Last week, the S&P 500 had its worst performance since February, down 1.9%, as the Federal Reserve’s policy update introduced the possibility of an earlier start date for interest rate hikes and forecast higher inflation. The Dow Jones Industrial Average and Russell 2000 had their worst performance since last October, off 3.4% and 4.2%, respectively.

According to data provider Statista,

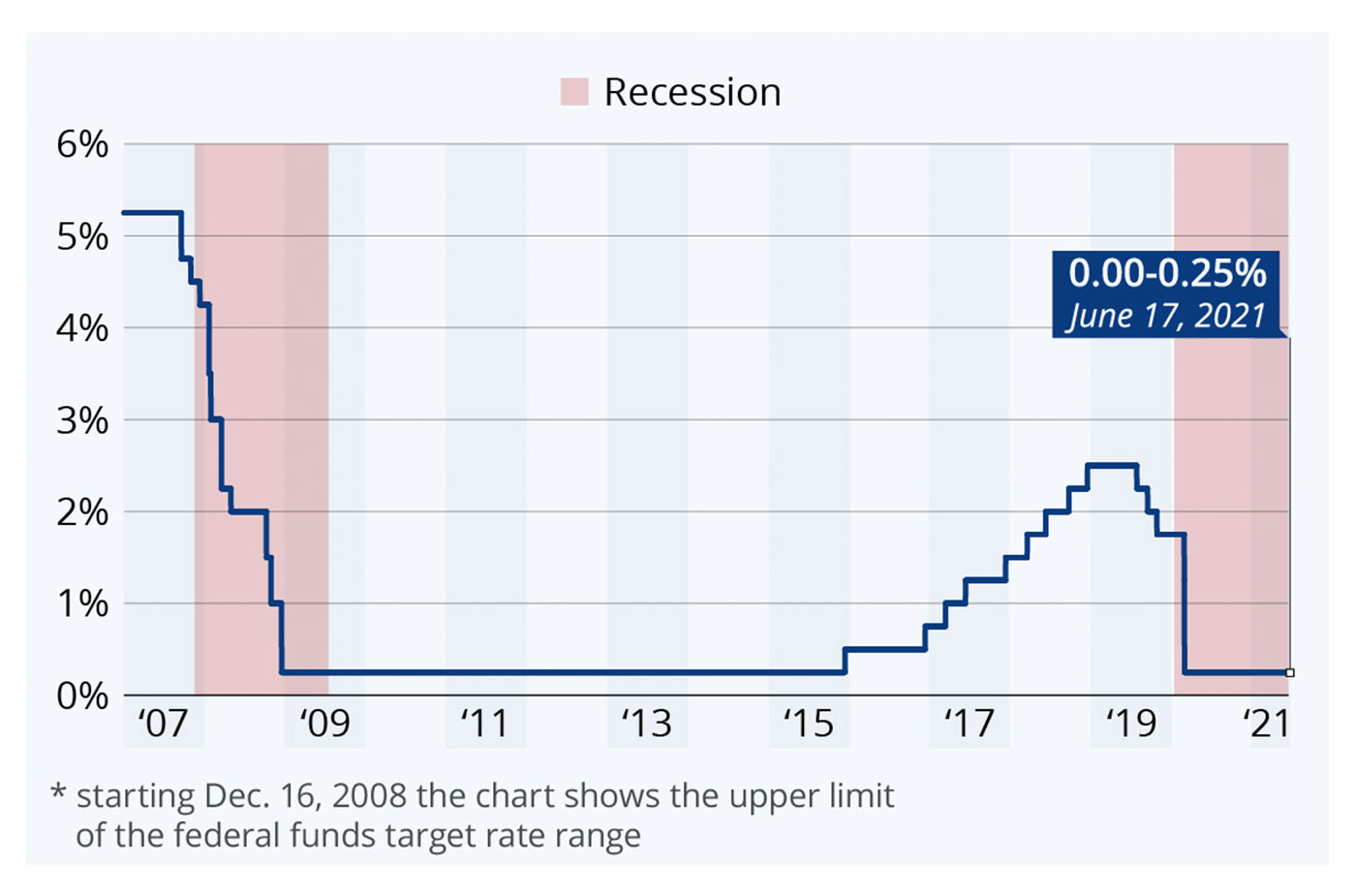

“As expected, the Federal Open Market Committee unanimously decided to keep interest rates near zero for the time being. As the U.S. economic recovery progresses and inflation is picking up, it did move up its timeline for possible rate hikes, however, with 13 of the 18 committee members expecting at least one rate hike by the end of 2023.

