After two consecutive quarters of GDP declines, the Bureau of Economic Analysis (BEA) reported last week that the U.S. economy had its first quarterly GDP increase of 2022.

Barron’s reported,

“The U.S. economy grew at a surprisingly high 2.6% annual rate in the third quarter, reversing two consecutive quarters of declines. But beneath the strong headline number were signs that consumers are feeling the pinch of inflation and that the housing market has been hit by this year’s dramatic rise in interest rates.

“Nevertheless, quarterly growth of this magnitude should reassure investors that the U.S. has not, at this point, been plunged into recession. Fears of an economic slowdown have been front of mind this year amid a dramatic tightening of financial conditions by the Federal Reserve. The central bank is attempting to get inflation, which is at its hottest in decades, under control by boosting interest rates.”

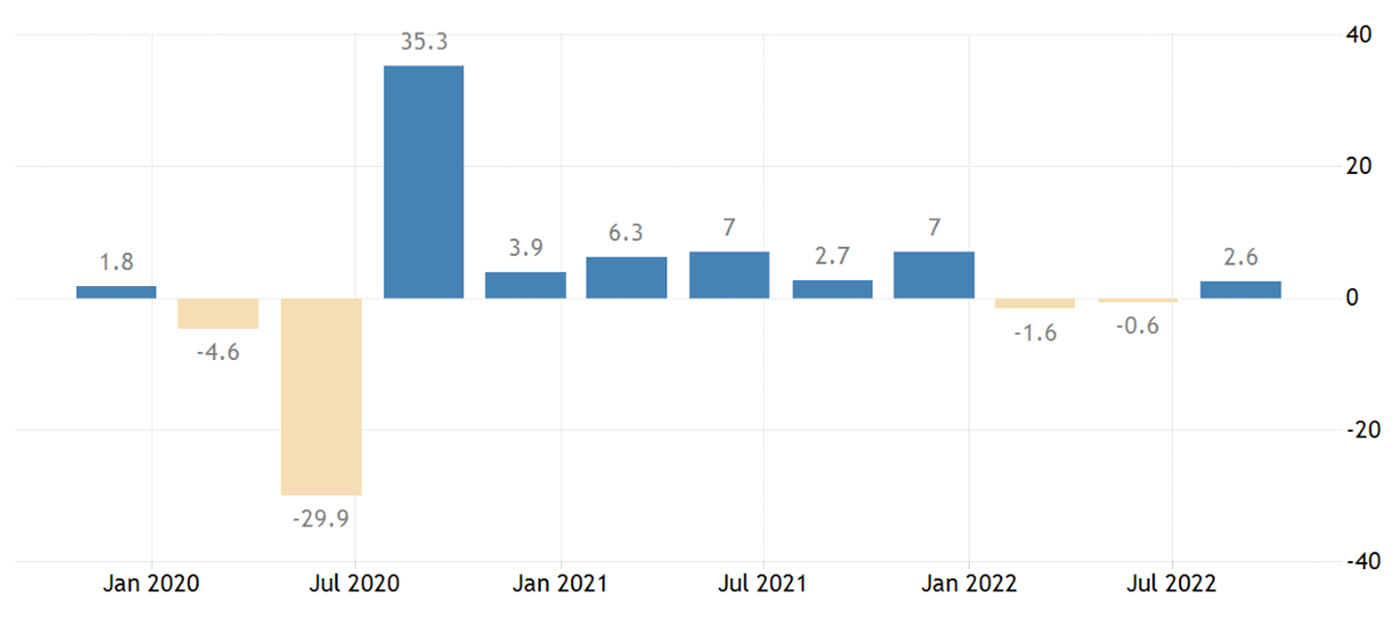

FIGURE 1: U.S. GDP QUARTERLY GROWTH RATE

Sources: Trading Economics, U.S. Bureau of Economic Analysis

The BEA noted on the report’s details,

“The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.”

