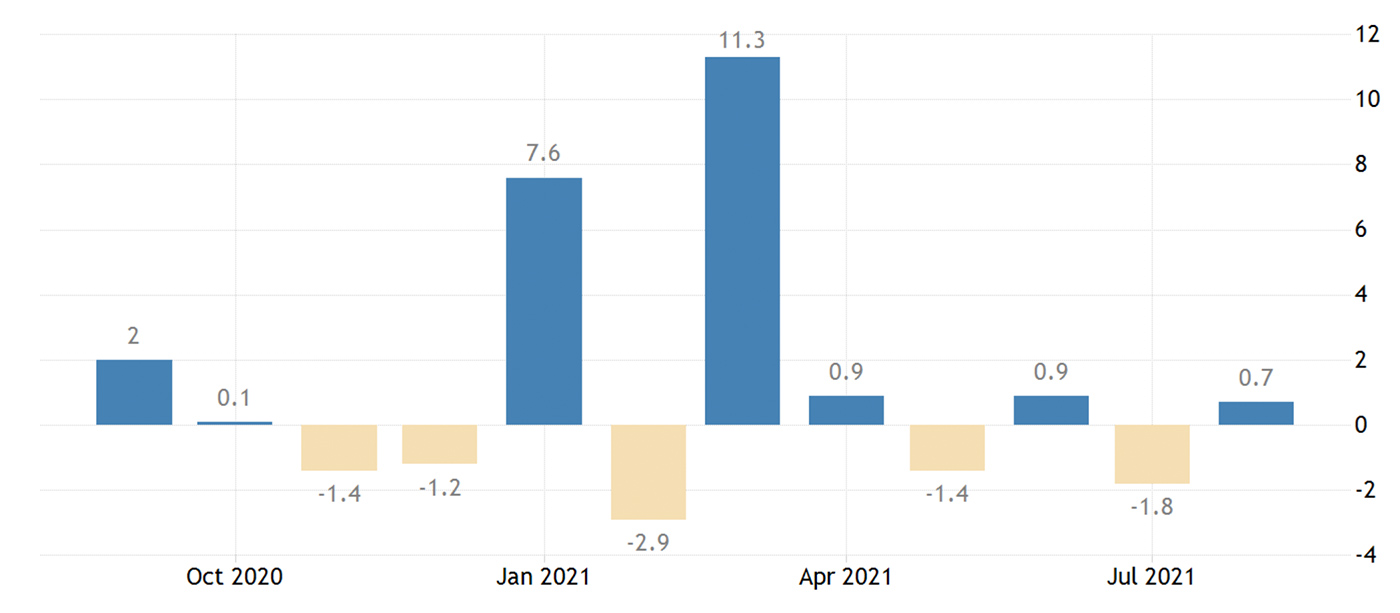

U.S. consumers continue to spend at levels well above 2020, surprising analysts looking for signs of a late summer pullback.

CNBC reported the following on last week’s retail sales report from the U.S. Census Bureau:

“Retail sales posted a surprise gain in August despite fears that escalating Covid cases and supply chain issues would hold back consumers. … Sales increased 0.7% for the month against the Dow Jones estimate of a decline of 0.8%. …

“The pandemic’s impact did show up in sales at bars and restaurants, which were flat for the month though still 31.9% ahead of where they were a year ago.

“The headline number would have been even better without a 3.6% monthly drop in auto-related activity; excluding the sector, sales rose 1.8%, also well above the 0.1% expected gain.”

Sources: Trading Economics, U.S. Census Bureau

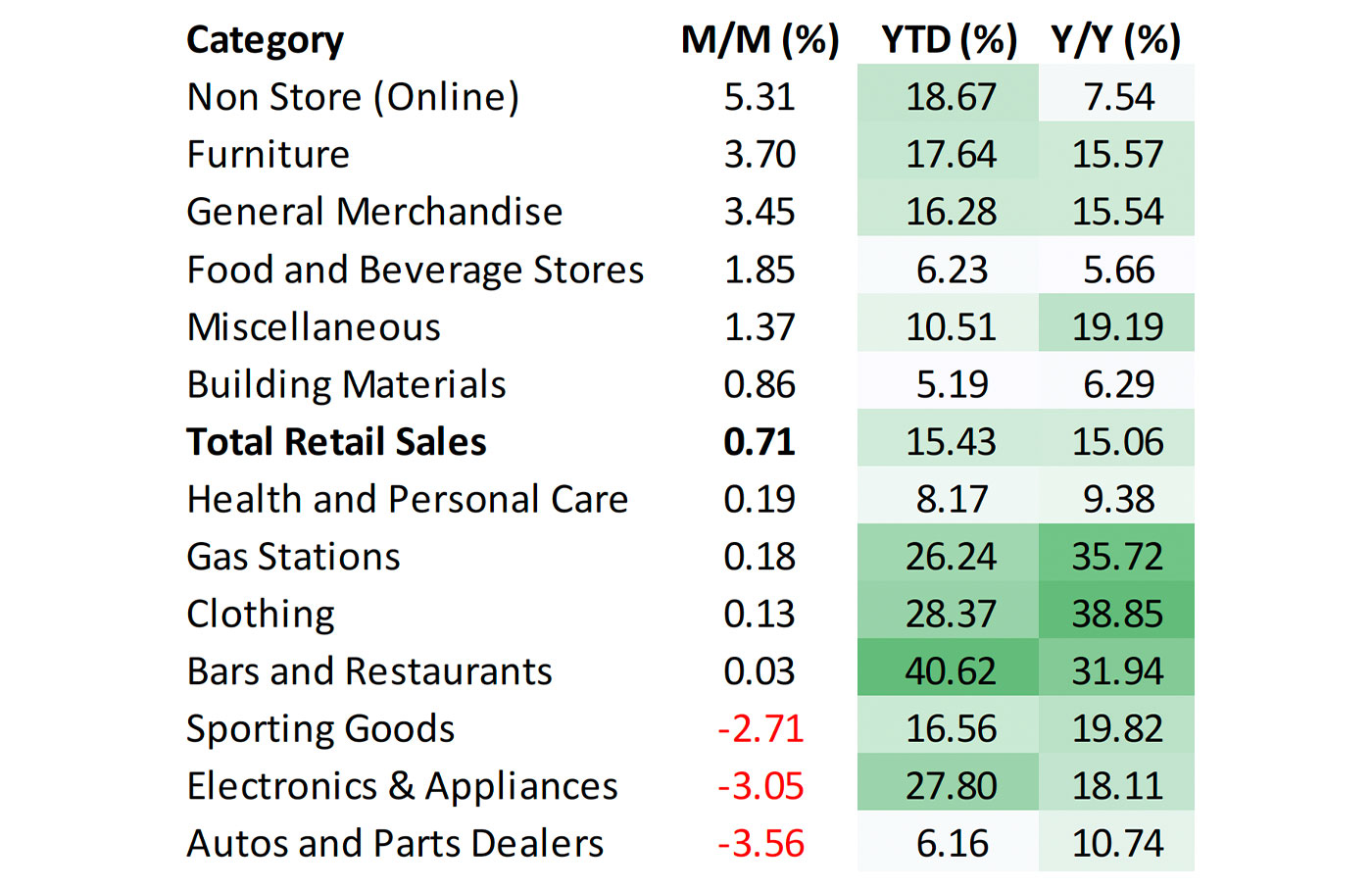

Bespoke Investment Group provided the following additional details on the retail sales report:

- “Breadth was strong as just 3 out of 13 sectors showed m/m declines.

- “Autos were the weakest sector (-3.56%) as parts shortages continue to hamper production, but Electronics & Appliances and Sporting Goods also both saw declines of more than 2.5%.

- “On the upside, Online experienced the strongest growth (+5.3%) followed by Furniture (+3.7%), and General Merchandise (+3.5%).

- “Looking further back, all but four sectors have seen YTD growth of more than 10% this year, led by Bars and Restaurants with total sales growth of more than 40%. Delta or not, American consumers are going back out to eat.”

Sources: Bespoke Investment Group, U.S. Census Bureau

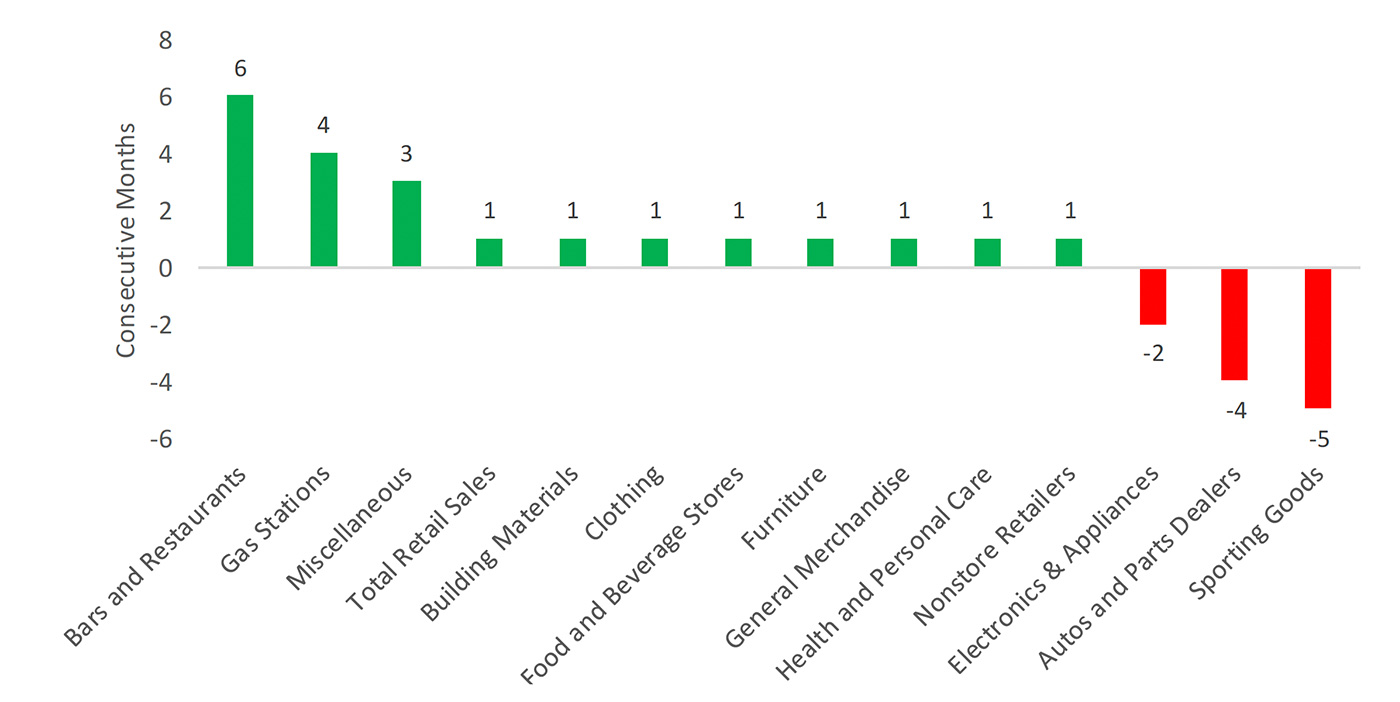

Bespoke also notes that the category of Bars and Restaurants, despite last month’s modest gains, has the longest streak of monthly increases in sales. The categories of Electronics & Appliances, Autos and Parts Dealers, and Sporting Goods have lagged other categories in this measure, with streaks of monthly sales declines.

Sources: Bespoke Investment Group, U.S. Census Bureau