“‘The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time,’ the FOMC wrote in its post-meeting statement.”

Sources: U.S. Federal Reserve, Statista

Barron’s commented this weekend that what appears to be a change in the Fed’s dovish stance “shapes up to be less than tranquil for the markets.”

The column, “Up and Down Wall Street” noted,

“Fed Chairman Jerome Powell allowed that the monetary authorities had finally begun talking about talking about a reduction of its massive bond buying, consisting of $80 billion of Treasuries and $40 billion of agency mortgage-backed securities every month.

“In other words, the Fed’s supereasy monetary policies, which were put in place in March 2020, during the worst of the economic and financial chaos brought by the pandemic, will have an eventual expiration date. With the U.S. economy growing strongly and inflation running at multiyear highs, the time for these emergency policies would seem to be running out. Yet the admission of this seemingly self-evident fact took markets by surprise.”

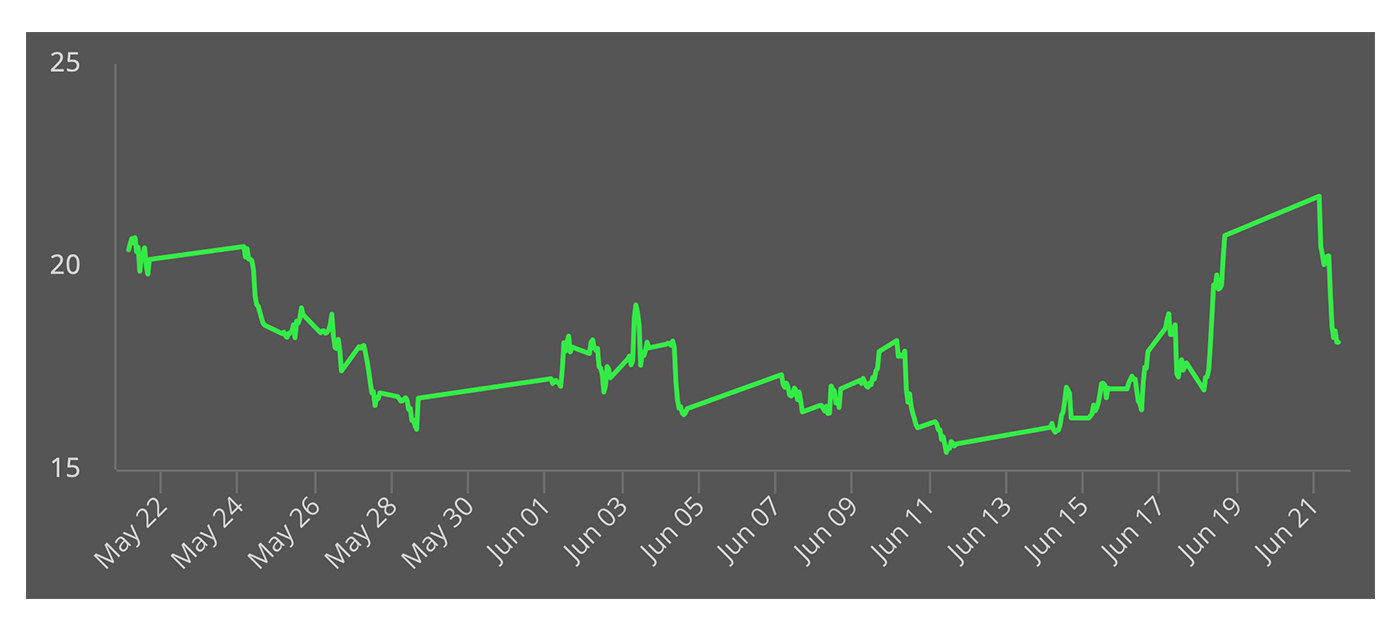

Market volatility, as measured by the VIX Index, did briefly move back above 20 after roughly a month below that level.

Last Friday’s move higher in volatility could, in part, be attributed to remarks by St. Louis Federal Reserve President James Bullard. He said that he sees an initial interest rate increase happening in late 2022 as inflation picks up faster than previous forecasts had anticipated. Said CNBC, “Bullard at several points described the Fed’s moves this week as ‘hawkish,’ or in favor of tighter monetary policy than what has prevailed since the onset of the Covid-19 pandemic.”

But it was a relatively modest and short-lived spike higher in volatility, as U.S. equity markets recovered strongly on Monday, June 21.

