With the stock market’s volatility in December, the U.S. government shutdown, and a weakening housing market, it is little wonder that consumer sentiment took a hit in the report released on Feb. 1.

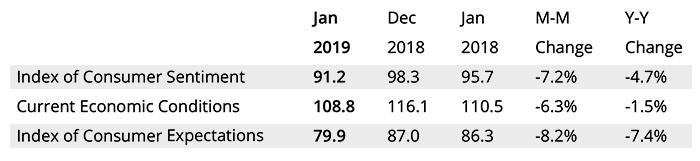

The University of Michigan Surveys of Consumers showed a retreat in consumer sentiment for January back to levels last seen prior to the presidential election in 2016. The overall Index of Consumer Sentiment was down 7.2% from December and the Index of Consumer Expectations was off 8.2%.

TABLE 1: FINAL JANUARY RESULTS FOR UNIVERSITY OF MICHIGAN CONSUMER SURVEY

Source: University of Michigan

Barron’s noted about the results,

“The late-month end of the government shutdown, or at least temporary end, had only limited impact on the consumer sentiment index which ended January at 91.2, up 5 tenths from mid-month but down a very steep 7.1 points from December.

“The shutdown’s effect on sentiment is having the greatest strain on expectations where confidence is sliding, with this component likewise down 7.1 points in the month to 79.9. Also sliding, however, is the assessment of current conditions, down 7.3 points to 108.8. All these readings, whether the composite or the two components, are at their lowest levels since October 2016.”

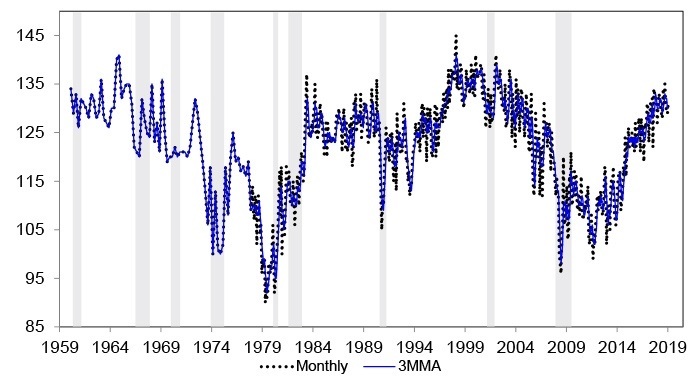

Source: University of Michigan

The question is whether consumer sentiment will rebound with the stock market’s strong January performance and what will hopefully be an end to threats of a further government shutdown this year.

Surveys of Consumers chief economist, Richard Curtin, wrote,

“The end of the shutdown caused only a modest boost in the Sentiment Index. The typical impact of such ‘crisis’ events is short lived, with consumers quickly regaining lost confidence. That is unlikely to occur this time as the deadline for resolution has only been extended until mid-February. If the standoff continues into late February, it could foster sustained declines in economic optimism among consumers. Even small spending cutbacks, occurring simultaneously across the majority of consumers, could push the economy into a recessionary downturn.”

And despite recent signs of weakness in global growth, the U.S. economy, according to an article in this past weekend’s Wall Street Journal, has some very positive trends in place:

- The 100th straight month of job gains, with January’s addition of 304,000 jobs in the nonfarm payrolls report exceeding expectations by a wide margin.

- Workforce wages rising at least 3% on a year-over-year, seasonally adjusted basis for the sixth straight month.

- A continuation of growth in corporate earnings, with WSJ estimates of an overall 14.9% increase in earnings for Q4 versus the prior year.

- A tight labor market that is “drawing workers off the sidelines” and shows hiring increases in “nearly every major category.”

- While the manufacturing sector in the U.S. has been uneven due to “a strong dollar and retaliatory tariffs,” it has been “propped up by solid domestic demand.”