The big economic news last week was a jobs report that surpassed consensus estimates by a wide margin.

Bespoke Investment Group wrote on Aug. 5,

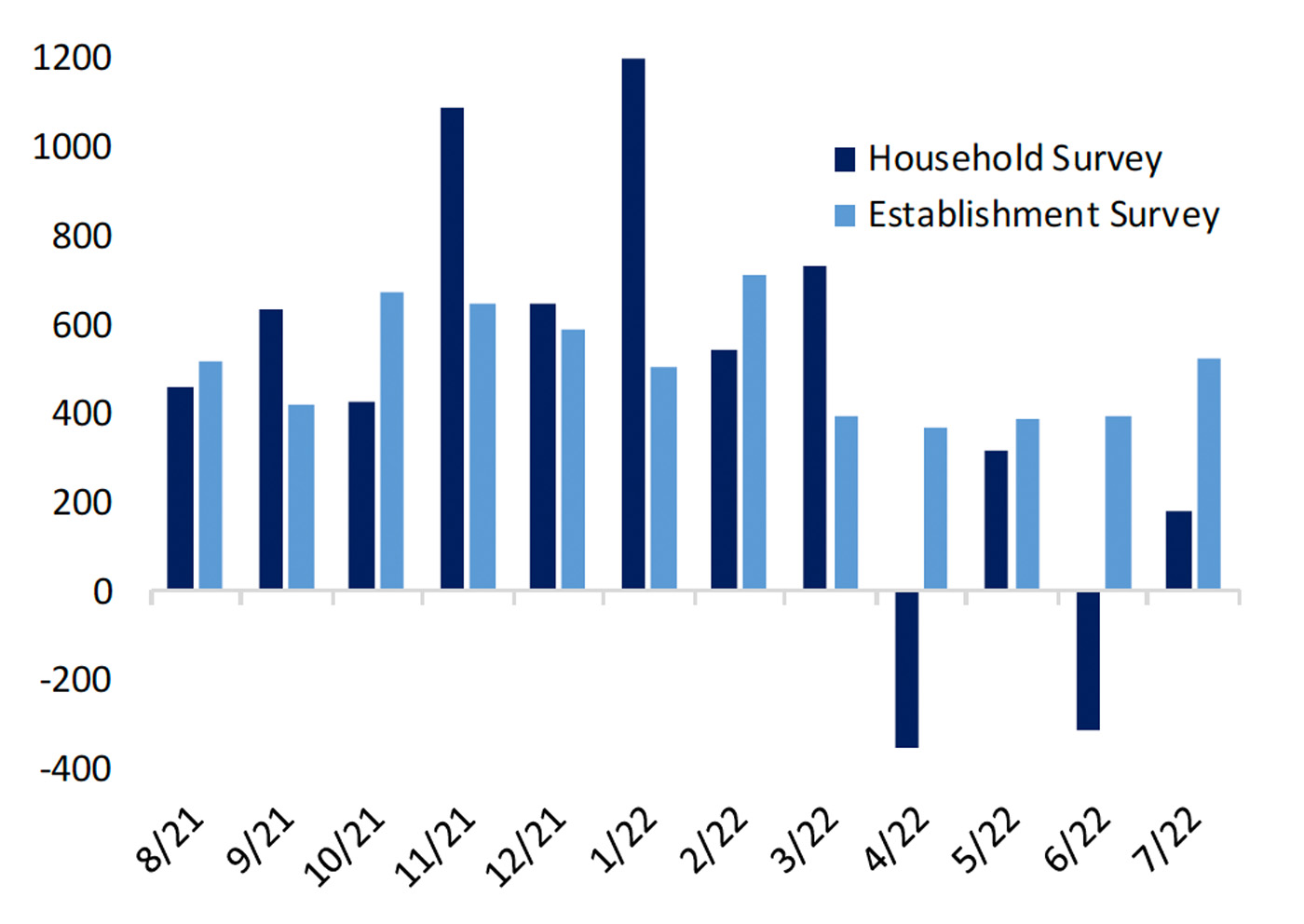

“Job growth absolutely smashed estimates as nonfarm payrolls rose 528k in July versus 250k expected; payrolls from the last two months were revised up another 28k as well. While the household survey continues to run at a much weaker pace than the establishment survey, that measure rose in July as well; its 180k pace is anything but weak. …

“Despite the steady rise in jobless claims, slack has continued to fall. … The number of workers that are available for full time work hit a low back to at least 1994 this week.”