Source: Cboe

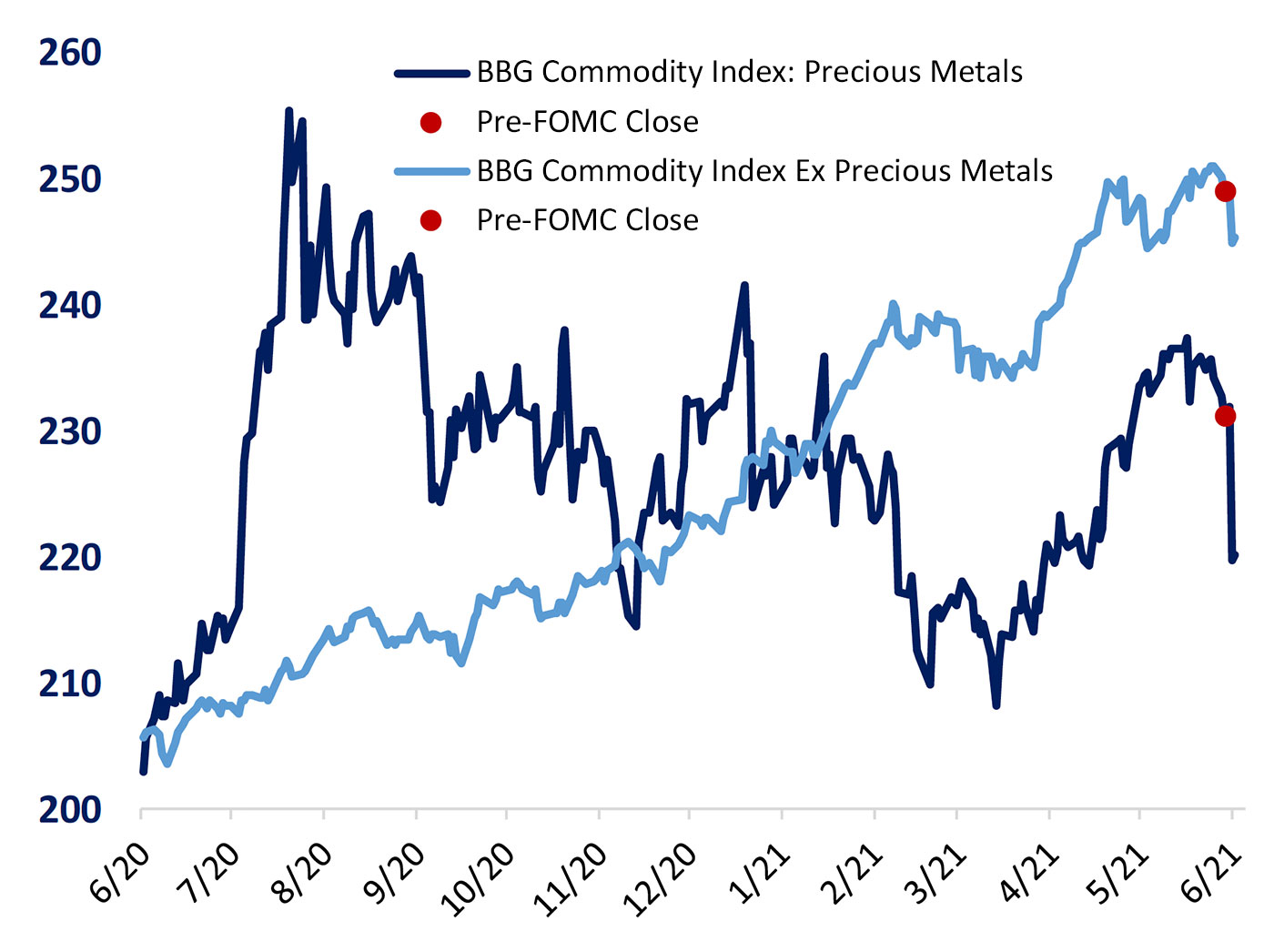

Many, but not all, commodities fell last week on the back of the Fed news.

Bloomberg reported, “Some commodities have now wiped out all of their 2021 rally. … The fact that some markets are falling while others—including crude oil and tin—are holding gains underscores how unevenly the complex is responding to economies reopening and expanding once again.”

Trading Economics attributed uncertainty in the commodity area to “… a stronger dollar, China’s moves to ease inflation, and hawkish Federal Reserve forecasts.”

Bespoke Investment Group said, “In the wake of the Fed, fixed income, currencies, and commodities (FICC) had a violent reaction. … Higher real yields and a stronger dollar have hit commodities hard, with precious metals standing out but broader commodity prices also dropping despite little movement from oil.”

Source: Bespoke Investment Group