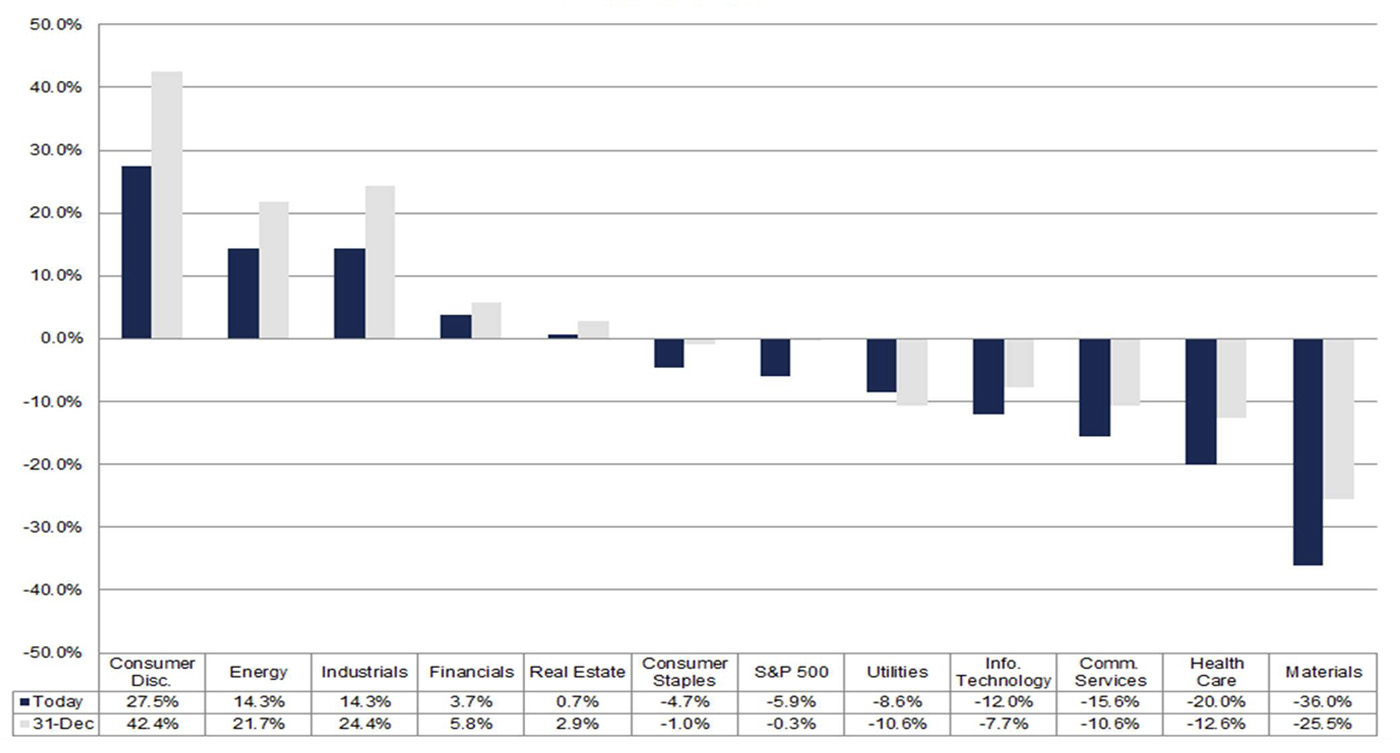

Concerns over recession and corporate earnings

Another factor that is likely impacting consumer attitudes about the labor market can be found in the final results for the Q4 2022 earnings season, the outlook for earnings moving forward, and the publicity around the threat of a U.S. recession in 2023.

FactSet reports that with the Q4 2022 earnings season essentially over, “the S&P 500 reported a decline in earnings of -4.9%—the first decline since Q3 2020.”

FactSet also says the following on prospects for earnings moving forward in 2023:

“Given concerns in the market about a possible economic slowdown or recession, have analysts lowered EPS estimates more than normal for S&P 500 companies for the first quarter?

“The answer is yes. During the months of January and February, analysts lowered EPS estimates for the first quarter by a larger margin than average. The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q1 for all the companies in the index) decreased by 5.7% (to $51.13 from $54.20) from December 31 to February 28. …

“… Looking ahead, analysts expect earnings declines for the first half of 2023, but earnings growth for the second half of 2023. For Q1 2023 and Q2 2023, analysts are projecting earnings declines of -5.9% and -3.8%, respectively. For Q3 2023 and Q4 2023, analysts are projecting earnings growth of 2.9% and 9.6%, respectively. For all of CY 2023, analysts predict earnings growth of 2.1%.”

FIGURE 4: S&P 500 PROJECTED EARNINGS GROWTH—Q1 2023

Source: FactSet, data as of March 3, 2023

New this week: