Quick question: How much of your global stock portfolio is in U.S. stocks? Let me guess: 70%? 80%? 100%?

The JPMorgan Guide to the Markets illustrates the U.S. as a percentage of global market capitalization (52%) and GDP (20%). Even if you are a die-hard Vanguard “Bogelhead” indexer, you should only have about half of your equity allocation in U.S. stocks.

But few do.

Most investors around the world invest the majority of their assets in their own stock market. This is called the home-country bias, and it occurs everywhere. Vanguard details the effect in the U.S., the U.K., Australia, and Canada. U.S. investors have approximately 72% invested in the U.S. market. It isn’t just retail investors—professional investors allocate most of their assets to their home countries as well.

A home-country bias is compounded by another unfortunate tendency that most investors exhibit: favoring market indexes weighted by market capitalization. Why is market-cap weighting so problematic? Market-cap-weighted indexes are constructed using only one variable—size—which is determined by price.

When overvalued assets grow to be bigger and bigger parts of a market—or become the market—you no longer want to invest in that market or stock. That’s the beauty of capitalism and creative destruction. When a company grows to be one of the most successful companies in the world, that success places a large target on its back. When Apple made the world-changing iPhone, companies began to seriously compete with it.

Japan’s stock market rose to account for nearly half of the world’s market cap in the 1980s. And if you believed in the efficient market, you would have invested half of your equity allocation in Japan. But Japan returned approximately -2% per year from 1990-2010, including more than 20 years of negative returns. A value-driven approach works not just by investing in the cheapest markets but also by avoiding the most expensive.

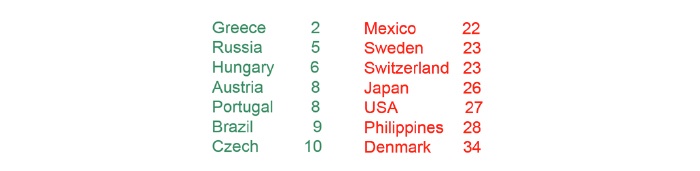

What is the biggest country in the world by market cap now? The U.S., with nearly half of global stock-market capitalization. The following table shows the cheapest and most expensive countries in the world. Notice that the U.S. is one of the most expensive countries.

Ranking country valuations by CAPE ratios

Source: Global financial data, MSCI, Bloomberg. Country valuations based on cyclically adjusted price-earnings (CAPE) ratios.

The U.S. was cheap relative to the rest of the world in the early 1980s, which also happened to be the start of the long bull market. The late 1990s saw the U.S. near the top of the range, which preceded the bear market that began in 2000. Will the current overvaluation signal another bear or perhaps a time to shift more assets to foreign markets? Time will tell.

The bad news is that U.S. stocks are expensive, although not in bubble territory. I expect U.S. stocks to return about 2% per annum for the next 10 years. The good news is most of the rest of the world is quite cheap.

Here are a few actions investors can take to improve the future returns of their equity portfolio: 1. Allocate your portfolio reflecting global market-cap weightings. 2. Consider also weighting along global GDP, avoiding market-cap-concentration risk. 3. Consider more of a value global approach, overweighting a basket of cheaper countries and lowering weight to the most overpriced. For those heavily allocated to the U.S., this might mean a significant reduction in relative percentage weight.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Meb Faber is a co-founder and the chief investment officer of Cambria Investment Management. Mr. Faber is the manager of Cambria’s ETFs, separate accounts and private investment funds. Mr. Faber has authored numerous white papers and three books: "Shareholder Yield," "The Ivy Portfolio," and "Global Value." He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker. Mr. Faber graduated from the University of Virginia with a double major in engineering science and biology. cambriafunds.com, mebfaber.com

Meb Faber is a co-founder and the chief investment officer of Cambria Investment Management. Mr. Faber is the manager of Cambria’s ETFs, separate accounts and private investment funds. Mr. Faber has authored numerous white papers and three books: "Shareholder Yield," "The Ivy Portfolio," and "Global Value." He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker. Mr. Faber graduated from the University of Virginia with a double major in engineering science and biology. cambriafunds.com, mebfaber.com