The preliminary look at Q3 GDP significantly beat analyst estimates, with the average forecast for 2.0% quarterly growth. But Barron’s also saw some weakness in the report:

“Consumer spending increased overall, reflecting money flowing to healthcare and other services. But shoppers stopped digging as deep in their pockets to purchase goods, with data showing a deceleration of spending on cars, parts, and food and beverages. This was the third straight quarter in which goods spending fell, indicating a squeeze on consumers.”

First Trust adds,

“Real personal consumption was also up in Q3, but at a relatively tepid 1.4% annual rate. Moving forward, it’s hard to be optimistic about growth in consumer purchasing power when ‘real’ (inflation-adjusted) earnings are falling and consumers have reduced the extra balances they had in bank accounts due to massive government stimulus checks in 2020-21.”

Some encouragement in the latest inflation measures

Two measures of inflation released last week provided some minor positives on the inflation front.

CNN summarized,

“The Personal Consumption Expenditures Index, which measures prices paid by consumers for goods and services, climbed by 0.3% from August to September but remained unchanged at 6.2% for the year, according to the latest report from the Bureau of Economic Analysis.

“Core PCE, which strips out volatile food and energy prices and is the Fed’s preferred measure of inflation, climbed by 5.1% on an annual basis, higher than the August rate of 4.9% but below the consensus estimate of 5.2%, per Refinitiv. …

“Separately, the Bureau of Labor Statistics released its latest Employment Cost Index, which shows a slowdown in wage and salary growth in quarterly labor costs. The central bank keeps a close eye on the ECI report to monitor the extent to which skyrocketing inflation is boosting wages—and fueling inflation.”

According to Mark Zandi, chief economist for Moody’s Analytics,

“There are a lot of moving parts, a lot of assumptions, but I think the most likely scenario is that we’re at the worst of the inflation, and it should be back close within spitting distance of the Fed’s [2%] target by spring of 2024.”

The final report from the University of Michigan showed consumer sentiment edged up in October from September, but inflation and the future economic outlook remain major concerns.

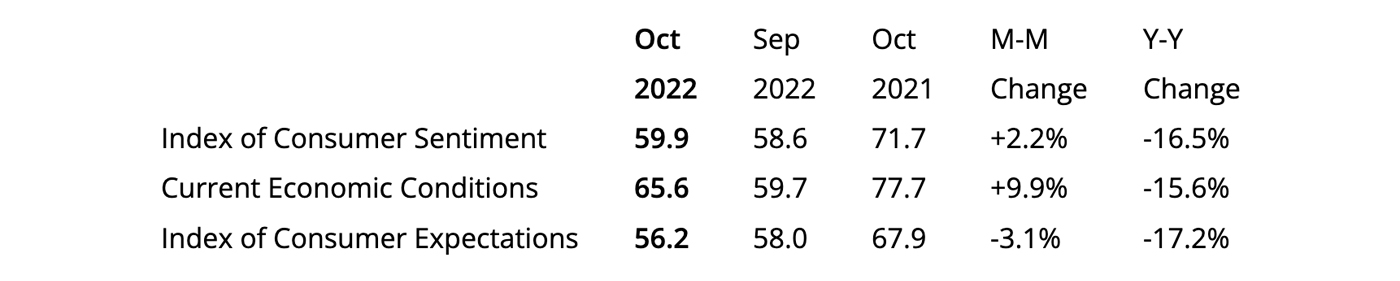

TABLE 1: FINAL OCTOBER UNIVERSITY OF MICHIGAN SENTIMENT REPORT

Source: University of Michigan Surveys of Consumers

Surveys of Consumers’ director Joanne Hsu reported on the mixed results of the latest survey,

“Consumer sentiment confirmed the preliminary reading earlier this month, inching up just 1.3 index points from September. With sentiment sitting only 10 index points above the all-time low reached in June, the recent news of a slowdown in consumer spending in the third quarter comes as no surprise. This month, buying conditions for durables surged 23% on the basis of easing prices and supply constraints. However, year-ahead expected business conditions worsened 19%. These divergent patterns reflect substantial uncertainty over inflation, policy responses, and developments worldwide, and consumer views are consistent with a recession ahead in the economy.”

