Bear market narratives: Guiding clients through volatile markets

Bear market narratives: Guiding clients through volatile markets

Long-term investment decisions should be based on a goals-based and risk-managed investment plan, rather than a wide range of diverging opinions and speculative market narratives.

It seems everyone has offered their views on the direction for the market in 2023, from weekly market commentary to annual outlooks. Despite an impressive start to the year for equities, this “forecasting” has been made more challenging by the still ongoing bear market, prominence of the Fed’s interest rate policy, and uncertainty about recession.

Market results, data, and opinion are assembled into a narrative along with forecasts and implied or direct recommendations. Investors seeking to reduce uncertainty and anxiety are easily attracted to such prognostications.

The current bear market, defined as a loss of 20% or more from an all-time high, has lasted many months. But did the market hit its low point at -25% in October, or will there be more declines to come? (On a closing basis, the S&P 500’s low was 3,577.03 points on Oct. 12, 2022. A 34% rally from there would bring the market to a close of 4,796.56, the level at the Jan. 3, 2022, start of the bear market. We believe this theoretically would signal the end of the bear market.)

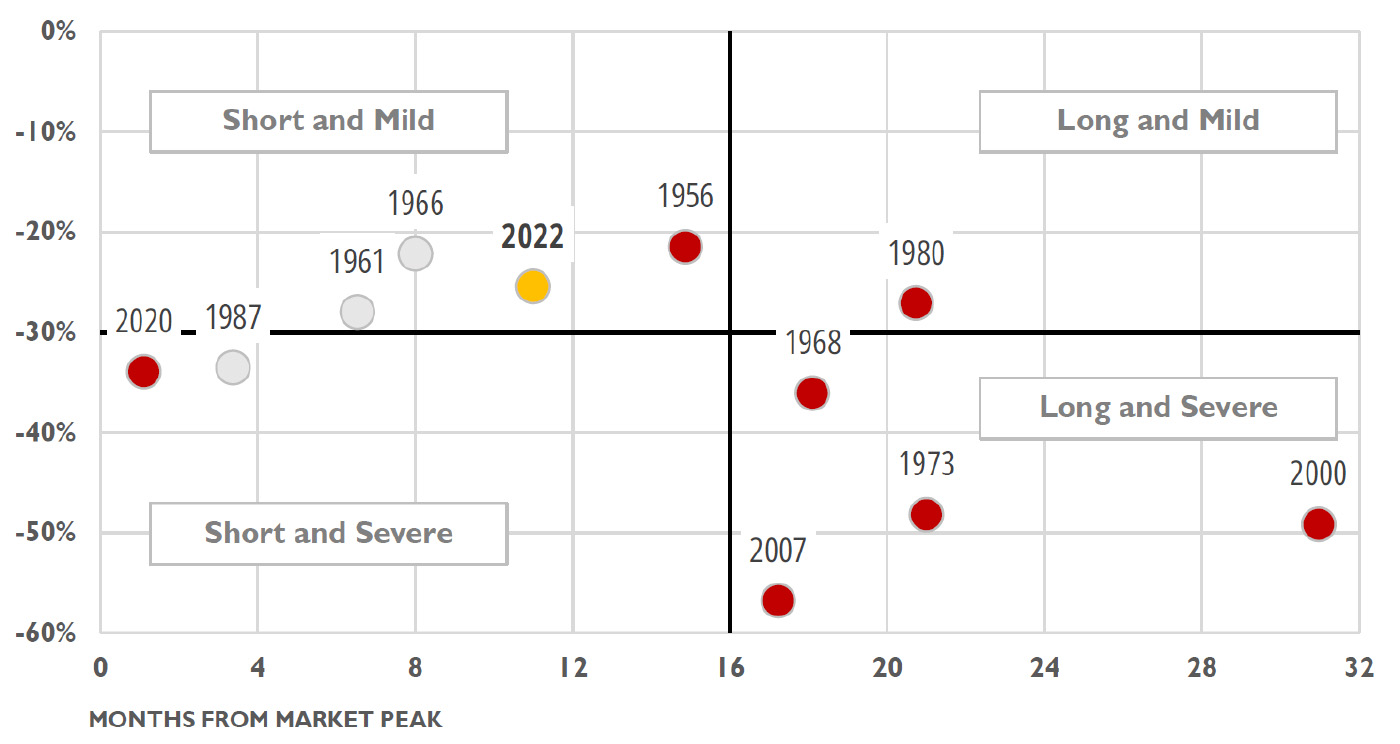

While every bear market is different, history can provide some perspective on where we are now. The median duration of the decline for the 11 bear markets charted in Figure 1 is 15 months, while the median loss is 34%.

FIGURE 1: DURATION AND MAXIMUM LOSS OF S&P 500 BEAR MARKETS FROM JAN 1960 TO NOV 2022

Sources: Dow Jones Indices LLC, AthenaInvest

Figure 1 shows drawdowns on the left axis and number of months until you hit the ultimate market bottom along the bottom axis. Red dots indicate the bear market was associated with a recession, gray dots are not associated with a recession, and the yellow dot is the current bear market. Most bear markets associated with a recession are longer than 16 months, suggesting we may have more time to go before we find the bottom.

A plethora of market narratives

It’s hard to know what to make of the bear market narratives that are put forward. If history is any guide, these well-crafted stories rarely pan out and provide little useful or actionable information. For long-term investors, stepping back with a longer-term perspective can help to avoid costly mistakes.

DIVINING VISIONS THROUGH THE MISTS OF TIME

The data would suggest that the most likely outcome in any given year is a stock market gain of 12%. This, according to the Fama/French factor return series, is the average annual broad equity total return, which includes bear market downturns and recessions. The data also reveals that 75% of the years are positive in the stock market.

Long-term investment decisions should be based on these probabilities, rather than the wide range of diverging opinions and largely speculative market narratives. Of course, the actual outcome in any given year can vary widely. But the longer you stay invested and the more opportunity you have to take advantage of the distribution of returns, the more likely you are to get the long-term average.

Successful investing requires patience and thinking in terms of years and decades, not months and quarters. While we may become fatigued from the volatility and long grind down and anxious for positive signals, having realistic expectations can help reduce the anxiety. Things will get better, but it might just take longer than you think. For most investors, staying invested and sticking to a well-developed plan is the best course of action.

There is little need to try to predict the near-term future based on the constant flow of information and opinion regarding recent events and the current investing landscape. Successful investors dedicate a portion of their assets to growth and invest based on long-term probabilities. When this perspective is taken, the largely random and unpredictable stream of yearly events, headlines, and subsequent results lose their significance. While the market will surely go up and down, often the best course of action is to stay invested and stick to your plan.

What is going on from a behavioral viewpoint?

- Calendar years, annual statements, and tax filing drive investors to anchor on recent events and returns. The media floods investors with an overload of new year information and opinion that stimulates our emotional need to act.

- We use patterns, stories, and shortcuts to help understand what is going on around us, even if it means making up stories and adopting plausible theories. This narrative fallacy creates a natural overemphasis on story over data that often results in faulty analysis and poor investment decisions.

- We are easily fooled by randomness and have a hard time accepting randomness. We want to believe that there must be some way to forecast and navigate largely unpredictable markets.

What guidance can advisors provide to their clients to navigate difficult environments?

- Help clients reframe their investment time horizon and learn to understand markets as a long-term return distribution. The more draws from the distribution of returns, the better the outcome. Develop realistic expectations and accept that both positive and negative returns will inevitably occur. Give resources allocated to growth the time necessary to mature and achieve expected long-term results.

- Develop a needs-based plan for each client that separates short-term and long-term investments and encourages clients to stay fully invested over time. Build a strategy-diverse equity (or multi-asset-class) portfolio that can be resilient in a variety of market conditions and is designed for the long run.

- Reinforce your value as an advisor by providing sound counsel during both market highs and lows, helping investors avoid poor investor behavior and overreaction. Make sure clients understand the risk-management elements of their plan during the development phase of the investment plan—and how these align with their specific risk profile. Have a disciplined investment process with a portfolio designed to be resilient over a wide range of market conditions. Rules-based investment strategies that strongly emphasize risk management can help remove the temptation for clients of emotional investment decision-making.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. The information provided here is for general informational purposes only and should not be considered an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.