2015 went out with a whimper. The Santa Claus Rally made a half-hearted attempt to deliver, but had rough sledding to close out the year, with the S&P 500 down 1.7% in the final two trading days. And the opening market action for 2016 obviously did little to salvage that traditional year-bridging rally.

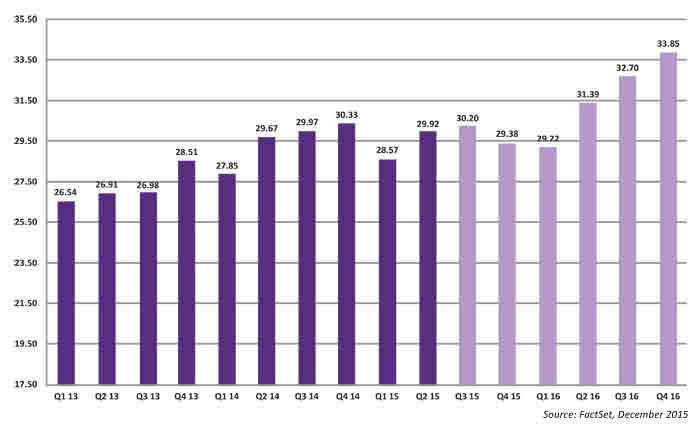

QUARTERLY BOTTOM-UP EPS ($) ACTUALS & ESTIMATES

However, prognostications for 2016 market performance from major Wall Street banks and investment firms were in a remarkably tight and optimistic range during a mid-December survey of top strategists. According to Barron’s, the projected year-end 2016 level for the S&P 500 clusters around the 2220 level.

Barron’s “Up and Down Wall Street” column noted at the time, “Wall Street strategists have penciled in returns of about 10% for the coming year. Which they did last year, as well. Sorry to be cynical, but I can’t remember a year when they haven’t.”

The question is, what do these strategists really know about the future, or better yet, what don’t they know? As seen during the credit crisis and in last year’s plunge in energy, commodities, and related stocks, these outlooks have little value when it comes to black swan events and crushing declines in a market index, asset class, or sector.

It is an understatement that the start of 2016 flew in the face of the relative complacency seen in most of those 2016 forecasts. Bespoke Investment Group pointed out on Monday that the widely held SPY, the exchange-traded fund that tracks the S&P 500, has opened down on the first trading day of the year on only two other occasions in its 22-year history. And MarketWatch reported that Monday’s intraday action for the Dow Jones Industrial Average (DJIA) represented the worst first trading day of a year for that index since 1932.

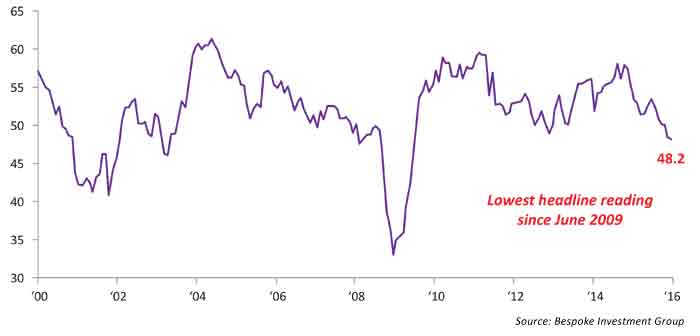

ISM MANUFACTURING (OVERALL): 2000-2015

There is little doubt that markets reacted strongly to turmoil in China’s markets and the continuing story of slower-than-expected growth in several foreign economies. While many observers still believe that U.S. markets will provide a relative safe haven in 2016, two key fundamental U.S. metrics bear watching, as seen in the accompanying charts.

- According to analysis by FactSet, quarterly earnings per share for the S&P 500 peaked at $30.33 in the fourth quarter of 2014. That’s expected to drop to $29.38 a share in Q4 2015, and perhaps even lower for Q1 2016. The good news is that overall S&P 500 earnings are expected to improve markedly by the second half of 2016.

- Monday’s ISM manufacturing report for the month of December came in weaker than the expected 49.0, falling from 48.6 to 48.2. December’s decline, says Bespoke, “marks the sixth straight month of declines, which is tied for the longest losing streak since November 2004. All these declines in the ISM manufacturing report are starting to add up.”