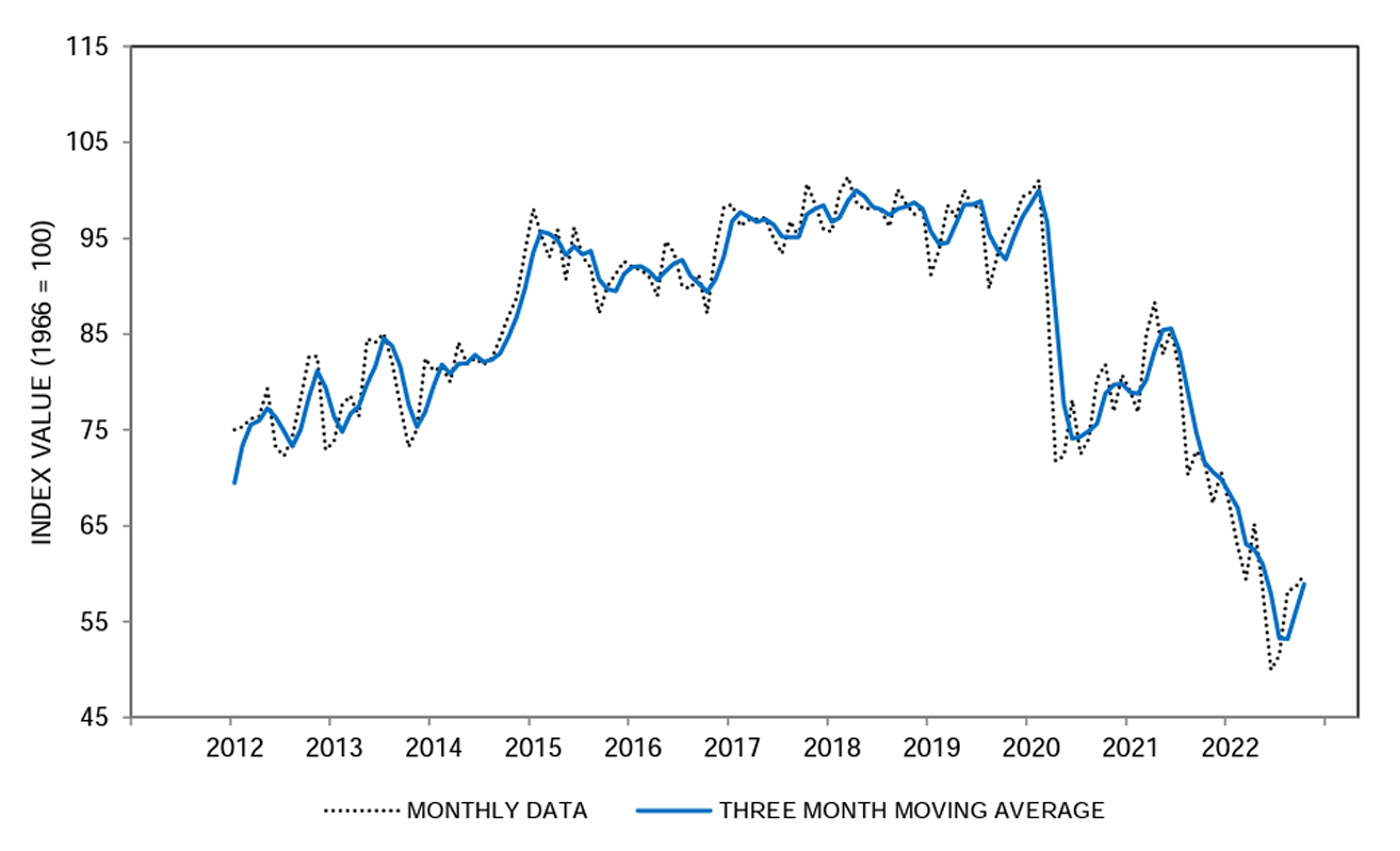

FIGURE 2: INDEX OF CONSUMER SENTIMENT—10-YEAR TREND

Source: University of Michigan Surveys of Consumers

New this week: