Lessons from ‘the best investor in the world’

Lessons from ‘the best investor in the world’

We counsel our clients not to worry about what other people are doing in the short term, even if one of them might be considered “the best investor in the world.” We would rather focus on our clients’ specific investment objectives—and the health of their retirement portfolio over the long term.

On average, the market goes up three out of every four years. The “perma-bear” who consistently preaches doom and gloom is forgotten each day until he is right. Then they put him on the news and ask how he “called” the top of the market.

How did he do it? Well, probably because he’d been “calling it” every day for the last decade.

Then there are legends in market lore, like Warren Buffett, who many consider to be the best investor in the world. With a nickname like the Oracle of Omaha, how could anything else be true? Want to find out? Read on.

Let’s start with the mortgage crisis, the Great Recession, the 2007–2009 market crash … whatever you want to call it.

Over this period, the S&P 500 (which we’ll call “the market”) was down almost 58% at its worst drawdown. As you can see in Figure 1, Buffett, as represented through the performance of Berkshire Hathaway’s Class B stock (BRK.B), was down about 55% from top to bottom.

Source: Libertas Wealth Management, market data.

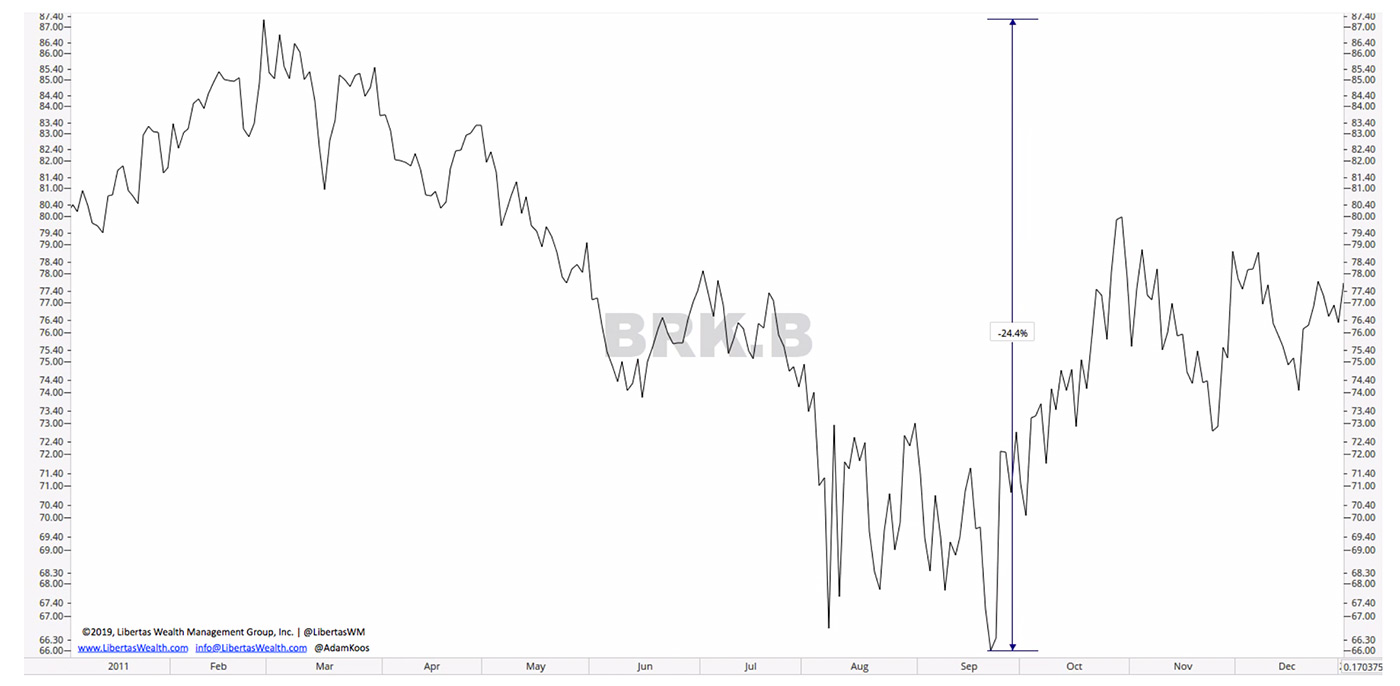

Let’s move on to the first real scare in the market after the crash, which took place in 2011 due to the U.S. Treasury downgrade. Understand that the downgrade didn’t take place until late summer, which was when the market’s wheels started to come off. Yet, Buffett’s Berkshire stock struggled earlier and longer. In the end, its decline of 24% was worse than the market’s 19.9% drop.

Source: Libertas Wealth Management, market data.

Source: Libertas Wealth Management, market data.

Source: Libertas Wealth Management, market data.

So, what’s the point of all of this? It’s definitely not to disparage the Oracle of Omaha. The wealth he has built for shareholders over the years is impressive.

By his standard of benchmarking, both the per-share book value and per-share market value of Berkshire has outperformed the S&P 500 on a compounded basis by a wide margin (about double) over the period 1965–2018.

I have three points.

First, even those considered to be the best investors (and company executives) in the world are not necessarily knocking it out of the park all of the time.

Second, the vast majority of what advisors and their clients often hear—from friends, neighbors, co-workers, and even family—is mostly just noise. I call it “The Country Club Effect.”

Whenever someone tells you how great their portfolio is doing (especially if they’re managing it themselves), be skeptical. Everyone wants to be a winner. (This includes just about all of us—even advisors. We all want to be a winner, whether for our own portfolios or those of our clients.) When clients hear that someone might be doing better than they are, the immediate psychological response is to become defensive.

In reality, those friends or associates probably aren’t Warren Buffett, and maybe they’re not doing as well as we think they are. Instead of reacting to the noise, stay focused on the long term. Your focus is something that you can control—and something you need to constantly reinforce with clients.

Third, while Mr. Buffet compares Berkshire’s performance to that of the S&P 500, that is almost certainly not the benchmark that individual clients should be using as they build toward their retirement. Who wants to use a benchmark that has proven its ability to drop around 50% twice this century alone?

As Table 1 shows, every decade since 1920, with the exception of the 1990s, has had at least one market decline over 20%. Most of those declines were much worse.

Source: FPI Research

Why is this critically important? Because the impact stemming from an unfavorable sequence of returns could be substantial.

When significant portfolio losses occur for any given investor is at the heart of the theory for the sequence of returns. The argument goes that a 25-year-old, with 35–40 years of earning and saving years in front of them, can afford to “ride out” stock bear markets. This assumes they never sell out at or near the bottom, as so many people do, nor make significant withdrawals from their portfolios.

However, for someone about to enter retirement and begin the distribution phase, as opposed to accumulation, a 25%–50% hit to their retirement funds early on will wreak havoc on their planned withdrawal rates. There is a good chance their funds will no longer last throughout a lengthy retirement.

In my opinion, and as demonstrated by the way I work with clients, I believe risk-managed strategies can benefit investors of all ages. When it comes to managing money, our firm focuses first on risk management, defending a portfolio from losses. This doesn’t mean being overly conservative—but a great offense without an equally great defense achieves little for clients in the long run.

We want to participate as much as possible when the market weather is good. Even when market “rainstorms” come along, like the ones we’ve lived through since the fall of 2018, it’s still just a rainstorm.

Tornadoes, on the other hand, are something we want to avoid.

When the sirens go off, we want to take our clients’ retirement portfolios to shelter to avoid catastrophic loss, even knowing that there is a good chance the tornado might not touch down.

I often tell clients, “I’d rather be out of the market when it’s going up, than in the market when it’s going down.” I demonstrate with the facts why this will enhance the probability of their being able to continue their lifestyle tomorrow and long into the future.

Retirement planning is a marathon, not a sprint. We counsel our clients not to worry about what other people are doing in the short term, even if one of them might be considered “the best investor in the world.”

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com