FIGURE 1: NONFARM PAYROLLS EXCEED ESTIMATES, RISING OVER 500K IN JULY

Sources: Bespoke Investment Group, Bureau of Labor Statistics

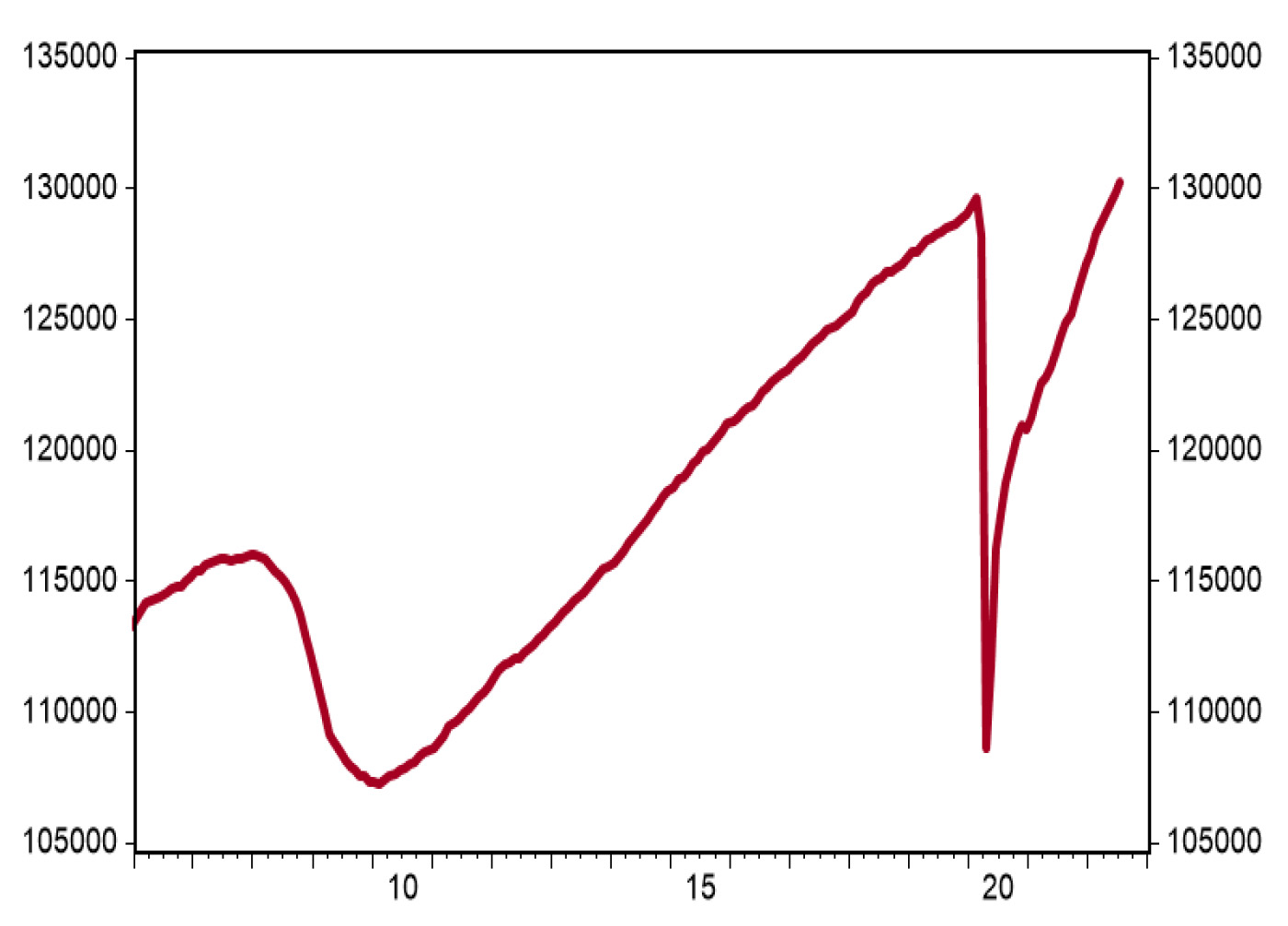

First Trust points out that, after 29 months, the total employment level for private industry has now surpassed pre-COVID levels.

FIGURE 2: ALL EMPLOYEES—TOTAL PRIVATE INDUSTRIES

Note: Data in thousands

Sources: First Trust, Bureau of Labor Statistics, Haver Analytics

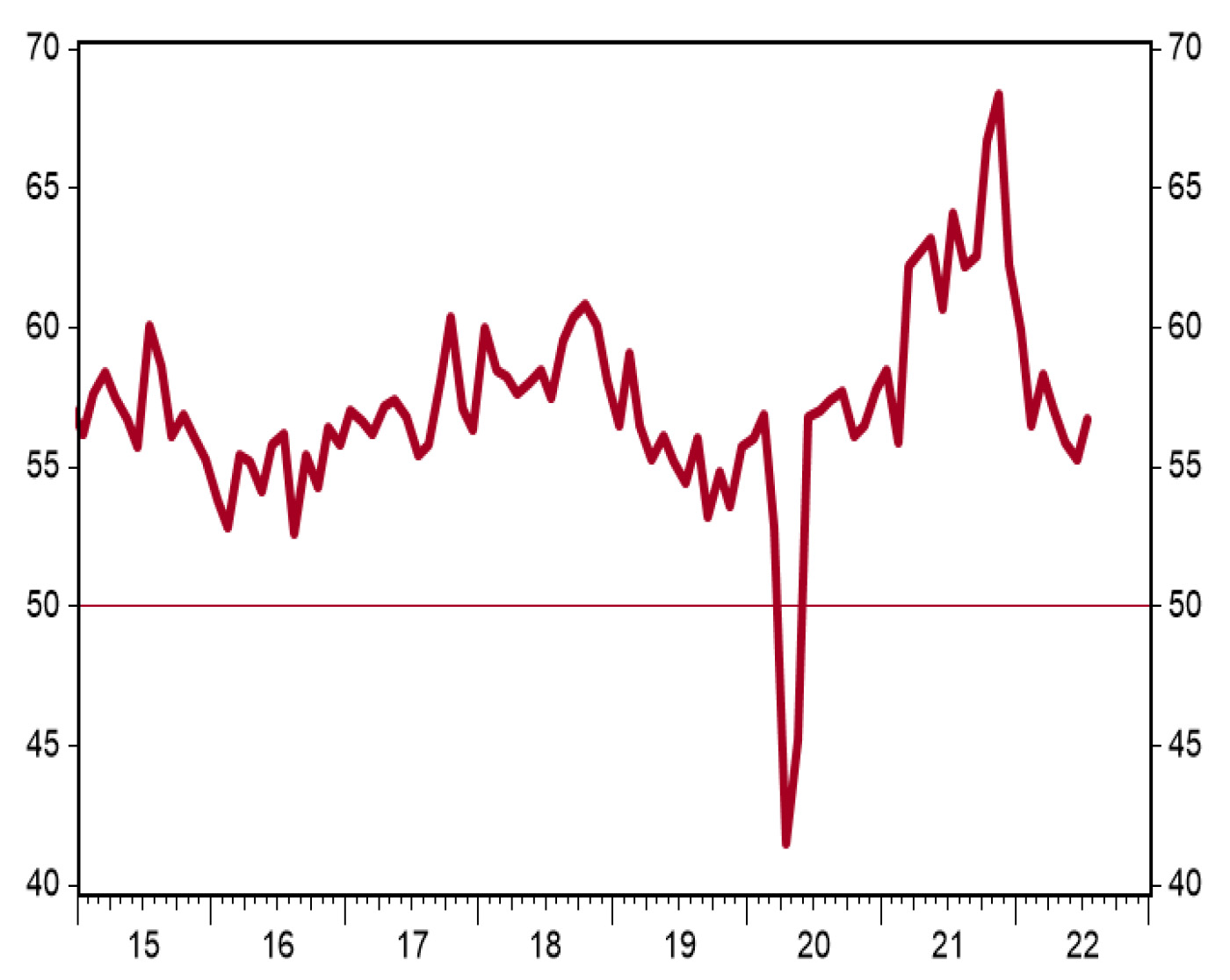

The Institute for Supply Management (ISM) also released key U.S. economic data last week, with both manufacturing and services data exceeding estimates.

The ISM Non-Manufacturing (Services) Index increased to 56.7 in July, while the ISM Manufacturing Index declined slightly to 52.8 in July. Both data points remain above the 50 level, indicating expansion.

On the ISM services data, First Trust notes,

“The service sector accelerated in July, with the ISM Services index easily beating consensus expectations. With intense scrutiny of every data point on the strength of businesses and consumers, today’s surprise to the upside combats concerns that the US economy is already in (or teetering on the edge of) a recession. We believe the service sector will lead the US economy higher in 2022, as consumers shift their spending habits away from goods and toward the still-reopening service sector. The details of today’s report proved to be very positive. Business activity and new orders, the two most forward-looking pieces of the report, both rose to 59.9. Contrasting this with Monday’s ISM Manufacturing report shows the shift in consumer spending.”

FIGURE 3: ISM SERVICES PMI

Note: 50+ level indicates expansion

Sources: First Trust, Institute for Supply Management, Haver Analytics

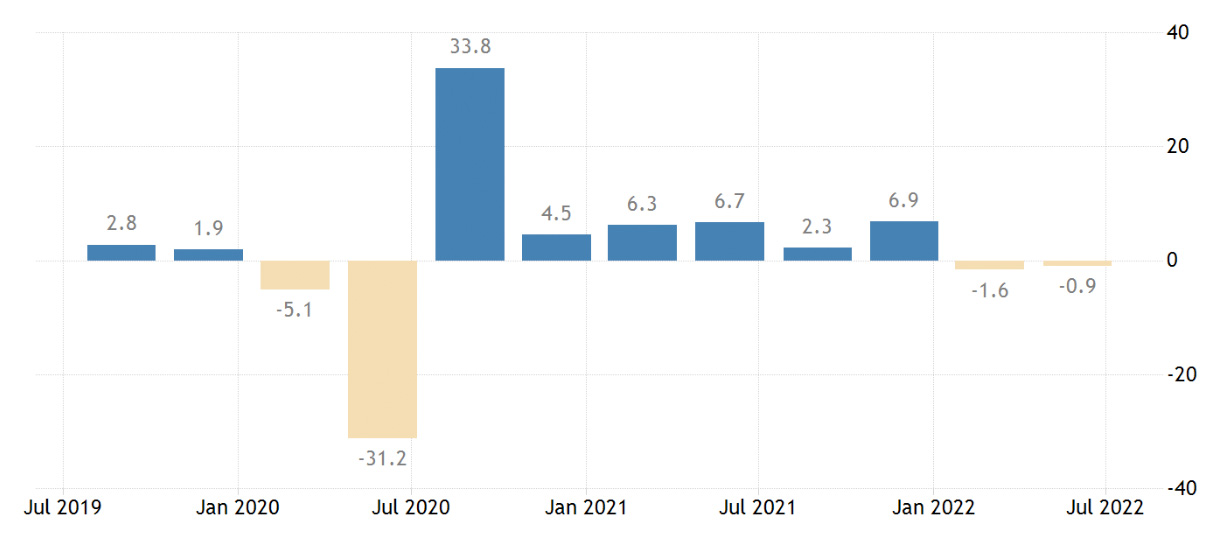

Positive data points versus declines in GDP

The debate remains on whether the U.S. economy is currently in a recession, or facing one in upcoming months. Certainly, the GDP readings over the past two months would seem to support a more negative outlook—with two consecutive quarters of declines

FIGURE 4: U.S. GDP MONTHLY GROWTH RATE

Source: Trading Economics, U.S. Bureau of Economic Analysis

However, the continued positive data on the labor front, ISM data that remains above 50, and corporate earnings estimated to show an earnings growth rate of 6.7% in Q2 are just a few of the factors arguing for a “slowdown” and not a full-blown recession.

However, some of the recent commentary remains skeptical.

MarketWatch’s Mark Hubert recently pointed out regarding the manufacturing data,

“This key indicator of economic health is currently at 52.8—down from as high as 63.7 in early 2021, and at its lowest level since the early days of the COVID-19 pandemic lockdown. As my MarketWatch colleague Jeffry Bartash reported, this latest reading is ‘a sign of creeping weakness in the U.S. economy.’

“Many bears have pounced on this latest reading as a reason to expect further weakness in coming months. They point out, with substantial historical supporting evidence, that corporate earnings tend to follow the lead of the ISM index with a several month time lag.”

In another article speaking about a “topsy-turvy recession,” MarketWatch points to key factors to evaluate for the economy moving forward:

“… The resilient labor market is causing many market observers to argue that despite suffering two successive quarters of contraction the U.S. economy is not really in a ‘proper’ recession. …

“‘In the topsy-turvy recession of 2022, there has been much greater inflation in consumer prices and nominal sales than in nominal wage rates. The result is that real wage rates have collapsed, profits have stayed resilient, and firms have not needed to lay off workers… so far,’ says Joshi [Dhaval Joshi, chief strategist for BCA Research’s Counterpoint]. …

“So, what happens next? Keep an eye on consumer price inflation and company sales. Once firms’ revenue growth starts dropping below the stickier wage growth, profits will decline and managers will look to trim the workforce.”

New this week: